- United States

- /

- Airlines

- /

- NYSE:CPA

3 US Dividend Stocks Yielding Up To 7.0%

Reviewed by Simply Wall St

As the U.S. markets react to a hotter-than-expected inflation report, with the Dow and S&P 500 closing lower and treasury yields soaring, investors are increasingly focused on finding stability amidst economic uncertainty. In such volatile times, dividend stocks can offer a reliable income stream, making them an attractive option for those looking to balance their portfolios against market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.29% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.93% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.92% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.33% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.87% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.88% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.51% | ★★★★★★ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

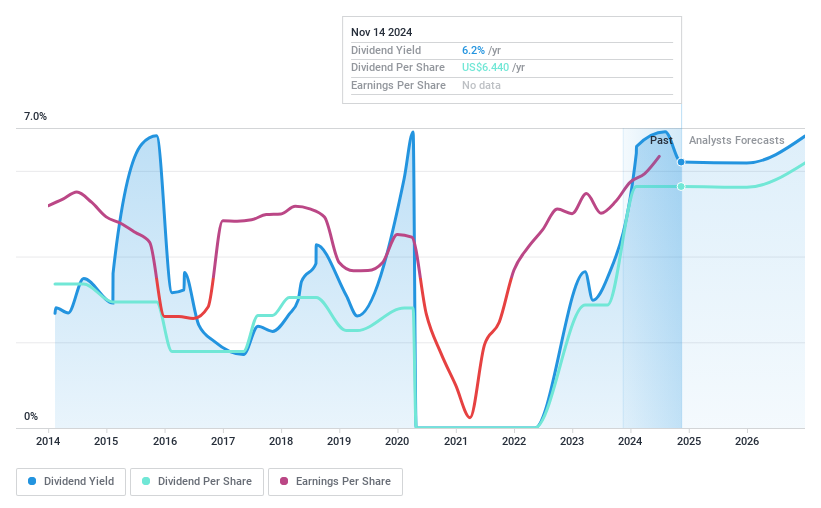

Copa Holdings (NYSE:CPA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Copa Holdings, S.A. operates through its subsidiaries to offer airline passenger and cargo services, with a market cap of approximately $3.71 billion.

Operations: Copa Holdings generates its revenue primarily from air transportation services, totaling approximately $3.48 billion.

Dividend Yield: 7.1%

Copa Holdings has a high dividend yield of 7.06%, placing it in the top 25% of U.S. dividend payers, but its dividends have been volatile over the past decade and are not well covered by free cash flows, with a high cash payout ratio of 243.4%. Despite reasonable earnings coverage with a low payout ratio of 37.5%, sustainability concerns persist due to inconsistent dividend history and reliance on non-cash earnings.

- Navigate through the intricacies of Copa Holdings with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Copa Holdings' share price might be too pessimistic.

