- United States

- /

- Water Utilities

- /

- NasdaqGS:CWCO

Undiscovered Gems in the US Market for December 2024

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, but it is up 27% over the past year with earnings expected to grow by 15% per annum over the next few years. In this environment, identifying undiscovered gems involves finding stocks that not only align with these growth trends but also possess unique qualities that set them apart from more widely recognized options.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Lifeway Foods (NasdaqGM:LWAY)

Simply Wall St Value Rating: ★★★★★★

Overview: Lifeway Foods, Inc. is a company that produces and markets probiotic-based products both in the United States and internationally, with a market capitalization of $362.26 million.

Operations: Lifeway generates revenue primarily from cultured dairy products, amounting to $181.98 million. The company's market capitalization is approximately $362.26 million.

Lifeway Foods, a prominent player in the U.S. kefir and probiotic market, has been making waves with its robust financial performance and strategic initiatives. The company boasts a debt-free status, having reduced its debt to equity ratio from 10% five years ago to zero today. Over the past year, Lifeway's earnings surged by 62%, significantly outpacing the food industry's modest growth of 0.6%. Despite rejecting Danone's acquisition offer of $27 per share as undervaluing their potential, Lifeway continues to focus on expanding its product line and international reach, particularly in markets like South Africa and UAE.

Consolidated Water (NasdaqGS:CWCO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Consolidated Water Co. Ltd. designs, constructs, manages, and operates water production and treatment plants primarily in the Cayman Islands, the Bahamas, and the United States with a market cap of $407.12 million.

Operations: Consolidated Water generates revenue through four key segments: Bulk ($34.18 million), Retail ($31.99 million), Manufacturing ($18.90 million), and Services Excluding Manufacturing ($73.74 million).

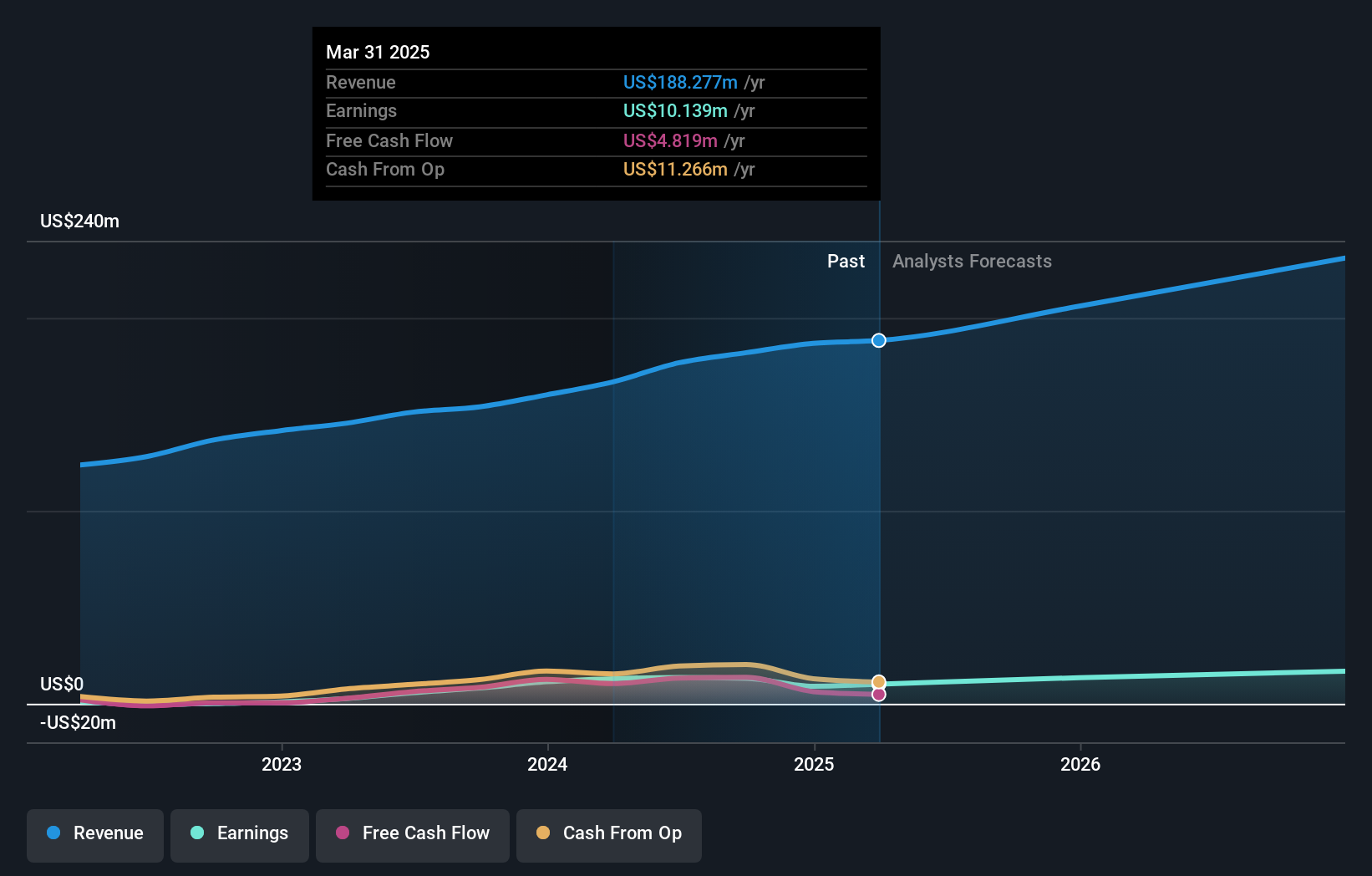

Consolidated Water, a notable player in the water utilities sector, is making strategic moves with its $147 million desalination project in Hawaii and expansion into Colorado through the acquisition of REC. Despite these growth opportunities, challenges such as reduced construction revenue and seasonal sales fluctuations pose risks to profitability. Recent earnings show a dip in quarterly sales to US$33.39 million from US$49.85 million last year, while net income fell to US$4.45 million from US$8.61 million. With shares priced at US$25.85 and a target of US$38.5, potential upside exists if projected earnings are realized amidst competitive pressures.

X Financial (NYSE:XYF)

Simply Wall St Value Rating: ★★★★★★

Overview: X Financial offers personal finance services in the People's Republic of China and has a market cap of $397.49 million.

Operations: X Financial generates revenue primarily from personal finance services, reporting CN¥5.36 billion in this segment.

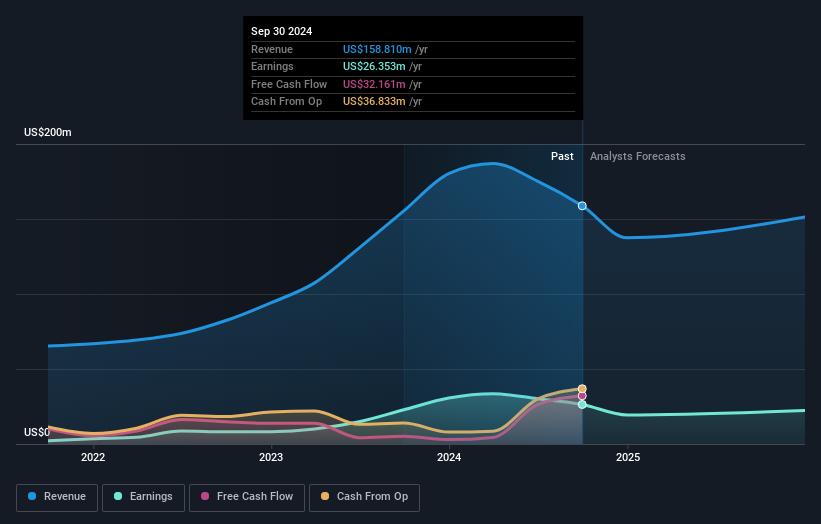

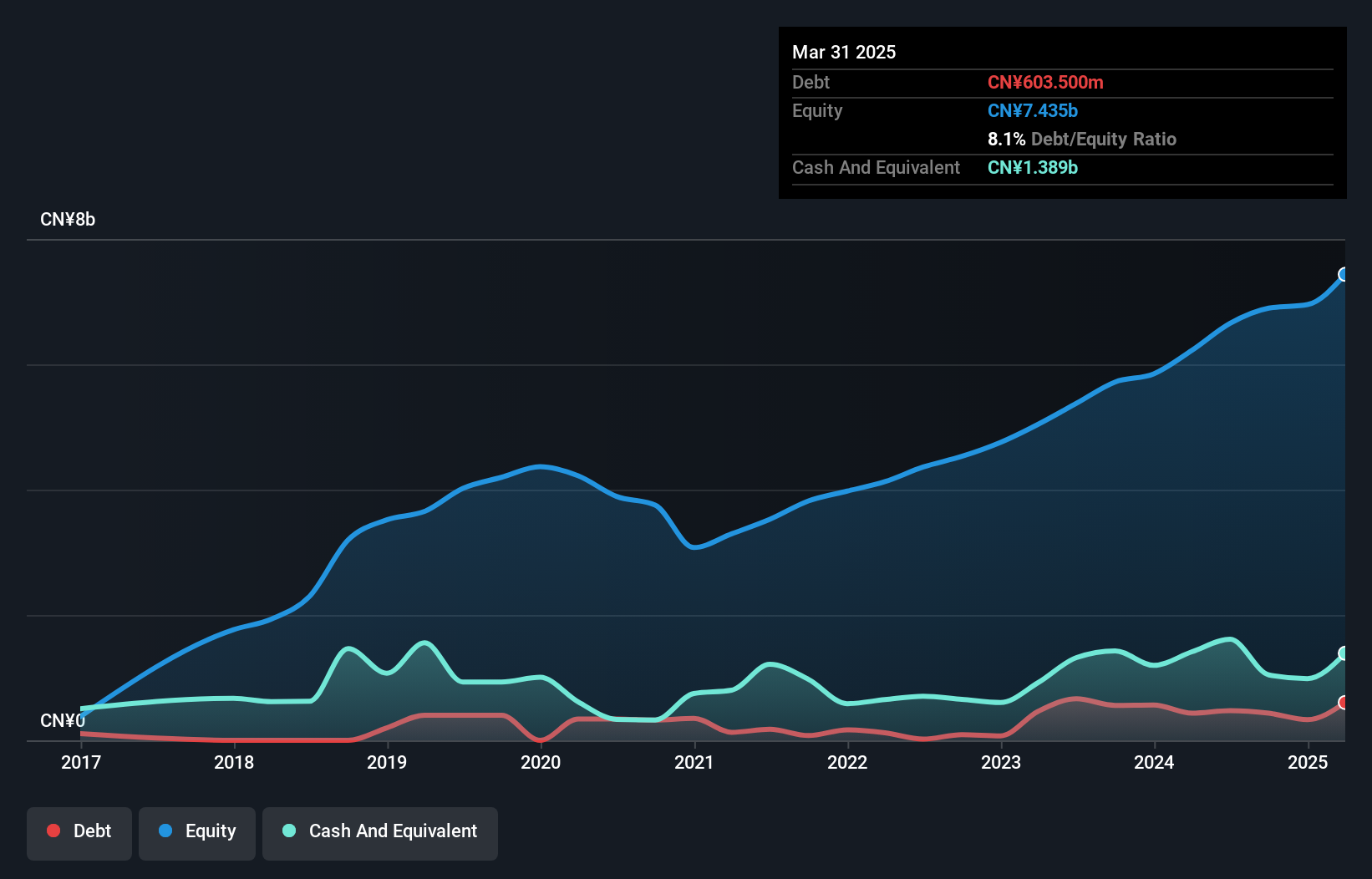

X Financial, a notable player in the consumer finance sector, has shown resilience with earnings growth of 5.6% over the past year, outpacing the industry average of -5.8%. The company reported CNY 1,582 million in revenue for Q3 2024 compared to CNY 1,397 million a year prior and net income rose to CNY 376 million from CNY 347 million. Despite shareholder dilution this past year, X Financial reduced its debt-to-equity ratio from 9.5 to 6.3 over five years and maintains more cash than total debt. Trading at a significant discount of around 75% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in this space.

- Click here to discover the nuances of X Financial with our detailed analytical health report.

Gain insights into X Financial's past trends and performance with our Past report.

Next Steps

- Dive into all 238 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CWCO

Consolidated Water

Designs, constructs, manages, and operates water production and water treatment plants primarily in the Cayman Islands, the Bahamas, and the United States.

Undervalued with excellent balance sheet and pays a dividend.