- United States

- /

- Software

- /

- NYSE:HUBS

Is HubSpot’s (HUBS) Competitive Edge at Risk as OpenAI Enters SaaS Sales and Marketing?

Reviewed by Sasha Jovanovic

- In the past week, HubSpot faced heightened industry attention after OpenAI announced AI-powered software tools aimed at core SaaS segments, including sales and marketing platforms.

- This development has intensified debate about whether emerging AI-driven applications could disrupt established players like HubSpot, even as analyst sentiment on the company's outlook remains broadly optimistic.

- We'll explore how new competitive threats from OpenAI’s AI-driven software could impact HubSpot's future business growth assumptions.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

HubSpot Investment Narrative Recap

To be a HubSpot shareholder, you need conviction in the company's ability to capture ongoing digital transformation within the SMB and mid-market segments, particularly as AI shapes the future of marketing, sales, and CRM. The recent rollout of AI applications by OpenAI raised short-term uncertainty, triggering a significant drop in HubSpot’s share price and intensifying focus on the risk of competitive disruption, a risk that may now demand closer scrutiny as a near-term catalyst for volatility and sentiment.

Among HubSpot’s recent product announcements, “The Loop”, its AI-powered growth playbook, stands out as especially relevant. This initiative signals HubSpot’s commitment to adapting its product suite for an AI-centric world, with the intent to strengthen engagement and customer retention, directly addressing the latest competitive challenges and connecting to the company’s most important growth catalysts.

Yet despite robust AI initiatives, investors should also be aware that while adoption accelerates, the early-stage credit-based monetization model for these tools remains unproven and could...

Read the full narrative on HubSpot (it's free!)

HubSpot's narrative projects $4.6 billion revenue and $388.4 million earnings by 2028. This requires 17.1% yearly revenue growth and a $400.3 million earnings increase from -$11.9 million today.

Uncover how HubSpot's forecasts yield a $695.33 fair value, a 56% upside to its current price.

Exploring Other Perspectives

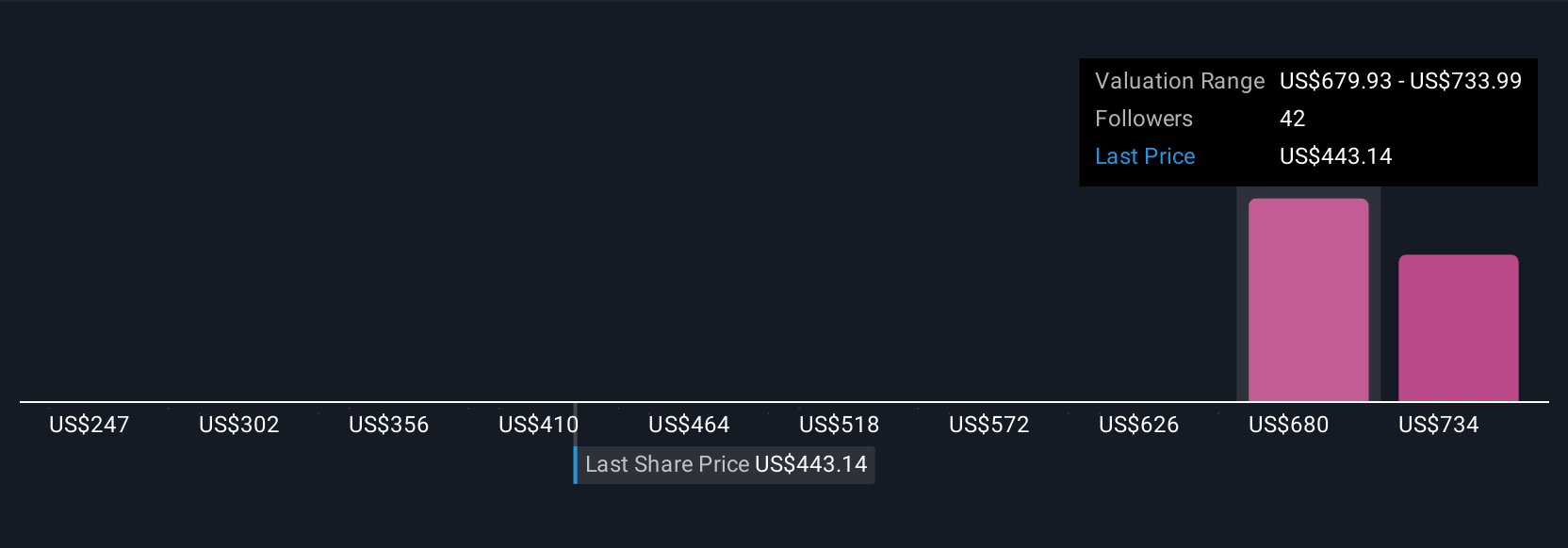

Simply Wall St Community members provided 9 fair value estimates for HubSpot ranging from US$243.84 to US$744.28 per share. As attention shifts to AI-driven disruption from new entrants, you can explore why perspectives on future growth and risk may be so varied.

Explore 9 other fair value estimates on HubSpot - why the stock might be worth as much as 67% more than the current price!

Build Your Own HubSpot Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HubSpot research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free HubSpot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HubSpot's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)