- United States

- /

- Software

- /

- NYSE:HUBS

Exploring 3 High Growth Tech Stocks in US Market

Reviewed by Simply Wall St

As the U.S. stock market continues to climb, with major indices like the Dow and S&P 500 setting fresh records despite concerns over a government shutdown, investors are closely watching high-growth sectors such as technology for potential opportunities. In this buoyant environment, identifying promising tech stocks often involves looking at companies that not only show robust growth prospects but also demonstrate resilience in navigating economic uncertainties and evolving market dynamics.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ACADIA Pharmaceuticals | 10.33% | 23.81% | ★★★★★☆ |

| ADMA Biologics | 20.60% | 23.25% | ★★★★★☆ |

| Palantir Technologies | 25.11% | 31.65% | ★★★★★★ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.88% | 74.81% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Circle Internet Group | 28.31% | 82.83% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

| Zscaler | 15.74% | 40.36% | ★★★★★☆ |

Click here to see the full list of 69 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Five9 (FIVN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Five9, Inc. offers intelligent cloud software solutions for contact centers globally and has a market capitalization of approximately $1.83 billion.

Operations: Five9 generates revenue primarily from its Internet Software & Services segment, amounting to $1.11 billion. The company's focus is on providing cloud-based solutions for contact centers both in the U.S. and internationally.

Amidst a transformative landscape for tech firms, Five9 stands out with its strategic integrations and AI enhancements, notably through the recent launch of Five9 Fusion for ServiceNow. This integration not only streamlines customer service processes by unifying voice and digital interactions but also leverages AI to enhance agent productivity and operational agility. Financially, Five9 has turned a corner, reporting a net income of $1.15 million in Q2 2025 after a loss the previous year, with sales rising to $283.27 million from $252.09 million. The company's R&D focus remains robust, aligning with its forward-looking growth strategies in cloud-based solutions and customer engagement technologies—a pivot that is reshaping expectations and setting new benchmarks within the tech sector.

- Take a closer look at Five9's potential here in our health report.

Review our historical performance report to gain insights into Five9's's past performance.

Cheetah Mobile (CMCM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cheetah Mobile Inc., along with its subsidiaries, offers internet services and artificial intelligence solutions across China, Hong Kong, Japan, and other international markets with a market capitalization of approximately $251.62 million.

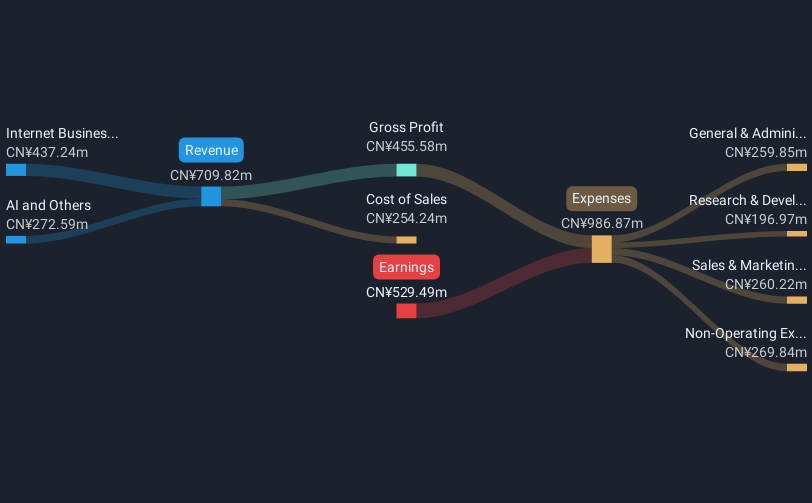

Operations: With a focus on internet services and AI, Cheetah Mobile generates revenue primarily from its Internet Business segment (CN¥611.42 million) and AI and Others segment (CN¥371.98 million).

Cheetah Mobile's trajectory in the tech sector illustrates a blend of challenges and growth potential. With an impressive forecasted annual revenue increase of 22.2%, the company outpaces the U.S. market average of 9.8%. Despite current unprofitability, earnings are expected to surge by 109.3% annually, positioning Cheetah Mobile for profitability within three years—a notable recovery given its recent reduction in net losses from CNY 123.84 million to CNY 22.64 million in Q2 2025 alone. This financial rebound is underpinned by significant R&D investments, aligning with strategic shifts towards more sustainable growth areas within tech, signaling a potentially brighter future despite a volatile share price and ongoing challenges in achieving positive free cash flow.

- Unlock comprehensive insights into our analysis of Cheetah Mobile stock in this health report.

Understand Cheetah Mobile's track record by examining our Past report.

HubSpot (HUBS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HubSpot, Inc. offers a cloud-based customer relationship management platform serving businesses across the Americas, Europe, and the Asia Pacific with a market cap of $23.20 billion.

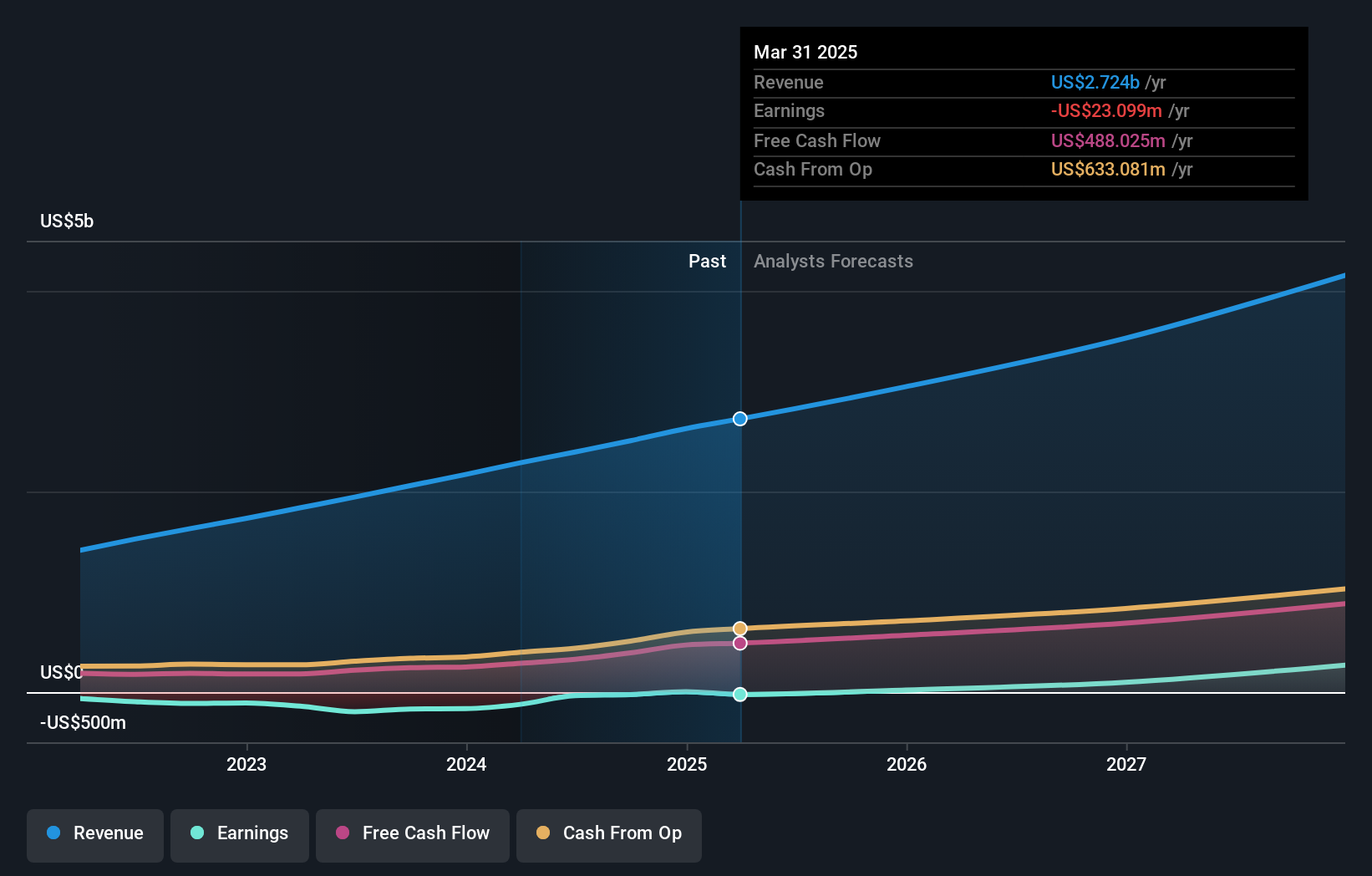

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $2.85 billion.

HubSpot's integration with innovative platforms like Talkdesk and CallRail, as highlighted in recent announcements, underscores its strategic focus on enhancing user experience and operational efficiency through AI-driven solutions. This approach not only streamlines workflows but also enriches customer interactions across sales and service teams, potentially boosting productivity by minimizing system toggling and data duplication. With a robust annual revenue growth of 14.5% and a significant reduction in net losses—from $14.44 million to $3.26 million in the latest quarter—HubSpot demonstrates a resilient financial trajectory despite its current unprofitability. The company's commitment to R&D, evidenced by substantial investments aligning with these integrations, positions it well for future profitability within the dynamic tech landscape.

- Delve into the full analysis health report here for a deeper understanding of HubSpot.

Gain insights into HubSpot's past trends and performance with our Past report.

Where To Now?

- Take a closer look at our US High Growth Tech and AI Stocks list of 69 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)