- United States

- /

- Capital Markets

- /

- NYSE:JEF

3 Growth Companies With High Insider Ownership And Up To 59% Earnings Growth

Reviewed by Simply Wall St

As the U.S. stock market navigates mixed signals with the Dow Jones and S&P 500 showing modest gains while the Nasdaq faces slight declines, investors are keenly observing growth opportunities amid a backdrop of encouraging economic data and dissipating global trade tensions. In such an environment, companies with high insider ownership can be particularly appealing to investors, as this often signals strong confidence from those who know the business best, especially when these firms are poised for significant earnings growth.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.1% | 37.4% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.4% | 68.3% |

| FTC Solar (NasdaqCM:FTCI) | 32.2% | 61.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.3% | 44.8% |

| Red Cat Holdings (NasdaqCM:RCAT) | 14.8% | 123% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| BBB Foods (NYSE:TBBB) | 16.2% | 30.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.5% | 102.6% |

Underneath we present a selection of stocks filtered out by our screen.

Elastic (NYSE:ESTC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Elastic N.V. is a search AI company that provides hosted and managed solutions for hybrid, public or private clouds, and multi-cloud environments globally, with a market cap of approximately $9.76 billion.

Operations: The company generates revenue of $1.43 billion from its Software & Programming segment.

Insider Ownership: 12.6%

Earnings Growth Forecast: 44.7% p.a.

Elastic is positioned for strong growth, with earnings expected to rise 44.73% annually and revenue projected to grow faster than the US market at 12.3% per year. The company recently introduced innovative features like Automatic Migration and expanded its AI capabilities, enhancing its security analytics offerings. Despite trading below fair value estimates and analyst price targets, insider activity shows more buying than selling in recent months, indicating confidence in Elastic's future prospects.

- Navigate through the intricacies of Elastic with our comprehensive analyst estimates report here.

- Our valuation report here indicates Elastic may be undervalued.

Jefferies Financial Group (NYSE:JEF)

Simply Wall St Growth Rating: ★★★★☆☆

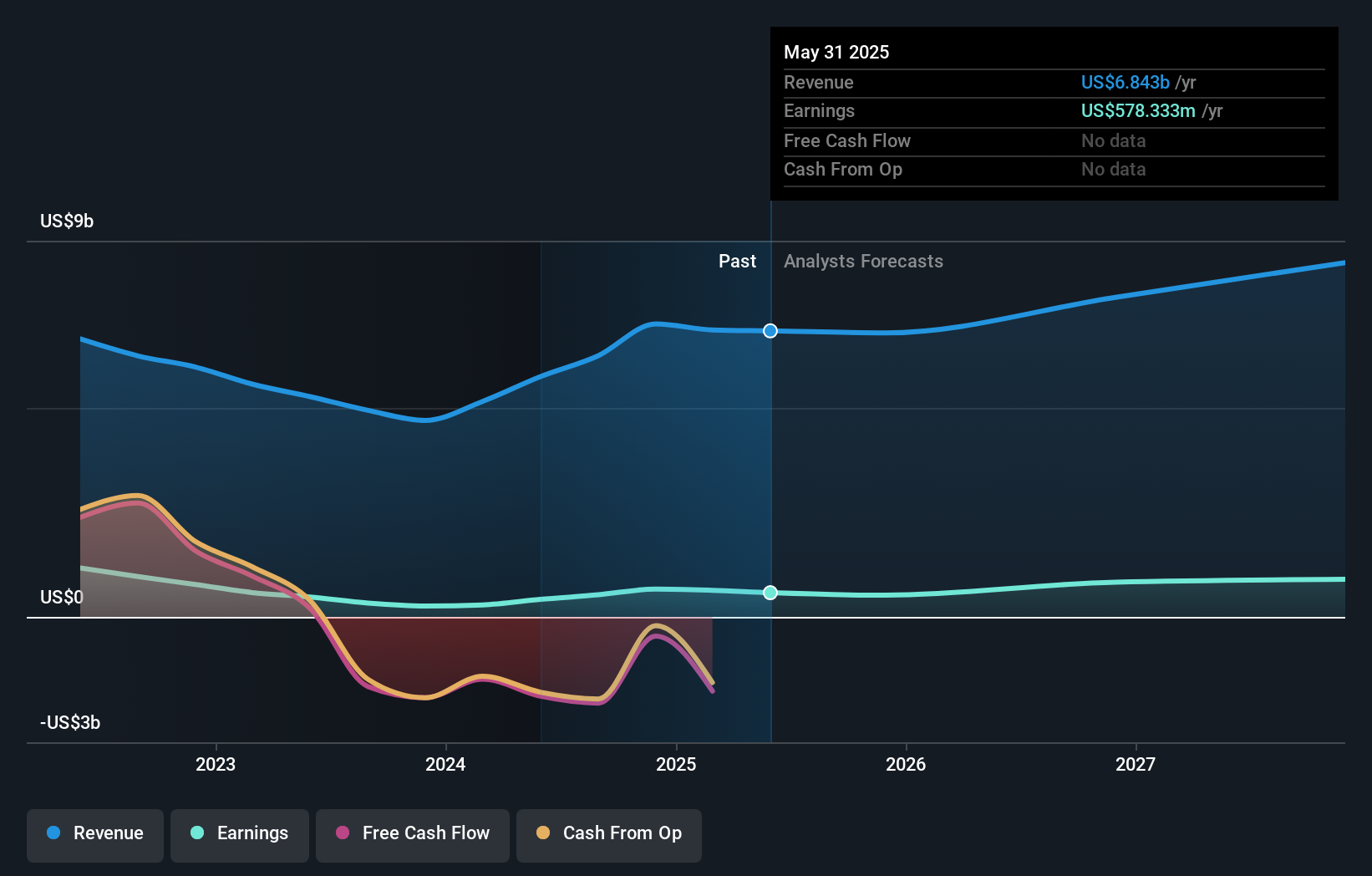

Overview: Jefferies Financial Group Inc. is an investment banking and capital markets firm operating across the Americas, Europe, the Middle East, and Asia-Pacific with a market cap of approximately $11.21 billion.

Operations: The company's revenue segments include Investment Banking and Capital Markets generating $6.15 billion and Asset Management contributing $722 million.

Insider Ownership: 20.3%

Earnings Growth Forecast: 28.3% p.a.

Jefferies Financial Group demonstrates potential for growth with earnings forecasted to increase by 28.3% annually, outpacing the US market. Despite slower revenue growth at 9.7%, it remains above the market average. The company maintains a favorable valuation with a price-to-earnings ratio of 17.6x, slightly below the US market average, and has completed significant fixed-income offerings recently. However, its dividend yield of 2.95% is not well-supported by free cash flows, which may concern some investors.

- Unlock comprehensive insights into our analysis of Jefferies Financial Group stock in this growth report.

- Upon reviewing our latest valuation report, Jefferies Financial Group's share price might be too pessimistic.

Karman Holdings (NYSE:KRMN)

Simply Wall St Growth Rating: ★★★★★☆

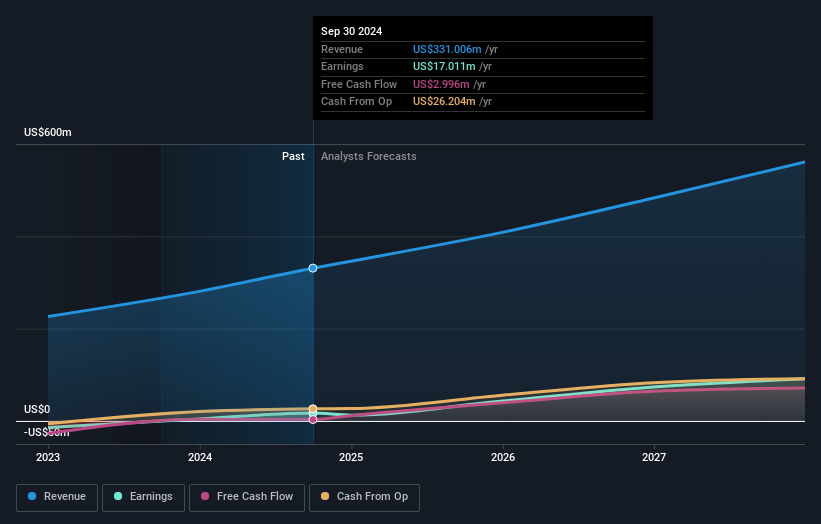

Overview: Karman Holdings Inc., with a market cap of approximately $5.65 billion, operates through its subsidiary to design, test, manufacture, and sell mission-critical systems in the United States.

Operations: Karman Holdings generates revenue from designing, testing, manufacturing, and selling mission-critical systems within the United States.

Insider Ownership: 14.3%

Earnings Growth Forecast: 59.2% p.a.

Karman Holdings is poised for substantial growth with earnings expected to rise significantly at 59.2% annually, outpacing the US market. Despite a slower revenue increase of 17%, it remains above market averages. Recent expansions, including a new facility in Alabama and a clean room in Washington, bolster its defense and space capabilities. However, financial challenges persist as interest payments are not well covered by earnings, and recent quarterly results showed a net loss of US$4.8 million.

- Click here and access our complete growth analysis report to understand the dynamics of Karman Holdings.

- Our comprehensive valuation report raises the possibility that Karman Holdings is priced higher than what may be justified by its financials.

Key Takeaways

- Explore the 195 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Searching for a Fresh Perspective? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JEF

Jefferies Financial Group

Operates as an investment banking and capital markets firm in the Americas, Europe, the Middle East, and the Asia-Pacific.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)