- United States

- /

- Software

- /

- NasdaqGM:FIVN

Five9 (FIVN): Reassessing Valuation After Upgraded EPS Forecasts and a Fresh Consensus Buy Rating

Reviewed by Simply Wall St

Five9 (FIVN) just caught investors’ attention after a wave of upward EPS revisions and a fresh consensus Buy signal, putting the contact center software specialist back on the radar for growth-focused portfolios.

See our latest analysis for Five9.

Those bullish EPS revisions are arriving after a tough stretch, with the share price at $21.47 and a year to date share price return of around negative 47% even though the 30 day share price return has turned positive. This suggests early signs that sentiment might be stabilising rather than sliding further.

If you are weighing whether Five9’s rebound has legs, it is also a good moment to scan other high growth tech names through high growth tech and AI stocks and compare how their momentum and fundamentals stack up.

With analysts seeing more than 60 percent upside and earnings momentum turning, is Five9 now trading at a meaningful discount to its AI driven growth story, or is the market already pricing in the next leg higher?

Most Popular Narrative Narrative: 36.9% Undervalued

With Five9 last closing at $21.47 against a narrative fair value of about $34.05, the valuation case leans firmly toward a sizable upside potential.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $98.5 million, and it would be trading on a PE ratio of 40.3x, assuming you use a discount rate of 9.6%.

Want to see how modest top line growth expectations still lead to a punchy earnings ramp and premium multiple? The revenue path, margin lift, and rerating assumptions powering that fair value may surprise you. Dive in to unpack the specific milestones behind this upside case.

Result: Fair Value of $34.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained competitive pressure and ongoing leadership transitions could derail the AI-driven growth story and force analysts to reassess these optimistic assumptions.

Find out about the key risks to this Five9 narrative.

Another Take on Valuation

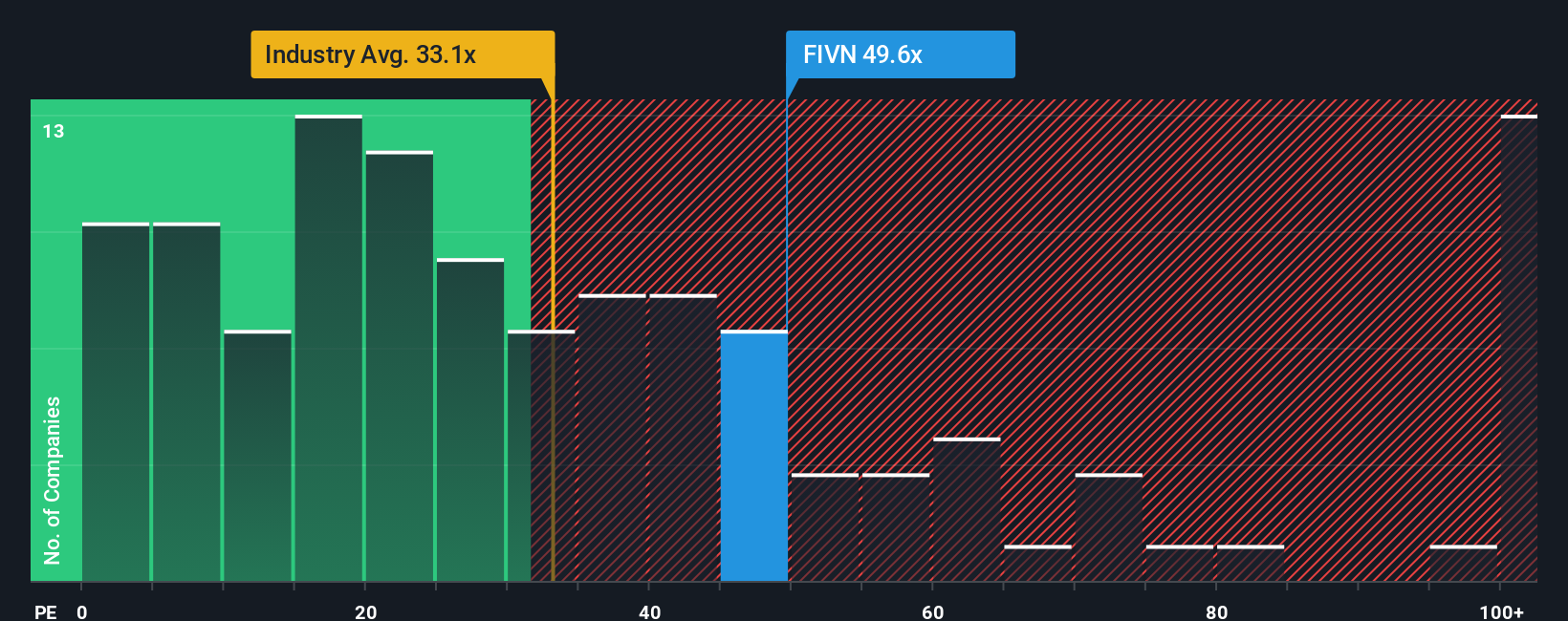

Our fair value work suggests upside, but the earnings multiple paints a sharper picture of risk. Five9 trades on a P/E of 53.7x, far richer than the US Software sector at 32.7x, its peers at 30.2x, and even our fair ratio of 38.3x. This implies the market could still compress the multiple if execution wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Five9 Narrative

If you would rather trust your own analysis than any consensus view, you can quickly build a personalised Five9 thesis in under three minutes, Do it your way.

A great starting point for your Five9 research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Strengthen your watchlist now, because smart capital never sits still when fresh opportunities are just a few clicks away on the Simply Wall Street Screener.

- Capture potential mispricing early by scanning these 905 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has overlooked.

- Lock in consistent income streams by targeting these 12 dividend stocks with yields > 3% that may keep paying you through different market cycles.

- Position ahead of the technology curve by reviewing these 27 quantum computing stocks shaping the next wave of computational breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FIVN

Five9

Provides intelligent cloud software for contact centers in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026