- United States

- /

- Real Estate

- /

- NYSE:BEKE

US Stocks Estimated To Be Trading Below Fair Value In December 2024

Reviewed by Simply Wall St

As the U.S. stock market looks to rebound from an end-of-year slump, major indices such as the Dow Jones and S&P 500 have shown notable gains throughout 2024 despite recent declines. In this environment, identifying stocks trading below their fair value can provide opportunities for investors seeking potential long-term growth amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $27.07 | $53.24 | 49.2% |

| ConnectOne Bancorp (NasdaqGS:CNOB) | $22.70 | $43.79 | 48.2% |

| Oddity Tech (NasdaqGM:ODD) | $42.88 | $84.59 | 49.3% |

| Western Alliance Bancorporation (NYSE:WAL) | $83.57 | $164.32 | 49.1% |

| Lamb Weston Holdings (NYSE:LW) | $64.97 | $125.18 | 48.1% |

| HealthEquity (NasdaqGS:HQY) | $96.84 | $189.22 | 48.8% |

| WEX (NYSE:WEX) | $170.68 | $334.24 | 48.9% |

| LifeMD (NasdaqGM:LFMD) | $5.12 | $9.78 | 47.7% |

| Progress Software (NasdaqGS:PRGS) | $65.05 | $129.48 | 49.8% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.40 | $29.97 | 48.6% |

Let's explore several standout options from the results in the screener.

Bloomin' Brands (NasdaqGS:BLMN)

Overview: Bloomin' Brands, Inc. operates a range of casual, upscale casual, and fine dining restaurants both in the United States and internationally, with a market cap of approximately $1.04 billion.

Operations: The company's revenue segments consist of $3.95 billion from its operations in the United States and $600.16 million from international markets.

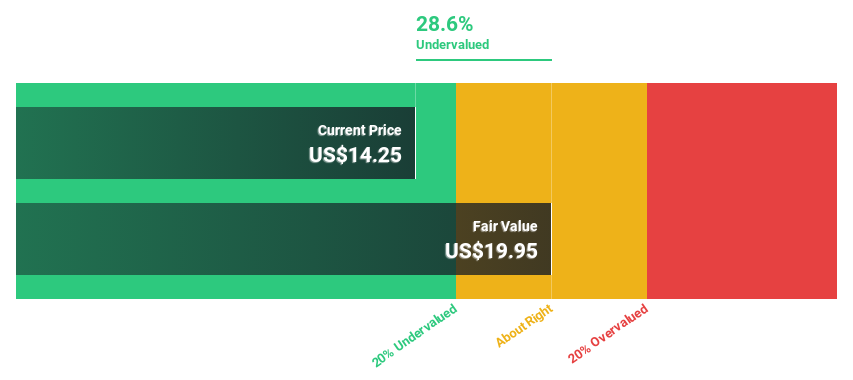

Estimated Discount To Fair Value: 39.3%

Bloomin' Brands is trading at US$12.11, significantly below its estimated fair value of US$19.95, indicating potential undervaluation based on cash flows. Despite recent revenue declines and a net loss for the nine months ending September 2024, analysts expect profitability within three years, with earnings forecasted to grow substantially annually. However, the company faces challenges with high debt levels and unsustainable dividend coverage from earnings or free cash flows.

- Our comprehensive growth report raises the possibility that Bloomin' Brands is poised for substantial financial growth.

- Click here to discover the nuances of Bloomin' Brands with our detailed financial health report.

Vita Coco Company (NasdaqGS:COCO)

Overview: The Vita Coco Company, Inc. develops, markets, and distributes coconut water products under the Vita Coco brand across various regions including the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of $2.06 billion.

Operations: The company's revenue segments consist of $424.40 million from the Americas and $70.46 million from international markets.

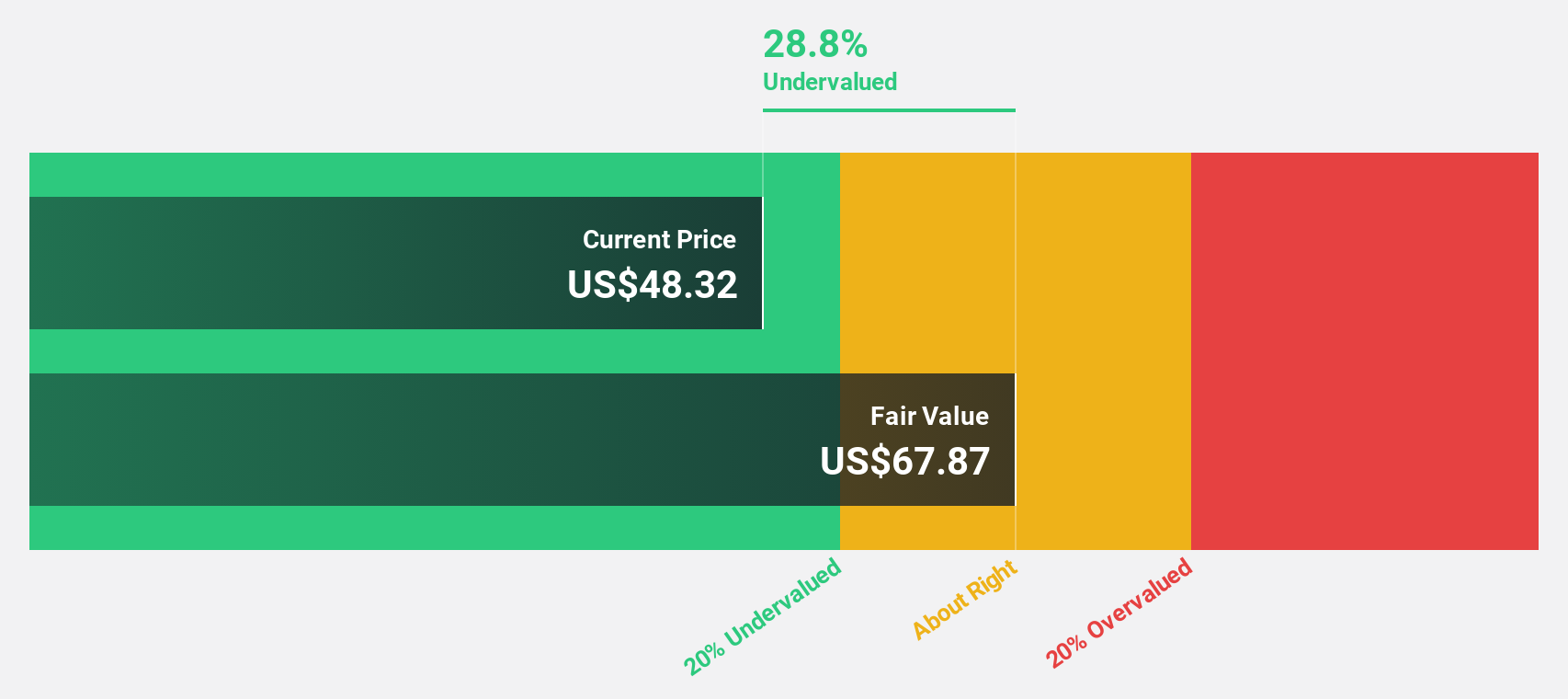

Estimated Discount To Fair Value: 36.3%

Vita Coco Company is trading at $36.37, significantly below its estimated fair value of $57.09, highlighting potential undervaluation based on cash flows. Despite a slight decline in quarterly sales to $132.91 million, net income rose to $19.25 million, reflecting strong earnings growth of 60.2% over the past year and forecasted annual growth of 15.5%. Recent buybacks and raised financial guidance further emphasize the company's positive cash flow outlook amidst insider selling concerns.

- Our earnings growth report unveils the potential for significant increases in Vita Coco Company's future results.

- Click to explore a detailed breakdown of our findings in Vita Coco Company's balance sheet health report.

KE Holdings (NYSE:BEKE)

Overview: KE Holdings Inc. operates an integrated online and offline platform for housing transactions and services in China, with a market cap of approximately $22.27 billion.

Operations: The company's revenue segments include CN¥28.15 billion from new home transaction services, CN¥25.33 billion from existing home transaction services, CN¥14.30 billion from home renovation and furnishing, and CN¥8.91 billion from emerging and other services excluding home renovation and furnishing.

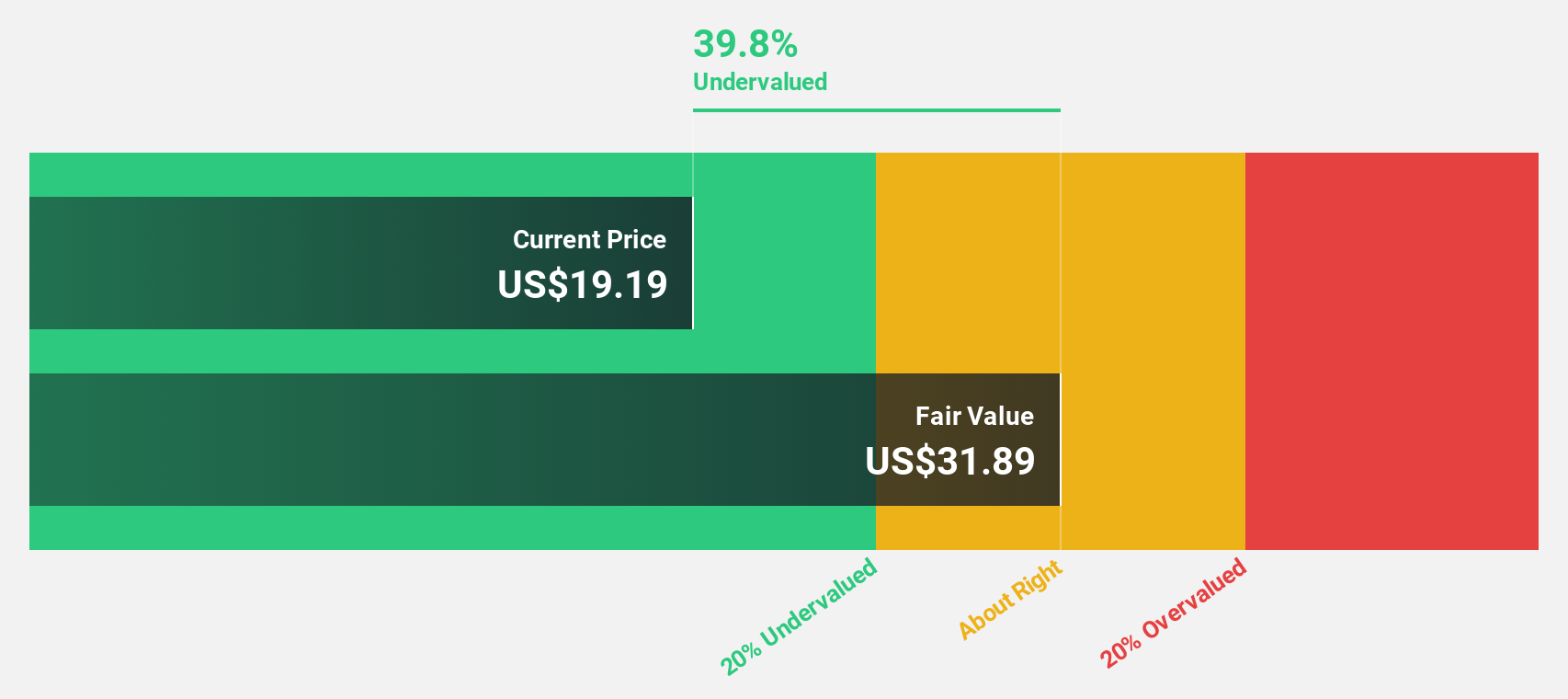

Estimated Discount To Fair Value: 36.1%

KE Holdings is trading at US$18.43, significantly below its estimated fair value of US$28.86, suggesting potential undervaluation based on cash flows. Despite a decline in profit margins from 7.5% to 5%, earnings are forecasted to grow significantly at 21% annually, outpacing the US market average. Recent buybacks totaling $1.49 billion underscore confidence in its valuation despite insider selling and large one-off items affecting financial results.

- The growth report we've compiled suggests that KE Holdings' future prospects could be on the up.

- Take a closer look at KE Holdings' balance sheet health here in our report.

Summing It All Up

- Get an in-depth perspective on all 179 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KE Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BEKE

KE Holdings

Through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives