- United States

- /

- Biotech

- /

- NasdaqGS:CTMX

CytomX Therapeutics, Inc.'s (NASDAQ:CTMX) Shares Bounce 26% But Its Business Still Trails The Industry

Those holding CytomX Therapeutics, Inc. (NASDAQ:CTMX) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 18% in the last twelve months.

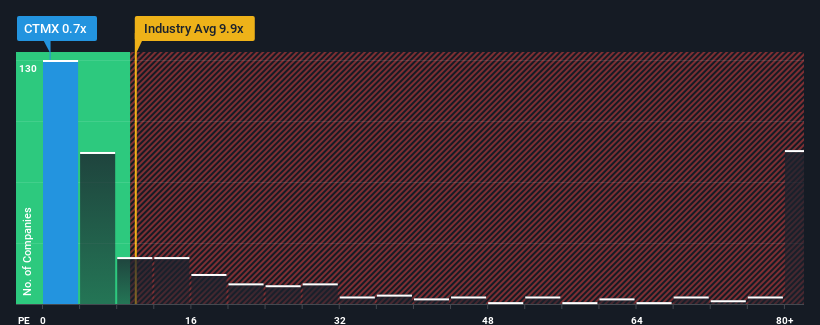

Although its price has surged higher, CytomX Therapeutics may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 9.9x and even P/S higher than 63x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for CytomX Therapeutics

What Does CytomX Therapeutics' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, CytomX Therapeutics has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on CytomX Therapeutics will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like CytomX Therapeutics' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 34% last year. The latest three year period has also seen an excellent 91% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue growth is heading into negative territory, declining 30% per year over the next three years. Meanwhile, the broader industry is forecast to expand by 113% per year, which paints a poor picture.

With this in consideration, we find it intriguing that CytomX Therapeutics' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On CytomX Therapeutics' P/S

CytomX Therapeutics' recent share price jump still sees fails to bring its P/S alongside the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of CytomX Therapeutics' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for CytomX Therapeutics (2 are potentially serious) you should be aware of.

If these risks are making you reconsider your opinion on CytomX Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CTMX

CytomX Therapeutics

Operates as an oncology-focused biopharmaceutical company that focuses on developing novel conditionally activated biologics localized to the tumor microenvironment.

Undervalued moderate.

Market Insights

Community Narratives