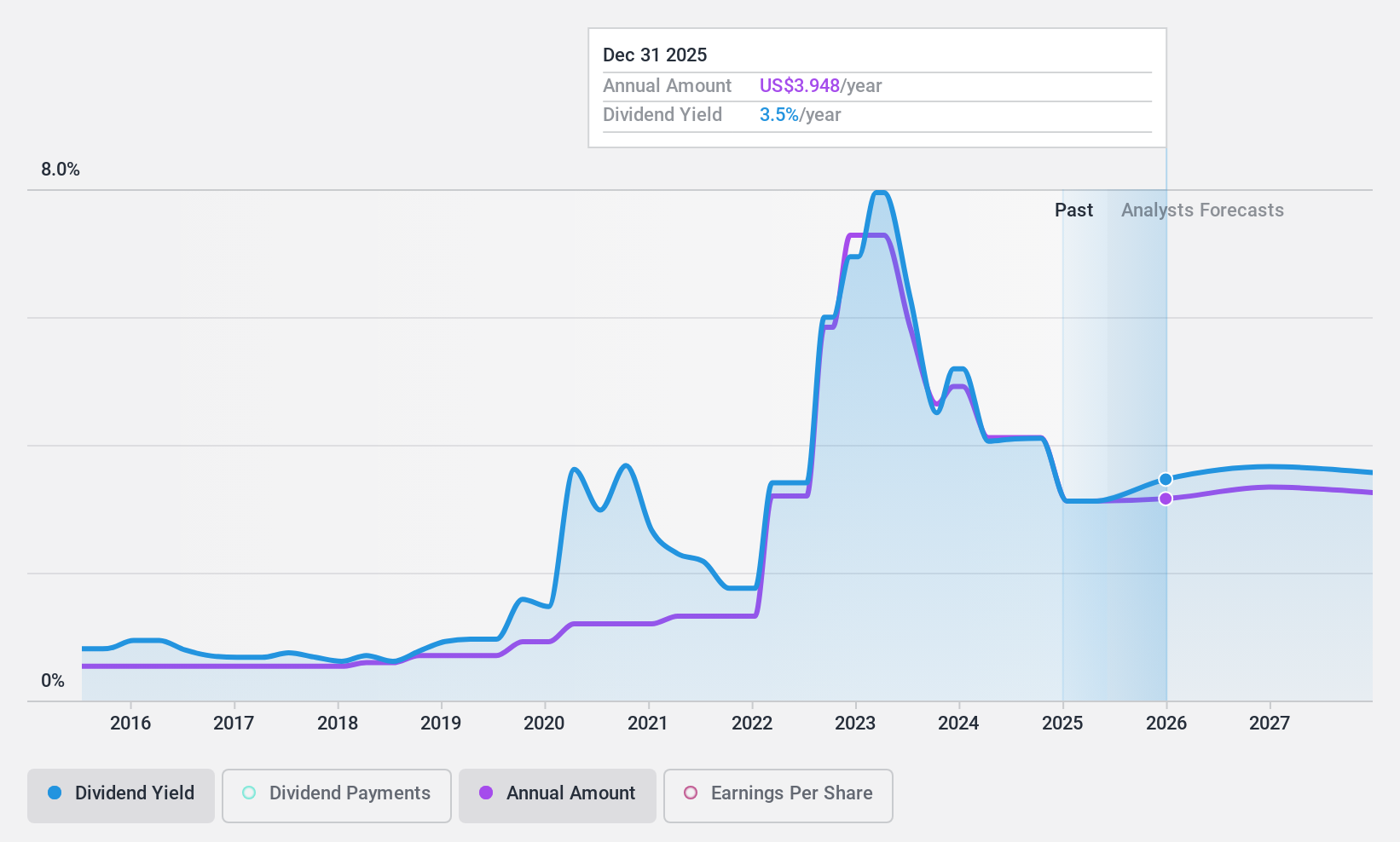

EOG Resources (NYSE:EOG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EOG Resources, Inc. is engaged in the exploration, development, production, and marketing of crude oil, natural gas liquids, and natural gas across various producing basins in the United States and internationally, with a market cap of approximately $74.09 billion.

Operations: EOG Resources generates revenue of $23.86 billion from its crude oil and natural gas exploration and production activities.

Dividend Yield: 3%

EOG Resources offers a dividend yield of 3.03%, which is lower than the top 25% of U.S. dividend payers. However, its dividends are well-covered by earnings and cash flows, with payout ratios of 29.2% and 36.7%, respectively. Despite trading at a good value relative to peers, EOG's dividend history has been volatile over the past decade, raising concerns about reliability and stability for income-focused investors. Recent executive changes may impact strategic direction but have no immediate effect on dividends.

- Click here to discover the nuances of EOG Resources with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of EOG Resources shares in the market.

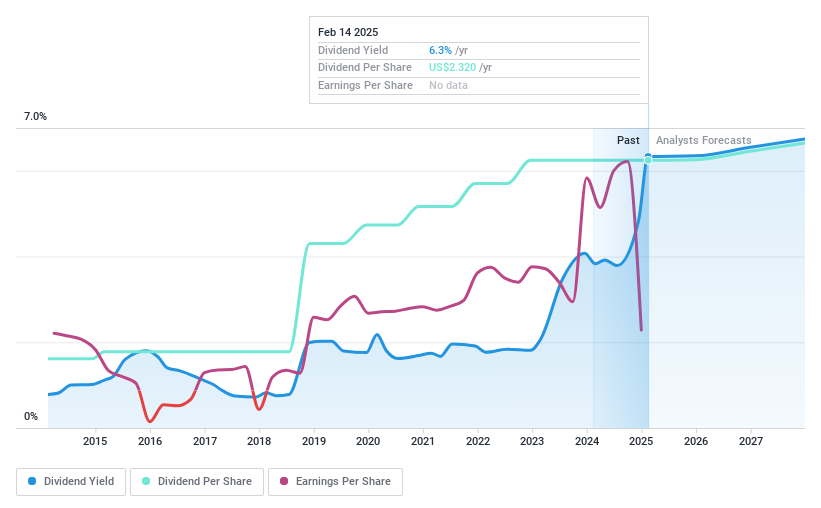

FMC (NYSE:FMC)

Simply Wall St Dividend Rating: ★★★★★★

Overview: FMC Corporation is an agricultural sciences company that offers crop protection, plant health, and professional pest and turf management products, with a market cap of $4.55 billion.

Operations: FMC Corporation's revenue segment includes Innovative Solutions, generating $4.25 billion.

Dividend Yield: 6.3%

FMC's dividend yield of 6.33% ranks in the top 25% of U.S. dividend payers, supported by stable and growing payments over the past decade. The dividends are well-covered by earnings (payout ratio: 72%) and cash flows (cash payout ratio: 48%). However, FMC's recent financial performance shows a decline in profit margins and net income, with debt not fully covered by operating cash flow. Recent amendments to its $2 billion credit facility address leverage and interest coverage ratios.

- Delve into the full analysis dividend report here for a deeper understanding of FMC.

- Our comprehensive valuation report raises the possibility that FMC is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Reveal the 135 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPA

Copa Holdings

Through its subsidiaries, provides airline passenger and cargo transport services.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives