- United States

- /

- Software

- /

- NasdaqGS:PLTR

3 US Stocks That Could Be Trading Below Their Estimated Fair Value

Reviewed by Simply Wall St

The U.S. stock market has recently experienced mixed performances, with the S&P 500 and Nasdaq showing gains while the Dow Jones Industrial Average continues its downward trend. Amidst this fluctuating landscape, investors are keenly observing economic indicators and corporate earnings to gauge potential opportunities. In such a climate, identifying stocks that may be trading below their estimated fair value can offer a strategic advantage for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MidWestOne Financial Group (NasdaqGS:MOFG) | $29.23 | $57.06 | 48.8% |

| Atlanticus Holdings (NasdaqGS:ATLC) | $36.86 | $72.49 | 49.2% |

| California Resources (NYSE:CRC) | $53.15 | $104.04 | 48.9% |

| Tompkins Financial (NYSEAM:TMP) | $61.87 | $121.03 | 48.9% |

| UFP Technologies (NasdaqCM:UFPT) | $278.32 | $537.74 | 48.2% |

| Vitesse Energy (NYSE:VTS) | $25.02 | $49.24 | 49.2% |

| Okta (NasdaqGS:OKTA) | $72.15 | $139.33 | 48.2% |

| Bowhead Specialty Holdings (NYSE:BOW) | $29.51 | $57.38 | 48.6% |

| AeroVironment (NasdaqGS:AVAV) | $215.655 | $418.39 | 48.5% |

| Dingdong (Cayman) (NYSE:DDL) | $3.62 | $6.96 | 48% |

Let's uncover some gems from our specialized screener.

KE Holdings (NYSE:BEKE)

Overview: KE Holdings Inc. operates an integrated online and offline platform for housing transactions and services in China, with a market cap of approximately $24.97 billion.

Operations: The company's revenue segments include CN¥26.33 billion from New Home Transaction Services, CN¥25.42 billion from Existing Home Transaction Services, and CN¥13.27 billion from Home Renovation and Furnishing.

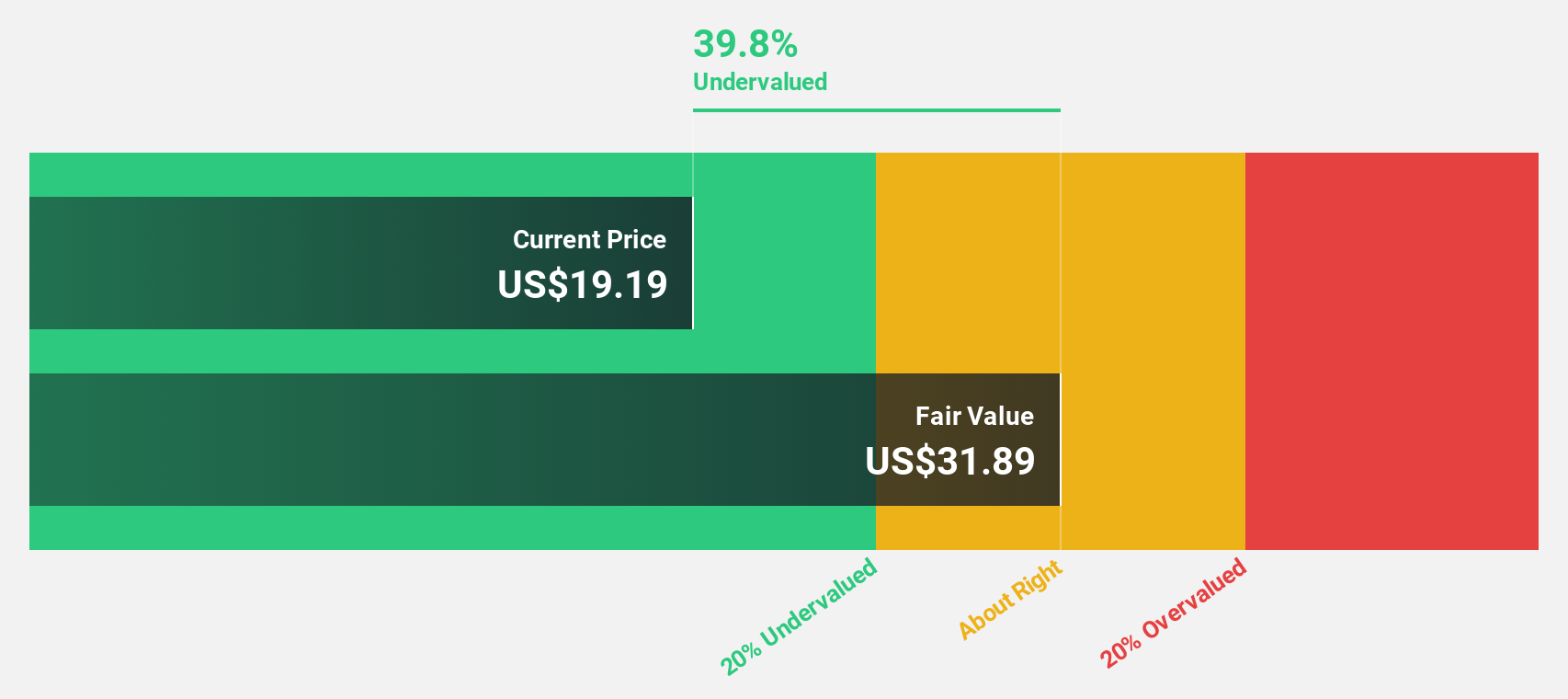

Estimated Discount To Fair Value: 31.9%

KE Holdings is trading at US$20.43, significantly below its estimated fair value of US$29.99, indicating potential undervaluation based on discounted cash flow analysis. Despite high share price volatility and an unstable dividend track record, the company anticipates a robust annual profit growth of over 20%, outpacing the broader U.S. market's expected growth rate. Recent buyback activities totaling US$1,389.78 million further reflect management's confidence in the company's valuation prospects amidst reported impairments and fluctuating earnings performance.

- Our expertly prepared growth report on KE Holdings implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of KE Holdings here with our thorough financial health report.

Palantir Technologies (NYSE:PLTR)

Overview: Palantir Technologies Inc. develops software platforms for intelligence and counterterrorism operations globally, with a market cap of approximately $95.38 billion.

Operations: The company's revenue is derived from two main segments: Commercial, contributing $1.14 billion, and Government, generating $1.34 billion.

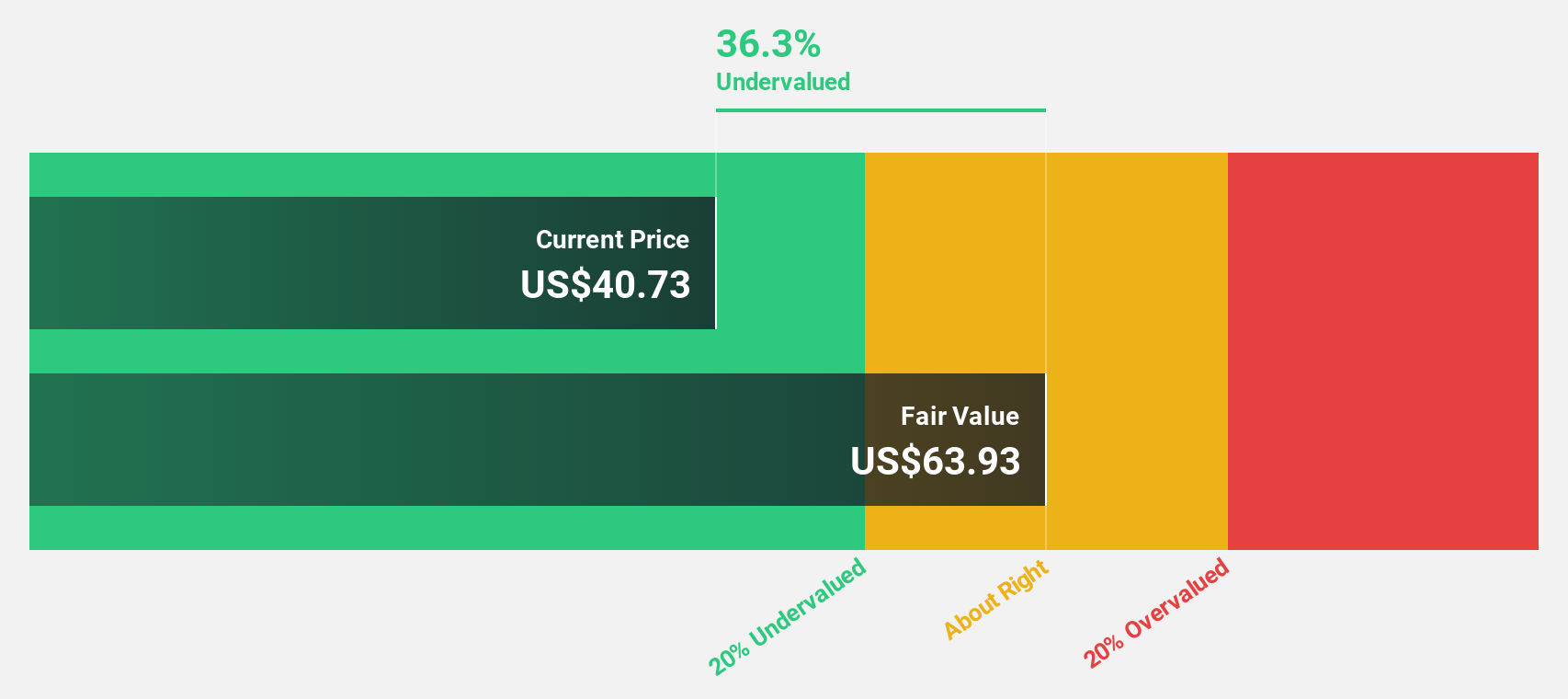

Estimated Discount To Fair Value: 15.4%

Palantir Technologies is trading at US$43.56, below its estimated fair value of US$51.48, suggesting potential undervaluation based on cash flow analysis. The company's earnings are projected to grow significantly over the next three years, outpacing the broader U.S. market's growth expectations. Recent strategic partnerships with Edgescale AI and Nebraska Medicine highlight Palantir's expanding footprint in AI-driven solutions across various sectors, enhancing its revenue streams and operational efficiencies despite past shareholder dilution concerns.

- Our comprehensive growth report raises the possibility that Palantir Technologies is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Palantir Technologies.

Truist Financial (NYSE:TFC)

Overview: Truist Financial Corporation is a financial services company offering banking and trust services in the Southeastern and Mid-Atlantic United States, with a market cap of approximately $57.67 billion.

Operations: Truist Financial generates revenue through its banking and trust services across the Southeastern and Mid-Atlantic regions of the United States.

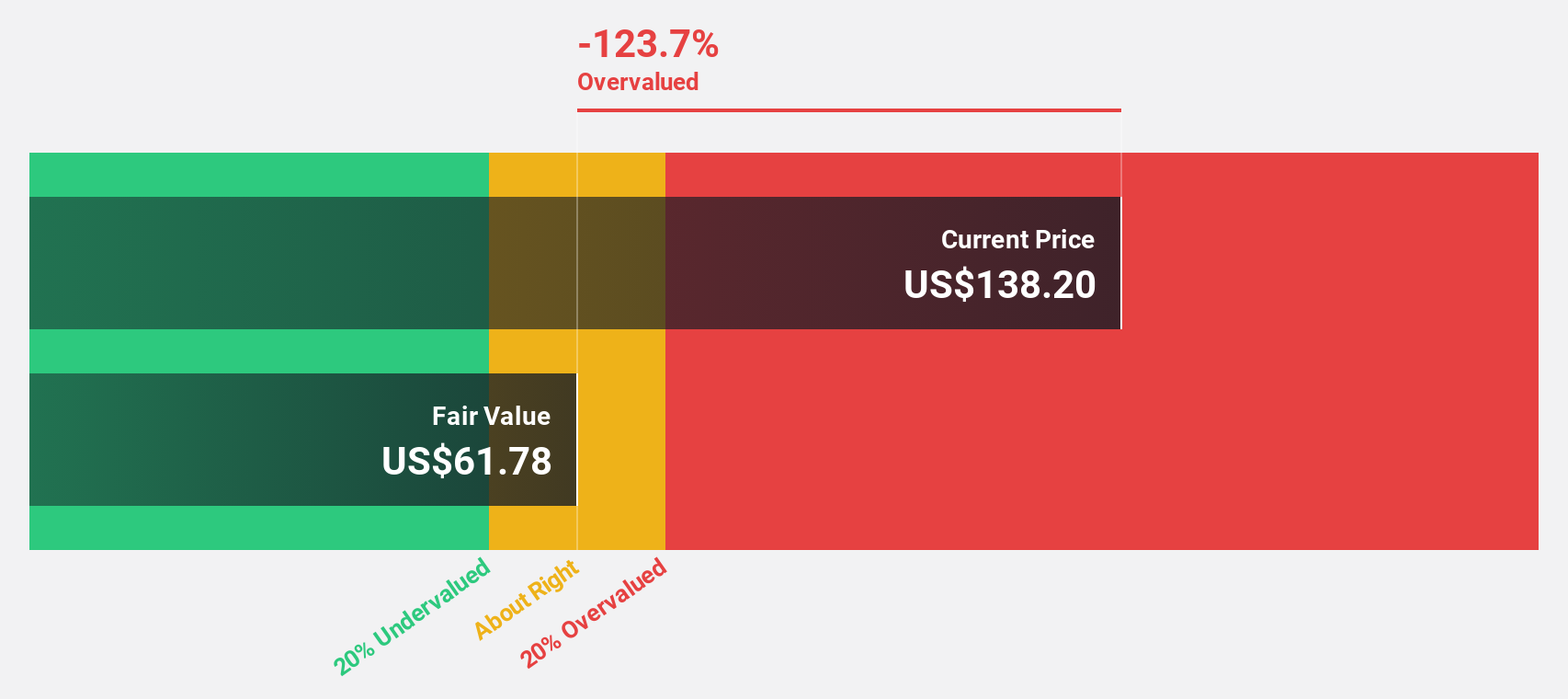

Estimated Discount To Fair Value: 42%

Truist Financial is trading at US$43.42, significantly below its estimated fair value of US$74.88, highlighting potential undervaluation based on cash flow analysis. Despite a dividend yield of 4.79% that may not be fully covered by earnings, the company forecasts above-average profit growth over the next three years. Recent initiatives like the Electronic Bill Presentment and Payment platform aim to enhance operational efficiency and accelerate cash flows, potentially improving financial performance amidst current revenue challenges.

- Our earnings growth report unveils the potential for significant increases in Truist Financial's future results.

- Navigate through the intricacies of Truist Financial with our comprehensive financial health report here.

Seize The Opportunity

- Discover the full array of 188 Undervalued US Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives