- United States

- /

- Banks

- /

- NasdaqGS:SRCE

Discovering Undiscovered Gems in the US Market September 2025

Reviewed by Simply Wall St

As the Nasdaq hits fresh record highs and the S&P 500 continues its upward trajectory, investors are keenly observing the broader market sentiment that has buoyed small-cap stocks, with indices like the Russell 2000 reaching new peaks. In this vibrant market environment, identifying promising small-cap stocks involves looking for companies with strong fundamentals and growth potential that have not yet caught widespread attention.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tri-County Financial Group | 82.51% | 3.15% | -17.04% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

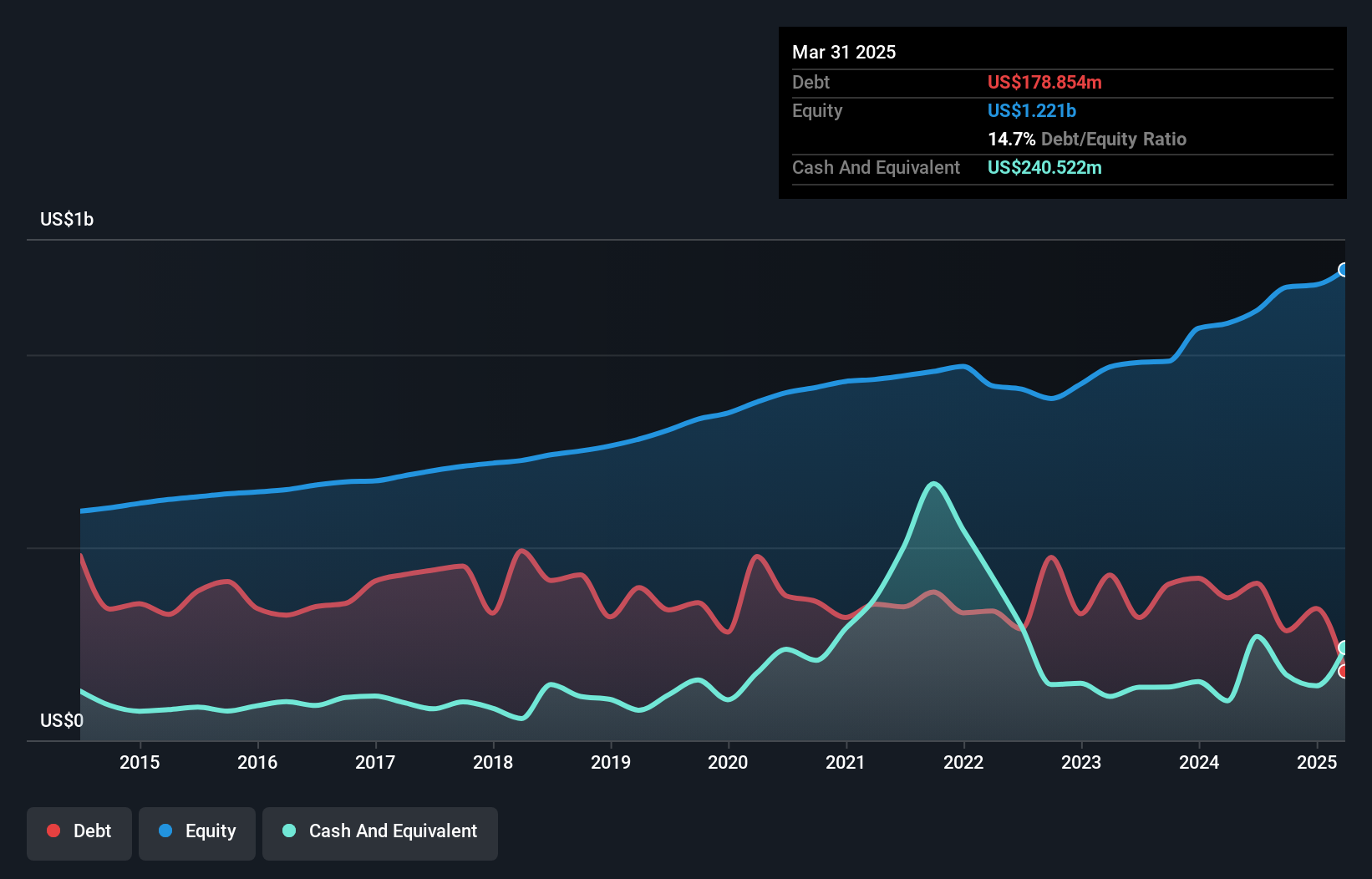

Pathward Financial (CASH)

Simply Wall St Value Rating: ★★★★★★

Overview: Pathward Financial, Inc. is a bank holding company for Pathward, National Association, offering a range of banking products and services in the United States with a market cap of $1.72 billion.

Operations: Pathward Financial generates revenue primarily from its Consumer segment, which accounts for $449.93 million, followed by the Commercial segment at $247.22 million. The company also has a smaller contribution from Corporate Services amounting to $36.43 million.

Pathward Financial, with assets of US$7.2 billion and equity of US$818.1 million, is navigating a challenging landscape. Despite trading at 47.7% below its estimated fair value, it faces hurdles like regulatory scrutiny and competitive fintech pressures. The company holds total deposits of US$6 billion against loans of US$4.6 billion, with a sufficient bad loan allowance at 1.5%. Recent share repurchases totaling 7.77% for US$141.92 million reflect a focus on shareholder returns amid compliance issues with Nasdaq listing rules due to delayed filings, highlighting both opportunities and risks in its evolving market position.

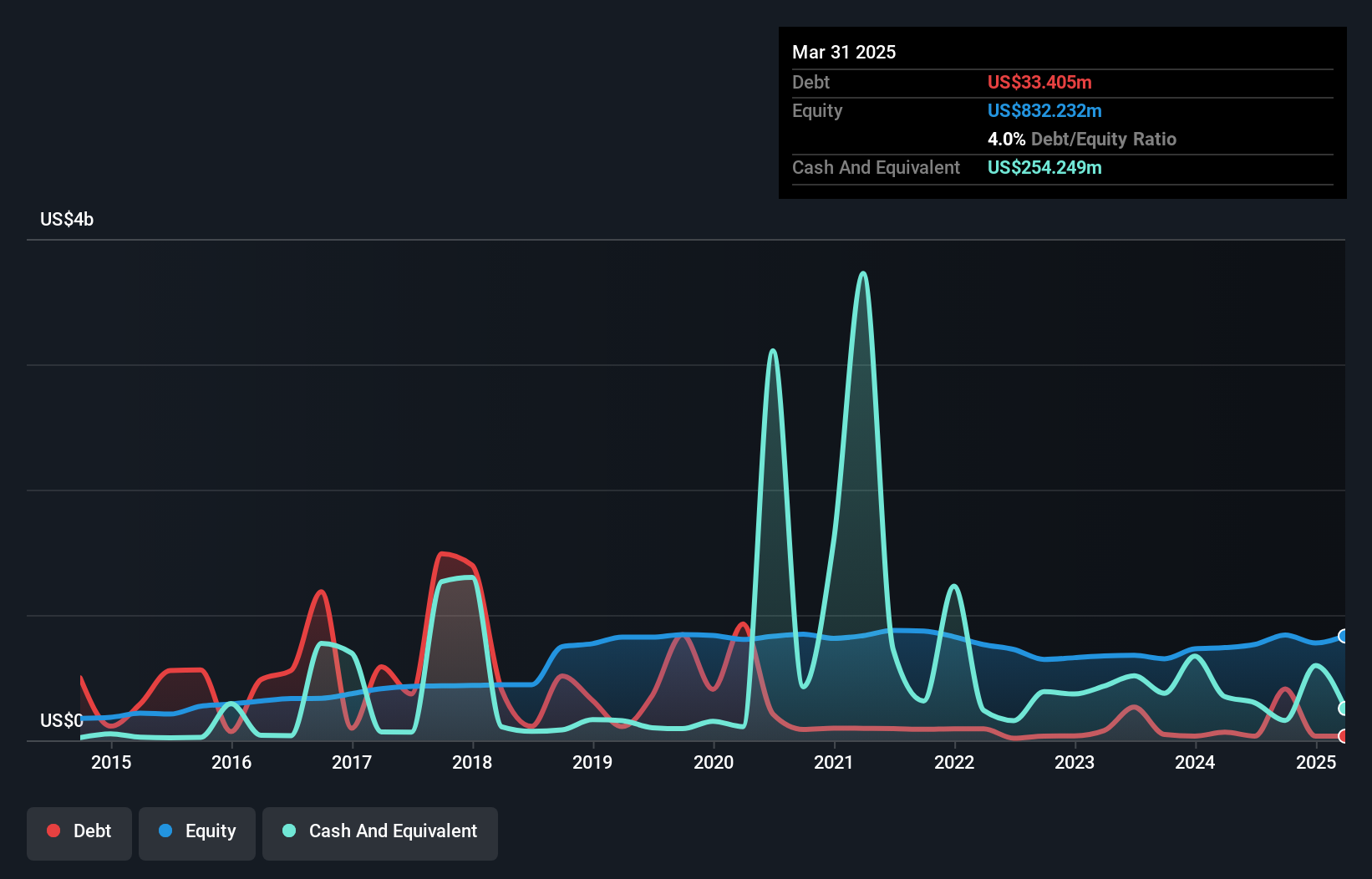

1st Source (SRCE)

Simply Wall St Value Rating: ★★★★★★

Overview: 1st Source Corporation is a bank holding company for 1st Source Bank, offering commercial and consumer banking services, trust and wealth advisory services, and insurance products to individuals and businesses in the United States, with a market cap of approximately $1.55 billion.

Operations: 1st Source generates revenue primarily from its commercial banking segment, contributing $391.81 million. The company's net profit margin reflects its financial efficiency in converting revenue into actual profit.

1st Source, with total assets of US$9.1 billion and equity of US$1.3 billion, shows a robust financial position. The bank's total deposits stand at US$7.4 billion against loans of US$6.9 billion, supported by a solid net interest margin of 3.6%. Its allowance for bad loans is sufficient at 227%, while non-performing loans are low at 1%. Despite earnings growth not outpacing the industry over the past year, it has achieved an average annual earnings growth rate of 9.3% over five years and is trading nearly 50% below estimated fair value, indicating potential undervaluation in the market.

- Take a closer look at 1st Source's potential here in our health report.

Examine 1st Source's past performance report to understand how it has performed in the past.

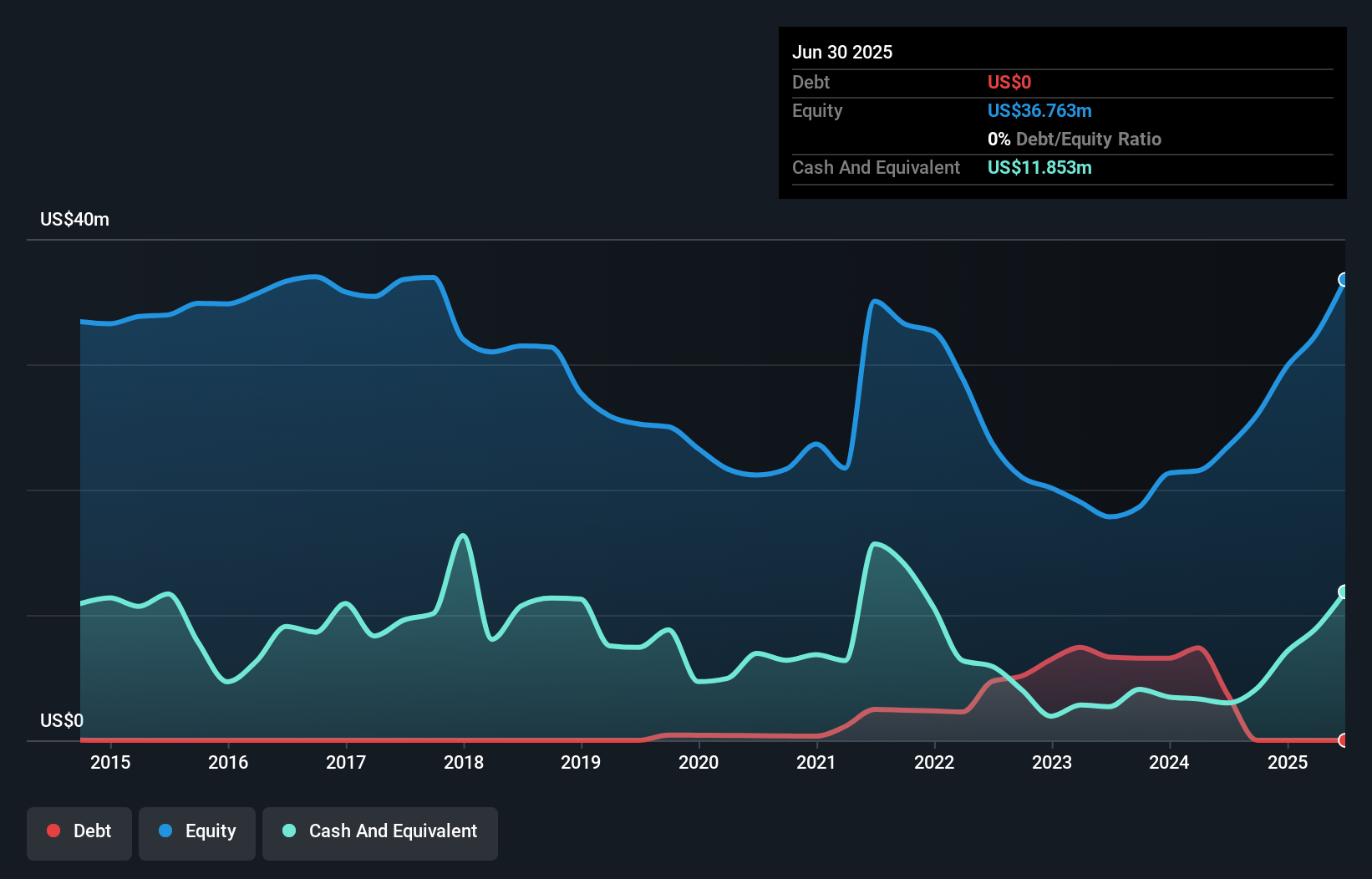

BK Technologies (BKTI)

Simply Wall St Value Rating: ★★★★★★

Overview: BK Technologies Corporation, with a market cap of $275.13 million, operates through its subsidiary to design, manufacture, and market wireless communications products both in the United States and internationally.

Operations: BK Technologies generates revenue primarily from its Land Mobile Radio (LMR) Products and Solutions segment, totaling $78.33 million.

BK Technologies, a nimble player in the communications sector, is gaining traction thanks to its focus on wireless communication products amid rising public safety investments. The company has no debt now compared to five years ago when its debt-to-equity ratio was 1.7%. Recent earnings reveal impressive growth with net income reaching US$3.74 million for Q2 2025, up from US$1.66 million last year, and basic EPS climbing to US$1.03 from US$0.47 year-over-year. Despite facing stiff competition and technological shifts, BK's strategic shift towards high-margin products and efficient manufacturing practices seems promising for sustained profitability growth.

Key Takeaways

- Explore the 281 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRCE

1st Source

Operates as the bank holding company for 1st Source Bank that provides commercial and consumer banking services, trust and wealth advisory services, and insurance products to individual and business clients in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>