- United States

- /

- Software

- /

- NYSE:HUBS

HubSpot (NYSE:HUBS) Shares Surge 14% Over Last Week Amid Partnership With HeyGen

Reviewed by Simply Wall St

HeyGen announced a partnership expansion with HubSpot (NYSE:HUBS) on April 8, 2025, enhancing integration by enabling marketers to auto-generate personalized videos within HubSpot workflows. This integration potentially bolstered HubSpot's appeal, possibly contributing to its 14% share price increase last week. While the market rose by 5% in the same period, HubSpot's significant uptick suggests that the collaboration with HeyGen resonated well with investors, adding weight to the broader market trend. The partnership aimed at improving customer engagement aligns with growing demand for video content, setting the company in a favorable position within the market.

We've spotted 2 risks for HubSpot you should be aware of.

The recent partnership expansion between HeyGen and HubSpot with HubSpot's integration into workflows appears to align well with the company's broader narrative of leveraging AI and acquisitions like frame.ai to enhance operational efficiency and customer engagement. This strategic alignment is crucial as HubSpot continues to reshape its operations with AI-driven solutions, aiming for higher revenue growth and improved profit margins. This collaboration has seemingly provided an immediate positive sentiment among investors, as reflected in the recent share price increase.

Over the past five years, HubSpot's total shareholder return, encompassing share price appreciation and dividends, surged a very large 283.34%. This impressive performance highlights the company's ability to generate robust returns for its shareholders over the long term. However, in the past year, HubSpot underperformed the US Software industry, which returned 6.7%, indicating potential challenges or shifts in investor sentiment more recently.

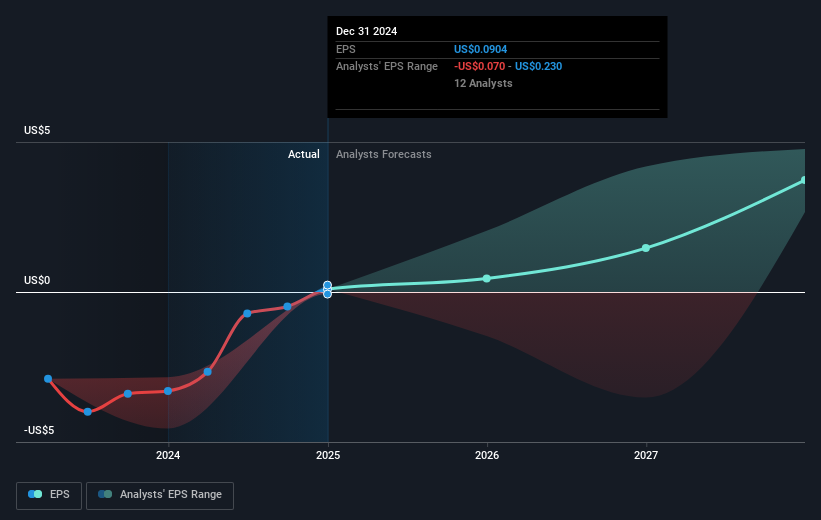

The integration with HeyGen could positively impact future revenue and earnings forecasts as it enhances HubSpot's product offerings and strengthens customer engagement efforts. Analysts anticipate that these strategic moves could contribute to HubSpot's projected revenue and earnings growth over the next few years. Given a current share price of US$565.96 and a consensus price target of US$779.42, the market appears to be optimistic about HubSpot's growth prospects, although the company is still trading below the analyst price target, suggesting potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives