- United States

- /

- Banks

- /

- NasdaqGM:FINW

3 Noteworthy Stocks Estimated To Be Up To 38.8% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market shows resilience with major indexes like the Dow Jones, S&P 500, and Nasdaq rebounding after recent inflation data met expectations, investors are increasingly on the lookout for opportunities amidst fluctuating economic indicators. In such an environment, identifying stocks that appear undervalued can be a strategic move to potentially capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| XPEL (XPEL) | $32.17 | $62.97 | 48.9% |

| Udemy (UDMY) | $6.96 | $13.71 | 49.2% |

| Royal Gold (RGLD) | $193.11 | $383.90 | 49.7% |

| Peapack-Gladstone Financial (PGC) | $28.28 | $56.54 | 50% |

| Northwest Bancshares (NWBI) | $12.46 | $24.41 | 49% |

| Niagen Bioscience (NAGE) | $9.41 | $18.68 | 49.6% |

| Metropolitan Bank Holding (MCB) | $76.02 | $150.26 | 49.4% |

| Horizon Bancorp (HBNC) | $16.11 | $31.77 | 49.3% |

| Glaukos (GKOS) | $81.47 | $161.57 | 49.6% |

| Customers Bancorp (CUBI) | $66.83 | $130.64 | 48.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Verra Mobility (VRRM)

Overview: Verra Mobility Corporation offers smart mobility technology solutions across the United States, Australia, Europe, and Canada with a market cap of approximately $3.89 billion.

Operations: The company's revenue segments include Parking Solutions at $80.16 million, Commercial Services at $418.25 million, and Government Solutions at $407.92 million.

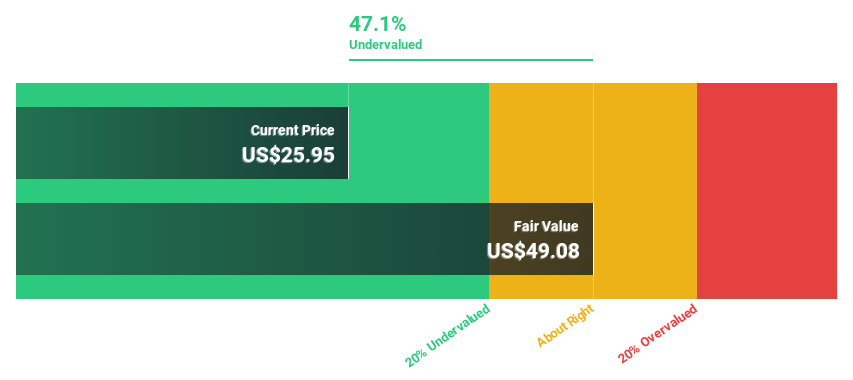

Estimated Discount To Fair Value: 38.8%

Verra Mobility, trading at US$24.64, is undervalued based on a discounted cash flow analysis with an estimated fair value of US$40.23. Despite high debt levels and one-off items affecting earnings quality, the company shows strong projected earnings growth of 46.4% annually over three years, outpacing the broader market's 15.4%. Recent financials report increased revenue and net income year-over-year for Q2 2025, alongside a US$100 million share repurchase program announcement.

- The analysis detailed in our Verra Mobility growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Verra Mobility's balance sheet health report.

FinWise Bancorp (FINW)

Overview: FinWise Bancorp is the bank holding company for FinWise Bank, offering a range of banking products and services to individual and corporate clients in Utah, with a market cap of $281.06 million.

Operations: The company generates revenue primarily through its banking segment, which accounts for $75 million.

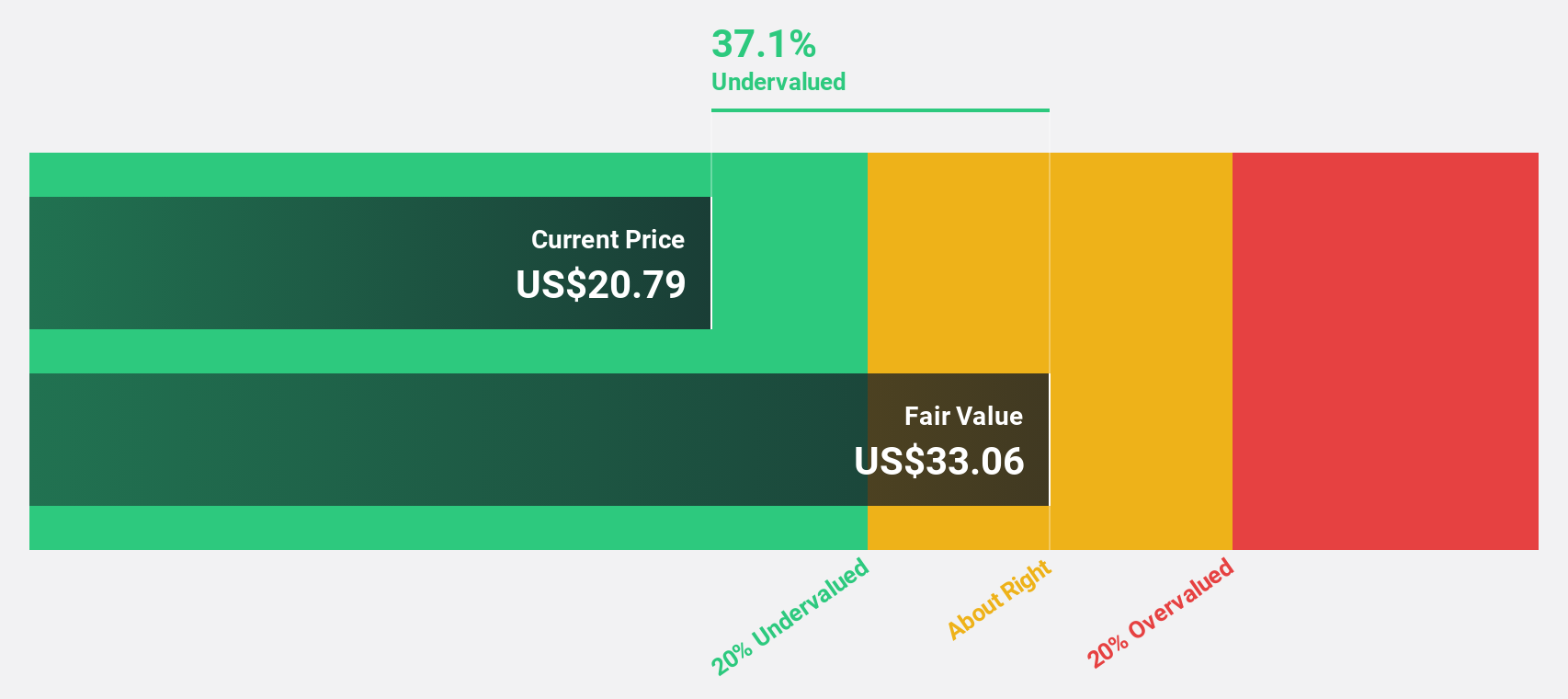

Estimated Discount To Fair Value: 37.6%

FinWise Bancorp, with a current trading price of US$20.64, is undervalued based on discounted cash flow analysis, showing a fair value of US$33.06. Despite high non-performing loans at 7.4%, the company reported Q2 2025 net income growth to US$4.1 million from US$3.18 million year-over-year and has been added to multiple indices like S&P Global BMI and Russell indexes, reflecting potential for future growth in revenue and earnings above market averages.

- Our earnings growth report unveils the potential for significant increases in FinWise Bancorp's future results.

- Unlock comprehensive insights into our analysis of FinWise Bancorp stock in this financial health report.

Consolidated Water (CWCO)

Overview: Consolidated Water Co. Ltd. operates in the Cayman Islands, the Bahamas, the United States, and the British Virgin Islands, supplying potable water, treating wastewater and water for reuse, and offering water-related products and services with a market cap of $555.69 million.

Operations: The company's revenue segments include Bulk ($33.57 million), Retail ($32.98 million), Manufacturing ($19.41 million), and Services Excluding Manufacturing ($43.14 million).

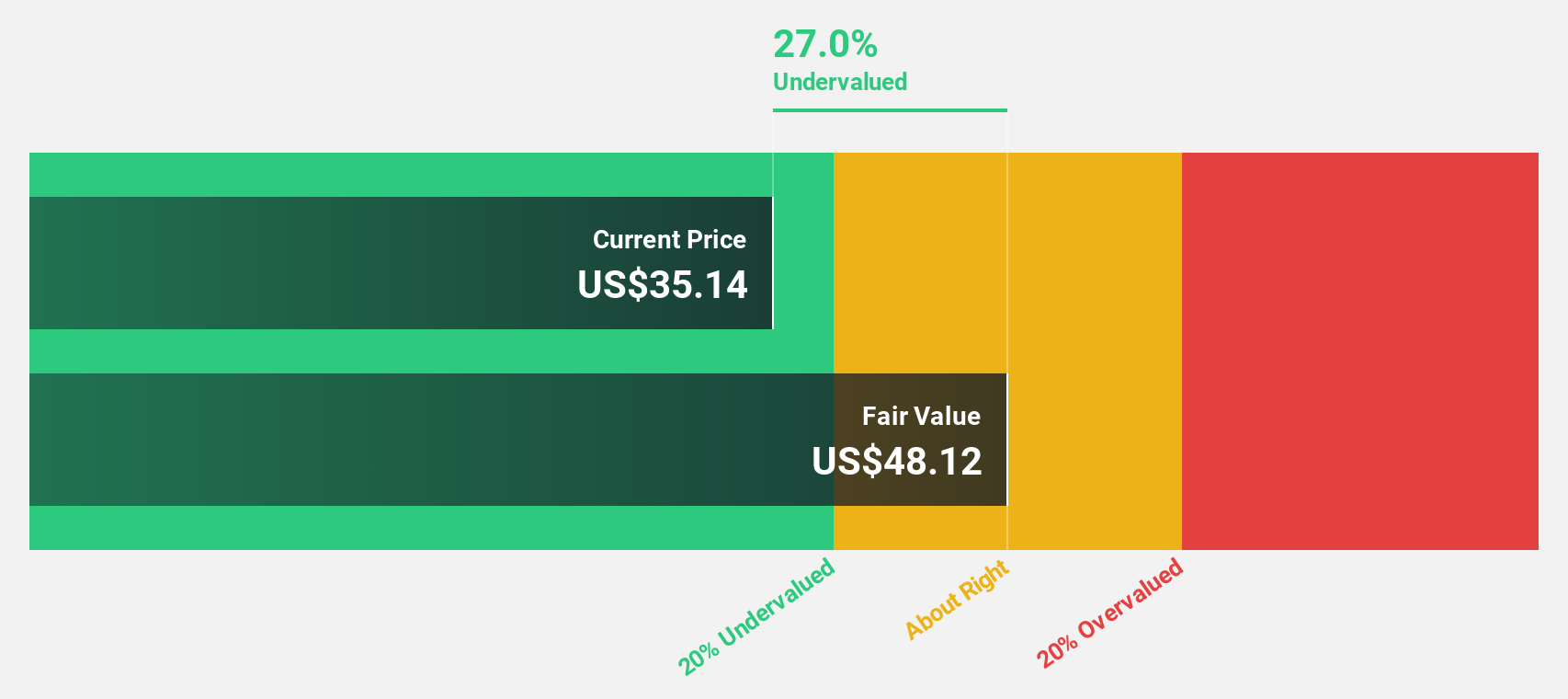

Estimated Discount To Fair Value: 27.8%

Consolidated Water, trading at US$34.72, is undervalued with a fair value estimate of US$48.12 based on discounted cash flows. Despite insider selling and a decrease in net income to US$5.1 million for Q2 2025 from US$15.85 million the previous year, revenue growth is expected to outpace the market significantly at 36.6% annually. The company maintains a reliable dividend and is actively pursuing M&A opportunities to enhance shareholder value further.

- The growth report we've compiled suggests that Consolidated Water's future prospects could be on the up.

- Take a closer look at Consolidated Water's balance sheet health here in our report.

Summing It All Up

- Reveal the 196 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FINW

FinWise Bancorp

Operates as the bank holding company for FinWise Bank that provides various banking products and services to individual and corporate customers in Utah.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives