- United States

- /

- Hospitality

- /

- NasdaqGS:PBPB

Insider Buying Highlights December 2024's Top Undervalued Small Caps In US

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.2% drop, yet it remains up by 24% over the past year, with earnings anticipated to grow by 15% annually in the coming years. In this context of fluctuating market dynamics and promising growth forecasts, identifying stocks that are potentially undervalued can be crucial for investors looking to capitalize on insider buying trends within small-cap companies.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| OptimizeRx | NA | 1.0x | 49.67% | ★★★★★☆ |

| Capital Bancorp | 14.6x | 3.0x | 46.03% | ★★★★☆☆ |

| Quanex Building Products | 35.6x | 0.9x | 36.41% | ★★★★☆☆ |

| Franklin Financial Services | 9.8x | 1.9x | 39.89% | ★★★★☆☆ |

| McEwen Mining | 4.1x | 2.1x | 47.20% | ★★★★☆☆ |

| ProPetro Holding | NA | 0.6x | 39.95% | ★★★★☆☆ |

| German American Bancorp | 14.7x | 4.9x | 45.67% | ★★★☆☆☆ |

| First United | 13.6x | 3.1x | 47.64% | ★★★☆☆☆ |

| Limbach Holdings | 37.6x | 1.9x | 42.05% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

SNDL (NasdaqCM:SNDL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: SNDL operates in the cannabis and liquor retail sectors, with a focus on cannabis operations and retail, and has a market cap of approximately CA$1.2 billion.

Operations: The company's primary revenue streams are derived from liquor retail, cannabis retail, and cannabis operations. Over recent periods, the gross profit margin has shown an upward trend, reaching 25.12% by September 2024. Operating expenses have consistently been significant, with a notable portion allocated to general and administrative expenses.

PE: -6.4x

SNDL is a smaller company in the U.S. market, recently making headlines with leadership changes and strategic initiatives. The appointment of Phil McBride as CIO and Navroop Sandhawalia as President of the Liquor Division signals a focus on digital transformation and operational efficiency. Despite reporting a CAD 19.33 million net loss for Q3 2024, SNDL's share repurchase plan aims to return value to shareholders, repurchasing up to 13.2 million shares by November 2025. Their solid balance sheet supports potential acquisitions, indicating future growth opportunities despite current profitability challenges.

- Delve into the full analysis valuation report here for a deeper understanding of SNDL.

Assess SNDL's past performance with our detailed historical performance reports.

Potbelly (NasdaqGS:PBPB)

Simply Wall St Value Rating: ★★★☆☆☆

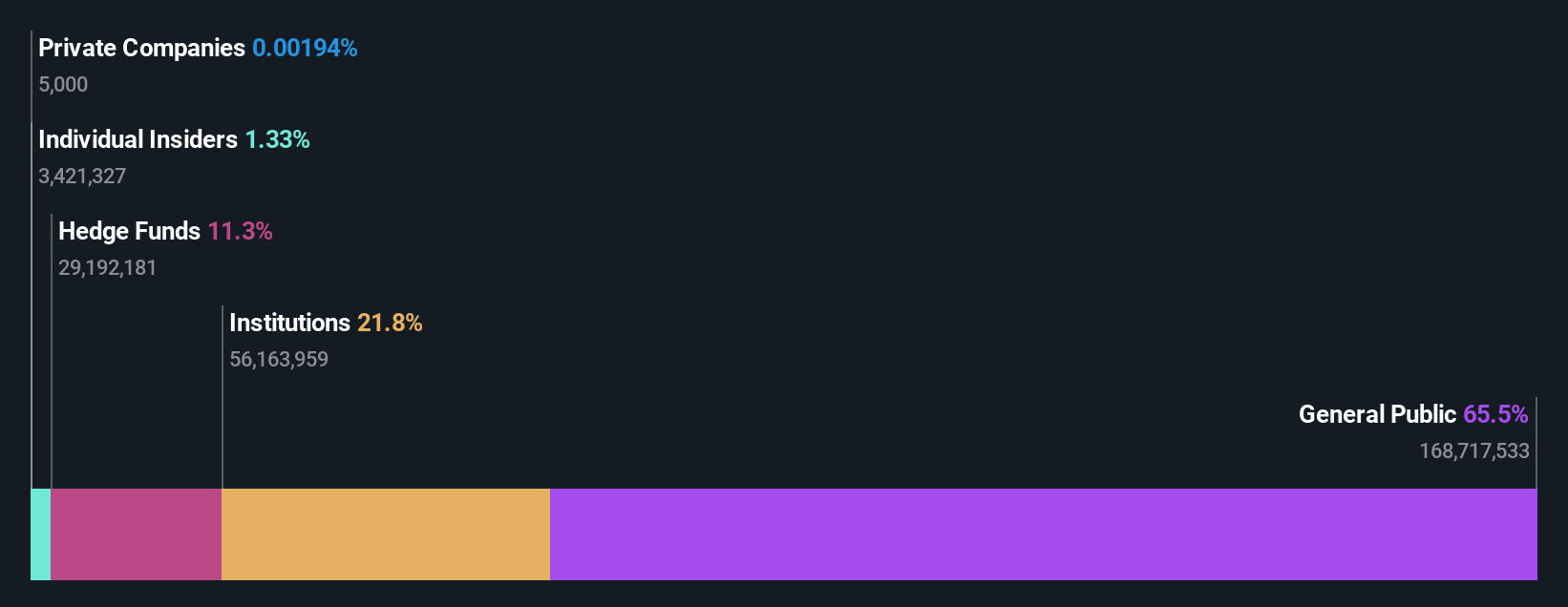

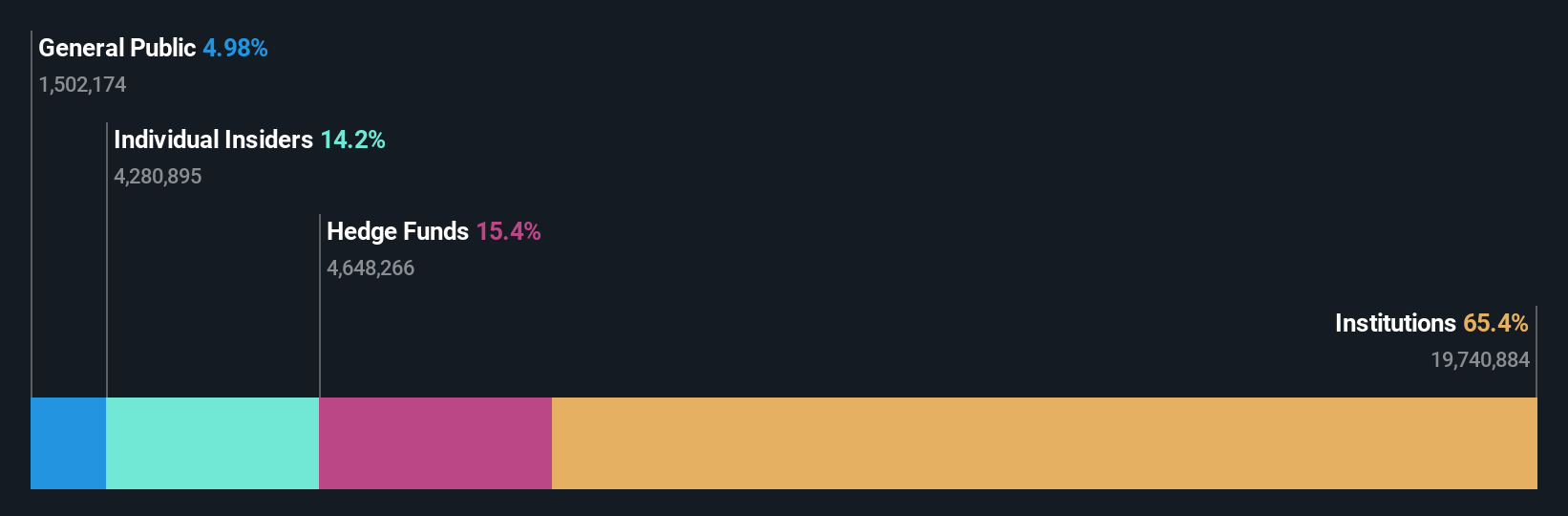

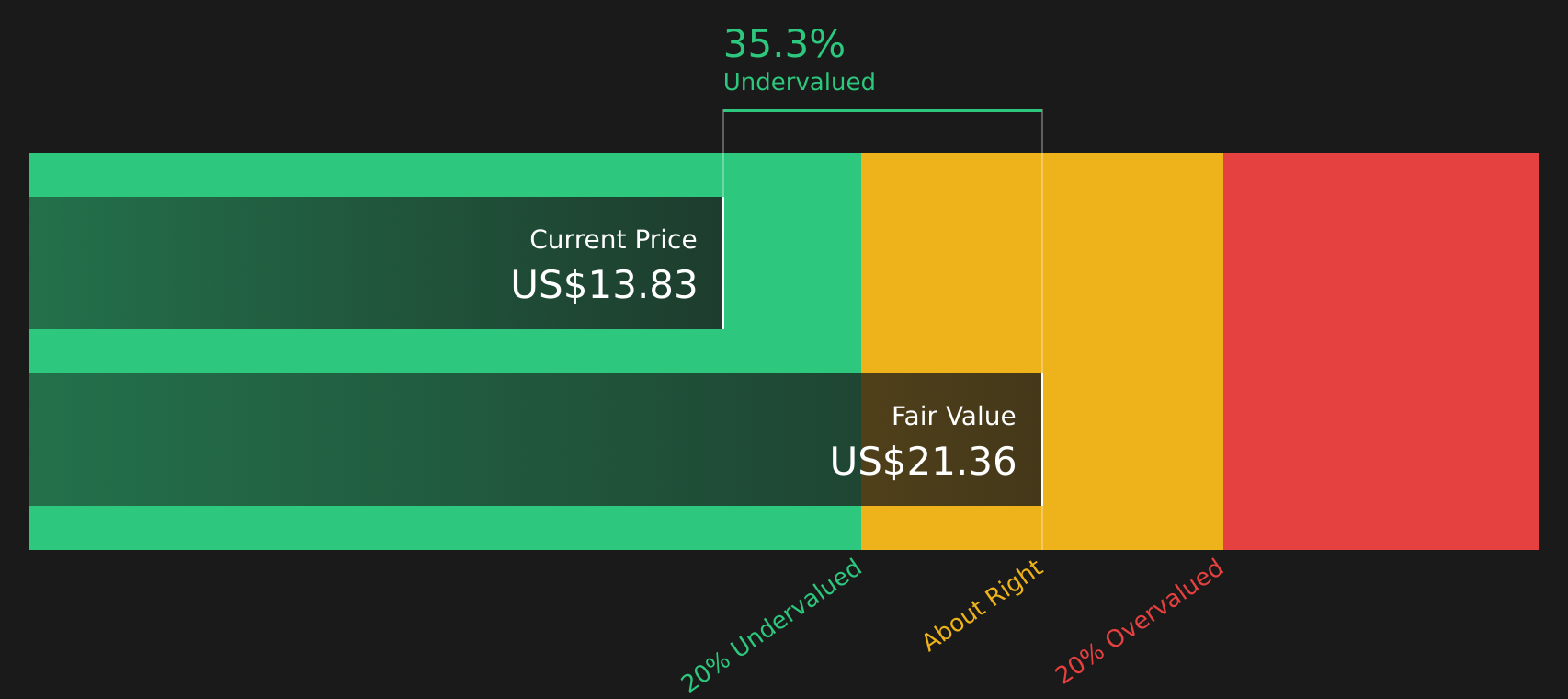

Overview: Potbelly is a restaurant chain specializing in sandwiches, operating Potbelly Sandwich Shops with a market capitalization of approximately $0.08 billion.

Operations: Potbelly generates revenue primarily from its sandwich shops, with recent figures indicating $471.72 million in revenue. The gross profit margin shows a notable trend, increasing to 35.50% by the end of 2024 from lower levels in previous years. Cost of goods sold (COGS) and operating expenses are significant components affecting profitability, with COGS at $304.27 million and operating expenses at $152.29 million as of the latest period reported.

PE: 7.2x

Potbelly, a small company in the U.S., is navigating an intriguing phase with insider confidence reflected in recent purchases. The company announced six new multi-unit development agreements since July 2024, aiming to expand into states like Arizona and Texas, aligning with their Franchise Growth Acceleration Initiative. Despite a dip in third-quarter revenue to US$115 million from US$121 million last year, net income rose to US$3.74 million. Investor activism suggests strategic reviews for value creation amidst forecasts of declining earnings growth over the next three years.

- Unlock comprehensive insights into our analysis of Potbelly stock in this valuation report.

Evaluate Potbelly's historical performance by accessing our past performance report.

