Last Update 05 Sep 25

Despite strong revenue growth and improved EBITDA margins, analysts are maintaining a discounted multiple due to lingering ownership structure uncertainties, keeping Lifeway Foods’ consensus price target unchanged at $33.00.

Analyst Commentary

- Bullish analysts are raising price targets due to strong 10% revenue growth in the latest quarter.

- The company has demonstrated a return to mid-teen EBITDA margins, indicating improved operational efficiency.

- Analysts are maintaining previously applied valuation multiples on forward estimates, signaling stable confidence in the company's business model.

- There is upside potential if Lifeway can resolve complications arising from its major ownership structure and standstill agreement.

- Despite positive financial trends, a discounted valuation multiple is still being applied until ownership uncertainties are fully resolved.

What's in the News

- Lifeway Foods reported estimated net sales of $39.1 million for the first two months of Q3 through August 31, 2025, and expressed confidence in achieving the strongest annual sales in company history with over 20% quarterly growth to date.

- The company expanded retail distribution with the launch of Lifeway Kefir in the San Diego Costco region, now available in 60 Costco locations.

- Lifeway announced the return of its Basics Plus™ kefir and colostrum supplement shots and expanded its ProBugs® line with a new conventional whole milk kefir for kids in three flavors.

- Investor activists Edward and Ludmila Smolyansky continued their consent solicitation campaign to replace the board, accusing current management of rejecting a Danone buyout offer at a 72% premium, implementing a poison pill, and awarding a controversial bonus to the CEO.

- Institutional Shareholder Services (ISS) recommended shareholders do not support the dissident-led consent solicitation, stating the activists have not presented a compelling case for change.

Valuation Changes

Summary of Valuation Changes for Lifeway Foods

- The Consensus Analyst Price Target remained effectively unchanged, at $33.00.

- The Consensus Revenue Growth forecasts for Lifeway Foods remained effectively unchanged, at 14.9% per annum.

- The Net Profit Margin for Lifeway Foods remained effectively unchanged, at 10.74%.

Key Takeaways

- Growing consumer demand for gut health and functional foods, combined with product innovation, is strengthening competitive advantage and supporting higher margins.

- Expanded national retail distribution and operational efficiency improvements are driving greater market penetration, improved cost structure, and enhanced earnings potential.

- Dependence on core dairy products, concentrated customers, and rising competition heighten risk to growth, margins, and profitability if costs rise or market preferences shift.

Catalysts

About Lifeway Foods- Produces and markets probiotic-based products in the United States and internationally.

- Accelerating consumer focus on gut health, immunity, and health-conscious lifestyles is driving sustained double-digit sales growth for Lifeway's probiotic product portfolio, which is likely to continue expanding the company's revenue base.

- Lifeway's new product innovations-such as kefir infused with collagen-capitalize on consumer demand for functional, premium foods, supporting higher margin opportunities and strengthening competitive differentiation, thereby positively impacting gross margins and earnings growth.

- The company's ongoing expansion of national retail distribution (including major new placements at Target, Publix, Costco, and Whole Foods) is significantly broadening market penetration and shelf presence, which is expected to drive top-line revenue growth.

- Strategic operational investments in facility upgrades and manufacturing automation are resulting in enhanced production efficiencies, positioning Lifeway to improve its cost structure, increase operating leverage, and potentially raise net margins as volumes scale.

- Momentum in proactive marketing and brand-building (e.g., partnerships, virality on TikTok, National Kefir Day) is amplifying brand awareness and consumer loyalty, likely translating to increased sales velocity and durable earnings growth.

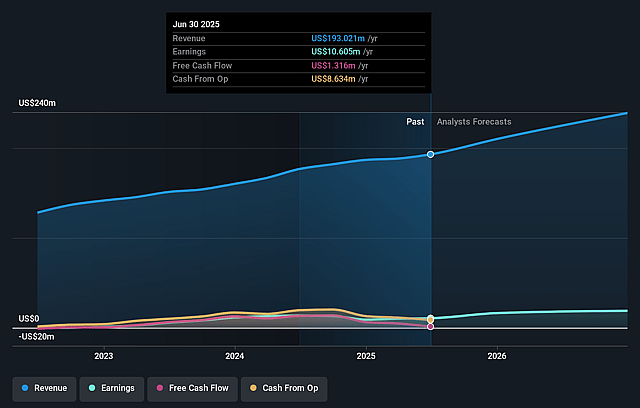

Lifeway Foods Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lifeway Foods's revenue will grow by 14.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.5% today to 10.7% in 3 years time.

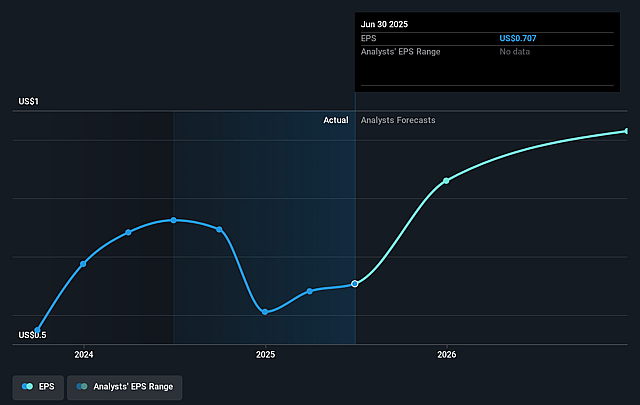

- Analysts expect earnings to reach $31.4 million (and earnings per share of $2.0) by about September 2028, up from $10.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.5x on those 2028 earnings, down from 46.7x today. This future PE is greater than the current PE for the US Food industry at 19.5x.

- Analysts expect the number of shares outstanding to grow by 2.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Lifeway Foods Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lifeway's portfolio remains heavily concentrated in its flagship kefir product, increasing vulnerability to category-specific demand shocks or consumer shifts toward plant-based or non-dairy alternatives, which could negatively impact future revenue growth.

- Sustained sales and margin growth are currently supported by favorable conventional milk pricing, but rising costs for organic milk and potential climate-related pressures on dairy sourcing could compress gross margins and constrain net earnings.

- Expansion through major retailers and distributors, while bolstering near-term growth, increases dependence on a concentrated customer base, exposing Lifeway to risks of decreased shelf space, tough negotiations, or distributor-specific disruptions that could impact both revenues and margins.

- Continued aggressive marketing and infrastructure investment, while supporting current momentum, could pressure SG&A expenses and strain operating leverage if topline growth slows, reducing net income and earnings growth in less favorable market conditions.

- Intensifying competition from both specialty startups and large CPG companies in the functional foods and beverages sector may erode Lifeway's market share, potentially triggering price wars and higher promotional spending, impacting both revenues and profitability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $33.0 for Lifeway Foods based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $292.6 million, earnings will come to $31.4 million, and it would be trading on a PE ratio of 20.5x, assuming you use a discount rate of 6.8%.

- Given the current share price of $32.51, the analyst price target of $33.0 is 1.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.