Last Update 05 Sep 25

Strengthening Pipeline with Breakthrough AI

Hoth Therapeutics (NASDAQ: HOTH) is layering cutting-edge technology on top of its strong clinical momentum. Already known for its standout Phase 2 trial results (100% patient improvement with HT-001 cancer rash trial), Hoth is now integrating Lantern Pharma’s PredictBBB.ai platform, an AI tool with 94% accuracy in predicting whether drugs can cross the blood–brain barrier (BBB). This move positions Hoth as a biotech innovator not only in supportive oncology care but also in next-gen, AI-powered drug development.

Why It Matters

- De-risking development: Crossing the blood–brain barrier is one of the toughest challenges in R&D. PredictBBB.ai helps Hoth screen candidates faster and identify viable CNS drugs earlier, saving years of work and millions in costs.

- Faster pipeline decisions: AI-enabled insights can sharpen Hoth’s go/no-go choices, helping it prioritize the most promising programs like HT-ALZ (Alzheimer’s) and HT-TBI (brain injury).

- Investor appeal: Combining strong clinical proof (HT-001) with advanced AI integration makes Hoth stand out among small-cap biotechs, opening the door to potential partnerships and broader investor attention.

Catalysts

- HT-001 (Cancer Rash): Final Phase 2 data expected mid-2026, with regulatory dialogue potentially starting soon after. Expanded Access Program already launched in 2025.

- HT-ALZ (Alzheimer’s) and HT-TBI (brain injury): Both stand to benefit directly from AI-driven BBB predictions, sharpening early-stage development.

- Strategic Optionality: The AI integration could attract further partnership interest, validating Hoth’s model of combining strong science with innovative platforms.

Investment Case

With a market cap near $16M, Hoth offers investors two compelling growth drivers:

- Clinical validation — HT-001’s Phase 2 trial success in cancer-therapy rashes, addressing a multi-hundred-million-dollar supportive oncology market.

- AI innovation — integration of Lantern’s PredictBBB.ai, positioning Hoth as a forward-looking biotech that leverages AI to enhance drug development efficiency

For risk-tolerant investors, Hoth’s story now combines tangible clinical progress with a technology catalyst that could materially increase its growth trajectory over the next 3–5 years.

Key Takeaways

- Hoth is a clinical-stage biotech with a diversified pipeline across oncology, neurology, and inflammation.

- Lead drug HT-001 targets cancer treatment related rashes, a multi-hundred-million-dollar niche where no approved therapies exist.

- Interim Phase 2 results were impressive: 100% of patients improved and stayed on cancer therapy without lowering their dose.

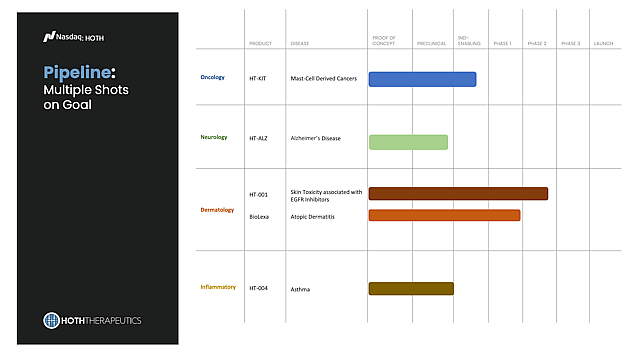

- The pipeline extends into big opportunities like Alzheimer’s (HT-ALZ), rare mast cell cancers (HT-KIT), eczema (BioLexa), lupus (HT-005), and brain injury (HT-TBI).

- With a market cap of just ~$16M, even conservative success with HT-001 could mean substantial upside for investors.

About Hoth Therapeutics

Founded in 2017 in New York, Hoth Therapeutics is building a portfolio of treatments targeting multi-billion-dollar markets with high unmet needs. The company’s lead program, HT-001, is a topical gel designed to help cancer patients manage drug-related rashes, using the FDA’s streamlined 505(b)(2) pathway to speed development. Beyond HT-001, Hoth has a diversified pipeline in Alzheimer’s, rare cancers, traumatic brain injury, eczema, and lupus. By partnering with top universities, research organizations, and even government agencies, Hoth has positioned itself with multiple shots on goal and a de-risked approach to innovation.

Catalysts

HT-001 – Tackling Cancer-Drug Rashes Head-On

Hoth’s lead program, HT-001, is moving through a mid-stage trial (CLEER-001) and has already delivered standout interim results: every single patient improved. Final data from the randomized, double-blind portion are expected by mid-2026, and strong results there could significantly reduce the risk profile for HT-001. The trial has also expanded into Europe, which should speed enrollment and help set the stage for a global Phase 3 program.

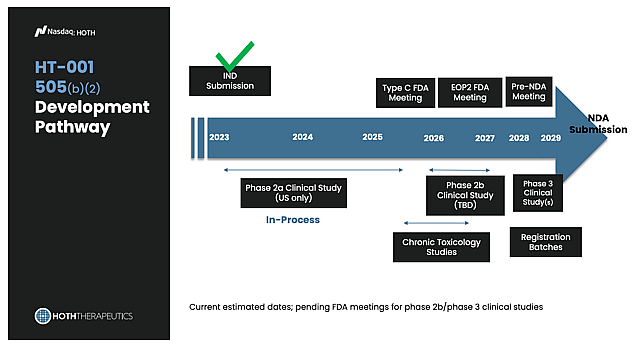

Regulatory Pathway HT-001 has a clear and efficient regulatory route. The program may qualify for Fast Track or even Breakthrough Therapy status, and because it’s developed under the FDA’s 505(b)(2) pathway, it can lean on existing safety data to move faster. If Phase 2 confirms the promise we’ve already seen, Hoth could be meeting with the FDA in 2026 to outline a Phase 3 plan, potentially just a single pivotal trial. On top of that, the Expanded Access Program (launched in 2025) already allows doctors to use HT-001 for patients in need, creating real-world evidence and demonstrating demand even before approval.

Partnership Potential Big players in oncology are reportedly showing interest. A licensing or co-development deal for HT-001 would not only bring in non-dilutive cash but also validate the program. Beyond that, partnerships around other pipeline assets, like BioLexa for eczema or HT-ALZ for Alzheimer’s, could help unlock even more value across Hoth’s portfolio.

HT-ALZ – An Alzheimer’s Bet with Large Potential

Alzheimer’s is one of biotech’s biggest markets, and Hoth is entering with HT-ALZ, an oral film formulation of an NK-1 receptor antagonist. Preclinical results have been promising, with an IND filing and Phase 1 expected in 2025–26, giving Hoth exposure to a massive, fast-growing therapeutic area.

HT-KIT – Rare Cancers and Severe Allergies in the Crosshair

HT-KIT targets rare mast cell cancers, a deadly disease category with little competition. IND-enabling studies are complete, and Phase 1 is expected in 2026. With orphan designation possible, development could move more quickly.

BioLexa – Affordable Innovation for the $18B Eczema Market

With Phase 1 safety complete, BioLexa is positioned for further trials in atopic dermatitis, a market projected to exceed $18B by 2027. Its novel mechanism could make it a safe, affordable option alongside steroids and biologics.

Other Catalysts – Long-Term Optionality in Obesity and Beyond

Hoth is also collaborating with Silo Pharma and the U.S. Veterans Affairs on an obesity and fatty liver program aimed at a $100B+ market currently dominated by semaglutide. Though early, this adds meaningful optionality. Other catalysts include upcoming data releases, FDA designations, and potential partnerships.

Catalyst Outlook

The next five years are catalyst-rich for Hoth. HT-001 remains the pivotal driver, but the broader pipeline and strategic deals provide a steady flow of potential value inflection points.

Assumptions

- HT-001 is the main driver. Our base case assumes it captures about 8% of the $391M market for EGFR-inhibitor rashes by 2030, translating to roughly $30M in sales. That’s based on around 6,000 patients paying $5,000 each year. This estimate is intentionally conservative, since the total market could support much higher revenue. We also account for possible competition (Lutris Pharma, Azitra) and payer pricing pressure.

- Profitability potential is strong. We model ~30% net margins by 2030, which works out to ~$9M in net income. Specialty pharma products like HT-001 typically see very high gross margins (~80%+), but we allow for the costs of a lean salesforce, continued R&D, and overhead. This still highlights attractive profitability once HT-001 is established.

- Earnings per share outlook. On ~16.85M shares by 2030 (up modestly from today’s 13.2M), EPS could reach ~$0.53. This assumes Hoth raises extra capital for Phase 3 and commercialization, but at valuations that don’t excessively dilute shareholders. If dilution is heavier, EPS could be lower; if Hoth lands a partnership, dilution risk could be minimized and per-share economics stronger.

- Other programs = upside. We exclude the rest of the pipeline from this base case because they’re still early stage. That said, Alzheimer’s (HT-ALZ), mast cell cancers (HT-KIT), and BioLexa for eczema all target multi-billion-dollar markets. Any surprise acceleration, a partnership, fast-track designation, or early licensing deal, would provide meaningful upside beyond these assumptions.

Risks

- Clinical trial: As with any biotech, trial results are the key driver. While later-stage studies remain pivotal, the strong Phase 2 data for HT-001 helps reduce uncertainty.

- Regulatory: The FDA could require more data or specific labeling, which is part of the normal review process. Hoth’s use of the 505(b)(2) pathway, however, provides a more efficient regulatory path.

- Financing: Additional funding will be needed to advance Phase 3 trials and commercialization. This is typical for small-cap biotech, and opportunities exist to mitigate dilution through partnerships or licensing deals.

- Commercial adoption: Market success will depend on physician uptake and payer coverage. With no approved therapies currently available, HT-001 has a clear opening to establish itself.

- Execution: Managing trials, IP, and manufacturing is always a challenge for emerging biotechs, but Hoth’s partnerships and collaborations provide important support.

Valuation

- Revenue (2030): ~$30M from HT-001 (~8% of the $391M projected market).

- Net income: ~$9M at 30% margin.

- EPS: ~$0.53 on ~16.85M shares.

- Future P/E multiple: 20× applied to $9M net income → $180M market cap in 2030 (~$10.70/share).

- Discounted back (15% rate, 5 years): ~$5.30/share present fair value.

- Current market cap: ~$16M ($1.20/share), implying ~4–5× upside in a successful outcome.

- Sensitivity: If margins drop to 20% or dilution rises toward 20–25M shares, fair value could fall into the ~$3–4/share range — still multiples above today’s price.

Conclusion

Hoth Therapeutics remains a speculative high-risk, high-reward bet, but with conservative assumptions, the upside looks compelling. If HT-001 is approved and captures a small part of the market (generating $30M annual revenue by 2030), today’s ~$1.20 stock could be fairly valued at ~$5.30, a 4-5x potential return. For risk-tolerant investors, Hoth provides asymmetric exposure to a unique oncology supportive care opportunity, with a diverse pipeline that could add even more long-term value.

How well do narratives help inform your perspective?

Disclaimer

The user Jolt_Communications holds no position in NasdaqCM:HOTH. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Sponsored Content Notice

This Narrative has been sponsored by Hoth Therapeutics (the Sponsor), which has paid Simply Wall St a fee for its publication on our platform and subsequent promotion. Any relationship between Simply Wall St and Hoth Therapeutics does not influence how we produce or moderate other content on this website. The Sponsor has a financial interest in the subject matter of this narrative. Simply Wall St has not independently verified any statements or projections made by the author, and does not endorse or guarantee the accuracy or completeness of the information provided.