- United States

- /

- Software

- /

- NasdaqGS:ADSK

June 2025's Top Three Value Stocks Trading Below Estimated Worth

Reviewed by Simply Wall St

In the last week, the United States market has been flat, but over the past 12 months, it has risen by 10%, with earnings forecast to grow by 15% annually. In this environment, identifying stocks trading below their estimated worth can offer potential opportunities for investors seeking value in a steadily growing market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TransMedics Group (TMDX) | $124.00 | $246.09 | 49.6% |

| StoneCo (STNE) | $14.86 | $29.31 | 49.3% |

| Shoals Technologies Group (SHLS) | $5.225 | $10.38 | 49.7% |

| Roku (ROKU) | $81.43 | $160.64 | 49.3% |

| Peoples Financial Services (PFIS) | $47.14 | $93.66 | 49.7% |

| MAC Copper (MTAL) | $11.94 | $23.54 | 49.3% |

| German American Bancorp (GABC) | $36.80 | $72.97 | 49.6% |

| EQT (EQT) | $59.37 | $117.07 | 49.3% |

| Central Pacific Financial (CPF) | $26.02 | $51.99 | 50% |

| Arrow Financial (AROW) | $24.93 | $49.74 | 49.9% |

Let's dive into some prime choices out of the screener.

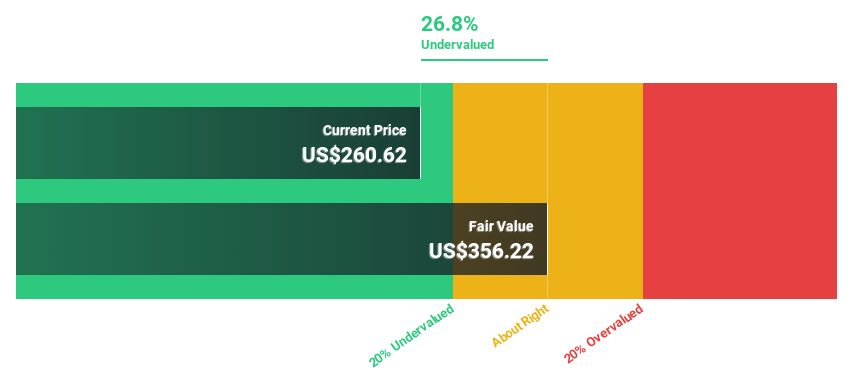

Autodesk (ADSK)

Overview: Autodesk, Inc. offers 3D design, engineering, and entertainment technology solutions globally and has a market cap of approximately $63.15 billion.

Operations: The company's revenue is primarily derived from its CAD / CAM Software segment, which generated $6.35 billion.

Estimated Discount To Fair Value: 10.4%

Autodesk is trading at 10.4% below its estimated fair value of US$329.56, suggesting it may be undervalued based on cash flows. The company recently completed a US$498.69 million fixed-income offering and secured a new US$1.5 billion credit facility, enhancing liquidity for future growth initiatives. Despite a decline in net income to US$152 million in Q1 2025, revenue increased to US$1.63 billion, with earnings forecasted to grow faster than the broader market annually.

- In light of our recent growth report, it seems possible that Autodesk's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Autodesk.

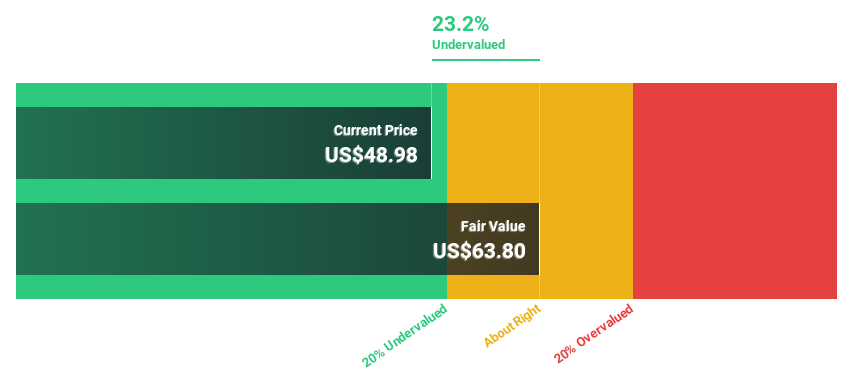

OneMain Holdings (OMF)

Overview: OneMain Holdings, Inc. is a financial service holding company operating in consumer finance and insurance sectors in the United States, with a market cap of approximately $6.39 billion.

Operations: The company generates revenue primarily through its consumer and insurance operations, totaling $2.57 billion.

Estimated Discount To Fair Value: 15%

OneMain Holdings, trading at US$53.68, is priced below its estimated fair value of US$63.12, indicating potential undervaluation based on cash flows. The company reported a Q1 2025 net income increase to US$213 million from US$155 million the previous year and forecasts significant annual earnings growth of 23.4%. However, operating cash flow does not sufficiently cover debt obligations, posing a financial risk despite positive revenue growth projections exceeding market averages.

- Upon reviewing our latest growth report, OneMain Holdings' projected financial performance appears quite optimistic.

- Take a closer look at OneMain Holdings' balance sheet health here in our report.

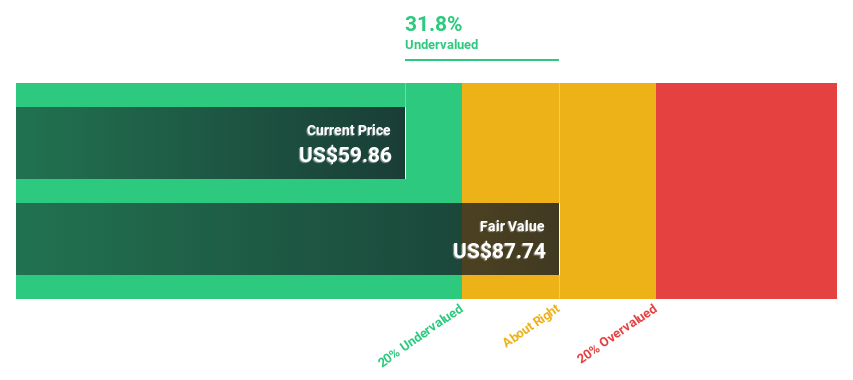

Somnigroup International (SGI)

Overview: Somnigroup International Inc., along with its subsidiaries, designs, manufactures, distributes, and retails bedding products both in the United States and internationally, with a market cap of $13.55 billion.

Operations: Revenue segments for SGI include design, manufacturing, distribution, and retail of bedding products in the U.S. and internationally.

Estimated Discount To Fair Value: 19.6%

Somnigroup International, trading at US$64.98, is undervalued relative to its fair value estimate of US$80.86. Despite a recent net loss of US$33.1 million in Q1 2025 compared to the previous year's net income, earnings are projected to grow significantly at 23.8% annually, outpacing market expectations. However, debt coverage from operating cash flow remains a concern despite successful debt refinancing efforts aimed at reducing interest expenses and leveraging strategic partnerships for revenue growth.

- Our expertly prepared growth report on Somnigroup International implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Somnigroup International.

Make It Happen

- Click this link to deep-dive into the 167 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion