- United States

- /

- Semiconductors

- /

- NasdaqGS:PDFS

3 Stocks That May Be Undervalued By Up To 35.4% According To Estimates

Reviewed by Simply Wall St

As U.S. stock indexes reach new highs, buoyed by partnerships and strategic investments in AI, investors are keenly observing opportunities that may still be undervalued amidst the market's upward trajectory. In such a vibrant environment, identifying stocks that are potentially undervalued can offer intriguing prospects for those looking to capitalize on discrepancies between current prices and estimated values.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webull (BULL) | $13.29 | $26.50 | 49.8% |

| Royal Gold (RGLD) | $191.67 | $383.08 | 50% |

| Pinnacle Financial Partners (PNFP) | $96.02 | $186.59 | 48.5% |

| Phibro Animal Health (PAHC) | $39.86 | $77.67 | 48.7% |

| Peapack-Gladstone Financial (PGC) | $29.06 | $56.54 | 48.6% |

| McGraw Hill (MH) | $13.54 | $26.49 | 48.9% |

| Investar Holding (ISTR) | $23.01 | $44.74 | 48.6% |

| Alnylam Pharmaceuticals (ALNY) | $453.56 | $902.17 | 49.7% |

| Advanced Flower Capital (AFCG) | $4.43 | $8.76 | 49.4% |

| AbbVie (ABBV) | $222.47 | $441.60 | 49.6% |

We're going to check out a few of the best picks from our screener tool.

PDF Solutions (PDFS)

Overview: PDF Solutions, Inc. offers proprietary software, intellectual property for integrated circuit designs, measurement hardware tools, methodologies, and professional services globally with a market cap of $869.24 million.

Operations: The company generates revenue primarily from its Software & Programming segment, which amounts to $196 million.

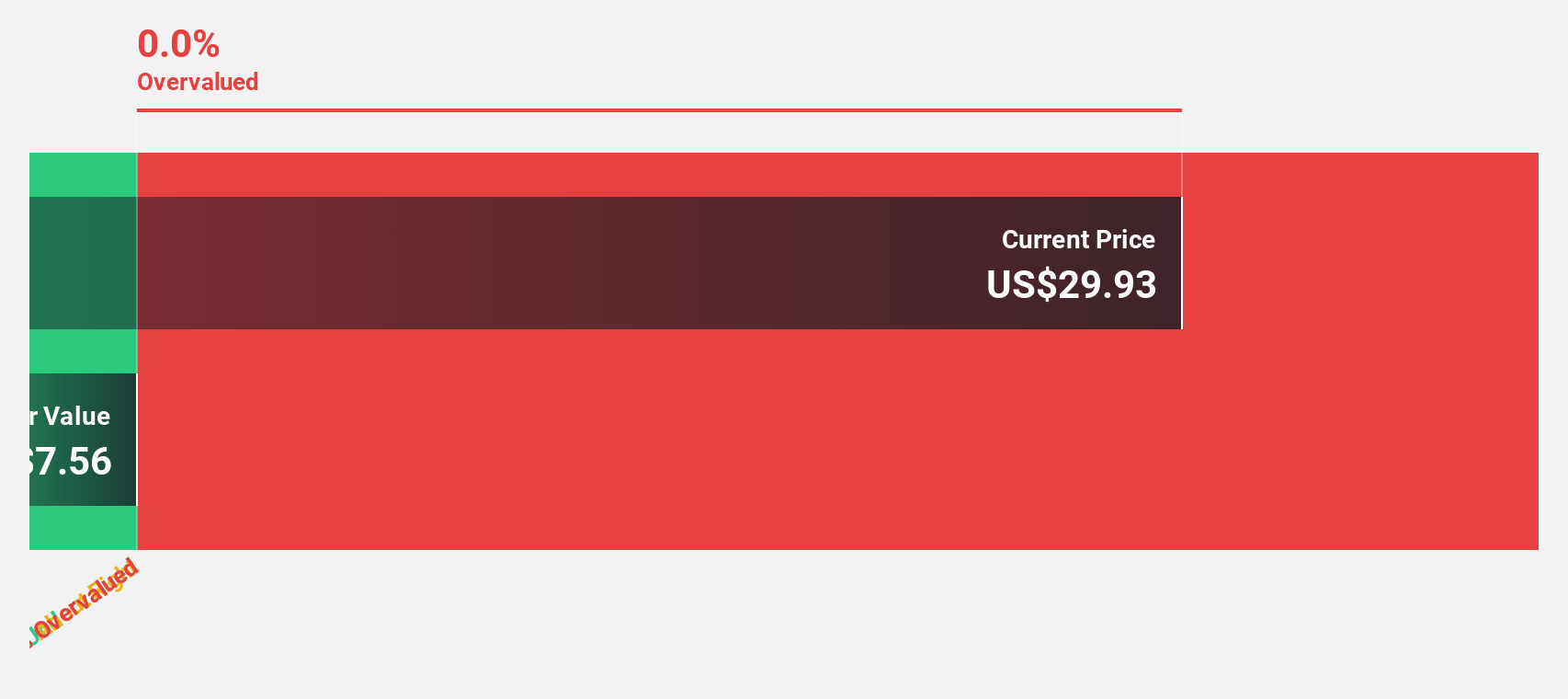

Estimated Discount To Fair Value: 31.8%

PDF Solutions is trading at US$22.01, significantly below its estimated fair value of US$32.27, suggesting it may be undervalued based on cash flows. The company recently reported increased sales for Q2 2025 at US$51.73 million compared to the previous year but experienced a decrease in net income to US$1.15 million from US$1.71 million last year. Despite this, earnings are forecasted to grow substantially at 88.6% annually, outpacing the broader U.S market growth expectations of 15.5%.

- Our growth report here indicates PDF Solutions may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of PDF Solutions.

Elastic (ESTC)

Overview: Elastic N.V. is a search AI company offering software platforms for hybrid, public, private, and multi-cloud environments globally, with a market cap of approximately $9.48 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, generating approximately $1.55 billion.

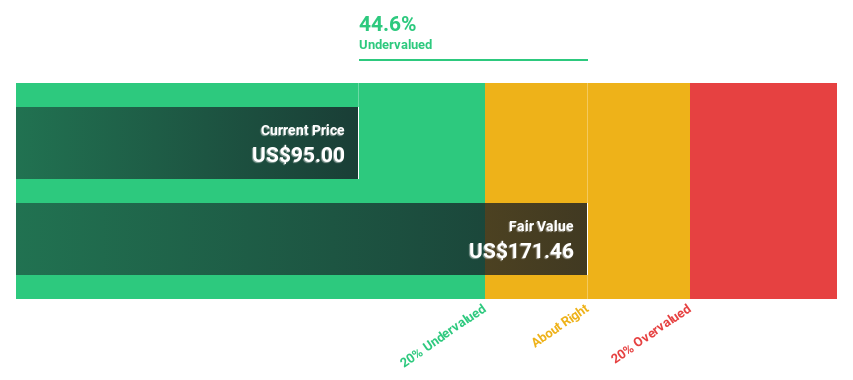

Estimated Discount To Fair Value: 35.4%

Elastic is trading at US$89.18, well below its estimated fair value of US$138.03, indicating potential undervaluation based on cash flows. Recent earnings show revenue growth to US$415.29 million for Q1 2025, with a decreased net loss of US$24.6 million compared to the prior year. The company anticipates continued revenue growth and profitability within three years, supported by innovative product offerings like Elastic Observability Logs Essentials and the AI SOC Engine enhancing operational efficiency and security capabilities.

- According our earnings growth report, there's an indication that Elastic might be ready to expand.

- Click to explore a detailed breakdown of our findings in Elastic's balance sheet health report.

KeyCorp (KEY)

Overview: KeyCorp is a financial services company that operates as the holding entity for KeyBank National Association, offering a range of retail and commercial banking products and services across the United States, with a market capitalization of approximately $20.92 billion.

Operations: KeyBank National Association's revenue is comprised of $3.30 billion from its Consumer Bank segment and $3.59 billion from its Commercial Bank segment.

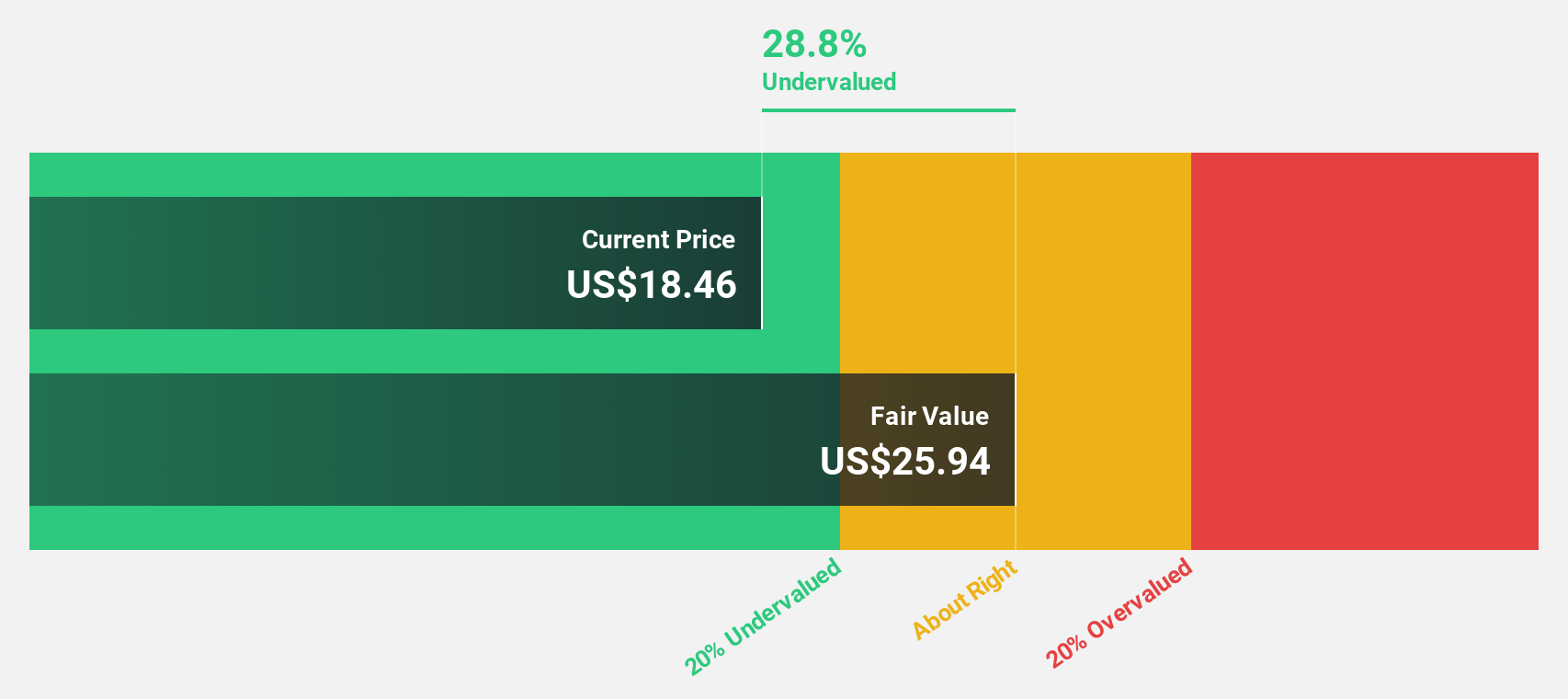

Estimated Discount To Fair Value: 31.7%

KeyCorp, trading at US$19.08, is significantly undervalued with an estimated fair value of US$27.94. The company reported strong net interest income growth to US$1.14 billion for Q2 2025 and net income of US$425 million, reflecting improved cash flow management despite recent loan charge-offs totaling US$102 million. KeyBank's launch of KeyTotal AR™, a fintech solution enhancing accounts receivable operations, underscores its commitment to innovation and improving client cash flow efficiency amidst forecasted earnings growth exceeding the market average.

- Upon reviewing our latest growth report, KeyCorp's projected financial performance appears quite optimistic.

- Dive into the specifics of KeyCorp here with our thorough financial health report.

Seize The Opportunity

- Embark on your investment journey to our 191 Undervalued US Stocks Based On Cash Flows selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDFS

PDF Solutions

Provides proprietary software, physical intellectual property for integrated circuit designs, electrical measurement hardware tools, proven methodologies, and professional services in the United States, Japan, China, Taiwan, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)