- United States

- /

- Hospitality

- /

- NasdaqGS:ATAT

Three US Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge led by big-tech rallies, with the S&P 500 posting its best week in two months, investors are keenly observing companies that demonstrate resilience and growth potential. In this environment, stocks with significant insider ownership often attract attention due to the confidence insiders show in their company's future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| Travelzoo (NasdaqGS:TZOO) | 38% | 34.7% |

| CarGurus (NasdaqGS:CARG) | 16.9% | 42.4% |

| Spotify Technology (NYSE:SPOT) | 17.6% | 29.8% |

| MP Materials (NYSE:MP) | 10.9% | 83% |

Let's dive into some prime choices out of the screener.

Astera Labs (NasdaqGS:ALAB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Astera Labs, Inc. designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure with a market cap of $21.14 billion.

Operations: The company's revenue is primarily derived from its semiconductor segment, which generated $305.71 million.

Insider Ownership: 16.1%

Earnings Growth Forecast: 69.8% p.a.

Astera Labs is experiencing rapid revenue growth, with a 186.4% increase over the past year and forecasted annual growth of 32.4%, outpacing the US market. Despite recent volatility in its share price and significant insider selling, no substantial insider buying occurred in the last three months. The company expects to become profitable within three years, with earnings projected to grow by 69.82% annually, although return on equity remains low at a forecasted 18.4%.

- Click here to discover the nuances of Astera Labs with our detailed analytical future growth report.

- According our valuation report, there's an indication that Astera Labs' share price might be on the expensive side.

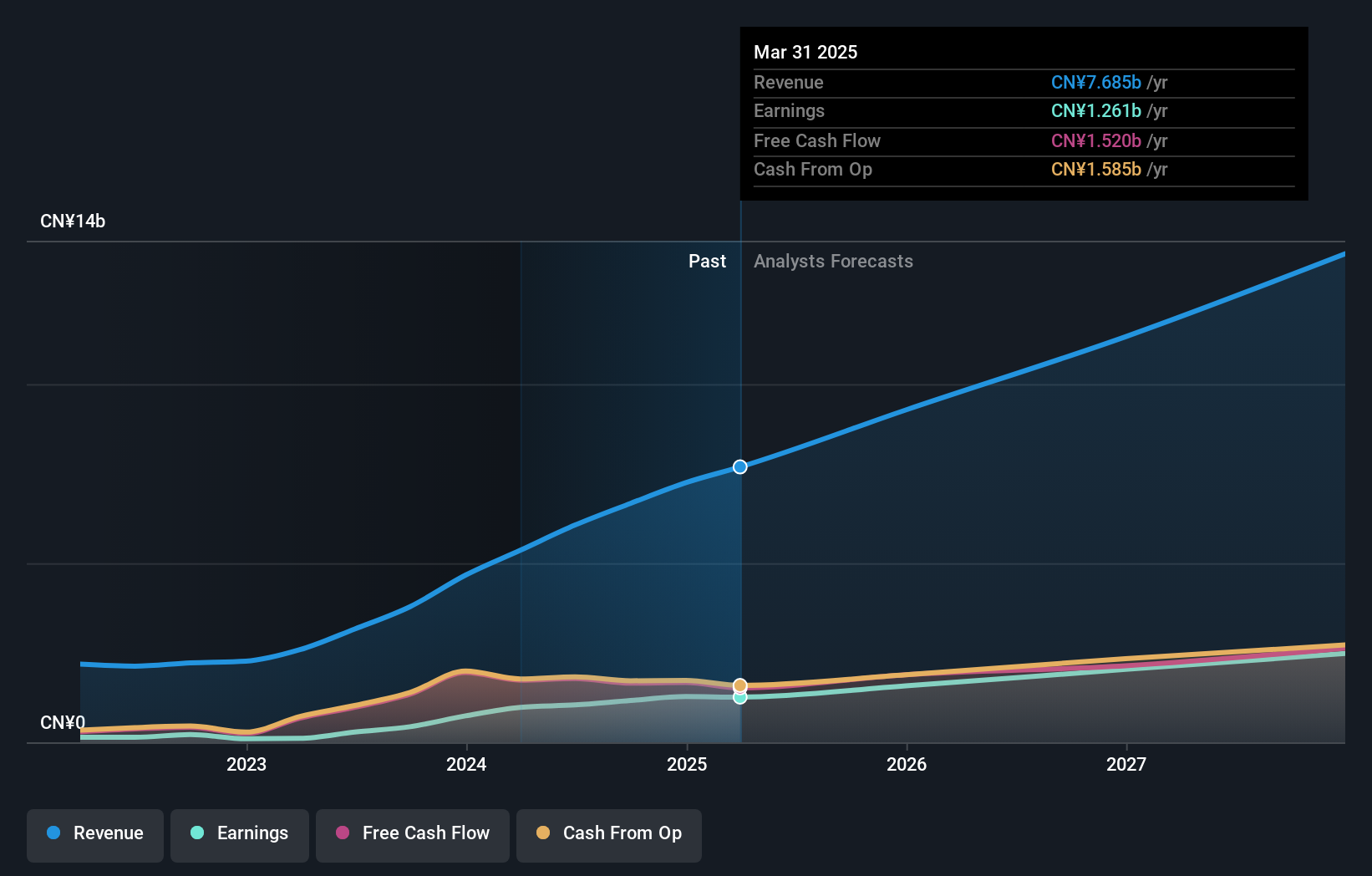

Atour Lifestyle Holdings (NasdaqGS:ATAT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Atour Lifestyle Holdings Limited, with a market cap of $3.56 billion, operates through its subsidiaries to develop lifestyle brands centered around hotel offerings in the People’s Republic of China.

Operations: The company's revenue segment includes Atour Group, which generated CN¥6.67 billion.

Insider Ownership: 26%

Earnings Growth Forecast: 25.6% p.a.

Atour Lifestyle Holdings is experiencing strong growth, with earnings forecasted to increase by 25.6% annually, outpacing the US market. Despite a decline in quarterly sales to CNY 189.53 million, revenue surged to CNY 1.90 billion year-over-year. The stock trades at a significant discount of 37.6% below its estimated fair value and boasts high insider ownership without recent substantial insider trading activity, suggesting alignment with shareholder interests and potential undervaluation compared to peers.

- Delve into the full analysis future growth report here for a deeper understanding of Atour Lifestyle Holdings.

- Our comprehensive valuation report raises the possibility that Atour Lifestyle Holdings is priced lower than what may be justified by its financials.

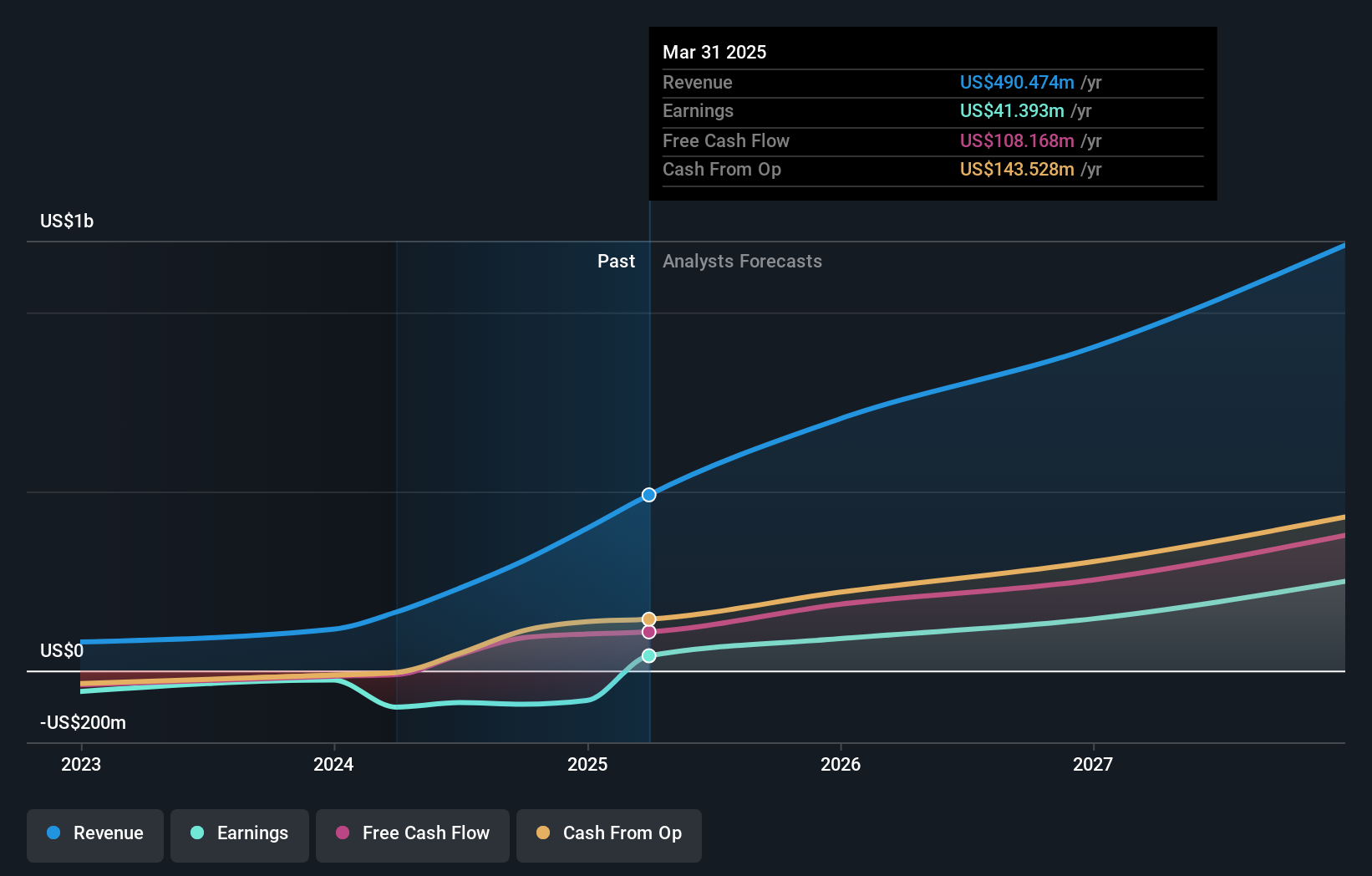

Toast (NYSE:TOST)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Toast, Inc. operates a cloud-based digital technology platform for the restaurant industry across the United States, Ireland, and India with a market cap of approximately $21.52 billion.

Operations: The company's revenue is primarily derived from its data processing segment, which generated $4.66 billion.

Insider Ownership: 20.3%

Earnings Growth Forecast: 44.8% p.a.

Toast is projected to grow earnings by 44.76% annually, with insider transactions showing more buying than selling in the past three months. Revenue growth of 16.2% annually outpaces the US market average, though it's below a high-growth threshold. Recent initiatives include expanding its retail solutions for convenience stores and partnering with Uber Direct to enhance delivery services, indicating strategic moves to diversify offerings and optimize operations across various retail environments.

- Click to explore a detailed breakdown of our findings in Toast's earnings growth report.

- The analysis detailed in our Toast valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Reveal the 207 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATAT

Atour Lifestyle Holdings

Through its subsidiaries, develops lifestyle brands around hotel offerings in the People’s Republic of China.

Very undervalued with exceptional growth potential.