- United States

- /

- Transportation

- /

- NYSE:YMM

High Insider Ownership Growth Stocks On US Exchange For January 2025

Reviewed by Simply Wall St

As the United States market experiences a rise with investors digesting recent executive orders, major indices like the Dow Jones and S&P 500 are looking to build on last week's gains. In this environment, growth companies with high insider ownership can offer unique insights into potential long-term value, as insiders often have a vested interest in the company's success and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| Ultralife (NasdaqGM:ULBI) | 36% | 43.8% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.6% | 34.7% |

| CarGurus (NasdaqGS:CARG) | 16.9% | 42.4% |

| RH (NYSE:RH) | 17.1% | 53.8% |

Here we highlight a subset of our preferred stocks from the screener.

Byrna Technologies (NasdaqCM:BYRN)

Simply Wall St Growth Rating: ★★★★☆☆

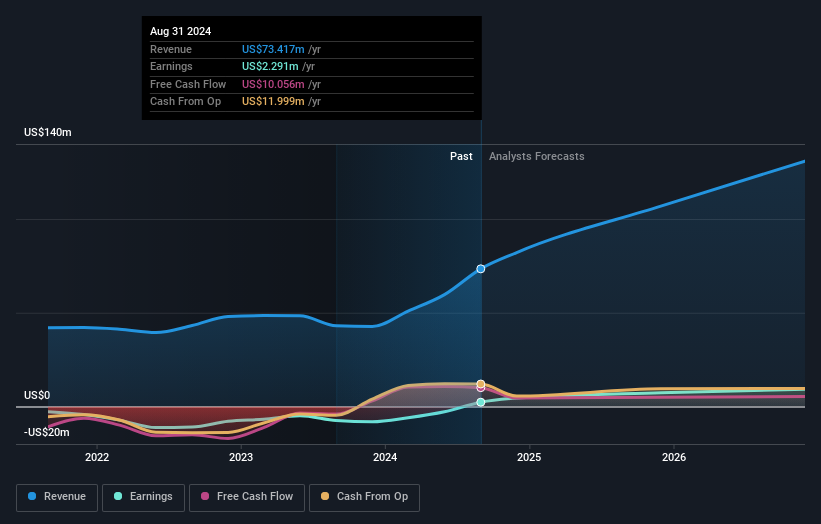

Overview: Byrna Technologies Inc. is a less-lethal self-defense technology company that develops, manufactures, and sells personal security solutions across various regions including the United States and internationally, with a market cap of approximately $661.63 million.

Operations: The company's revenue primarily comes from its Aerospace & Defense segment, totaling $73.42 million.

Insider Ownership: 21.1%

Byrna Technologies, with high insider ownership and no substantial insider selling recently, is experiencing significant earnings growth forecasts of 35.4% annually, outpacing the US market average. While revenue growth is slower at 18.9%, it still exceeds the market's 9%. The company became profitable this year and projects a record full-year revenue of US$85.8 million for 2024, more than doubling from the previous year’s US$42.6 million.

- Unlock comprehensive insights into our analysis of Byrna Technologies stock in this growth report.

- According our valuation report, there's an indication that Byrna Technologies' share price might be on the expensive side.

Fiverr International (NYSE:FVRR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fiverr International Ltd. operates a global online marketplace and has a market cap of approximately $1.20 billion.

Operations: The company's revenue segments primarily consist of its online marketplace operations.

Insider Ownership: 13.9%

Fiverr International, with substantial insider ownership, became profitable this year and anticipates significant earnings growth of 43.9% annually over the next three years, surpassing the US market average. Despite revenue growth being slower at 9.5%, it remains above the market's 9%. The company recently launched Dynamic Matching, an AI tool enhancing freelancer-client connections, reflecting strategic innovation amidst its projected annual revenue of US$388 million to US$390 million for 2024.

- Take a closer look at Fiverr International's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Fiverr International shares in the market.

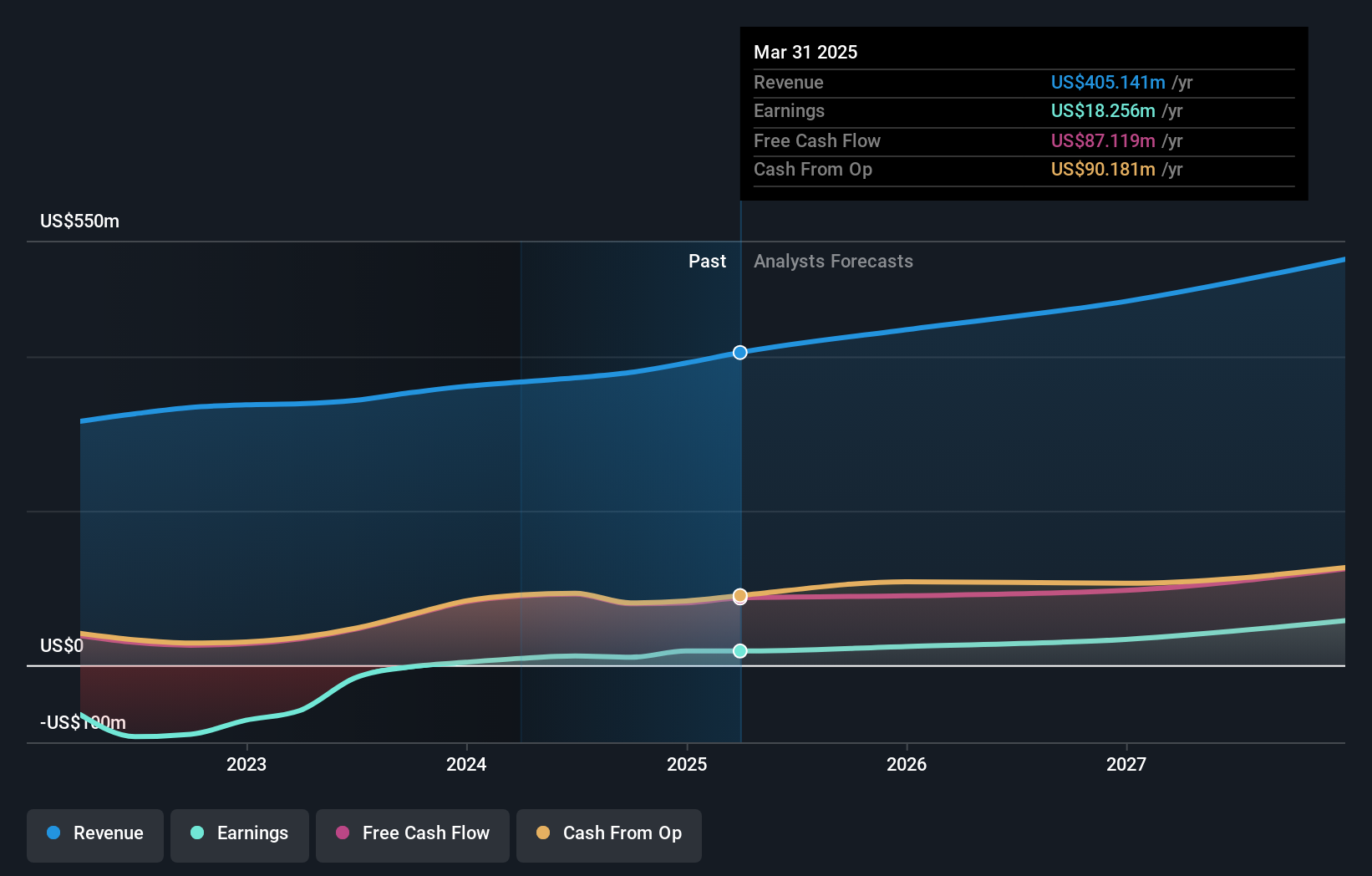

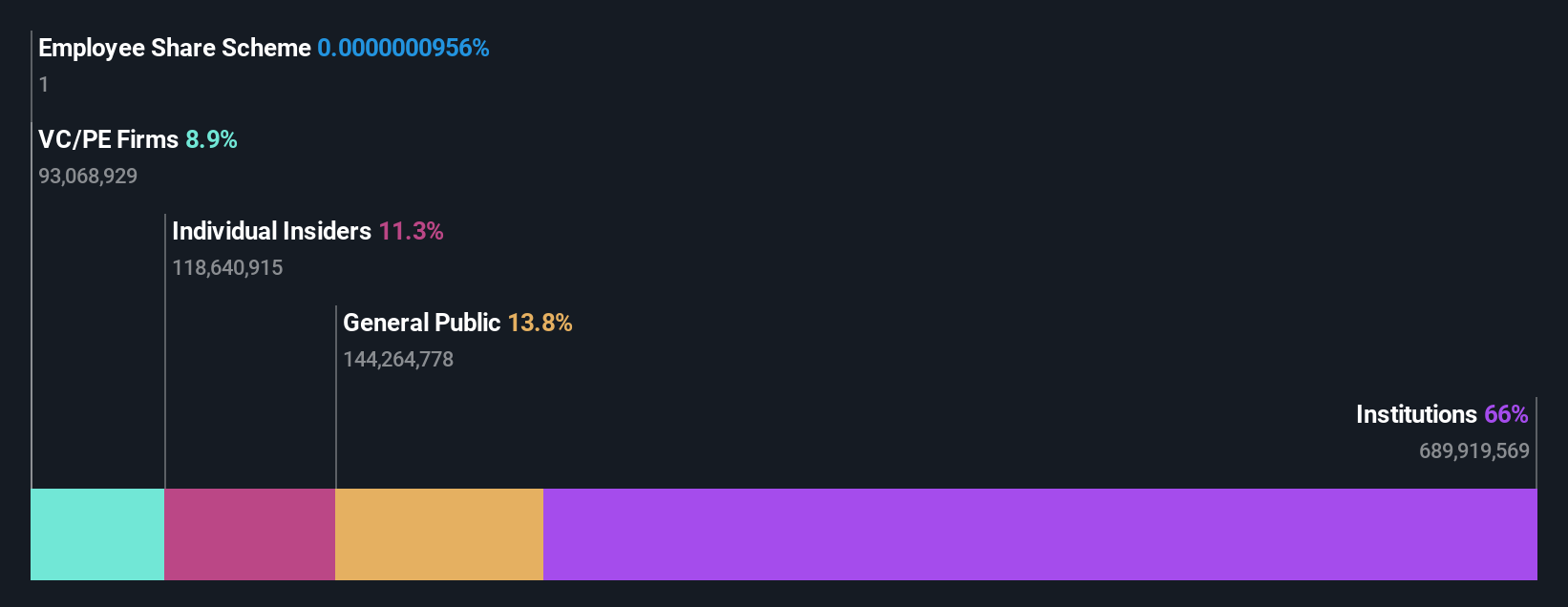

Full Truck Alliance (NYSE:YMM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Full Truck Alliance Co. Ltd. operates a digital freight platform in the People's Republic of China, connecting shippers with truckers for various shipment needs, and has a market cap of approximately $11.78 billion.

Operations: The company's revenue primarily comes from its Internet Information Providers segment, generating CN¥10.47 billion.

Insider Ownership: 10.4%

Full Truck Alliance, with significant insider ownership, is forecasted to achieve annual earnings growth of 27%, outpacing the US market. Despite revenue growth projections at 17.7% per year being slower than its earnings trajectory, they still exceed the US average. The company recently reported strong Q3 results with sales reaching CNY 3.03 billion and net income increasing to CNY 1.11 billion, alongside a positive revenue outlook for Q4 reflecting robust operational performance.

- Delve into the full analysis future growth report here for a deeper understanding of Full Truck Alliance.

- Our expertly prepared valuation report Full Truck Alliance implies its share price may be lower than expected.

Turning Ideas Into Actions

- Reveal the 206 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YMM

Full Truck Alliance

Operates a digital freight platform that connects shippers with truckers to facilitate shipments across distance ranges, cargo weights, and types in the People’s Republic of China.

Flawless balance sheet with solid track record.