Key Takeaways

- Strategic acquisitions and digital integration are enhancing EVI's scale, operational efficiency, and ability to capture new growth opportunities in key end-markets.

- Heightened sector standards and demand for efficient equipment position EVI to benefit from sustained product upgrades and margin expansion.

- EVI's acquisition-led strategy and dependence on exclusive supplier relationships heighten integration, supplier, and industry disruption risks that could undermine profitability and market stability.

Catalysts

About EVI Industries- Through its subsidiaries, engages in the distribution, sale, rental, and lease of commercial and industrial laundry and dry-cleaning equipment in the United States, Canada, the Caribbean, and Latin America.

- The recent strategic acquisition of Girbau North America expands EVI's operational scale, logistics capabilities, and geographic reach, positioning the company to leverage growing demand in urban and institutional end-markets, resulting in an expanded revenue base and opportunities for cross-selling.

- Investments in digital platforms (Field Service Management, CRM, and digital commerce) are expected to drive operational efficiencies and unify acquired entities, supporting scalable growth, service differentiation, and ultimately improving both net margins and recurring revenue streams.

- EVI's access to significant liquidity and strong operating cash flow enables the company to continue its disciplined acquisition strategy in a fragmented industry, which should drive further revenue growth and operational synergies leading to higher earnings.

- Heightened emphasis on hygiene and infection control standards in key sectors like healthcare and hospitality is likely to result in sustained, above-trend demand for advanced laundry solutions, providing a long-term tailwind for revenue expansion.

- Growing customer and regulatory focus on modern, energy

- and water-efficient equipment is expected to accelerate replacement cycles, benefitting distributors like EVI with revenue and margin uplift from premium product offerings.

EVI Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming EVI Industries's revenue will grow by 13.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.7% today to 2.1% in 3 years time.

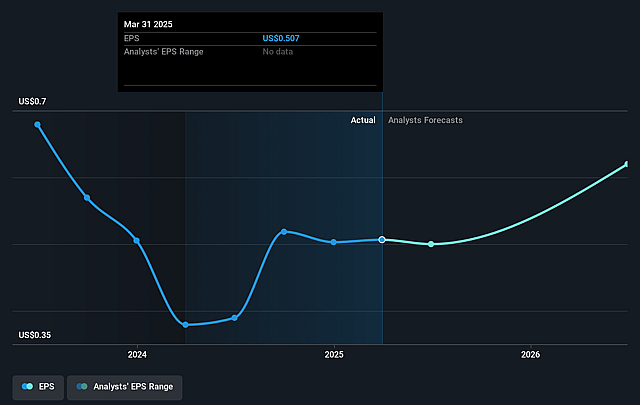

- Analysts expect earnings to reach $11.4 million (and earnings per share of $0.83) by about September 2028, up from $6.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.4x on those 2028 earnings, down from 54.2x today. This future PE is greater than the current PE for the US Trade Distributors industry at 23.3x.

- Analysts expect the number of shares outstanding to grow by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.1%, as per the Simply Wall St company report.

EVI Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- EVI's aggressive acquisition-driven growth strategy, as highlighted by the large and transformational Girbau North America acquisition, exposes the company to long-term execution and integration risks that can result in elevated expenses, difficulties merging operations, and potential overpayment-adversely affecting net margins and long-term earnings growth.

- The company's focus on expanding within the United States, as demonstrated by the importance of GNA's national distribution and customer base, could leave EVI vulnerable to regional economic downturns, regulatory shifts, or natural disasters-potentially creating significant volatility in revenues.

- Heavy investments in technology, digital infrastructure, and integration of acquisitions, while critical for the long-term strategy, have driven up SG&A expenses and may continue to pressure margins and cash flows if efficiency gains or cross-sell synergies fail to materialize as expected.

- EVI's reliance on exclusive supplier and distributor relationships, such as the deepening ties with GNA and its equipment manufacturers, increases supplier risk; any disruption, loss, or unfavorable renegotiation of key supplier agreements could significantly impact revenues and gross margins.

- Persistent industry-wide risks-like digital disintermediation (manufacturers bypassing distributors via direct online channels) and increased competition resulting from consolidation-could erode the traditional trade distribution model and diminish EVI's market share and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $28.0 for EVI Industries based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $547.1 million, earnings will come to $11.4 million, and it would be trading on a PE ratio of 37.4x, assuming you use a discount rate of 8.1%.

- Given the current share price of $27.37, the analyst price target of $28.0 is 2.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.