Smith Douglas Homes (NYSE:SDHC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Smith Douglas Homes operates in the homebuilding industry, focusing on constructing and selling residential homes, with a market cap of $1.25 billion.

Operations: The company generates revenue primarily from its homebuilding business, with recent figures reaching $905.30 million. Over the analyzed periods, net income margin has shown a declining trend, dropping from 18.59% in December 2022 to 4.60% by September 2024. Cost of goods sold (COGS) and operating expenses have increased over time, impacting profitability metrics such as the net income margin.

PE: 5.8x

Smith Douglas Homes, a smaller company in the U.S. housing market, recently reported third-quarter sales of US$277.84 million, up from US$197.64 million the previous year, though net income dropped significantly to US$5.35 million from US$33.93 million. Despite challenges with declining earnings forecasts and lower profit margins at 4.6%, insider confidence is evident as Lead Independent Director Jeffrey Jackson purchased 8,605 shares worth approximately US$256K in November 2024. A strategic alliance with loanDepot aims to enhance their market presence through Ridgeland Mortgage, targeting key growth areas like Atlanta and Houston for expansion opportunities amidst a forecasted revenue growth of 12% annually over the next few years.

Make It Happen

- Navigate through the entire inventory of 46 Undervalued US Small Caps With Insider Buying here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PBPB

Potbelly

Owns, operates, and franchises Potbelly sandwich shops in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives