- United States

- /

- Software

- /

- NasdaqGS:XNET

GoodRx Holdings Leads The Charge With These 3 Promising Penny Stocks

Reviewed by Simply Wall St

The U.S. stock market has recently experienced volatility, with tech stocks leading a significant sell-off amid concerns about economic policies and tariffs. In such uncertain times, investors often seek opportunities in less conventional areas of the market. Penny stocks, while an older term, still capture the imagination by offering potential growth at lower price points. These smaller or newer companies can present valuable opportunities when backed by solid financials and fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $125.74M | ★★★★★★ |

| Safe Bulkers (NYSE:SB) | $3.75 | $409.62M | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.87 | $5.96M | ★★★★★☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.49 | $40.53M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.51 | $76.74M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.46 | $47.19M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $4.20 | $155.92M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.37 | $23.94M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8201 | $75.14M | ★★★★★☆ |

Click here to see the full list of 748 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

GoodRx Holdings (NasdaqGS:GDRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoodRx Holdings, Inc. provides tools and information for consumers to compare prices and save on prescription drug purchases in the United States, with a market cap of approximately $1.88 billion.

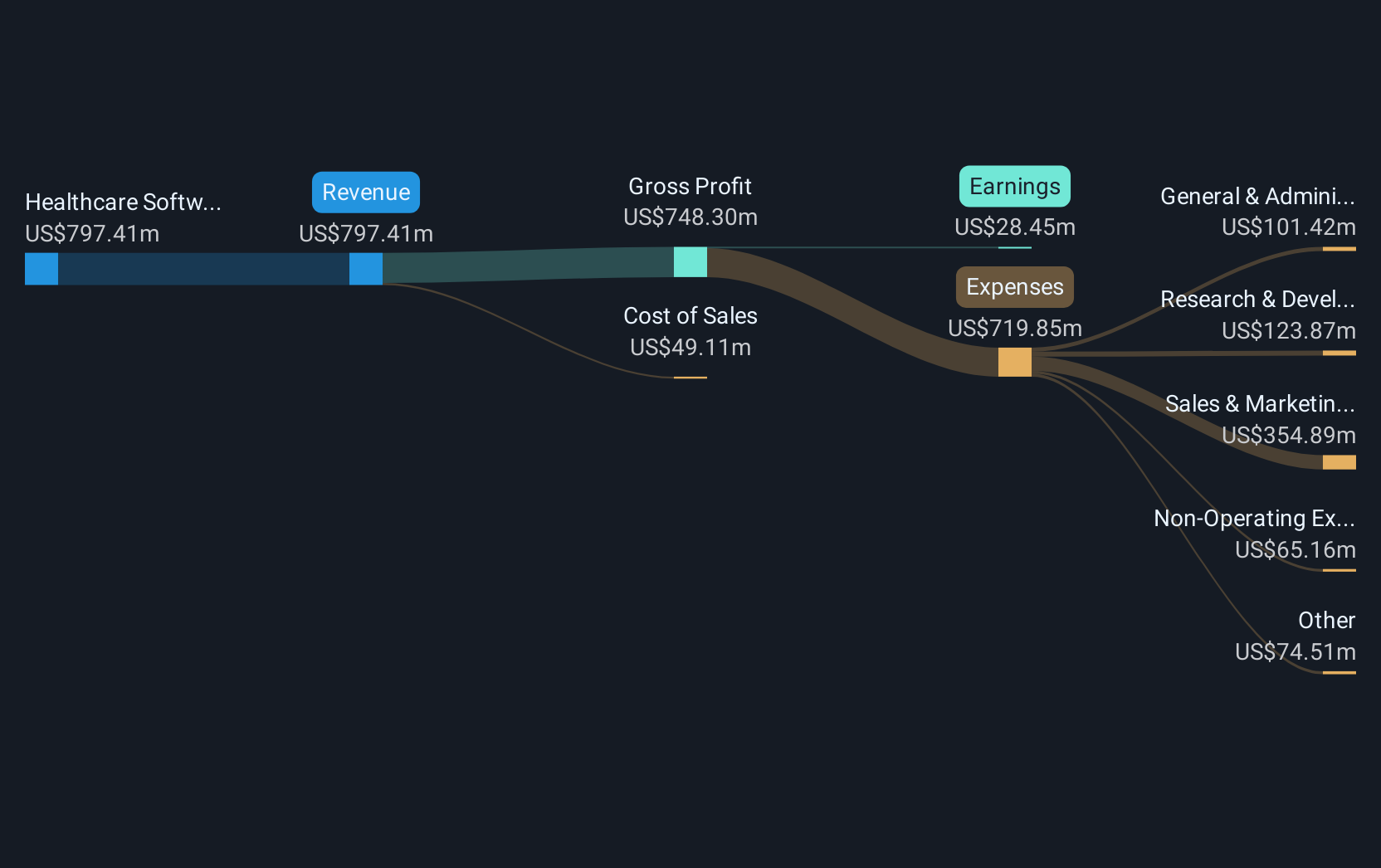

Operations: The company generates revenue primarily from its Healthcare Software segment, totaling $790.39 million.

Market Cap: $1.88B

GoodRx Holdings, with a market cap of US$1.88 billion, is navigating the penny stock landscape by reducing losses at an annual rate of 16.4% over five years while maintaining a satisfactory net debt to equity ratio of 9.7%. The company has projected revenue growth for 2025 between US$810 million and US$840 million, reflecting stability in its financial outlook. Recent earnings show a shift from loss to profit, with Q4 2024 net income reaching US$6.74 million compared to a previous loss. Despite being unprofitable overall, GoodRx's positive free cash flow provides it with more than three years of cash runway stability.

- Take a closer look at GoodRx Holdings' potential here in our financial health report.

- Evaluate GoodRx Holdings' prospects by accessing our earnings growth report.

Puma Biotechnology (NasdaqGS:PBYI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Puma Biotechnology, Inc. is a biopharmaceutical company dedicated to developing and commercializing cancer care products globally, with a market cap of approximately $136 million.

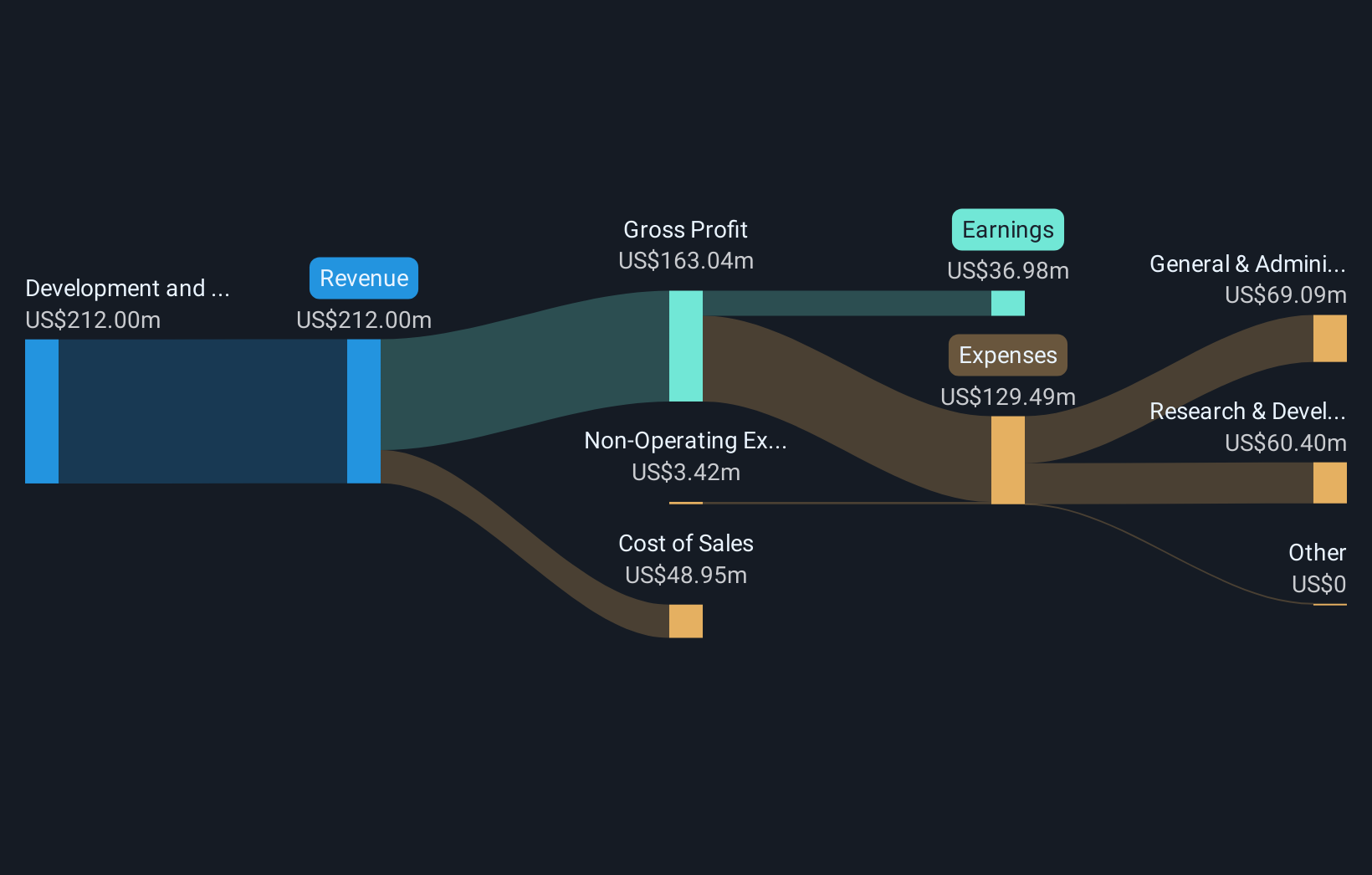

Operations: The company's revenue is derived entirely from the development and commercialization of innovative products to enhance cancer care, totaling $243.57 million.

Market Cap: $135.97M

Puma Biotechnology, with a market cap of US$136 million, has shown significant earnings growth of 525.3% over the past year, outpacing the biotech industry average. The company's debt management has improved substantially, with a reduction in its debt to equity ratio from very high levels to 109.8%, and it now holds more cash than total debt. Despite a forecasted decline in earnings by 47.6% annually over the next three years, Puma's recent inclusion of neratinib in NCCN Guidelines for cervical cancer highlights its ongoing product development efforts. Revenue for Q4 2024 was US$59.1 million with net income rising to US$19.3 million from US$12.3 million year-over-year, reflecting enhanced profitability despite declining revenue figures compared to previous periods.

- Click to explore a detailed breakdown of our findings in Puma Biotechnology's financial health report.

- Examine Puma Biotechnology's earnings growth report to understand how analysts expect it to perform.

Xunlei (NasdaqGS:XNET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xunlei Limited, with a market cap of approximately $183.84 million, operates an internet platform for digital media content in the People's Republic of China.

Operations: The company generates revenue primarily from the operation of its online media platform, which amounts to $359.61 million.

Market Cap: $183.84M

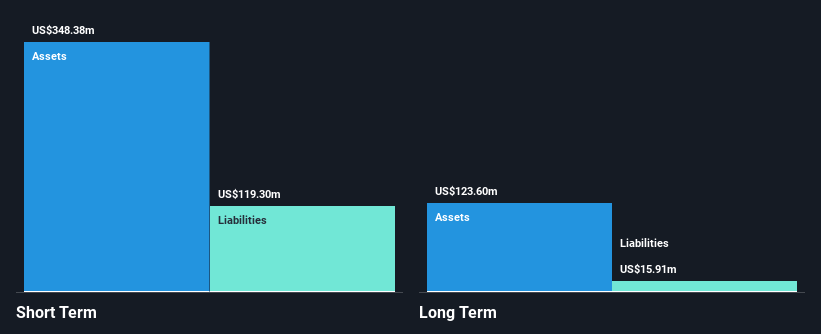

Xunlei Limited, with a market cap of US$183.84 million, operates an internet platform generating US$359.61 million in revenue. Despite its low return on equity at 4.2%, the company boasts high-quality earnings and has experienced significant earnings growth of 139.4% over the past year, surpassing industry averages. The board and management are seasoned with average tenures of 3.8 and 4.8 years respectively, providing stability amid high share price volatility over recent months. Xunlei's financial health is reinforced by strong cash flow covering debt obligations and short-term assets exceeding liabilities, positioning it as a potentially resilient investment within the penny stock sector.

- Get an in-depth perspective on Xunlei's performance by reading our balance sheet health report here.

- Evaluate Xunlei's historical performance by accessing our past performance report.

Next Steps

- Gain an insight into the universe of 748 US Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XNET

Xunlei

Operates an internet platform for digital media content in the People's Republic of China.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives