- United States

- /

- Software

- /

- NYSE:FICO

3 High Growth Tech Stocks Leading The US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 4.1%, and over the past 12 months, it is up by 7.9%, with earnings forecasted to grow by 14% annually. In this environment of robust growth, identifying high-growth tech stocks that align with these positive trends can be key to capitalizing on potential opportunities in the market.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.29% | 29.79% | ★★★★★★ |

| TG Therapeutics | 26.06% | 37.39% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 66.06% | ★★★★★★ |

| Arcutis Biotherapeutics | 26.11% | 58.46% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Clene | 62.08% | 64.01% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.08% | 58.88% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.34% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.78% | 59.70% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Gilead Sciences (NasdaqGS:GILD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gilead Sciences, Inc. is a biopharmaceutical company that focuses on discovering, developing, and commercializing medicines for unmet medical needs globally, with a market cap of $132.62 billion.

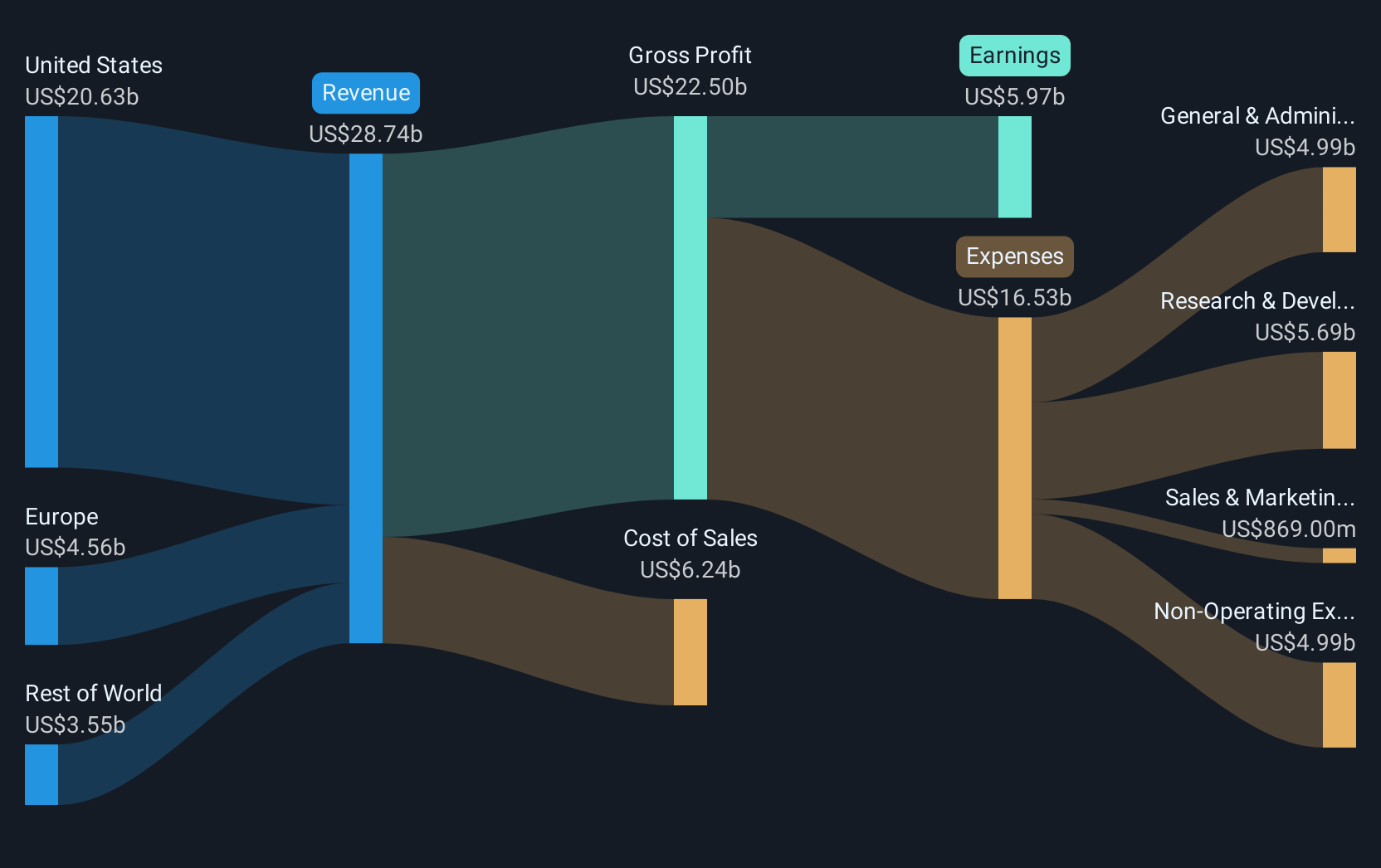

Operations: Gilead Sciences generates revenue primarily through the discovery, development, and commercialization of innovative medicines, amounting to $28.75 billion. The company's business model focuses on addressing unmet medical needs across various regions, including the United States and Europe.

Despite a challenging year with a net earnings decline of 91.5%, Gilead Sciences is poised for recovery, forecasting an impressive 22.9% annual earnings growth over the next three years. This growth trajectory significantly outpaces the broader US market's expected 13.9% increase. However, revenue growth projections remain modest at 3.5% annually, trailing the market average of 8.1%. Recent strategic developments include promising Phase 3 clinical trial results for Trodelvy in treating triple-negative breast cancer, potentially bolstering its oncology portfolio amid financial volatility marked by a substantial $9.3 billion one-off loss last year.

- Take a closer look at Gilead Sciences' potential here in our health report.

Gain insights into Gilead Sciences' past trends and performance with our Past report.

monday.com (NasdaqGS:MNDY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: monday.com Ltd., along with its subsidiaries, develops software applications across various regions including the United States, Europe, the Middle East, Africa, and the United Kingdom, with a market cap of approximately $12.59 billion.

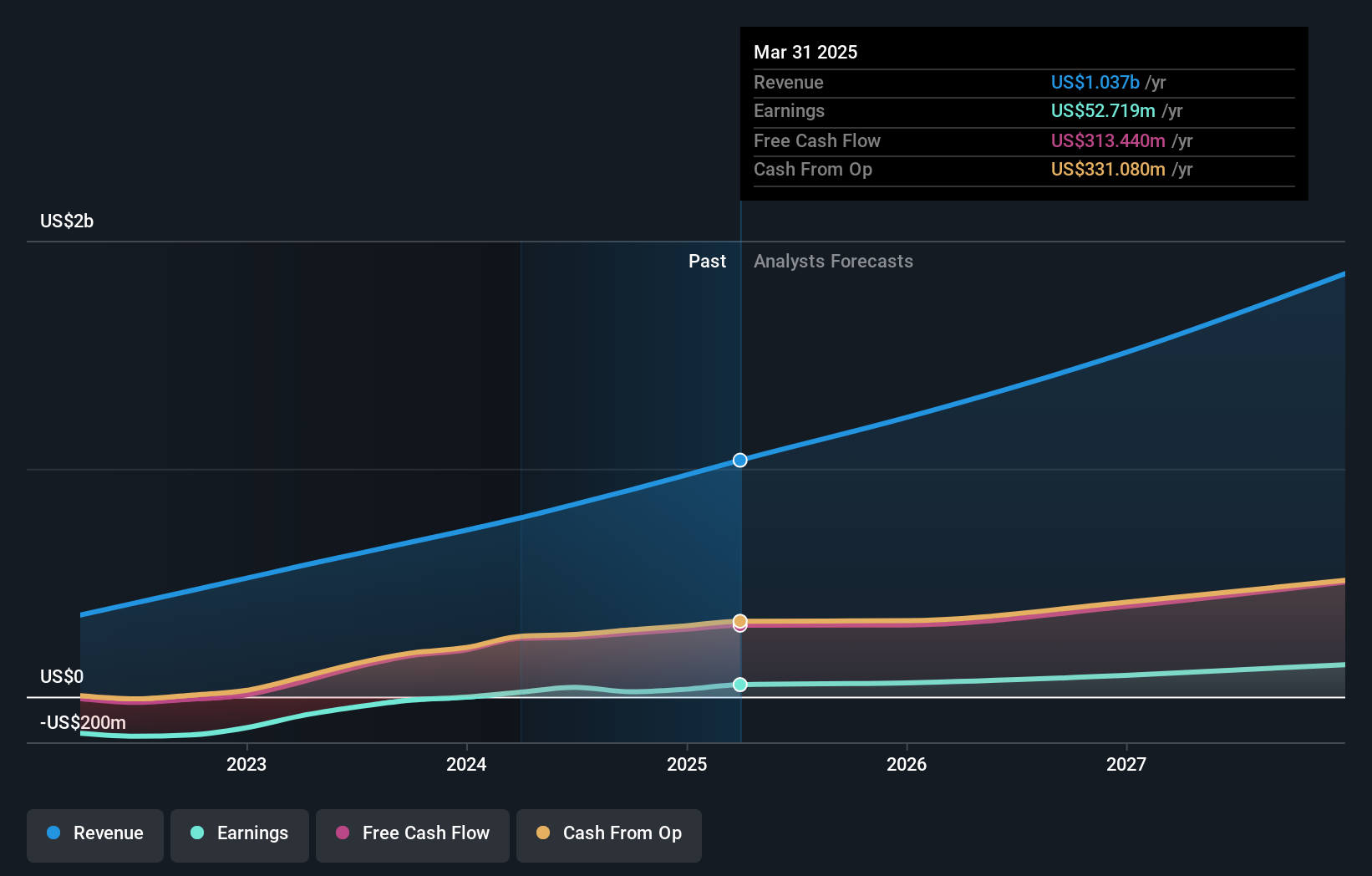

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling approximately $972 million. It operates across multiple regions, offering software solutions to a diverse range of markets.

Amidst a dynamic tech landscape, monday.com stands out with its robust growth metrics and strategic initiatives aimed at capturing enterprise markets. In 2024, the company reported a significant revenue increase to $972 million from the previous year's $729.7 million, underscoring an impressive 18.1% annual growth rate. This performance is bolstered by an earnings jump to $32.37 million from a prior loss, reflecting a sharp turnaround with earnings growing at an anticipated rate of 31.3% annually. The appointment of Casey George as Chief Revenue Officer marks a strategic move to enhance monday.com's enterprise market presence, leveraging his extensive experience in scaling tech companies. Additionally, recent partnerships and product launches like monday service—an AI-first Enterprise Service Management platform—highlight the company’s commitment to innovation and customer-centric solutions, ensuring it remains competitive in the rapidly evolving software industry.

- Unlock comprehensive insights into our analysis of monday.com stock in this health report.

Assess monday.com's past performance with our detailed historical performance reports.

Fair Isaac (NYSE:FICO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fair Isaac Corporation specializes in creating software that leverages analytics and digital decisioning technologies to help businesses automate and improve their decision-making processes globally, with a market cap of $47.03 billion.

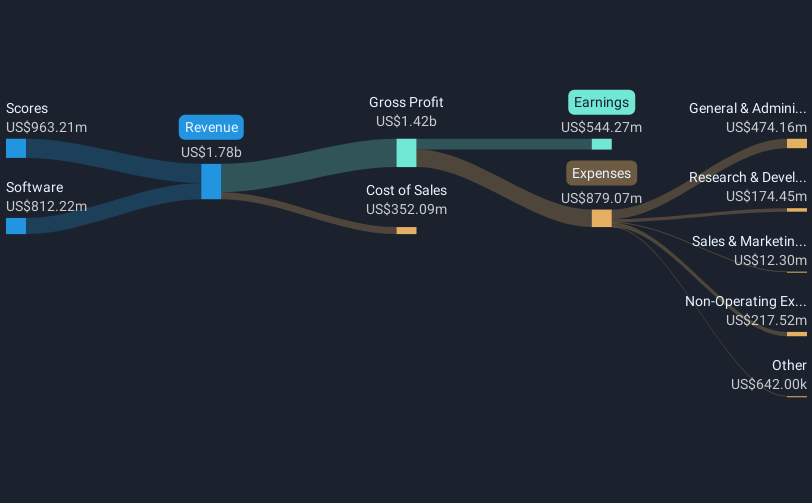

Operations: Fair Isaac Corporation generates revenue primarily through its Scores segment, contributing $963.21 million, and its Software segment, which brings in $812.22 million.

Fair Isaac, known for its sophisticated analytics and decision-making solutions, recently highlighted significant strides in enhancing insurance underwriting processes. Through partnerships with iA Financial and dacadoo, FICO leverages its AI-driven FICO® Platform to boost automation and real-time decision-making capabilities in the insurance sector. These strategic moves not only streamline operations but also position Fair Isaac at the forefront of transforming traditional business models into more dynamic, data-centric frameworks. With a reported 13.9% annual revenue growth and an 18.3% increase in earnings per year, Fair Isaac's commitment to innovation is evident as it continues to invest heavily in R&D, ensuring sustained leadership in applying advanced analytics across industries.

- Delve into the full analysis health report here for a deeper understanding of Fair Isaac.

Explore historical data to track Fair Isaac's performance over time in our Past section.

Key Takeaways

- Take a closer look at our US High Growth Tech and AI Stocks list of 234 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Fair Isaac, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Develops software with analytics and digital decisioning technologies that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives