- United States

- /

- Auto

- /

- NYSE:XPEV

US Stocks With Insider Ownership Growing Earnings Up To 214%

Reviewed by Simply Wall St

As U.S. markets grapple with heightened volatility due to surging Treasury yields and strong labor market data, investors are keenly observing how these conditions impact growth stocks. In such an environment, companies with high insider ownership and robust earnings growth can signal confidence from those closest to the business, potentially offering resilience amidst broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.3% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.7% |

| Smith Micro Software (NasdaqCM:SMSI) | 23.1% | 85.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| XPeng (NYSE:XPEV) | 20.7% | 55.8% |

We're going to check out a few of the best picks from our screener tool.

BRC (NYSE:BRCC)

Simply Wall St Growth Rating: ★★★★☆☆

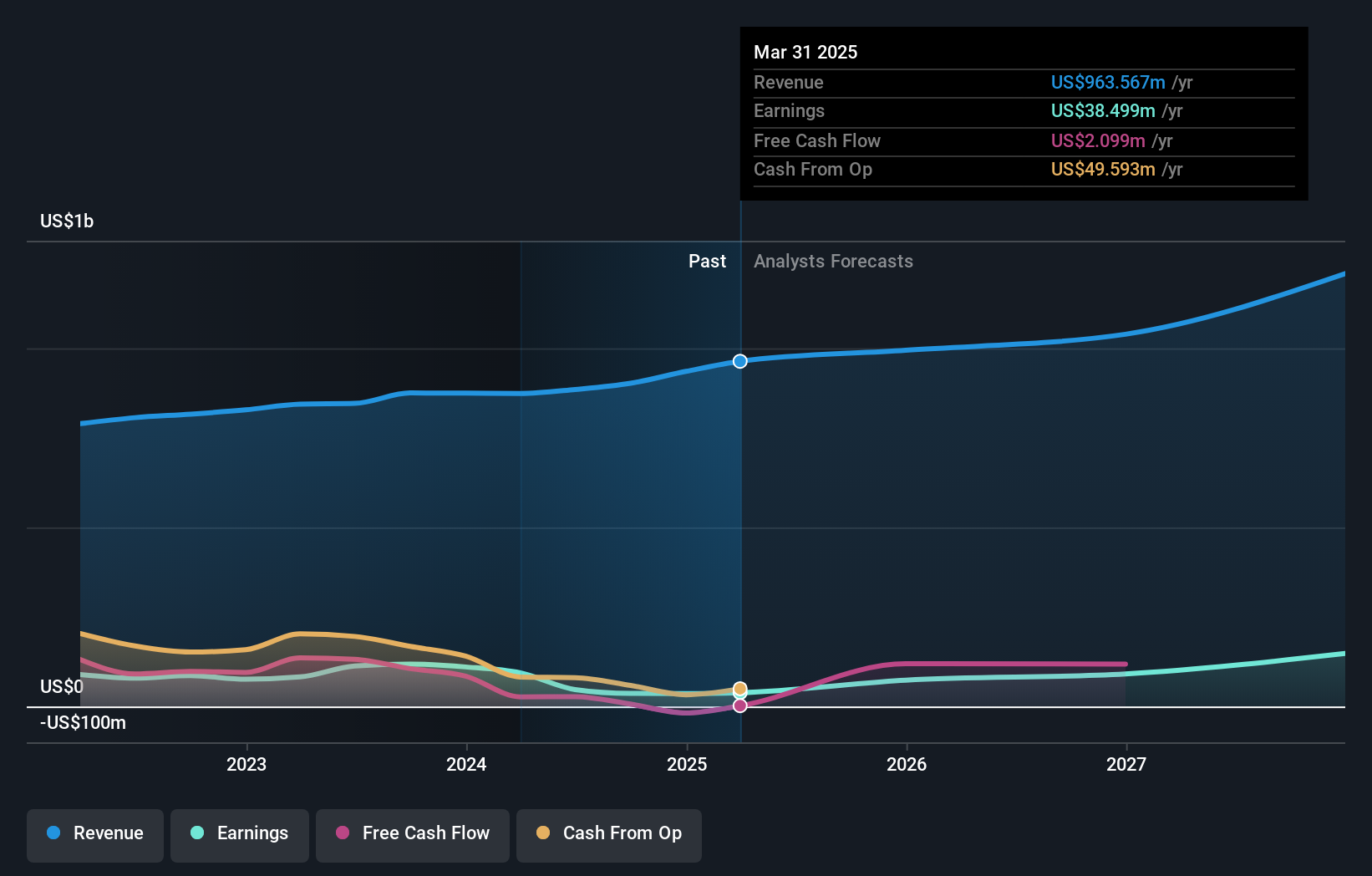

Overview: BRC Inc., operating through its subsidiaries, engages in purchasing, roasting, and selling coffee, coffee accessories, and branded apparel in the United States with a market cap of approximately $655.25 million.

Operations: The company's revenue primarily comes from its Consumer Products Business, totaling $405.26 million.

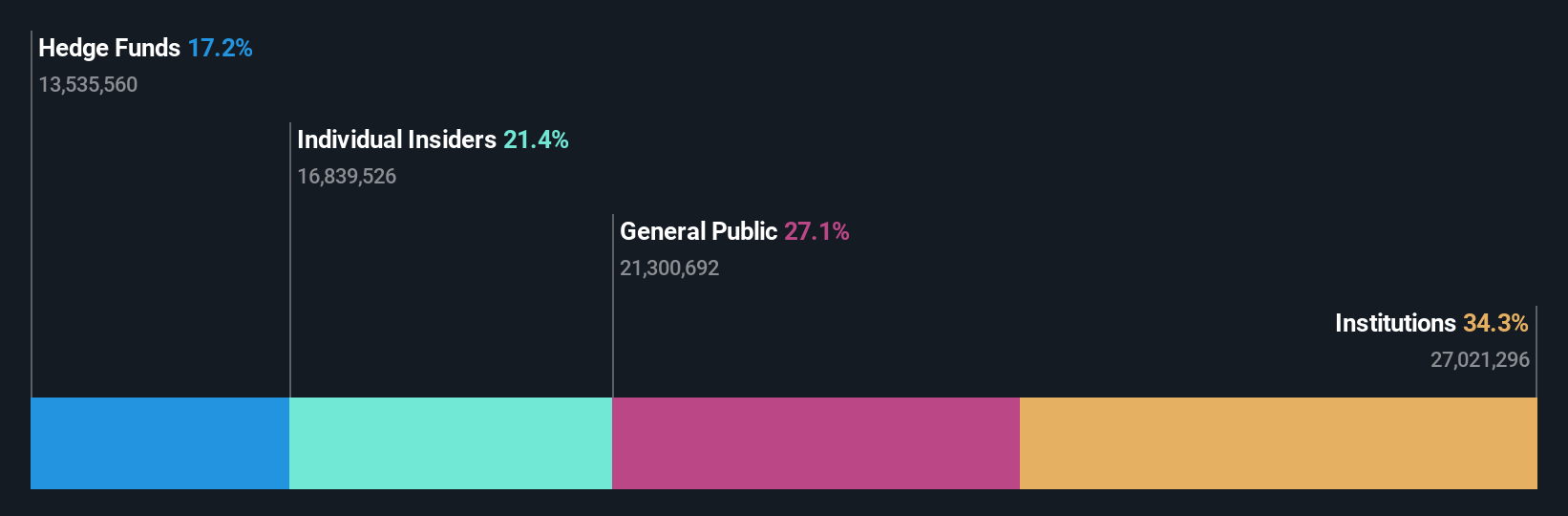

Insider Ownership: 21.7%

Earnings Growth Forecast: 214.6% p.a.

BRC Inc. showcases potential for growth with a forecasted annual profit increase of over 200% and revenue growth surpassing the US market average at 12.5% per year. Despite reporting a net loss reduction in recent earnings, the company revised its full-year revenue guidance, reflecting some uncertainty. Trading significantly below its estimated fair value suggests relative attractiveness compared to peers, although insider trading data is limited for the past three months.

- Dive into the specifics of BRC here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of BRC shares in the market.

Shutterstock (NYSE:SSTK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shutterstock, Inc. operates a platform that connects brands and businesses to high-quality content across North America, Europe, and internationally, with a market cap of approximately $1.07 billion.

Operations: The company generates revenue of $902.18 million from its Internet Software & Services segment.

Insider Ownership: 28.5%

Earnings Growth Forecast: 48.1% p.a.

Shutterstock, Inc. is poised for growth with forecasted annual earnings expansion of over 48%, outpacing the US market. Despite a recent dip in profit margins from 13.5% to 4%, its stock trades significantly below estimated fair value, indicating potential upside. Recent strategic moves include a merger agreement with Getty Images valued at US$1.2 billion and leadership changes aimed at bolstering its Marketplace division, which could enhance operational efficiency and growth prospects.

- Take a closer look at Shutterstock's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Shutterstock's current price could be quite moderate.

XPeng (NYSE:XPEV)

Simply Wall St Growth Rating: ★★★★★☆

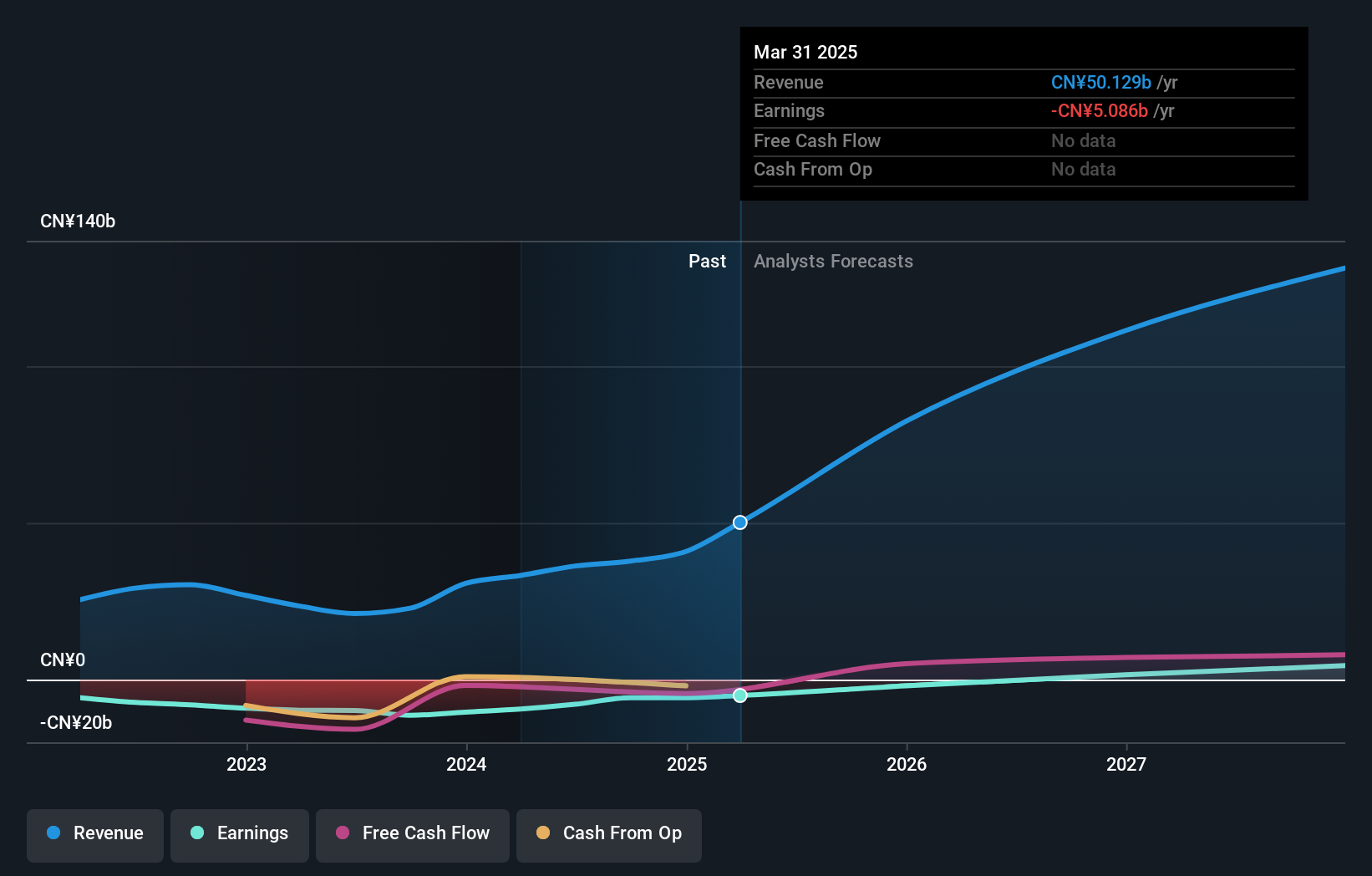

Overview: XPeng Inc. designs, develops, manufactures, and markets smart electric vehicles in the People's Republic of China with a market cap of approximately $11.59 billion.

Operations: The company generates revenue primarily from its smart electric vehicle segment, amounting to CN¥37.81 billion.

Insider Ownership: 20.7%

Earnings Growth Forecast: 55.8% p.a.

XPeng is set for robust growth, with revenue projected to rise 27.8% annually, surpassing the US market's average. Although currently unprofitable, it aims to achieve profitability within three years. Recent innovations include the global rollout of XOS 5.4 software, enhancing AI-driven mobility and safety features. Despite high share price volatility, XPeng's strategic expansion in Europe and strong vehicle delivery growth highlight its commitment to becoming a significant player in the electric vehicle sector.

- Click to explore a detailed breakdown of our findings in XPeng's earnings growth report.

- Our valuation report unveils the possibility XPeng's shares may be trading at a premium.

Taking Advantage

- Discover the full array of 205 Fast Growing US Companies With High Insider Ownership right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with adequate balance sheet.