Last Update 04 Nov 25

PayPal Stock: Growth Is Back, Dividend Introduced

PayPal (NASDAQ: PYPL) delivered a stronger-than-expected Q3 2025 and, for the first time in its history, announced a quarterly dividend — signaling confidence in its ability to generate consistent free cash flow. Revenue climbed 7% year-over-year to $8.4 billion, while transaction margin dollars rose 6% to $3.9 billion. GAAP EPS jumped 32% to $1.30, and non-GAAP EPS grew 12% to $1.34.

CEO Alex Chriss confirmed that the company is now on pace to deliver 6–7% transaction margin dollar growth for the full year, excluding interest on customer balances. This was accompanied by raised full-year guidance — a sign that PayPal’s turnaround strategy is beginning to gain traction.

The Return to Real, Profitable Growth

This quarter’s strength wasn’t just about revenue — it was about execution across every major operating segment:

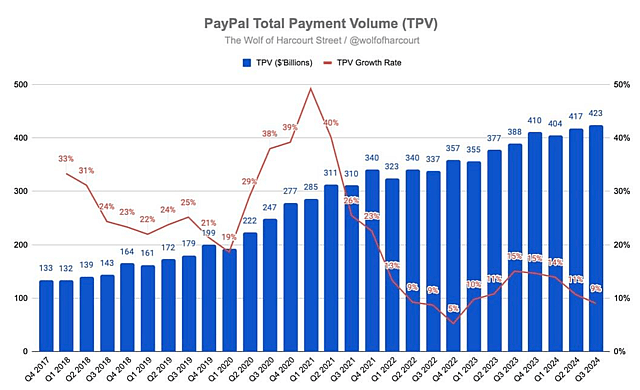

- Total Payment Volume (TPV): up 8% to $458.1 billion

- Active accounts: grew modestly to 438 million

- Free cash flow: $1.7 billion, with adjusted FCF at $2.3 billion

- Share repurchases: $1.5 billion in Q3 alone

The more symbolic milestone? PayPal declared its first-ever dividend of $0.14 per share, with a 10% payout ratio of non-GAAP earnings. This marks PayPal’s transition from "growth-only" to a diversified capital return strategy — much like Microsoft and Apple did in their maturation phases.

Expert Viewpoint: Strong Quarter, but Competitive Moat Is Not Risk-Free

According to Andrew Gosselin, CPA at Save My Cent, PayPal is showing clear operational progress, but its long-term advantage still relies on whether it can strengthen — not just stabilize — its branded checkout dominance.

He notes:

- Branded PayPal usage is under pressure from Apple Pay, Google Pay, Shopify Pay, and embedded card-on-file systems.

- AI partnerships with OpenAI, Google, and Perplexity are promising, but must translate into better fraud detection, faster checkout, and merchant loyalty — not just innovation headlines.

- The dividend is a signal of financial maturity, but it also means PayPal must now maintain disciplined capital allocation while still competing aggressively in consumer payments.

In Gosselin’s view, PayPal’s challenge is no longer growth — it’s relevance in an ecosystem where payments are increasingly invisible and bundled inside apps.

Where PayPal Is Winning Again

Despite competitive pressure, PayPal still controls a massive financial network:

- Branded checkout still handles over 40% of U.S. e-commerce transactions.

- Venmo continues scaling, especially among Gen Z, and is now monetized through credit cards, cash-back shopping, and business profiles.

- PSP (unbranded processing) — including Braintree — saw double-digit growth as PayPal became the payment infrastructure behind Uber, Airbnb, and many subscription apps.

- Transaction margin excluding customer interest increased 7%, showing stronger operational efficiency.

But the Weak Spots Are Still Visible

Not everything was perfect:

- Payment transactions per user fell 6% to 57.6 annually, signaling lower engagement.

- Unbranded PSP transactions reduced headline transaction volume visibility, making the business look weaker on the surface.

- Active accounts grew only 1% YoY, suggesting user adoption has plateaued.

Gosselin argues that PayPal doesn’t need more users — it needs deeper monetization per user, higher merchant loyalty, and embedded financing tools like Pay Later and merchant credit.

Balance Sheet & Dividend: A Turning Point

- Cash & investments: $14.4 billion

- Total debt: $11.4 billion

- Share repurchases (TTM): $5.7 billion

- New dividend: $0.14 per share, payable December 10, 2025

PayPal now mirrors mature fintech predecessors — capable of investing in AI/payments innovation while also rewarding shareholders.

As PayPal (PYPL) solidifies its position in the digital payments landscape, it presents a promising opportunity driven by transaction growth, profitability, and an attractive valuation. This analysis delves into how each of these areas contributes to PayPal’s robust potential as an investment.

Transaction growth is a cornerstone of PayPal’s continued strength, underpinned by the company’s broad array of services and expanding user base. Since Q1 2022, PayPal’s transaction volume has grown from 5,161 million to 6,631 million by Q3 2024. This increase, amounting to an additional 1,470 million transactions, reflects PayPal’s ability to attract and retain a dedicated customer base across its ecosystem. Stability in transaction frequency is bolstered by brand loyalty, as seen in minor fluctuations in the year-over-year (YoY) transaction growth rate, which has largely remained stable at around 10% after some initial variability.

Much of PayPal’s growth has been driven by the performance of its core products. PayPal’s branded checkout continues to perform strongly, with a YoY growth rate of 6%, supported by large enterprises, marketplaces, and international markets. Venmo, a key driver in the peer-to-peer payments space, has contributed an 8% increase in Total Payment Volume (TPV), further strengthening PayPal’s transaction base. Cross-border transactions have also grown by 7%, fueled by continued demand within Europe, where digital payment adoption is high.

Source: Threads

To further enhance its checkout process, PayPal has recently launched an improved mobile interface that streamlines the checkout experience for consumers, whether using one-time checkouts, recurring payments, or vaulted options. This update has already shown positive results, with a 20% transaction rate increase for one-time purchases through the new interface.

Increasingly, Venmo is expanding beyond peer-to-peer transactions- a further indication that PayPal is working to ensure more touchpoints and greater user engagement by adding more features such as merchant rewards, debit card cashback, and refreshed app experiences. Indeed, the portfolio of services that the PayPal ecosystem represents has become a diverse, rich platform for user engagement, lending to the long-term path to revenue stability.

This is also reflected in PayPal's resiliency in another area: profitability. Although margins have compressed somewhat over the last few quarters, the company has maintained healthy profit margins through cost rationalization. PayPal's transaction margin has averaged around 45-46% for the last two quarters, therefore, after an initial decline from 50.9% in Q1 '22 to 46.6% in Q3 '24. Though the road was somewhat rocky due to strategic cost control, PayPal's profitability was maintained, allowing its non-GAAP EPS in Q3 '24 to rise 22% YoY—a strong 146% improvement from Q1 '22.

PayPal’s strong profitability derives from effective cost control in sales and marketing. PayPal has strategically managed its marketing and sales expenses, with sales and marketing costs dropping by 22% YoY in Q2 2023 and 18% in Q3 2023. However, this expense rose by 17% in Q3 2024, indicating a targeted approach to reinvestment in high-impact areas while maintaining overall efficiency in cost management.

PayPal’s Profitability Push: Tech-Driven Margins Amid Fierce Fintech Competition

Enhanced technology has contributed to PayPal’s profitability by reducing transaction losses and boosting the transaction margin by 115 basis points in Q3 2024. This improvement underscores PayPal’s commitment to minimizing credit risks and fraud-related losses and maintaining its profit margins. Although YoY revenue growth has slowed somewhat, PayPal’s ability to balance operational expenses has enabled it to maintain stable margins. In Q3 2024, revenue grew by 6% YoY, while non-GAAP operating income rose by 18%, demonstrating that PayPal can still deliver profitability even with slower payment volume growth.

Lastly, PayPal faces fierce competition due to the entry of tech giants like Apple, Google, and emerging fintechs offering integrated payment ecosystems, advanced financial products, and seamless user experiences that challenge PayPal’s market share in digital payments. According to the CPA, David Kindness, to remain competitive in the market, PayPal should leverage its vast merchant network, enhance personalization, and develop omnichannel solutions to strengthen its core. By pursuing strategic partnerships, investing in technologies like blockchain and AI, and improving user experience, PayPal can boost its competitive edge. Expanding ‘buy now, pay later’ and entering emerging markets would fuel growth while focusing on security and simplicity, building trust and reinforcing its position as a digital payments leader.

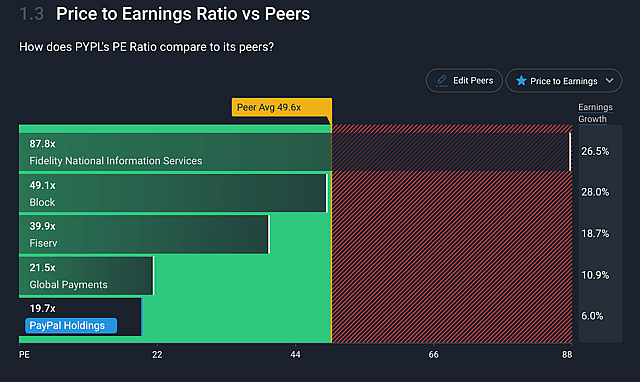

PayPal’s Valuation Discount: A Strategic Buy Opportunity?

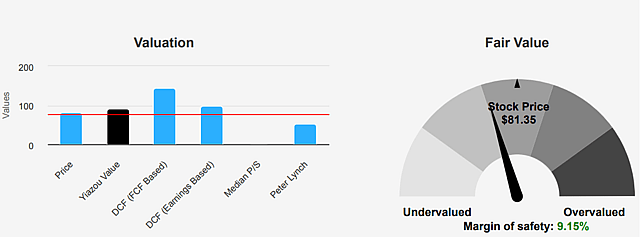

The concept of margin of safety refers to the difference between a stock’s market price and its intrinsic value, offering a cushion for investors against potential downside risks. In PayPal’s case, the intrinsic value is around $90, while the current market price is $81.35. This difference suggests a margin of safety of 9%, meaning investors are potentially paying less than the stock’s estimated worth, which reduces the risk if the company’s growth expectations are not fully met.

Source: yiazou.com

One key reason investors may want to consider an investment in the stock is for valuation purposes. Currently, PayPal trades at a forward price to sales of 2.5 and at a substantial 58.52% discount to its five-year average P/S of 6.03, which could suggest that PayPal is undervalued in the market. In addition, the forward P/E ratio of 17.32, while up 41.73% from the sector median, has yet to reach a commonly accepted discount relative to PayPal's five-year average P/E, which presently trades 43.97% cheaper than its historical average, considering recent pressures on growth.

Source: Simply Wall Street.

In addition to attractive valuation metrics, there is a commitment to creating long-term value from PayPal in its free cash flow and shareholder returns. For Q3 2024, the free cash flow generation by PayPal stood at $1.4 billion, up 31% YoY, underlining strong cash generation capability. During Q3 2024, PayPal returned $1.8 billion to its shareholders through share repurchases, a total of $5.4 billion over twelve months, and decreased outstanding shares by 7%. This capital allocation strategy underpins PayPal's share price and speaks volumes of management's confidence in the company's intrinsic value.

Takeaway

In summary, PayPal's transaction growth, strategic cost control, and generally attractive valuation make it a very attractive investment. The company's ecosystem continues to develop and benefits greatly from user loyalty and significant service diversification. Meanwhile, PayPal can maintain a stable profit margin due to operational efficiency and cost management even if revenue growth slows down.

On a valuation basis, PayPal's metrics reflect an attractive entry point for investors steeped in upside potential against historical and sector benchmarks. Therefore, PayPal combines resilience with upside for investors in the digital payments area, maintaining a balanced risk-reward profile with significant growth possibilities over the coming years.

Have other thoughts on PayPal Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user yiannisz has a position in NasdaqGS:PYPL. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.