- United States

- /

- Software

- /

- NYSE:PD

XPEL And 2 Stocks That Could Be Trading Below Estimated Value

Reviewed by Simply Wall St

As U.S.-China trade tensions flare up once more, major stock indexes have experienced notable declines, with the Nasdaq falling 3.6% and the S&P 500 down by 2.7% in a single session. In such volatile market conditions, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors seeking to navigate the current economic landscape effectively.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $134.15 | $260.99 | 48.6% |

| TowneBank (TOWN) | $32.48 | $62.93 | 48.4% |

| Perfect (PERF) | $1.88 | $3.64 | 48.4% |

| NeuroPace (NPCE) | $10.28 | $20.14 | 49% |

| Glaukos (GKOS) | $82.56 | $162.17 | 49.1% |

| e.l.f. Beauty (ELF) | $129.69 | $254.55 | 49.1% |

| Dime Community Bancshares (DCOM) | $29.00 | $57.31 | 49.4% |

| Corpay (CPAY) | $280.11 | $548.40 | 48.9% |

| Atlassian (TEAM) | $144.56 | $280.93 | 48.5% |

| AGNC Investment (AGNC) | $9.93 | $19.72 | 49.6% |

Here's a peek at a few of the choices from the screener.

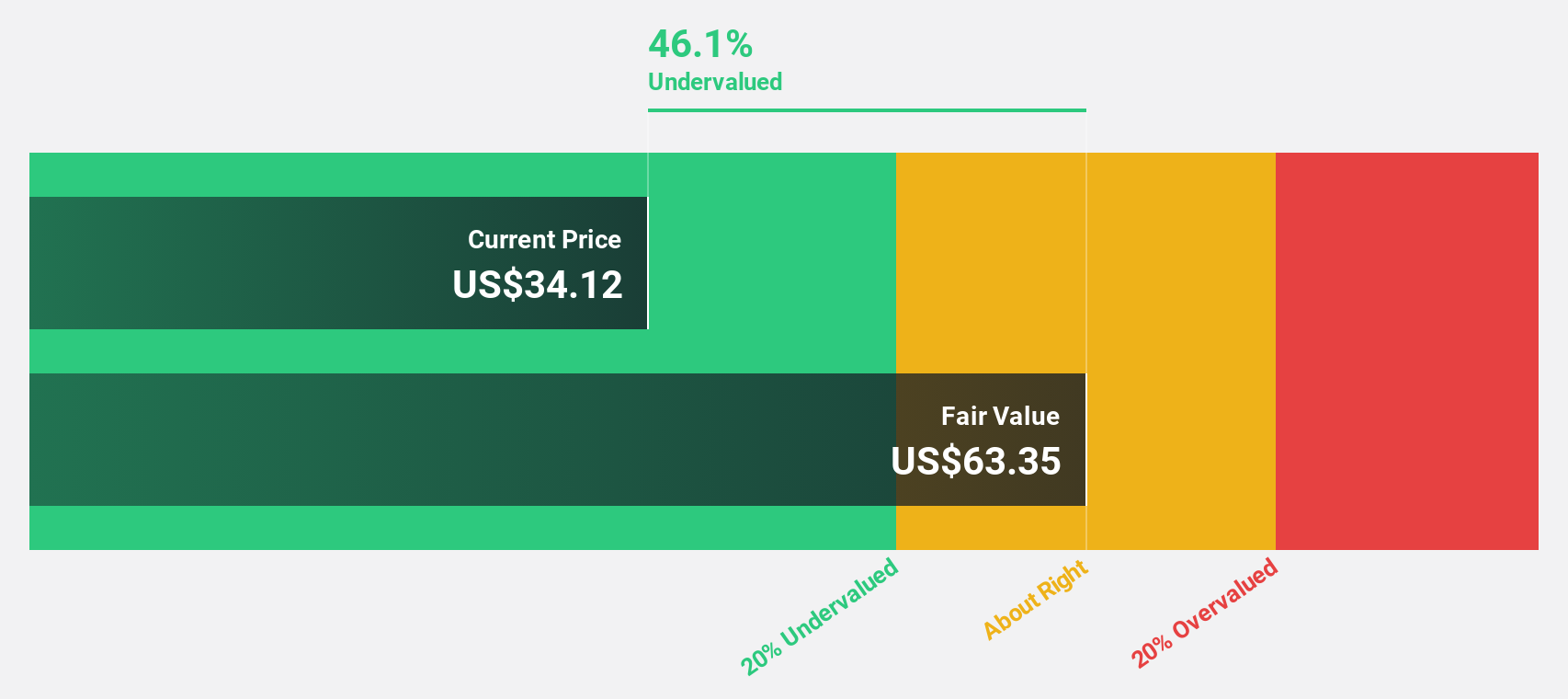

XPEL (XPEL)

Overview: XPEL, Inc. is involved in the manufacturing, installation, sale, and distribution of protective films and coatings with a market cap of approximately $937.83 million.

Operations: The company generates revenue of $448.90 million from its Auto Parts & Accessories segment.

Estimated Discount To Fair Value: 46.5%

XPEL is trading at US$33.89, significantly below its estimated fair value of US$63.39, indicating potential undervaluation based on cash flows. The company's recent extension of its credit agreement to 2028 enhances financial flexibility, supporting growth initiatives like the COLOR Paint Protection Film line. Recent earnings reports show steady revenue and profit growth, with future earnings expected to grow faster than the broader U.S. market, reinforcing its attractiveness as an undervalued stock.

- Our growth report here indicates XPEL may be poised for an improving outlook.

- Take a closer look at XPEL's balance sheet health here in our report.

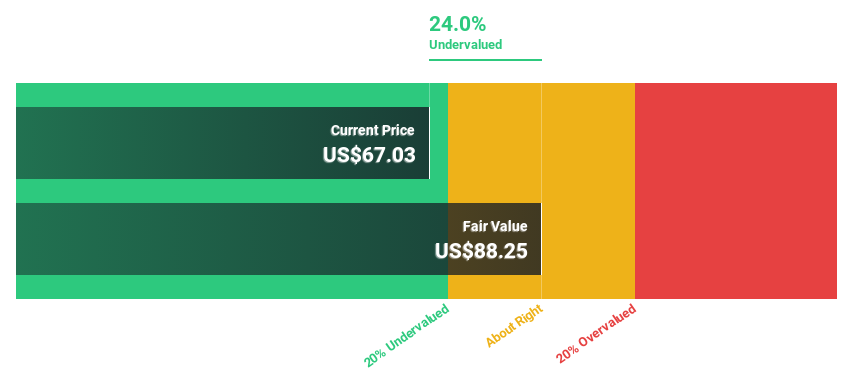

Blackbaud (BLKB)

Overview: Blackbaud, Inc. provides cloud software and services both in the United States and internationally, with a market cap of $3.02 billion.

Operations: The company generates revenue from its Software & Programming segment, amounting to $1.14 billion.

Estimated Discount To Fair Value: 25.5%

Blackbaud is trading at US$63.39, below its estimated fair value of US$85.04, suggesting potential undervaluation based on cash flows. Recent product announcements at bbcon 2025 highlight significant AI advancements aimed at enhancing nonprofit capabilities and expanding revenue streams efficiently. Despite slower forecasted revenue growth compared to the market, Blackbaud's profitability is expected to improve above average in the next three years, supported by high return on equity projections and strategic product enhancements.

- Upon reviewing our latest growth report, Blackbaud's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Blackbaud with our comprehensive financial health report here.

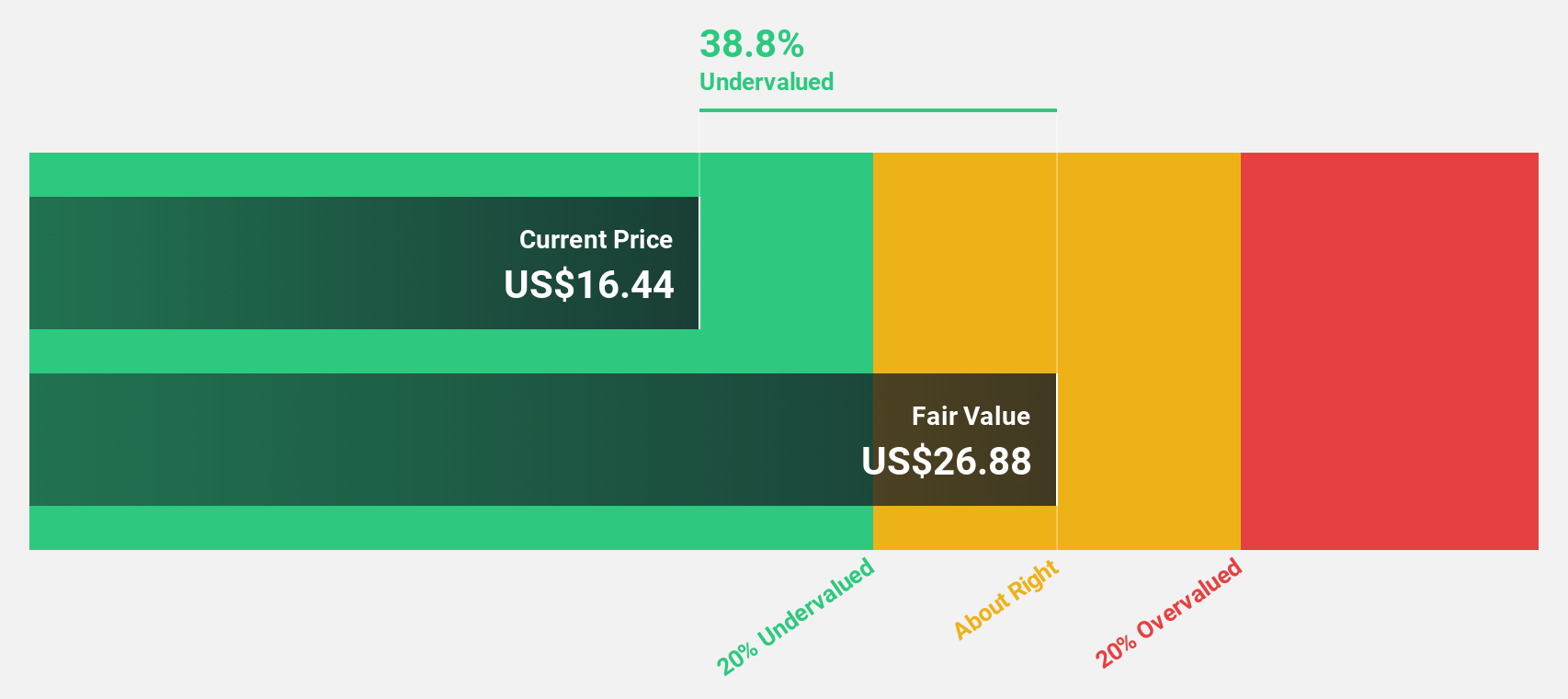

PagerDuty (PD)

Overview: PagerDuty, Inc. operates a digital operations management platform globally and has a market cap of approximately $1.51 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, totaling $483.61 million.

Estimated Discount To Fair Value: 39.9%

PagerDuty, trading at US$16.15, is undervalued based on cash flows with an estimated fair value of US$26.86. Despite slower revenue growth forecasts compared to the market, earnings are expected to grow significantly over the next three years as profitability improves. Recent product releases featuring AI enhancements aim to boost operational efficiency and customer satisfaction. The appointment of a new Chief Revenue Officer is set to drive strategic growth initiatives further supporting its valuation prospects.

- Insights from our recent growth report point to a promising forecast for PagerDuty's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of PagerDuty.

Make It Happen

- Get an in-depth perspective on all 188 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PD

PagerDuty

Engages in the operation of a digital operations management platform in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion