- United States

- /

- Real Estate

- /

- NasdaqGS:ZG

3 US Stocks Estimated To Be Undervalued By Up To 49.9% Presenting An Opportunity

Reviewed by Simply Wall St

As U.S. stock futures point to a lower open amid concerns about Chinese advances in artificial intelligence, the market is experiencing heightened volatility, particularly within the tech sector. In such a climate, identifying undervalued stocks can be crucial for investors seeking opportunities that may offer potential value despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | $24.50 | $48.65 | 49.6% |

| Berkshire Hills Bancorp (NYSE:BHLB) | $28.32 | $56.60 | 50% |

| German American Bancorp (NasdaqGS:GABC) | $39.23 | $78.06 | 49.7% |

| Meridian (NasdaqGS:MRBK) | $15.90 | $31.52 | 49.6% |

| Privia Health Group (NasdaqGS:PRVA) | $22.58 | $44.59 | 49.4% |

| FrontView REIT (NYSE:FVR) | $16.84 | $32.15 | 47.6% |

| BeiGene (NasdaqGS:ONC) | $222.08 | $438.07 | 49.3% |

| Bilibili (NasdaqGS:BILI) | $16.89 | $33.13 | 49% |

| Tenable Holdings (NasdaqGS:TENB) | $43.39 | $86.65 | 49.9% |

| Equifax (NYSE:EFX) | $268.82 | $534.36 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

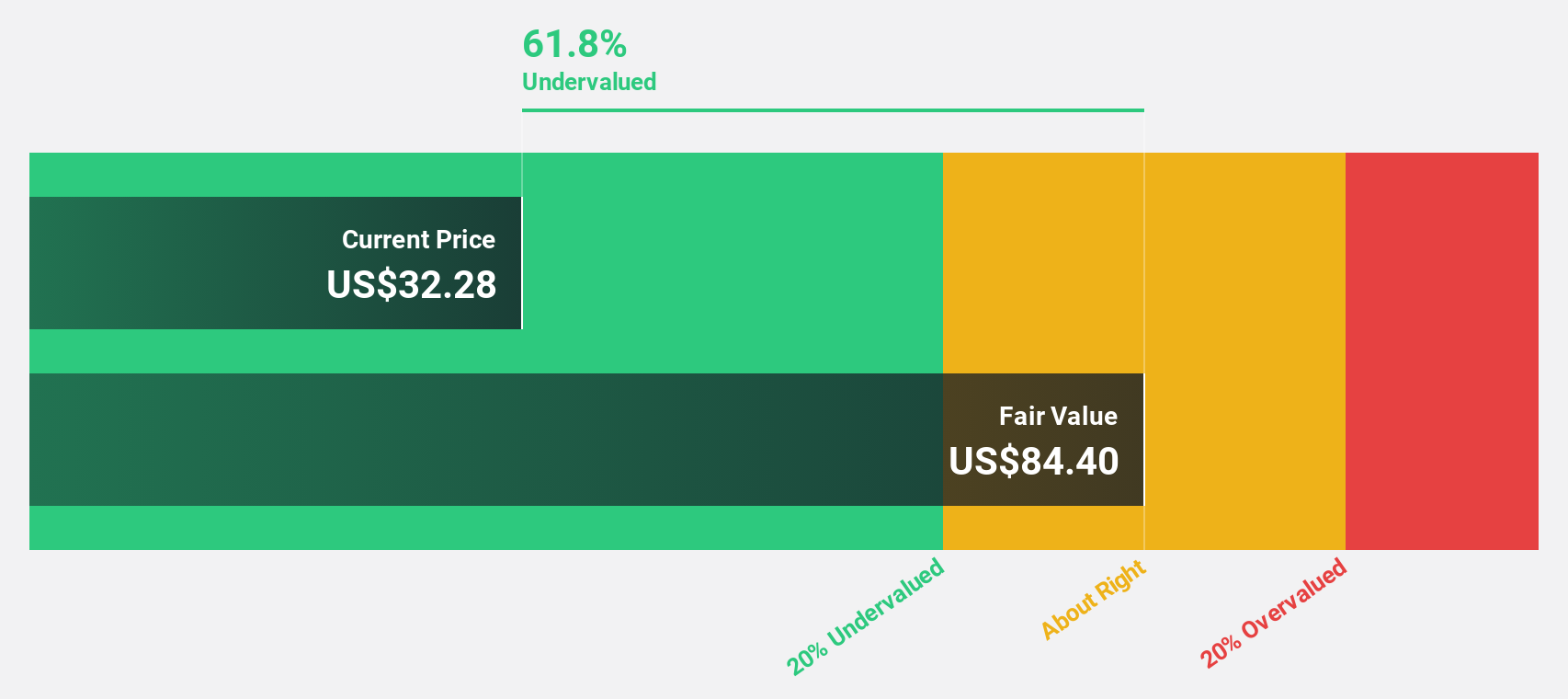

Veracyte (NasdaqGM:VCYT)

Overview: Veracyte, Inc. is a diagnostics company that operates both in the United States and internationally, with a market cap of approximately $3.40 billion.

Operations: The company's revenue is primarily derived from its diagnostic products segment, which generated $425.33 million.

Estimated Discount To Fair Value: 34%

Veracyte, Inc. reported a significant turnaround with a net income of US$15.16 million for Q3 2024 compared to a loss the previous year, alongside raising its full-year revenue guidance to US$442-445 million. The stock is trading at 34% below its estimated fair value of US$66.33 and is expected to achieve profitability within three years, indicating potential undervaluation based on cash flows despite low forecasted return on equity.

- Our expertly prepared growth report on Veracyte implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Veracyte's balance sheet health report.

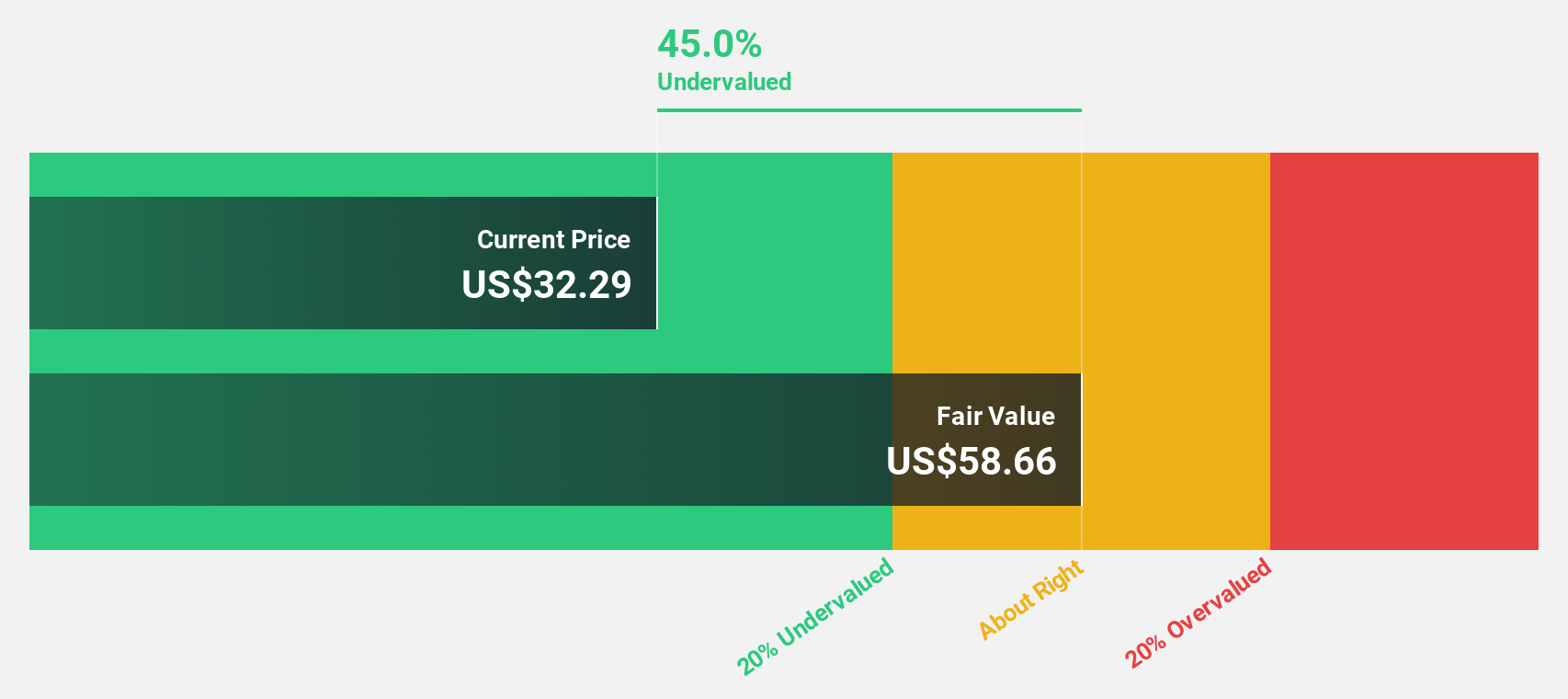

Tenable Holdings (NasdaqGS:TENB)

Overview: Tenable Holdings, Inc. offers cyber exposure solutions across various regions including the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan, with a market cap of approximately $5.21 billion.

Operations: The company's revenue is primarily derived from its Security Software & Services segment, amounting to $877.60 million.

Estimated Discount To Fair Value: 49.9%

Tenable Holdings' stock is trading at US$43.39, significantly below its estimated fair value of US$86.65, highlighting potential undervaluation based on cash flows. The company is expected to achieve profitability within three years and has a forecasted earnings growth rate of 56.77% per year, which is above average market growth. Despite slower revenue growth projections at 9.3% annually, Tenable's strategic innovations in cybersecurity strengthen its market position amidst recent leadership changes.

- Upon reviewing our latest growth report, Tenable Holdings' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Tenable Holdings stock in this financial health report.

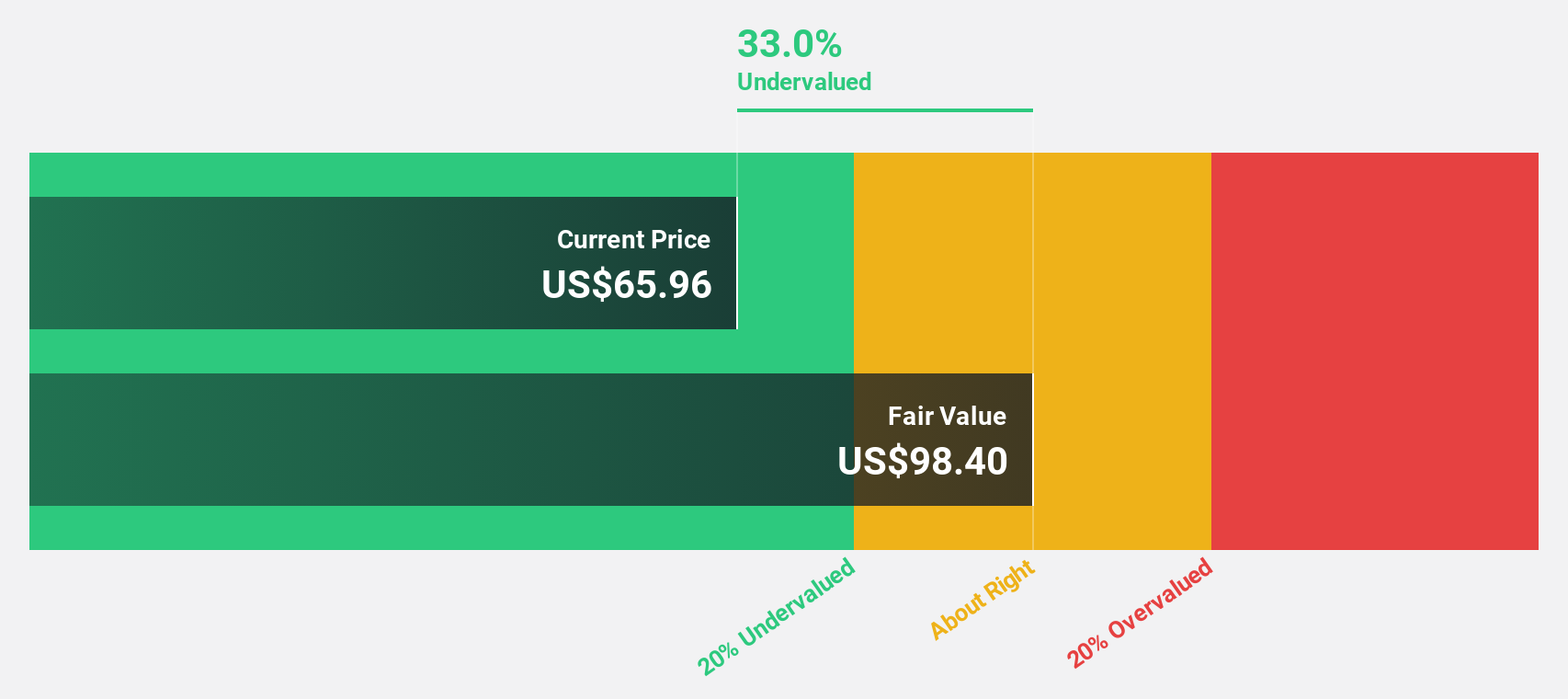

Zillow Group (NasdaqGS:ZG)

Overview: Zillow Group, Inc. operates real estate brands through mobile applications and websites in the United States, with a market cap of approximately $18.49 billion.

Operations: Zillow Group generates revenue through its core segments, which include the Internet, Media & Technology segment at $1.47 billion and the Homes segment at $2.69 billion.

Estimated Discount To Fair Value: 43%

Zillow Group's stock is trading at US$76.83, well below its estimated fair value of US$134.76, suggesting undervaluation based on cash flows. The company anticipates becoming profitable within three years with a robust forecasted earnings growth rate of 68.78% annually, surpassing market averages. Recent leadership appointments aim to enhance Zillow's strategic focus on integrated housing solutions and digital expansion, potentially bolstering its financial performance and market presence despite current low returns on equity forecasts.

- Our earnings growth report unveils the potential for significant increases in Zillow Group's future results.

- Delve into the full analysis health report here for a deeper understanding of Zillow Group.

Next Steps

- Get an in-depth perspective on all 169 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zillow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZG

Zillow Group

Operates real estate brands in mobile applications and Websites in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives