- United States

- /

- Machinery

- /

- NYSE:GBX

US Undiscovered Gems With Potential For Growth In August 2025

Reviewed by Simply Wall St

As of August 2025, the U.S. stock market is experiencing a notable upswing, with the S&P 500 reaching record highs and investors closely monitoring developments in major tech companies like Nvidia. Amidst this backdrop, identifying promising small-cap stocks can be crucial for investors looking to capitalize on growth potential in less-explored areas of the market. A good stock in this context often combines strong fundamentals with resilience to broader economic shifts, offering an opportunity for growth even as larger indices capture most headlines.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Morris State Bancshares | NA | 3.34% | 3.70% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| First Northern Community Bancorp | NA | 8.05% | 12.27% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Elron Ventures | 5.70% | 13.72% | 25.56% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

EVI Industries (EVI)

Simply Wall St Value Rating: ★★★★★★

Overview: EVI Industries, Inc. operates through its subsidiaries to distribute, sell, rent, and lease commercial and industrial laundry and dry-cleaning equipment across the United States, Canada, the Caribbean, and Latin America with a market cap of $350.99 million.

Operations: Revenue primarily comes from the wholesale of machinery and industrial equipment, totaling $370.02 million.

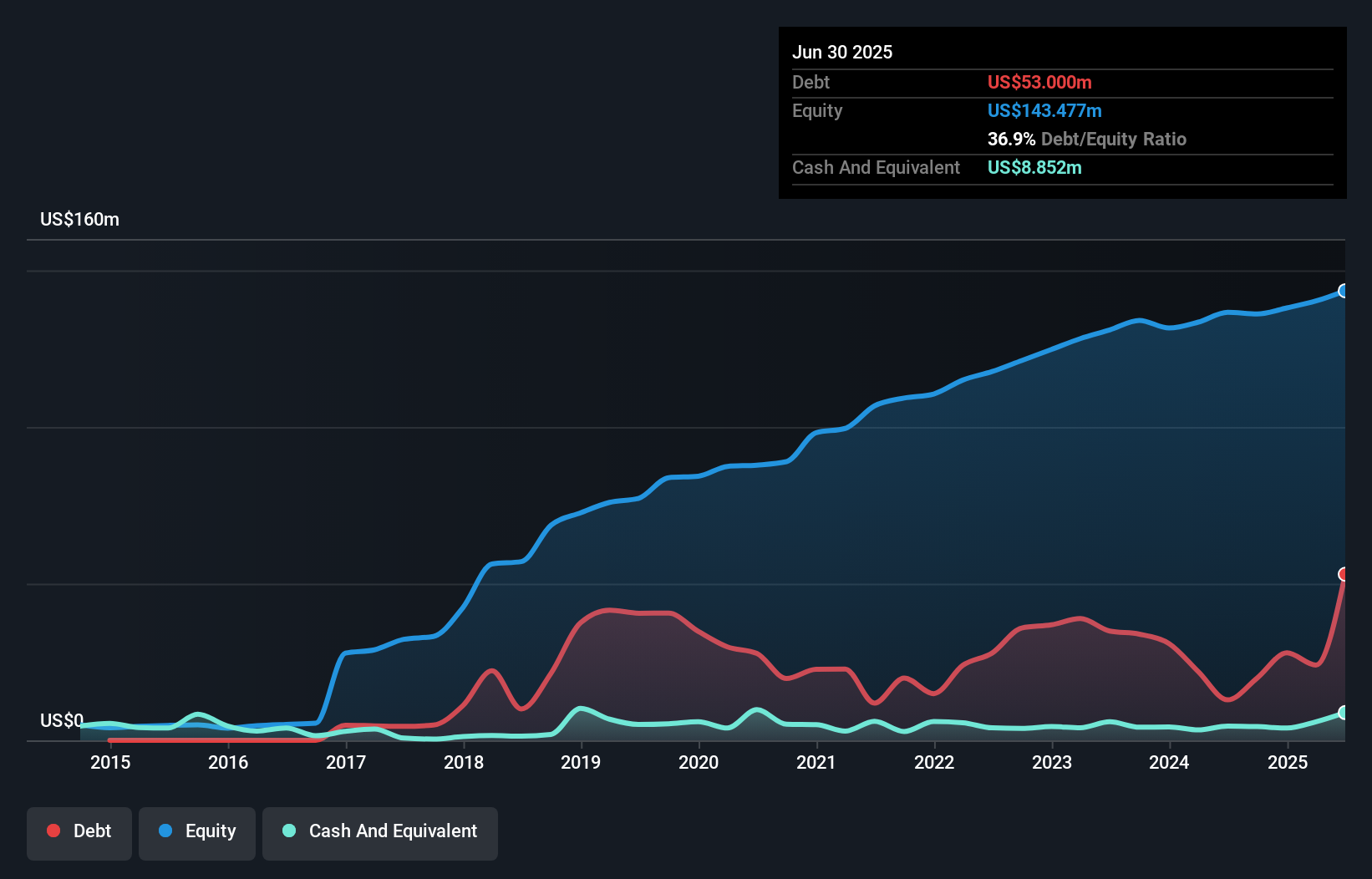

EVI Industries, a nimble player in the trade distribution sector, has demonstrated robust earnings growth of 34.5% over the past year, surpassing its industry peers. With a satisfactory net debt to equity ratio of 12.9%, EVI's financial health appears stable. The company’s interest payments are well-covered by EBIT at 6.2 times coverage, reflecting sound financial management. Despite recent removal from several Russell indices, EVI is strategically expanding through acquisitions like Girbau North America and digital integration to enhance logistics and efficiency in key markets such as healthcare and hospitality; however, integration challenges remain a potential risk factor for profitability enhancement efforts.

Greenbrier Companies (GBX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Greenbrier Companies, Inc. designs, manufactures, and markets railroad freight car equipment across North America, Europe, and South America with a market capitalization of approximately $1.46 billion.

Operations: Greenbrier generates revenue primarily through its Manufacturing segment, which accounts for $3.09 billion, and its Leasing & Fleet Management segment, contributing $248.8 million.

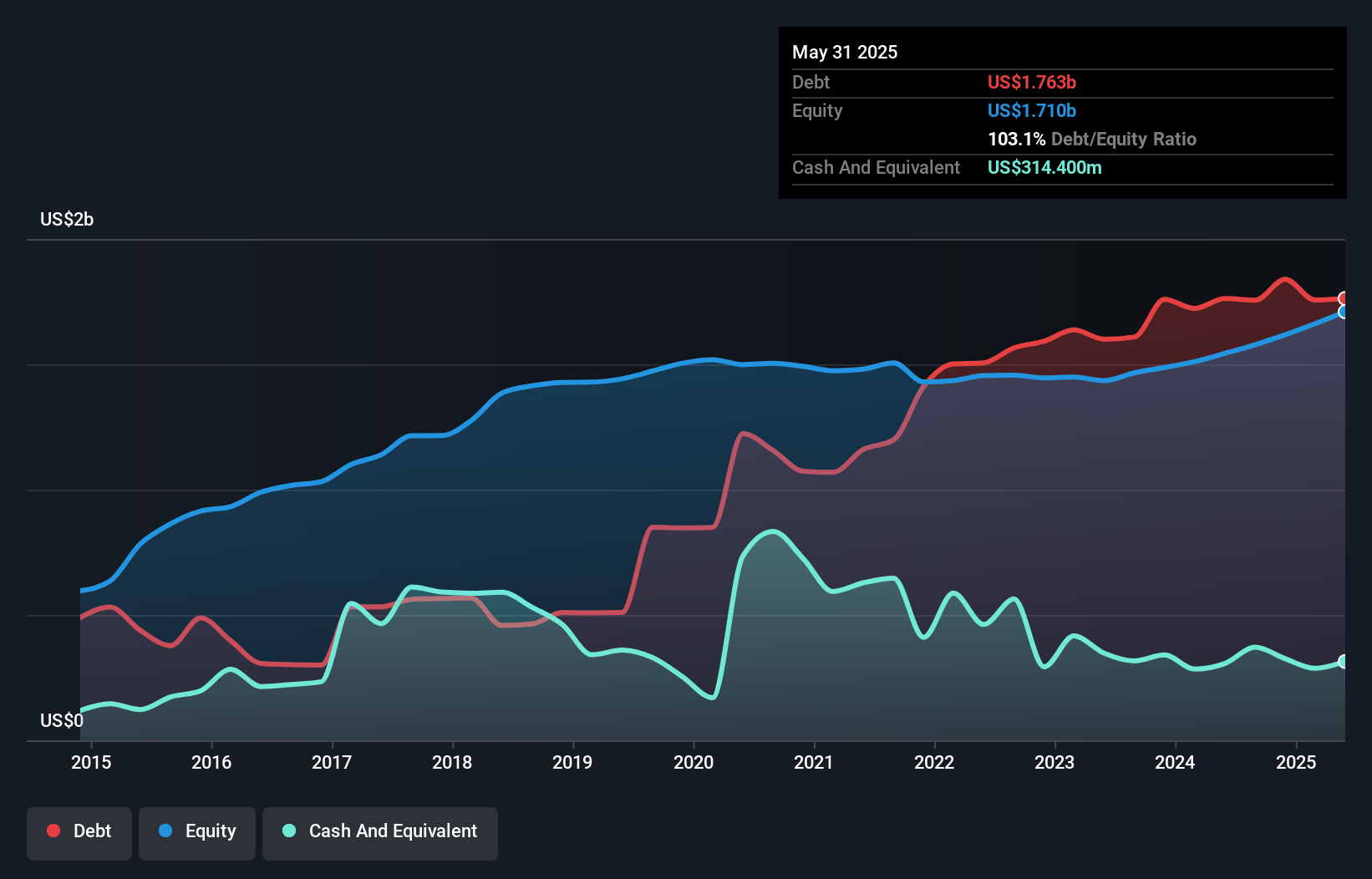

Greenbrier Companies, a notable player in the railcar industry, is navigating through a complex market landscape. The company has demonstrated strong earnings growth of 85.6% over the past year, outpacing its industry peers significantly. Despite this, it faces challenges with a high net debt to equity ratio of 84.7%, which could impact financial flexibility. Greenbrier's interest payments are well covered by EBIT at 4.7 times coverage, reflecting solid operational performance amidst these hurdles. Recent strategic moves include repurchasing shares worth US$21.75 million and adding seasoned executives to the board, potentially bolstering future governance and strategic direction.

IDT (IDT)

Simply Wall St Value Rating: ★★★★★★

Overview: IDT Corporation offers communications and payment services across the United States, the United Kingdom, and internationally, with a market cap of approximately $1.60 billion.

Operations: IDT Corporation generates revenue primarily from its Traditional Communications segment, contributing $867.40 million, followed by Fintech at $147.17 million, National Retail Solutions (NRS) at $122.69 million, and Net2phone at $86.47 million.

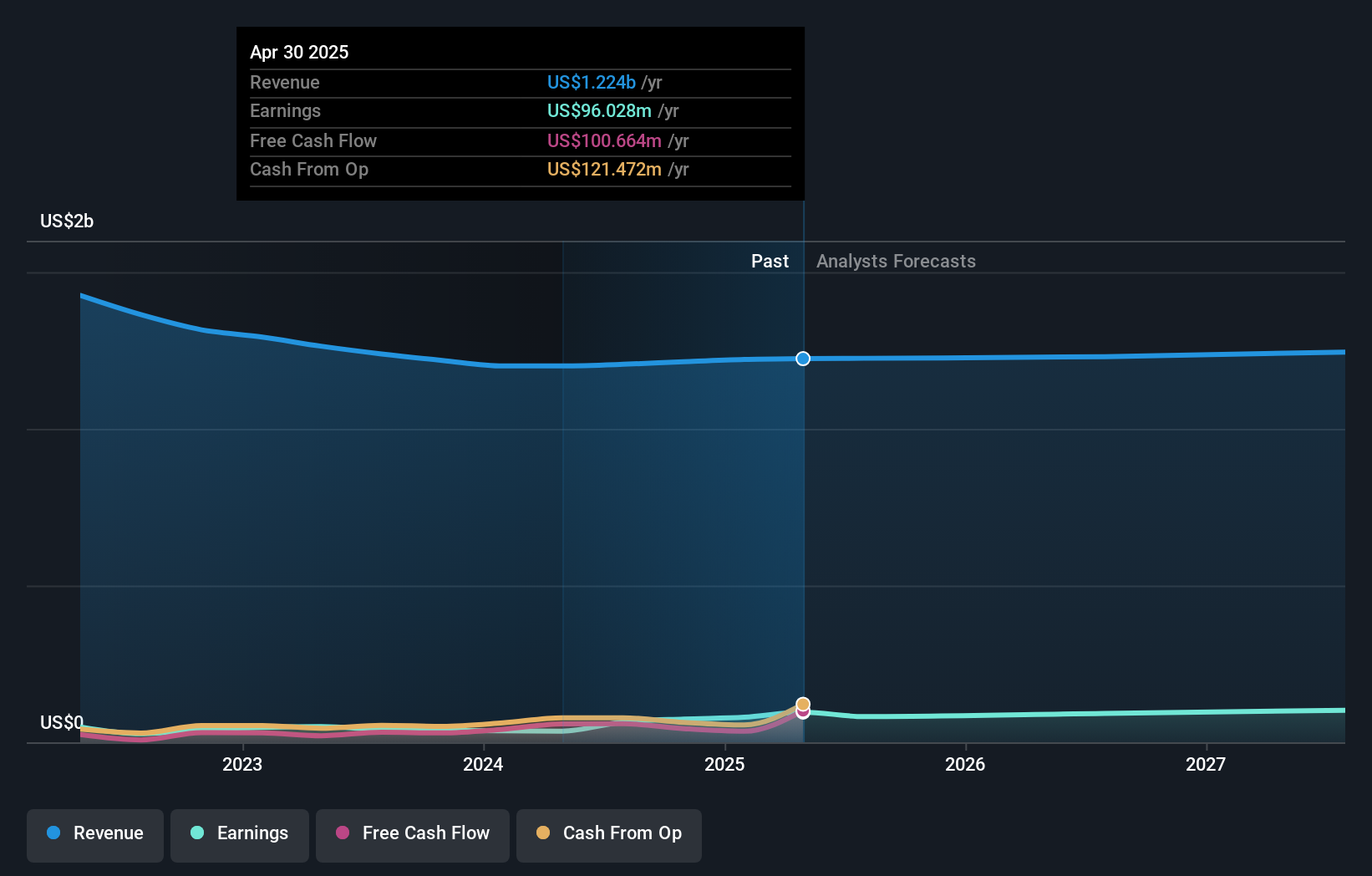

IDT Corporation, a telecom player with a strong foothold in the industry, is currently trading at 47.4% below its estimated fair value, offering potential upside for investors. The company boasts impressive earnings growth of 169.7% over the past year, significantly outpacing the telecom industry's average of 61.7%. Despite being debt-free and having high-quality earnings, IDT faces challenges like reliance on BOSS Money for working capital and potential impacts from federal policy changes. Recent financials show net income surged to US$21.69 million in Q3 2025 compared to US$5.55 million last year, with basic EPS climbing to US$0.86 from US$0.22 previously.

Summing It All Up

- Click this link to deep-dive into the 287 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBX

Greenbrier Companies

Designs, manufactures, and markets railroad freight car equipment in North America, Europe, and South America.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)