- United States

- /

- Biotech

- /

- NasdaqGM:CDNA

Exploring High Growth Tech Stocks In The United States December 2024

Reviewed by Simply Wall St

The United States market has been flat over the last week but is up 32% over the past year, with earnings forecast to grow by 15% annually. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Ardelyx | 25.24% | 69.64% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.51% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| Clene | 78.50% | 60.16% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 246 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

CareDx (NasdaqGM:CDNA)

Simply Wall St Growth Rating: ★★★★☆☆

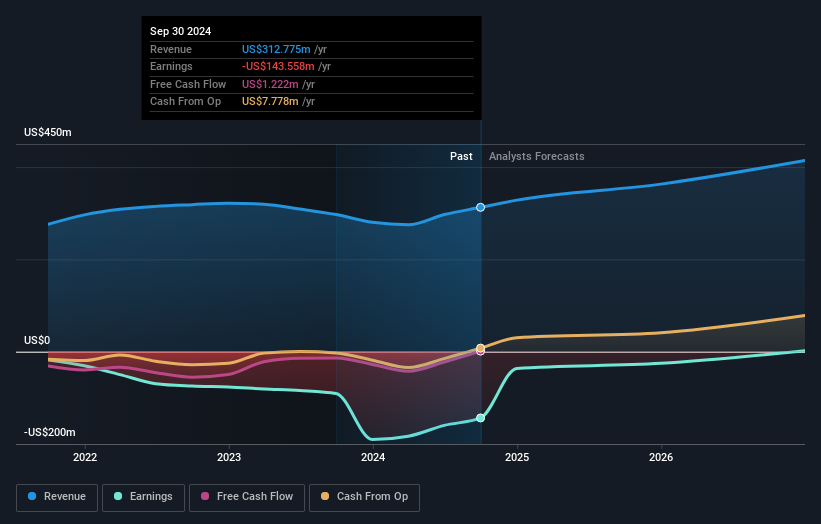

Overview: CareDx, Inc. focuses on developing and commercializing diagnostic solutions for transplant patients and caregivers globally, with a market cap of approximately $1.32 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to $312.78 million.

CareDx has showcased resilience and strategic foresight in the high-growth tech landscape, particularly with its recent advancements in HLA genotyping technologies. The company's revenue surged to $82.88 million in Q3 2024, up from $67.19 million the previous year, indicating a robust growth trajectory of 12.3% annually. This performance is bolstered by strategic alliances like the one with Dovetail Genomics, aiming to revolutionize organ transplant matching through next-gen sequencing solutions. Furthermore, CareDx's commitment to R&D is evident as they integrate AI enhancements into their offerings, aligning with industry shifts towards more data-driven and personalized medical solutions. These efforts are set against a backdrop of improved financial health, with a significant reduction in net loss to $7.41 million from $23.49 million year-over-year and an optimistic revenue forecast increase for 2024, setting a promising stage for future growth.

- Click to explore a detailed breakdown of our findings in CareDx's health report.

Gain insights into CareDx's past trends and performance with our Past report.

Amicus Therapeutics (NasdaqGM:FOLD)

Simply Wall St Growth Rating: ★★★★★☆

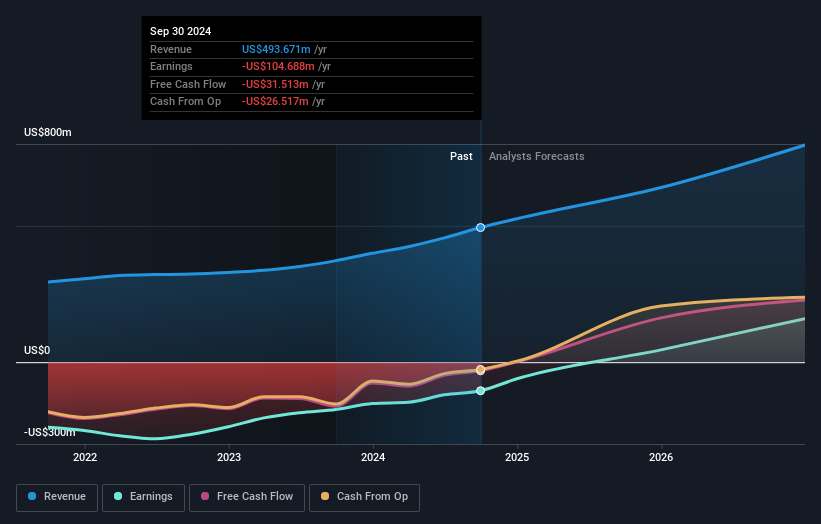

Overview: Amicus Therapeutics, Inc. is a biotechnology company dedicated to discovering, developing, and delivering medicines for rare diseases with a market capitalization of approximately $2.98 billion.

Operations: Focusing on the discovery, development, and commercialization of advanced therapies for rare diseases, Amicus Therapeutics generates revenue primarily from this segment, amounting to $493.67 million.

Amicus Therapeutics, despite its unprofitable status, is making strides in the high-growth tech sector with a notable reduction in net loss from $21.58 million to $6.73 million in Q3 2024 and a promising revenue growth forecast of 30% to 32% for the year. The company's commitment to innovation is underscored by significant R&D investments, which have grown earnings at an impressive rate of 66.55% per year. Additionally, Amicus has raised its financial outlook and continues to engage actively in industry conferences, suggesting a strategic push towards enhancing its market presence and technological capabilities within biotech-focused therapies.

- Navigate through the intricacies of Amicus Therapeutics with our comprehensive health report here.

Examine Amicus Therapeutics' past performance report to understand how it has performed in the past.

Dynavax Technologies (NasdaqGS:DVAX)

Simply Wall St Growth Rating: ★★★★☆☆

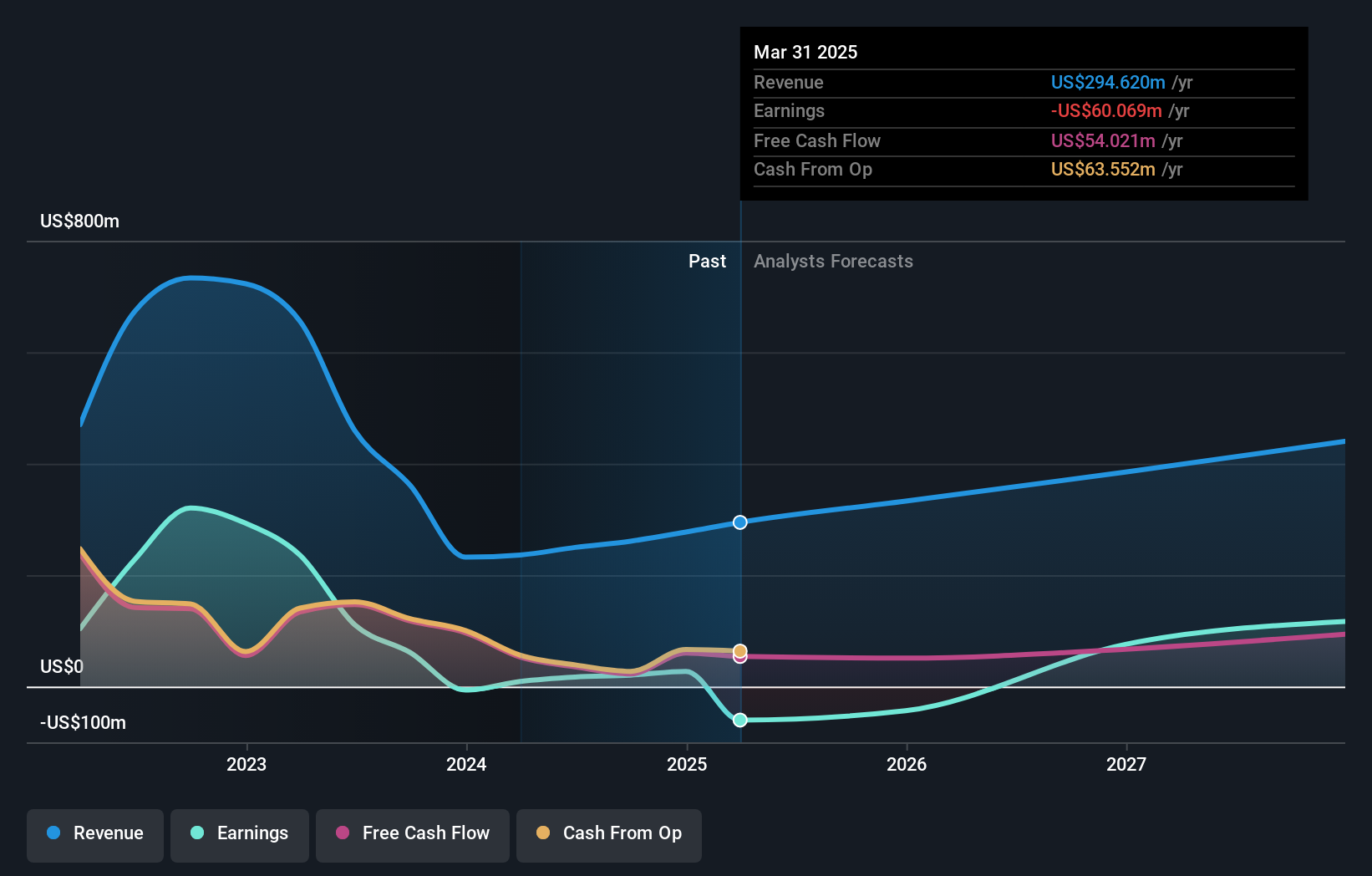

Overview: Dynavax Technologies Corporation is a commercial-stage biopharmaceutical company that develops and commercializes vaccines in the United States, with a market cap of approximately $1.69 billion.

Operations: The company generates revenue primarily from the discovery, development, and commercialization of novel vaccines, amounting to $260.81 million.

Despite a challenging year with a 66.5% dip in earnings, Dynavax Technologies has maintained robust revenue growth at 17.6% annually, outpacing the US market average of 8.9%. This performance is bolstered by significant R&D investments, which are not only enhancing product development but also positioning the company favorably for future technological advancements with an expected annual profit surge of 39.4%. Recently, Dynavax updated its financial guidance upwards and initiated a $200 million share repurchase program, reflecting confidence in its operational stability and commitment to shareholder value. These strategic moves underscore its resilience and adaptability in the fast-evolving biotech sector.

Summing It All Up

- Embark on your investment journey to our 246 US High Growth Tech and AI Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CareDx, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CDNA

CareDx

Engages in the discovery, development, and commercialization of diagnostic solutions for transplant patients and caregivers in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives