- United States

- /

- Media

- /

- NasdaqGS:SCHL

Scholastic And 2 Other Compelling Dividend Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed movements, with tech stocks driving gains in the S&P 500 and Nasdaq while the Dow lags, investors are closely watching economic indicators like job data and potential Federal Reserve rate cuts. In this environment of fluctuating indices and economic uncertainty, dividend stocks can offer a reliable income stream, making them an attractive option for those seeking stability amidst market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.33% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.51% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.77% | ★★★★★★ |

| Ennis (EBF) | 5.48% | ★★★★★★ |

| Employers Holdings (EIG) | 3.00% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.53% | ★★★★★☆ |

| Dillard's (DDS) | 4.70% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.33% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.53% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.45% | ★★★★★☆ |

Click here to see the full list of 128 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

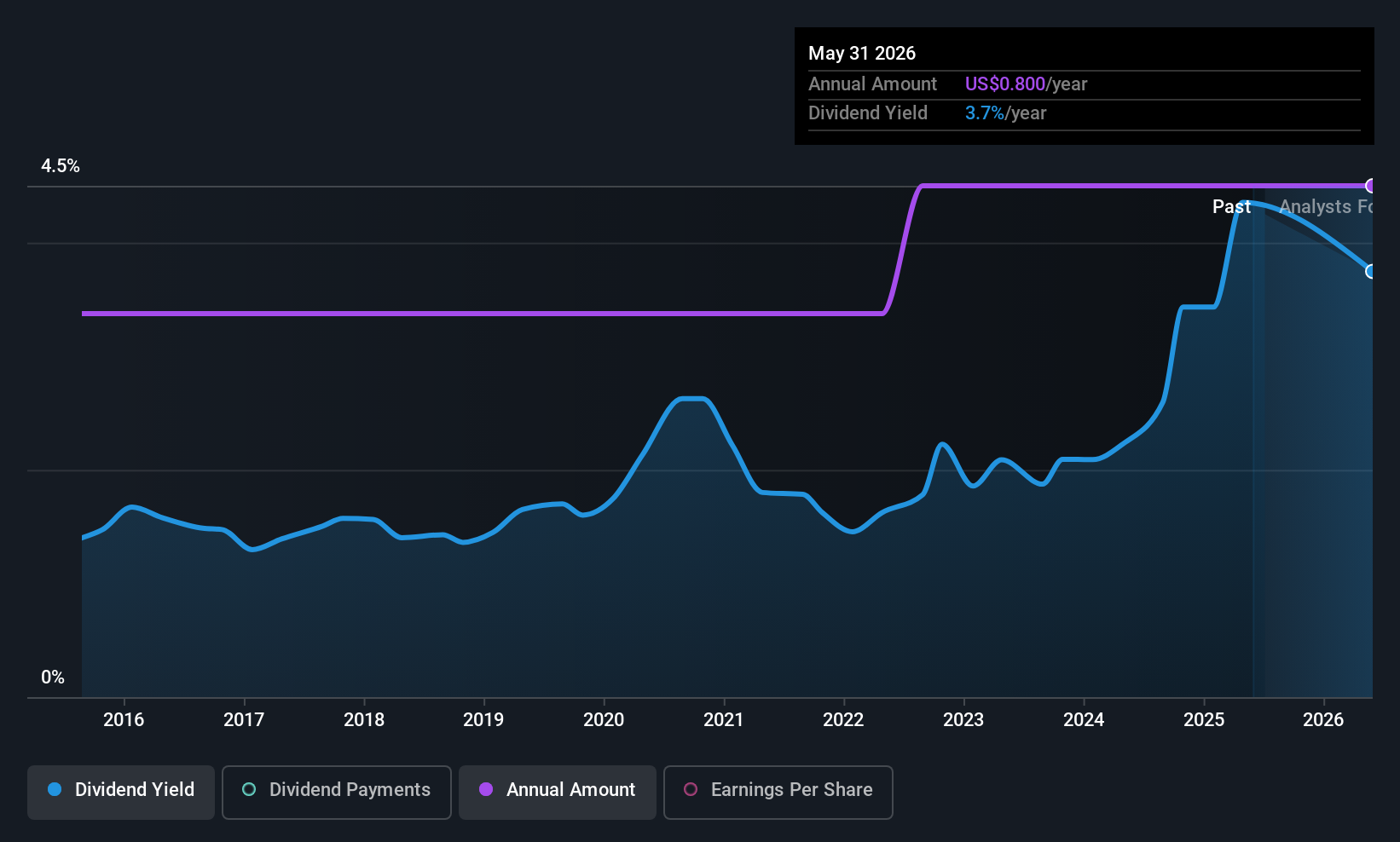

Scholastic (SCHL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Scholastic Corporation, with a market cap of $644.08 million, publishes and distributes children's books both in the United States and internationally.

Operations: Scholastic Corporation's revenue is primarily derived from its Children's Book Publishing and Distribution segment at $963.90 million, followed by Education Solutions at $309.80 million, International operations contributing $279.60 million, and Entertainment bringing in $61 million.

Dividend Yield: 3.2%

Scholastic Corporation has consistently grown its dividend over the past decade, maintaining stability despite recent financial challenges. Although the company posted a net loss of US$1.9 million for fiscal 2025, its dividends are well-covered by cash flows with a low cash payout ratio of 27.9%. Trading below estimated fair value, Scholastic's dividend yield is modest compared to top-tier payers but remains reliable due to prudent capital management and strategic initiatives aimed at enhancing long-term growth and profitability.

- Delve into the full analysis dividend report here for a deeper understanding of Scholastic.

- Upon reviewing our latest valuation report, Scholastic's share price might be too pessimistic.

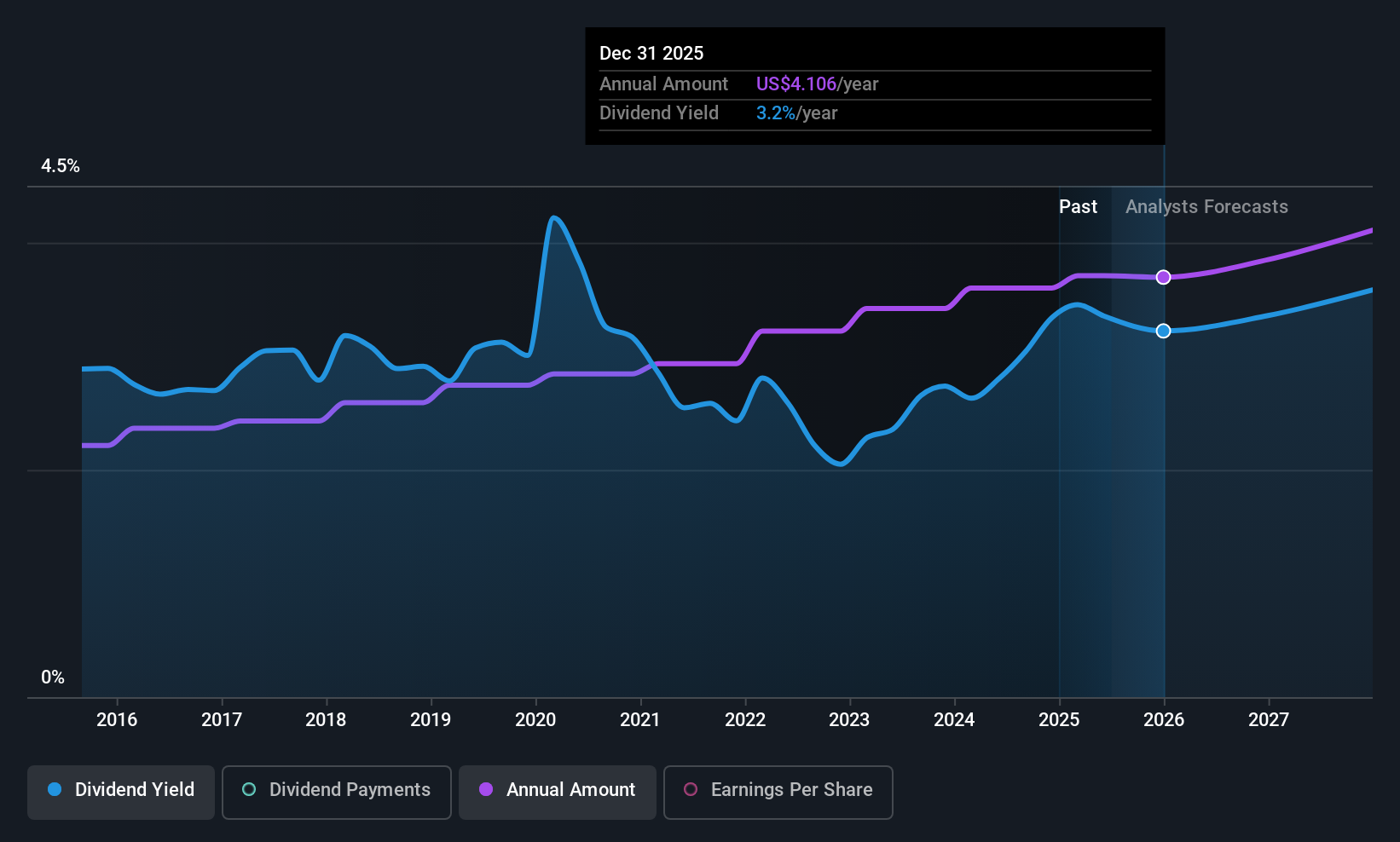

Genuine Parts (GPC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Genuine Parts Company distributes automotive and industrial replacement parts and has a market cap of approximately $19.38 billion.

Operations: Genuine Parts Company's revenue is primarily derived from its Automotive segment, generating $15.05 billion, and its Industrial segment, which includes Electrical/Electronic Materials, contributing $8.73 billion.

Dividend Yield: 3%

Genuine Parts Company has a stable dividend history over the past decade, but its current dividend yield of 3.03% is lower than top-tier US payers. The company's dividends are covered by earnings with a payout ratio of 69.7%, though not well-supported by free cash flow, indicating potential sustainability concerns. Recent earnings showed decreased net income despite increased sales, and the company lowered its annual sales growth guidance to between 1% and 3%.

- Click to explore a detailed breakdown of our findings in Genuine Parts' dividend report.

- Our valuation report here indicates Genuine Parts may be overvalued.

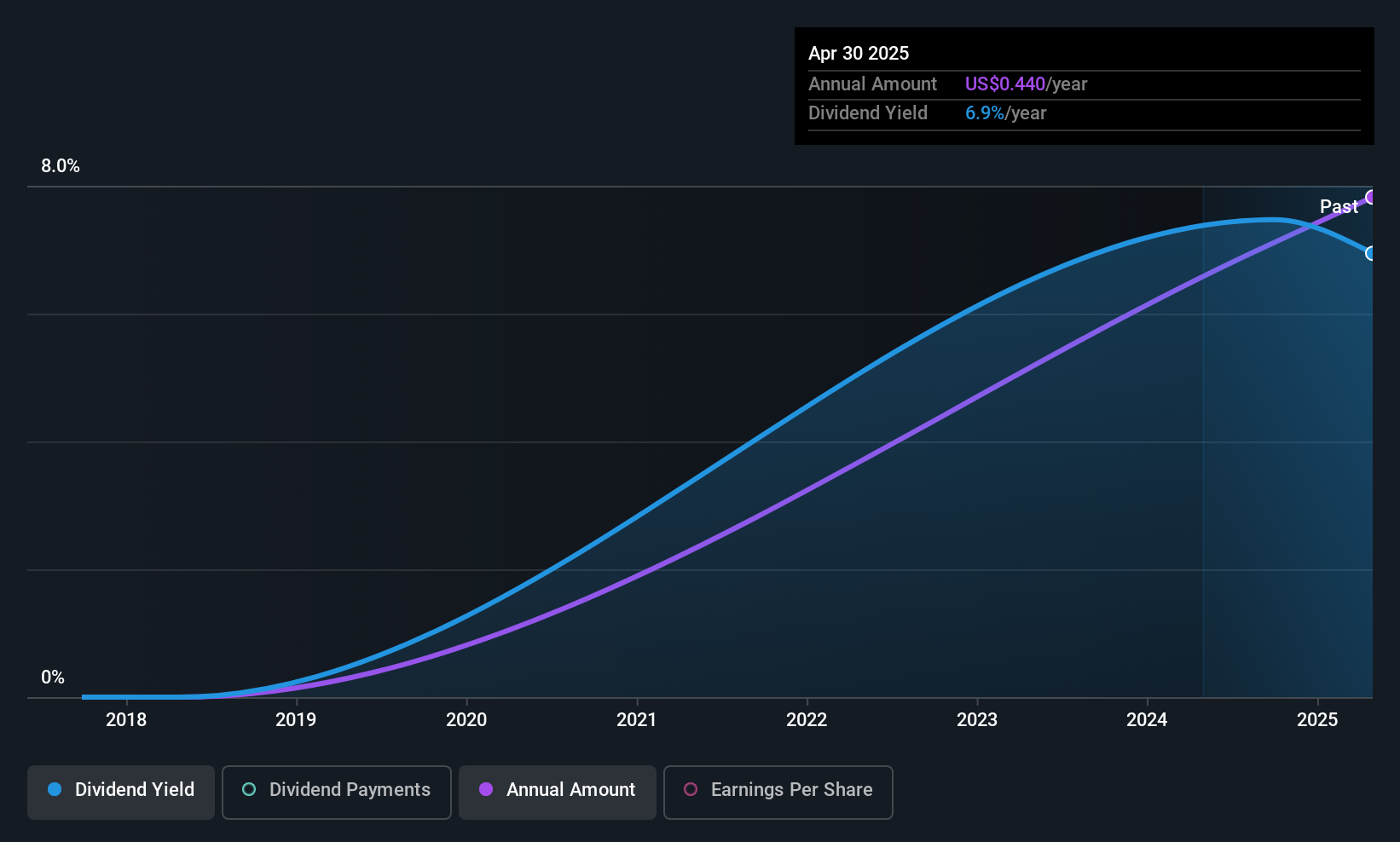

Yiren Digital (YRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yiren Digital Ltd. operates an AI-powered financial services platform in China with a market cap of $502.89 million.

Operations: Yiren Digital Ltd. generates revenue from its Financial Services Business (CN¥4.67 billion), Insurance Brokerage Business (CN¥321.51 million), and Consumption & Lifestyle Business (CN¥1.15 billion).

Dividend Yield: 7.5%

Yiren Digital's recent semi-annual dividend announcement of US$0.20 per share highlights its commitment to returning value to shareholders. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 21.3% and 20.8%, respectively, indicating sustainability despite being new to dividend payments. However, net income has declined compared to the previous year, reflecting a lower profit margin of 21% from last year's 37%, which could impact future financial flexibility.

- Click here to discover the nuances of Yiren Digital with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Yiren Digital shares in the market.

Where To Now?

- Click through to start exploring the rest of the 125 Top US Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SCHL

Scholastic

Scholastic Corporation, together with its subsidiaries, publishes and distributes children’s books in the United States and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives