Last Update 24 Jul 25

Fair value Decreased 32%Zwfis has decreased revenue growth from 11.0% to -2.6%.

PayPal at it's surface might not seem like fanciest option available; but as you take a deeper dive into the company it has a lot more to offer than just the app we use for transactions and sending money to others.

Most of their revenue comes from transactions while they also source some revenue from other added value services like:

- Payment Gateway

- Subscriptions

- Interest and fees from consumer loans and merchant loans

- Other credit products

- referrals

- partnerships

One other source that recently has begun to catch traction for them is Venmo; which is quite similar to the normal services of PayPal but has been very popular with younger populations. Last quarter Venmo's revenue even grew 20%; which will be exciting to see how it has done for Q2 which comes out next week.

Under their new leadership they are even stating the goal to have EPS grow in the low teens+ by 2027 and then in the 20%'s in the following years. Which is a very ambitious goal, but if they play their cards right I have full faith they can accomplish that. The two biggest things that make me excited about this company are 1: The monetization of Venmo and then 2: PayPal open.

Venmo is a very popular app/tool that people are using all over. One thing that they/past management had issues with was how to monetize it. Slowly besides transaction fees and earning interest off of customers unused cash they have started to begin to add a Debit and a Credit card into the mix. Along with that; and what I am most bullish on is how they are having Venmo being able to be used in stores. I mean even the other day when I was on doordash I noticed that Venmo is now an option to use for payment. They already made a very simple process begin to spread into the merchant business which I believe will bring in a lot of revenue while raising profit margins.

The biggest thing that makes me think PayPal is going somewhere is along the lines of their PayPal open which is centralized around merchants being able to use PayPal for transactions with customers. As they are able to gain more traction with this they are bringing in two big sources of revenue/growth. The first is by having new/more businesses adopt PayPal's different tools for merchants to use them as a transactional service; that means that for every purchase within that company PayPal will be earning a fee for every single use. How I look at this is a lot like with how Visa charges fees to companies for customer's using Visa in their stores. If they are able to spread this out to a greater scale then they could be hitting a storm of reoccurring revenue that just grows by the day. Along with if more merchants begin to use it, that means they will begin to gain more and more users for PayPal's different platforms. With this that means that for one they will earn more interest off of the more money that sits within their company but also with more users comes more opportunities to use PayPal's other offerings. And with continual positive users joining their platform I feel very confident in their ability to scale this.

As I was writing this PayPal actually came out with another service that they announced that makes me even more excited about the company. In Fall of 2025 they are unveiling what they call PayPal World. What this does is it connects major digital wallets and payment systems for customers. It is stated its initial launch will include Mercado Pago, NPCI, PayPal, Tenpay Global and Venmo which in total represents 2 billion users globally. This will allow customers to shop internationally while using their domestic payment system. From the company they state "The technology-agnostic platform will support cross-border commerce, AI-powered shopping, and future payment technologies including stable coins". Along with all of this it will also finally let PayPal and Venmo become fully interoperable. If they are able to exceed with this then it could be huge for them.

Now let me get into the numbers.

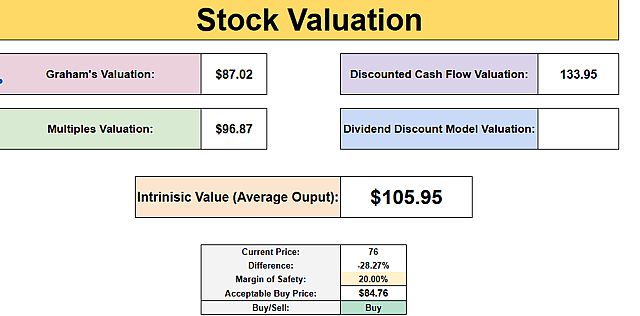

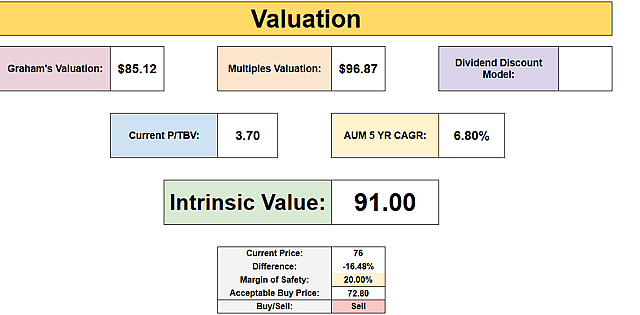

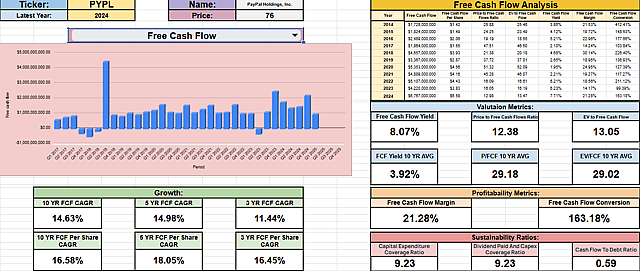

I ran two separate scenarios which you can see above to help me get a pretty good idea of their current Intrinsic Value. From running it you can see we fall between 90-100 roughly. Their DCF value even comes out at $133.95; which is almost double what their price is at as I am writing this.

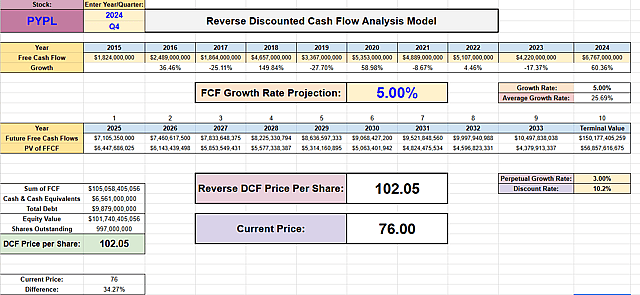

Reverse DCF

For this scenario I ran it at a FCF Growth Rate of 5% which I personally think is a little bit on the lower end but I thought it would give us a good idea of what is going on. According to this even if they hold a 5% FCF Growth Rate then their value is at $102.05 which once again is above the current price.

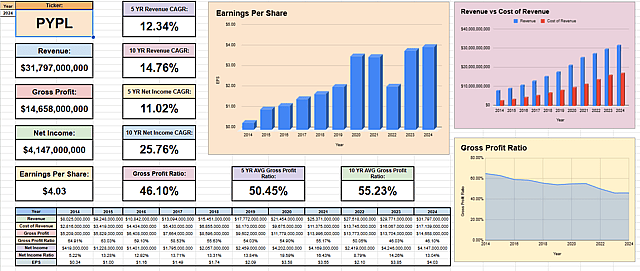

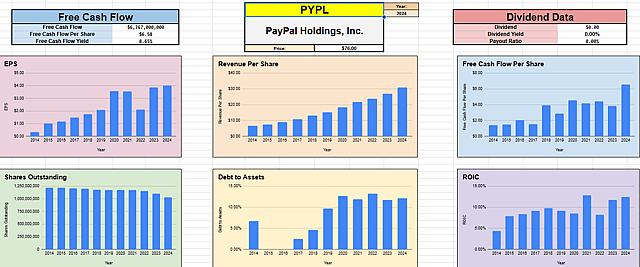

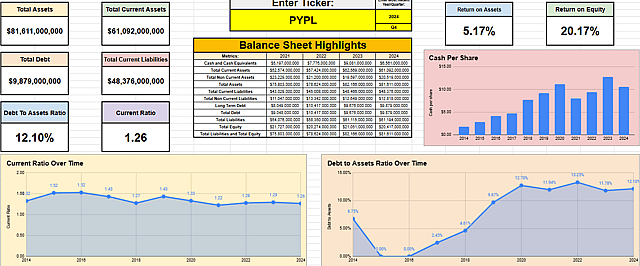

Profitability

PayPal has continually grown year in and year out...............and that was before they even had some of the things that we talked about before to help boost future revenue. One thing also that I love that the company is doing is how they are continually buying back shares with their FCF to help reduce Outstanding Shares. This year included they have pledged $1.9 Billion to share buy backs.

Based off of this data and the HG/SG Rate projections I ran below; I value PYPL at $105.25 at the moment.

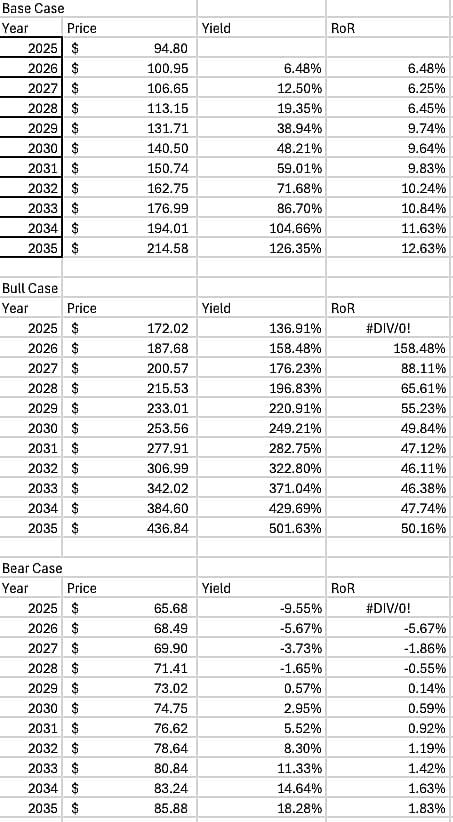

Now with all of this into consideration I have also created my own Sustainable Growth and Historical Growth rate projections. To simplify it I took the averages for my base, bull, and bear cases and then just put them into one.

From these I have come to my own personal conclusions of where I think PayPal will end up in the next couple of years

2 Years: $144.31 (46.4% Annual RoR)

5 Years: $215 (37.4% Annual RoR)

10 Years: $325 (33.5% Annual RoR)

In order for me to obtain my 20% compounded annual RoR for the next 10 years on average, I am willing to spend up to $108 on this company at the moment. However that might change with their Q2 earnings coming in soon.

I believe as long as PayPal continues to grow and expand on their transaction fees that they charge then I think that they could most definitely achieve these numbers. However I would not be surprised at all if they absolutely destroy these numbers as well. Especially with the direction that the management is planning on going; I do not have any doubts in them at all. Now I do not thing it will be a stock that just randomly jumps in price overnight, but I do think it will very slowly inch its way up.

Have other thoughts on PayPal Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user Zwfis has a position in NasdaqGS:PYPL. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.