- United States

- /

- Capital Markets

- /

- NYSE:JEF

Top Growth Companies With High Insider Ownership On US Exchanges In September 2024

Reviewed by Simply Wall St

As the U.S. stock market shows signs of recovery with the S&P 500 and Nasdaq Composite extending their winning streaks, investors are closely monitoring growth companies that exhibit strong insider ownership. In this environment, stocks with high insider ownership can be particularly attractive as they often indicate confidence from those within the company about its future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95.9% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

CarGurus (NasdaqGS:CARG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CarGurus, Inc. operates an online automotive platform for buying and selling vehicles in the United States and internationally, with a market cap of $2.81 billion.

Operations: CarGurus generates revenue primarily from its U.S. Marketplace segment, which accounts for $686.26 million, and its Digital Wholesale segment, contributing $134.48 million.

Insider Ownership: 17.3%

Revenue Growth Forecast: 12.9% p.a.

CarGurus, a growth company with high insider ownership, recently appointed Mike O’Hanlon as Chief Revenue Officer to drive customer growth and retention. Despite reporting a net loss of US$68.72 million for Q2 2024, the company forecasts earnings to grow 51.54% annually and expects revenue to increase by 12.9% per year, outpacing the US market average. Additionally, CarGurus has repurchased shares worth US$61.35 million in Q2 2024 as part of its buyback program.

- Click here and access our complete growth analysis report to understand the dynamics of CarGurus.

- In light of our recent valuation report, it seems possible that CarGurus is trading behind its estimated value.

Jefferies Financial Group (NYSE:JEF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jefferies Financial Group Inc. is an investment banking and capital markets firm operating in the Americas, Europe, the Middle East, and the Asia-Pacific with a market cap of $11.69 billion.

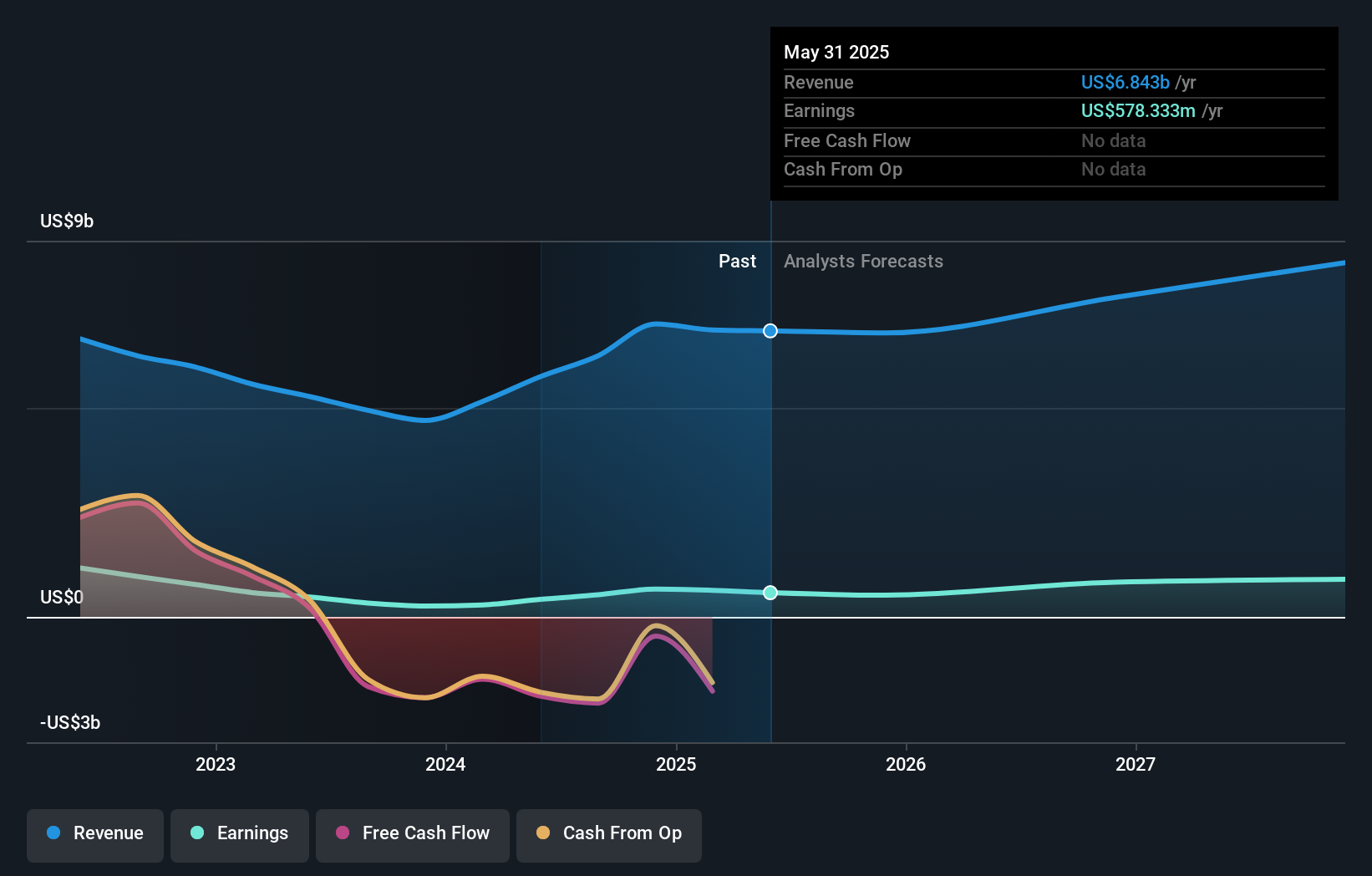

Operations: The company's revenue segments include $5.17 billion from Investment Banking and Capital Markets, and $580.70 million from Asset Management.

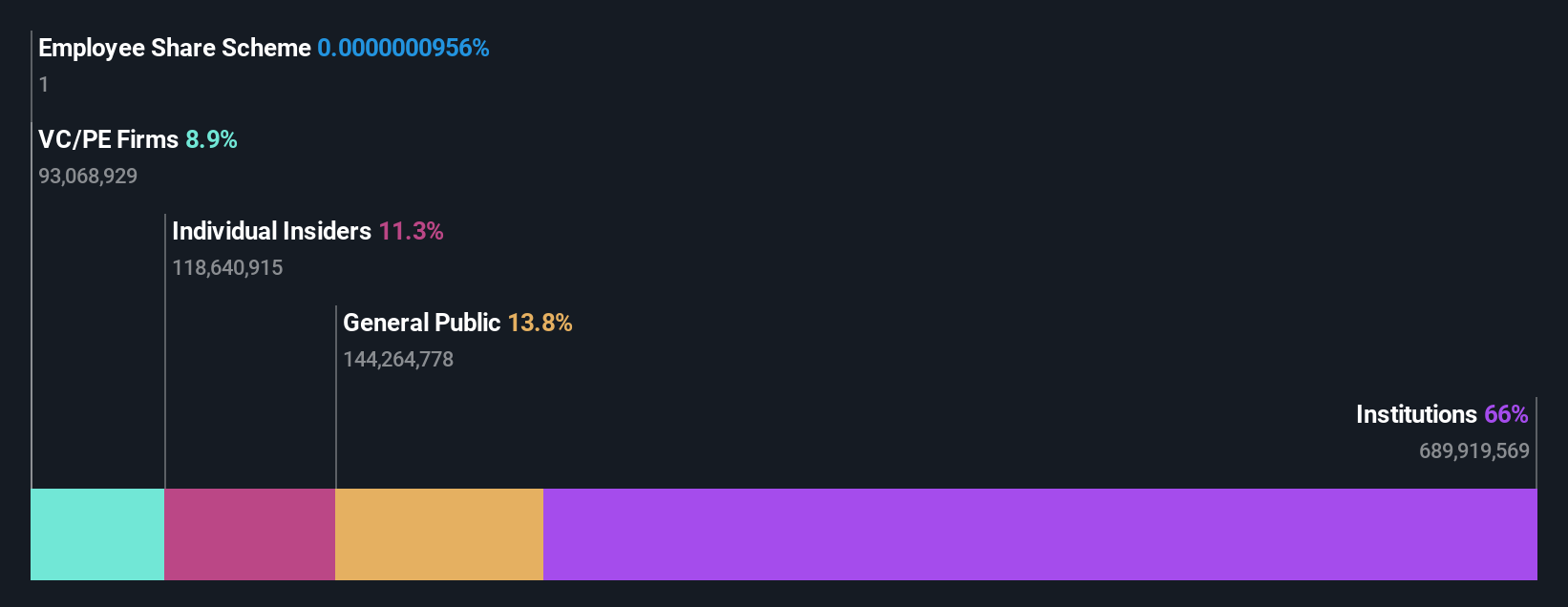

Insider Ownership: 21.3%

Revenue Growth Forecast: 14.7% p.a.

Jefferies Financial Group, with high insider ownership, is projected to see significant earnings growth of 33.88% annually over the next three years, outpacing the US market average. However, its dividend yield of 2.49% is not well covered by free cash flows. Recent fixed-income offerings and strategic board appointments underscore its efforts to strengthen financial stability and strategic alliances. Despite these positives, Jefferies' forecasted return on equity remains low at 9.8%.

- Delve into the full analysis future growth report here for a deeper understanding of Jefferies Financial Group.

- According our valuation report, there's an indication that Jefferies Financial Group's share price might be on the expensive side.

Full Truck Alliance (NYSE:YMM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Full Truck Alliance Co. Ltd. operates a digital freight platform in China that connects shippers with truckers for various shipment needs and has a market cap of approximately $7.42 billion.

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to CN¥9.70 billion.

Insider Ownership: 10.4%

Revenue Growth Forecast: 18.4% p.a.

Full Truck Alliance, with substantial insider ownership, is forecasted to experience significant earnings growth of 30.25% annually over the next three years, surpassing the US market average. Recent Q2 2024 results showed sales of CNY 2.76 billion and net income of CNY 823.13 million, both up from last year. Despite trading at a good value compared to peers and industry standards, its return on equity is expected to be low at 11.7% in three years.

- Get an in-depth perspective on Full Truck Alliance's performance by reading our analyst estimates report here.

- Our valuation report here indicates Full Truck Alliance may be undervalued.

Turning Ideas Into Actions

- Access the full spectrum of 178 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JEF

Jefferies Financial Group

Operates as an investment banking and capital markets firm in the Americas, Europe, the Middle East, and the Asia-Pacific.

Reasonable growth potential with proven track record and pays a dividend.