- United States

- /

- Transportation

- /

- NasdaqGS:LYFT

Lyft And 2 Other Stocks That May Be Trading Below Fair Value Estimates

Reviewed by Simply Wall St

As of early December 2025, U.S. markets have shown resilience with major indexes closing higher amid a rebound in tech and crypto-related stocks. This environment presents opportunities for investors to explore stocks that may be trading below their fair value estimates, such as Lyft and others, by focusing on fundamental strengths and market positioning amidst the current economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webull (BULL) | $9.00 | $17.92 | 49.8% |

| Warrior Met Coal (HCC) | $78.00 | $154.15 | 49.4% |

| Super Group (SGHC) (SGHC) | $10.93 | $21.59 | 49.4% |

| Sotera Health (SHC) | $16.93 | $33.49 | 49.5% |

| Lyft (LYFT) | $22.24 | $43.69 | 49.1% |

| Freshworks (FRSH) | $12.22 | $23.78 | 48.6% |

| First Busey (BUSE) | $23.50 | $45.34 | 48.2% |

| DexCom (DXCM) | $64.45 | $126.46 | 49% |

| BioLife Solutions (BLFS) | $25.37 | $49.72 | 49% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $18.75 | $37.29 | 49.7% |

Underneath we present a selection of stocks filtered out by our screen.

Lyft (LYFT)

Overview: Lyft, Inc. operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada, with a market cap of approximately $8.88 billion.

Operations: Lyft's revenue primarily comes from its Internet Information Providers segment, which generated approximately $6.27 billion.

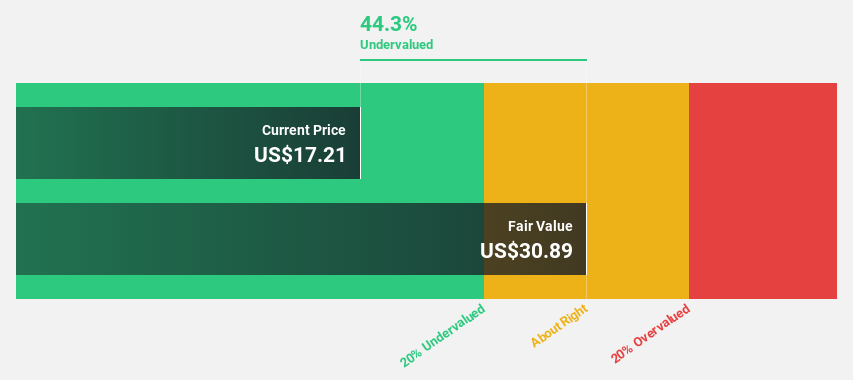

Estimated Discount To Fair Value: 49.1%

Lyft is trading at US$22.24, which is 49.1% below its estimated fair value of US$43.69, suggesting it may be undervalued based on cash flows. While revenue growth is forecast to lag behind the market at 10.5% annually, earnings are expected to grow significantly by 29.5% per year, outpacing the broader market's growth rate of 16%. Recent strategic partnerships in healthcare and entertainment sectors could enhance operational efficiency and expand service reach.

- The growth report we've compiled suggests that Lyft's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Lyft's balance sheet health report.

Roku (ROKU)

Overview: Roku, Inc. operates a TV streaming platform both in the United States and internationally, with a market cap of approximately $14.52 billion.

Operations: The company's revenue is derived from two main segments: Devices, generating $587.13 million, and Platform, contributing $3.96 billion.

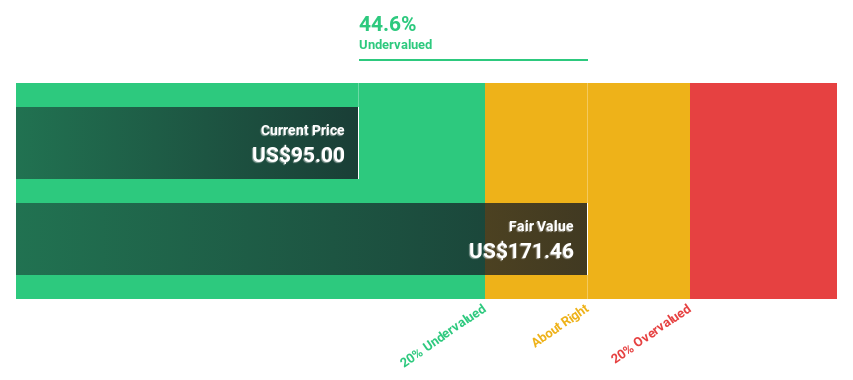

Estimated Discount To Fair Value: 36.5%

Roku is trading at US$98.26, significantly below its estimated fair value of US$154.84, highlighting a potential undervaluation based on cash flows. Despite slower revenue growth forecasts of 10.8% annually compared to the broader market, earnings are projected to grow robustly at 61.09% per year over the next three years. Recent initiatives like collaborations with DoubleVerify and FreeWheel enhance ad fraud protection and monetization capabilities, potentially strengthening Roku's financial position in the competitive streaming landscape.

- Our growth report here indicates Roku may be poised for an improving outlook.

- Navigate through the intricacies of Roku with our comprehensive financial health report here.

Elastic (ESTC)

Overview: Elastic N.V. is a search AI company that offers software platforms for hybrid, public or private clouds, and multi-cloud environments globally, with a market cap of $7.49 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, amounting to $1.61 billion.

Estimated Discount To Fair Value: 46.7%

Elastic, trading at US$72.26, is significantly undervalued compared to its fair value estimate of US$135.60, suggesting strong potential based on cash flows. Despite a forecasted revenue growth of 12.1% annually, below the desired 20%, earnings are expected to grow by 52.46% per year and become profitable within three years. Recent product innovations like the Amazon Bedrock integration and DiskBBQ algorithm enhance Elastic's capabilities in AI observability and vector search efficiency, potentially supporting future cash flow improvements.

- Our earnings growth report unveils the potential for significant increases in Elastic's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Elastic.

Make It Happen

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 211 more companies for you to explore.Click here to unveil our expertly curated list of 214 Undervalued US Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LYFT

Lyft

Operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026