- United States

- /

- Semiconductors

- /

- NYSE:ONTO

3 Intriguing Stock Opportunities Estimated To Be Trading Up To 31.1% Below Intrinsic Value

Reviewed by Simply Wall St

In a dramatic turn of events, the United States stock market experienced significant gains as major indices soared following President Trump's announcement of a 90-day pause on tariffs. This volatility presents an opportunity for investors to explore stocks that may be trading below their intrinsic value, offering potential for growth amidst the current economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CareTrust REIT (NYSE:CTRE) | $27.41 | $54.76 | 49.9% |

| NBT Bancorp (NasdaqGS:NBTB) | $40.45 | $78.70 | 48.6% |

| Semrush Holdings (NYSE:SEMR) | $9.14 | $18.17 | 49.7% |

| First Reliance Bancshares (OTCPK:FSRL) | $9.35 | $18.55 | 49.6% |

| Vericel (NasdaqGM:VCEL) | $44.24 | $86.05 | 48.6% |

| Veracyte (NasdaqGM:VCYT) | $32.62 | $64.53 | 49.4% |

| Elastic (NYSE:ESTC) | $83.35 | $163.03 | 48.9% |

| Zillow Group (NasdaqGS:ZG) | $64.96 | $128.27 | 49.4% |

| BioLife Solutions (NasdaqCM:BLFS) | $22.79 | $44.51 | 48.8% |

| CNX Resources (NYSE:CNX) | $29.35 | $57.33 | 48.8% |

We'll examine a selection from our screener results.

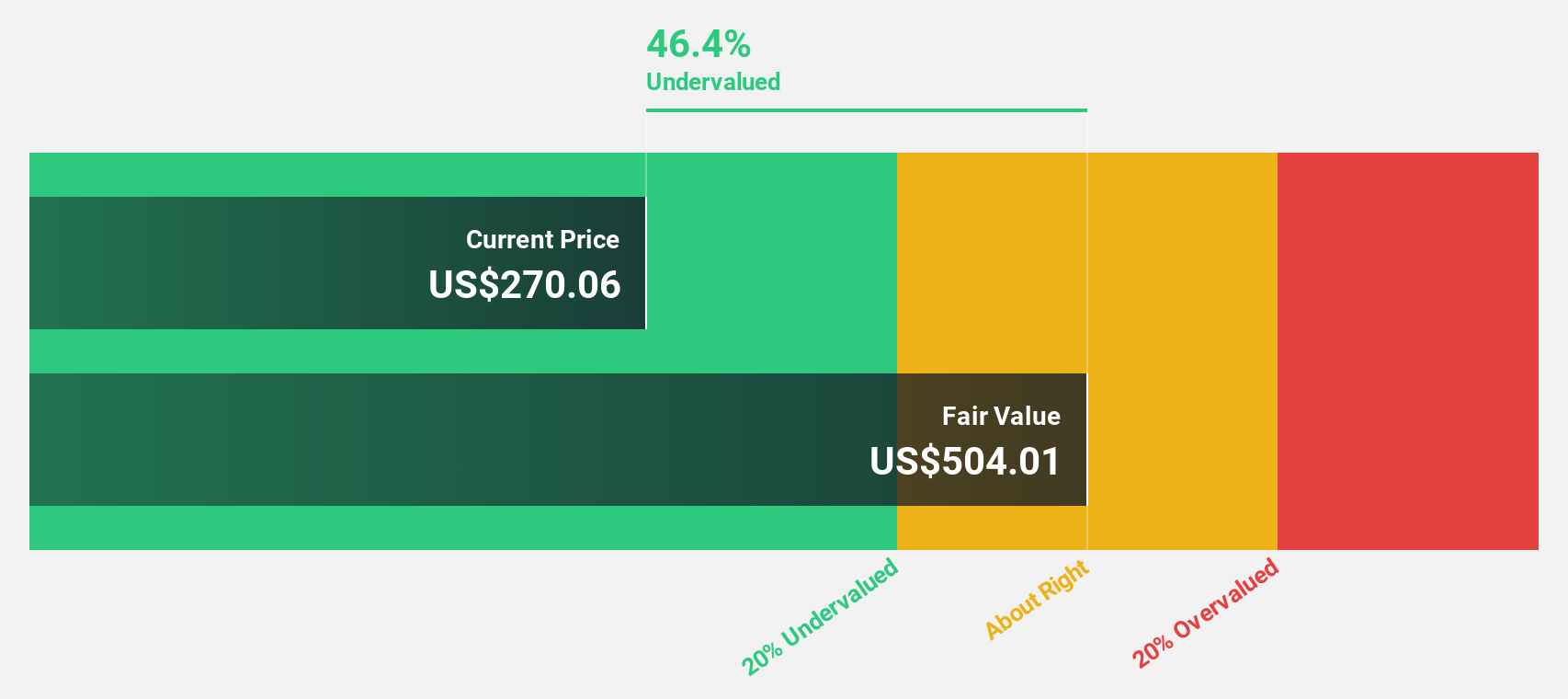

Flutter Entertainment (NYSE:FLUT)

Overview: Flutter Entertainment plc is a sports betting and gaming company with operations in the United States, the United Kingdom, Ireland, Australia, Italy, and internationally, and has a market cap of approximately $37.67 billion.

Operations: The company's revenue is derived from several segments: $5.80 billion from the US, $3.60 billion from the UK and Ireland, $1.40 billion from Australia, and $3.26 billion internationally.

Estimated Discount To Fair Value: 31.1%

Flutter Entertainment is trading at US$236.67, significantly below its estimated fair value of US$343.58, suggesting undervaluation based on discounted cash flow analysis. The company has recently become profitable with net income reaching US$43 million in 2024, compared to a loss the previous year. Earnings are forecast to grow substantially at 45.6% annually, outpacing the broader market's growth expectations and indicating strong future cash flow potential despite recent board changes and index adjustments.

- Our comprehensive growth report raises the possibility that Flutter Entertainment is poised for substantial financial growth.

- Get an in-depth perspective on Flutter Entertainment's balance sheet by reading our health report here.

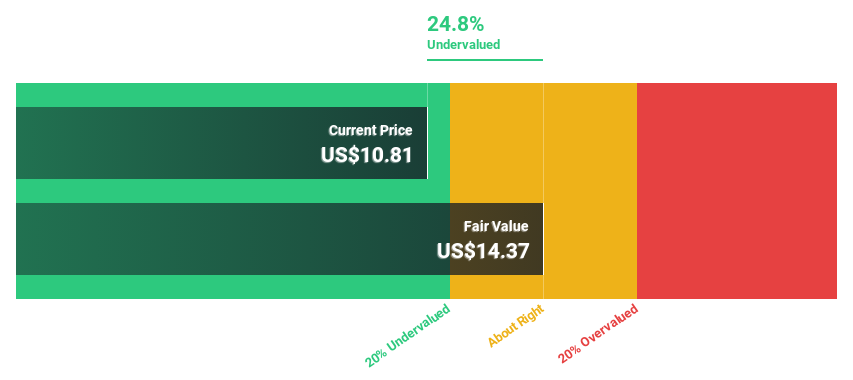

Nu Holdings (NYSE:NU)

Overview: Nu Holdings Ltd. operates a digital banking platform across several countries including Brazil, Mexico, and Colombia, with a market capitalization of approximately $48.04 billion.

Operations: The company's revenue from its digital banking operations is approximately $5.51 billion.

Estimated Discount To Fair Value: 22.6%

Nu Holdings is currently trading at US$10.92, below its fair value estimate of US$14.11, highlighting potential undervaluation based on cash flow analysis. The company reported significant earnings growth with net income reaching nearly US$2 billion in 2024, up from just over US$1 billion the previous year. Despite a high level of bad loans at 7.8%, earnings are expected to grow significantly at 24% annually, surpassing market expectations and indicating robust future cash flows.

- According our earnings growth report, there's an indication that Nu Holdings might be ready to expand.

- Dive into the specifics of Nu Holdings here with our thorough financial health report.

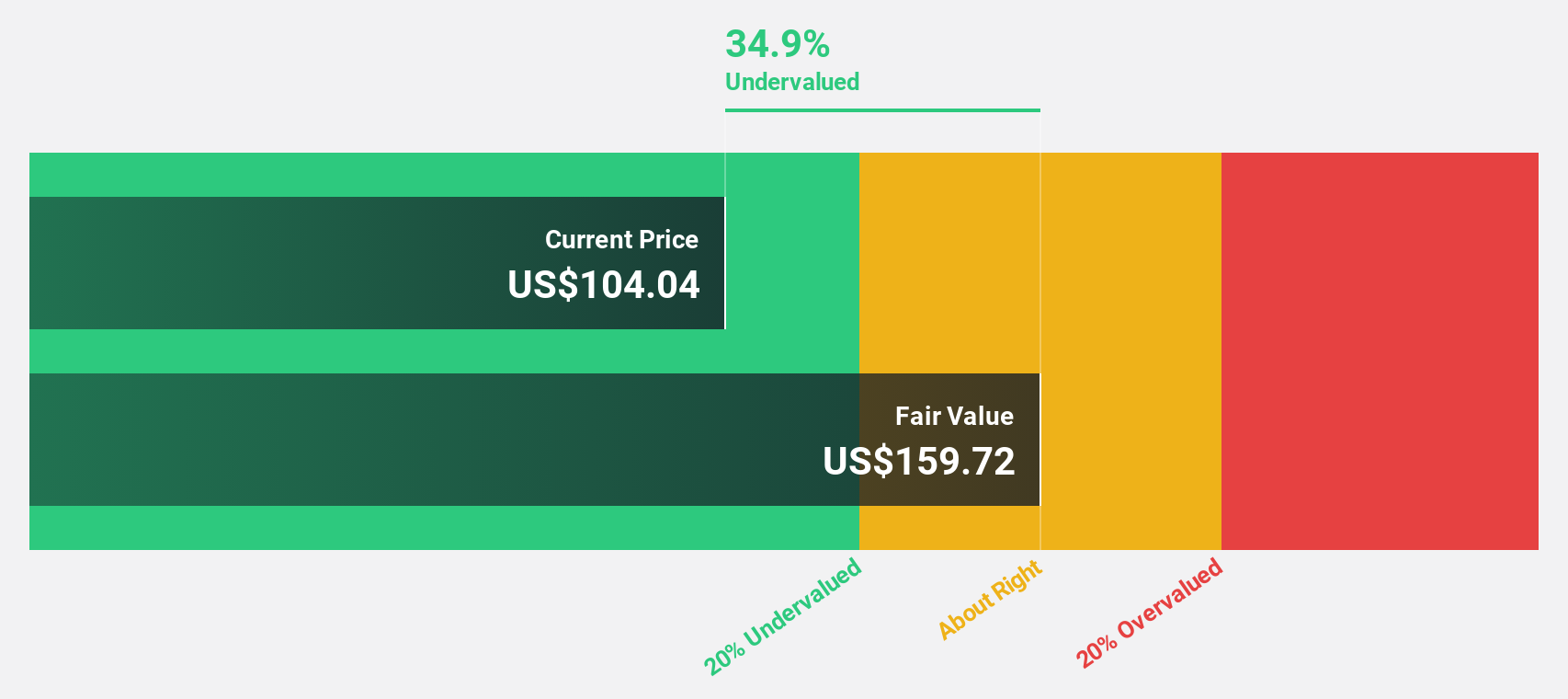

Onto Innovation (NYSE:ONTO)

Overview: Onto Innovation Inc. designs, develops, manufactures, and supports process control tools for optical metrology and inspection globally, with a market cap of approximately $5.20 billion.

Operations: The company's revenue is primarily generated from its Semiconductor Equipment and Services segment, totaling $987.32 million.

Estimated Discount To Fair Value: 30.4%

Onto Innovation is trading at US$133.37, significantly below its estimated fair value of US$191.7, suggesting potential undervaluation based on cash flows. Recent earnings reports show strong growth with net income rising to US$201.67 million in 2024 from US$121.16 million the previous year, and earnings are forecasted to grow at an annual rate of 24.79%. Despite some share price volatility and lower projected revenue growth than desired, the company's financial health remains robust.

- Our growth report here indicates Onto Innovation may be poised for an improving outlook.

- Click here to discover the nuances of Onto Innovation with our detailed financial health report.

Where To Now?

- Get an in-depth perspective on all 183 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONTO

Onto Innovation

Engages in the design, development, manufacture, and support of process control tools that performs optical metrology and inspection worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives