- United States

- /

- Software

- /

- NasdaqGS:CDNS

3 US Stocks That Could Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq Composite continue their winning streaks, buoyed by strong performances in large-cap technology stocks, investors are increasingly on the lookout for opportunities in an evolving market landscape. In this context, identifying undervalued stocks becomes crucial for those seeking to capitalize on potential growth while navigating economic uncertainties. Here are three U.S. stocks that could be trading below their estimated value amidst current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Kaspi.kz (NasdaqGS:KSPI) | $122.05 | $243.53 | 49.9% |

| Peoples Financial Services (NasdaqGS:PFIS) | $44.28 | $87.09 | 49.2% |

| Owens Corning (NYSE:OC) | $159.90 | $315.87 | 49.4% |

| Amdocs (NasdaqGS:DOX) | $85.05 | $167.23 | 49.1% |

| Cadence Bank (NYSE:CADE) | $30.22 | $59.32 | 49.1% |

| Veritex Holdings (NasdaqGM:VBTX) | $23.84 | $46.66 | 48.9% |

| Fluence Energy (NasdaqGS:FLNC) | $21.09 | $42.10 | 49.9% |

| Vasta Platform (NasdaqGS:VSTA) | $2.52 | $4.91 | 48.6% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | $261.91 | $511.77 | 48.8% |

| Metals Acquisition (NYSE:MTAL) | $10.35 | $20.55 | 49.6% |

Here we highlight a subset of our preferred stocks from the screener.

Cadence Design Systems (NasdaqGS:CDNS)

Overview: Cadence Design Systems, Inc. offers software, hardware, services, and reusable integrated circuit (IC) design blocks globally with a market cap of approximately $72.50 billion.

Operations: The company generates $4.16 billion from its CAD/CAM software segment.

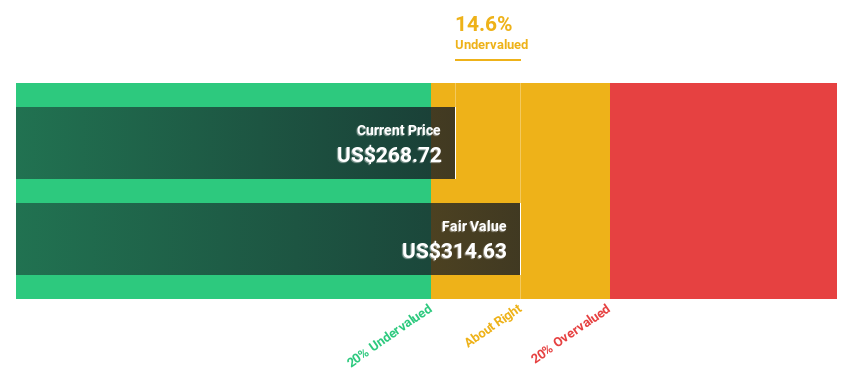

Estimated Discount To Fair Value: 15.9%

Cadence Design Systems is trading at US$264.72, below its estimated fair value of US$314.82, indicating it may be undervalued based on cash flows. Earnings are forecast to grow 18.4% annually, outpacing the broader market's 15.2%. Recent financial moves include a $2.5 billion shelf registration and multiple fixed-income offerings totaling over $2 billion, which could enhance liquidity and support growth initiatives without significant equity dilution risks.

- Insights from our recent growth report point to a promising forecast for Cadence Design Systems' business outlook.

- Get an in-depth perspective on Cadence Design Systems' balance sheet by reading our health report here.

First Solar (NasdaqGS:FSLR)

Overview: First Solar, Inc. is a solar technology company that provides photovoltaic solar energy solutions globally, with a market cap of $25.67 billion.

Operations: First Solar generates revenue primarily from its modules segment, which accounted for $3.76 billion.

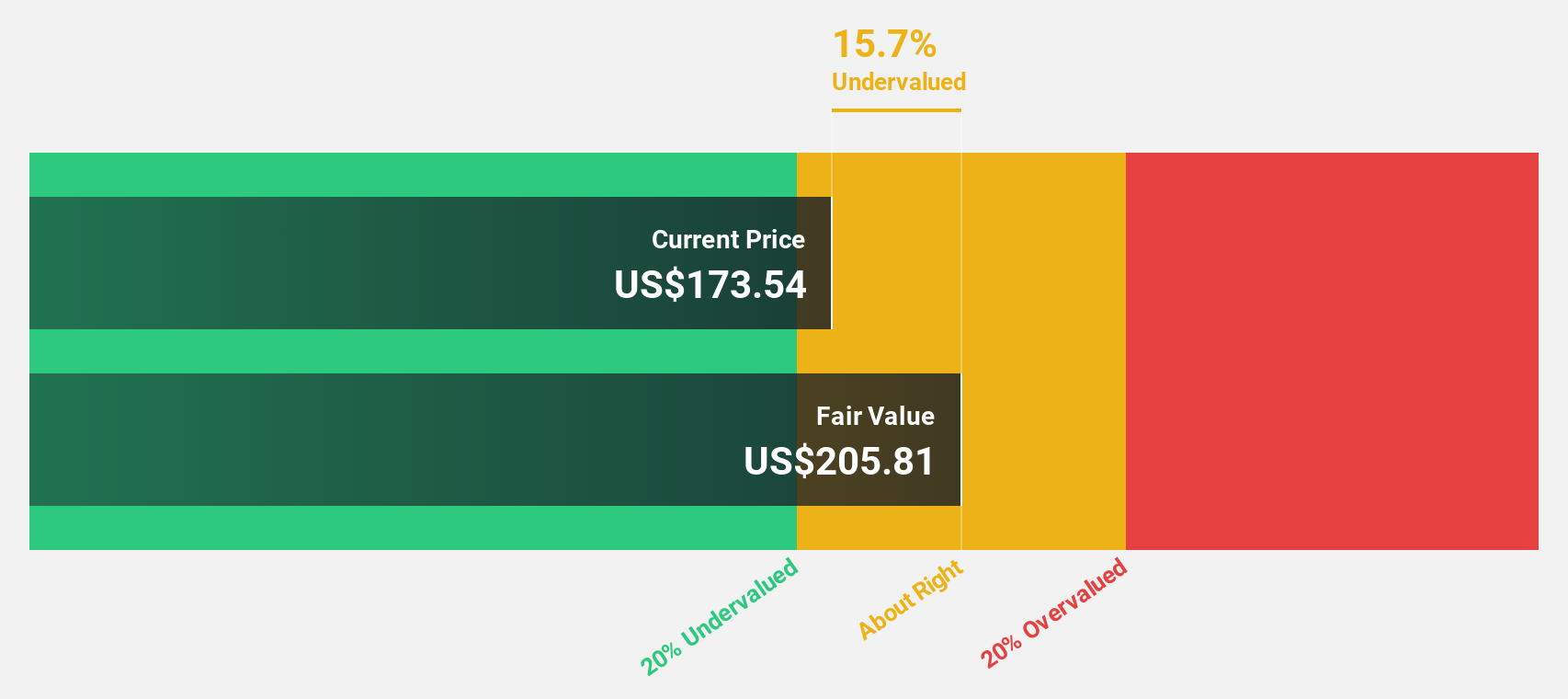

Estimated Discount To Fair Value: 48.6%

First Solar is trading at US$239.84, significantly below its estimated fair value of US$466.34, making it highly undervalued based on discounted cash flows. Recent earnings show robust growth, with Q2 sales reaching US$1.01 billion and net income doubling to US$349.36 million year-over-year. The company’s new R&D center in Ohio aims to accelerate innovation cycles and support future revenue growth, which is expected to outpace the market at 17.1% annually.

- According our earnings growth report, there's an indication that First Solar might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of First Solar.

Vertiv Holdings Co (NYSE:VRT)

Overview: Vertiv Holdings Co (NYSE:VRT) designs, manufactures, and services critical digital infrastructure technologies for data centers, communication networks, and commercial and industrial environments globally, with a market cap of $30.91 billion.

Operations: Revenue segments for Vertiv Holdings Co are: Americas: $4.11 billion, Asia Pacific: $1.68 billion, and Europe, Middle East & Africa: $1.95 billion.

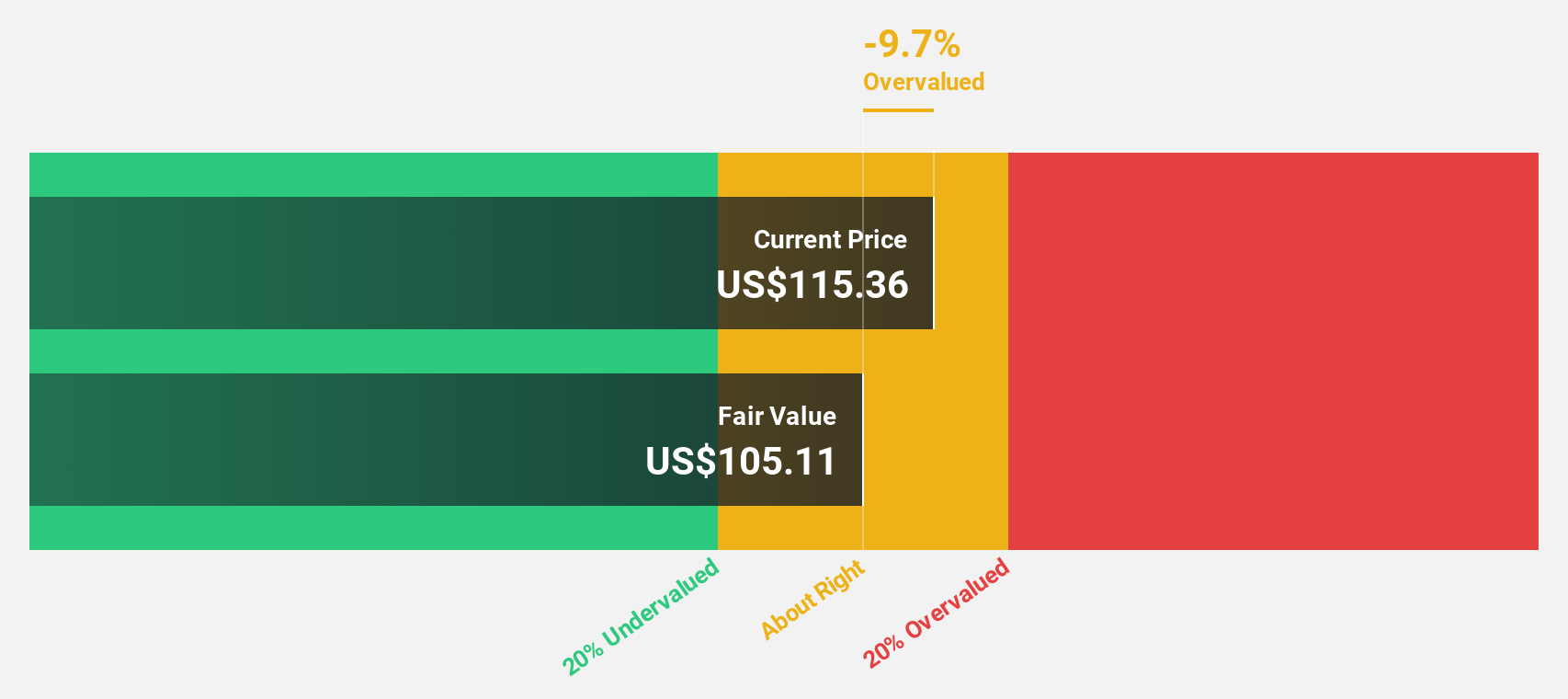

Estimated Discount To Fair Value: 43.1%

Vertiv Holdings Co. is trading at US$82.39, significantly below its estimated fair value of US$144.78, indicating substantial undervaluation based on discounted cash flows. The company's earnings grew by 175.2% over the past year and are forecast to grow at 29.7% annually, outpacing the market average of 15%. Despite high debt levels, Vertiv's revenue guidance for 2024 has been raised to $7.67 billion, reflecting strong financial performance and growth potential.

- The growth report we've compiled suggests that Vertiv Holdings Co's future prospects could be on the up.

- Dive into the specifics of Vertiv Holdings Co here with our thorough financial health report.

Seize The Opportunity

- Embark on your investment journey to our 189 Undervalued US Stocks Based On Cash Flows selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CDNS

Cadence Design Systems

Provides software, hardware, and other services worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives