- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

3 Growth Companies In US With Up To 38% Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences slight fluctuations ahead of a crucial Federal Reserve decision on interest rates, investors are keenly observing growth companies with substantial insider ownership. In this environment, stocks with high insider ownership can signal strong confidence from those closest to the company's operations and strategy, making them particularly interesting to watch.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 27.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

We're going to check out a few of the best picks from our screener tool.

AppLovin (NasdaqGS:APP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation operates a software-based platform that helps advertisers improve the marketing and monetization of their content both in the United States and internationally, with a market cap of $37.63 billion.

Operations: AppLovin's revenue segments include $1.49 billion from Apps and $2.47 billion from its Software Platform.

Insider Ownership: 38.4%

AppLovin's earnings are projected to grow significantly at 24.2% annually, outpacing the US market. Despite a high debt level and recent substantial insider selling, the company reported strong Q2 2024 results with net income rising to US$309.97 million from US$80.36 million a year ago. Revenue forecasts for Q3 2024 range between US$1.115 billion and US$1.135 billion, reflecting continued growth momentum despite being delisted from multiple Russell indices in July 2024.

- Navigate through the intricacies of AppLovin with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of AppLovin shares in the market.

PDD Holdings (NasdaqGS:PDD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PDD Holdings Inc., a multinational commerce group with a market cap of approximately $131.92 billion, owns and operates a diverse portfolio of businesses.

Operations: The company's revenue primarily comes from its Internet Software & Services segment, which generated CN¥341.59 billion.

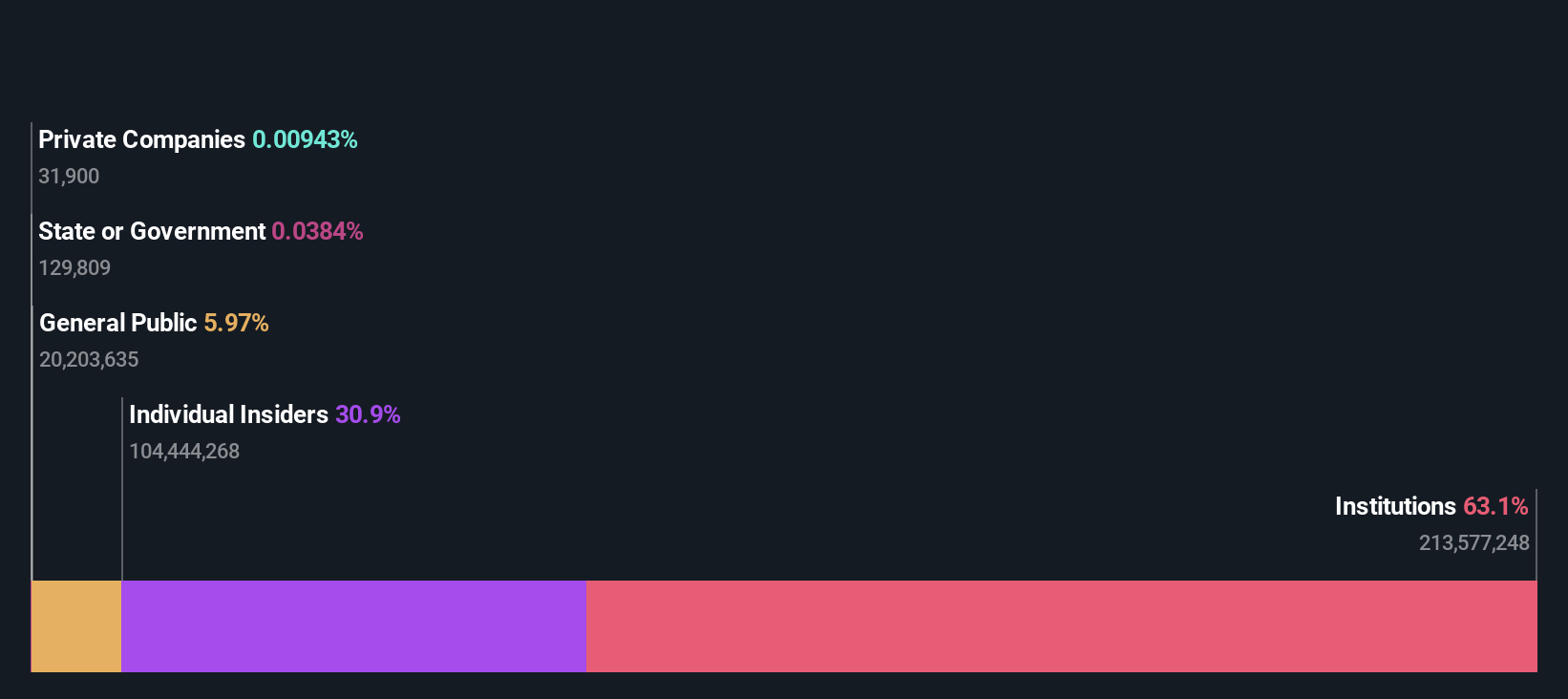

Insider Ownership: 32.1%

PDD Holdings is experiencing robust growth, with earnings forecasted to increase by 17.3% annually and revenue by 18.9% per year, outpacing the US market. The company reported impressive Q2 2024 results with net income rising to CNY 32 billion from CNY 13.11 billion a year ago. However, PDD faces legal challenges over alleged misleading statements and security issues within its applications, which could impact investor sentiment despite its strong financial performance and high insider ownership.

- Click to explore a detailed breakdown of our findings in PDD Holdings' earnings growth report.

- Upon reviewing our latest valuation report, PDD Holdings' share price might be too pessimistic.

Shutterstock (NYSE:SSTK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shutterstock, Inc. operates a platform that connects brands and businesses to high-quality content across North America, Europe, and internationally with a market cap of $1.19 billion.

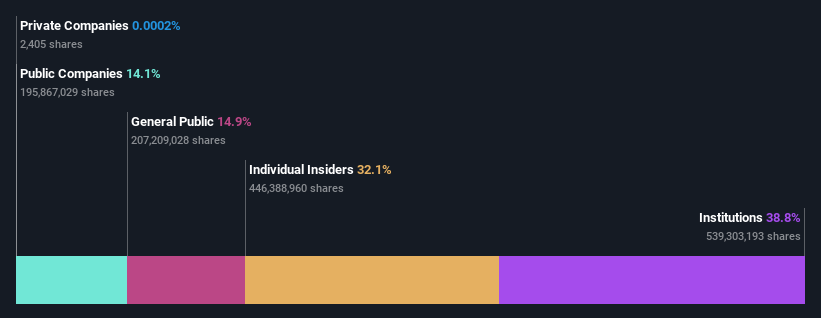

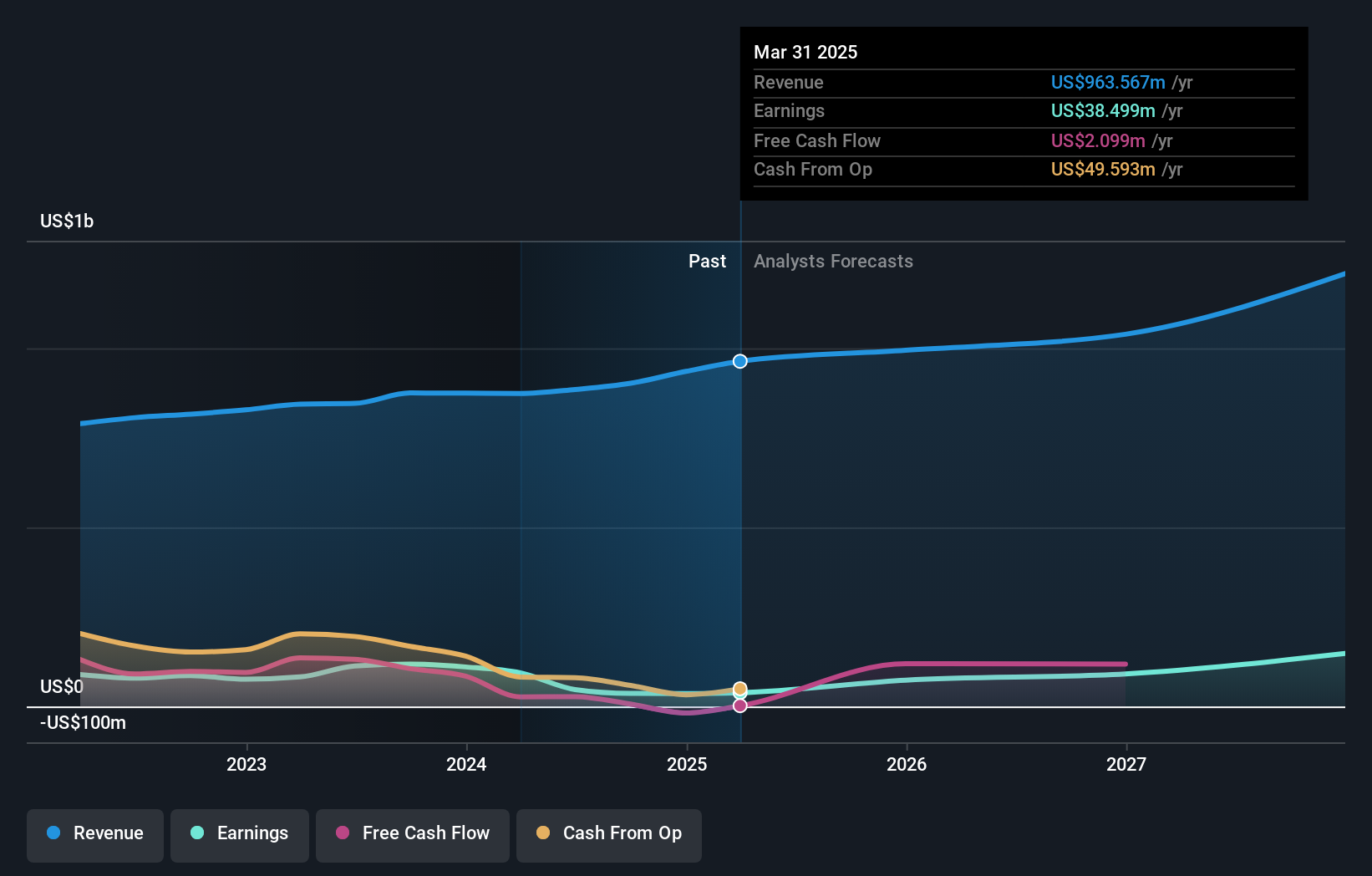

Operations: The company's revenue primarily comes from its Internet Information Providers segment, which generated $884.84 million.

Insider Ownership: 25.9%

Shutterstock is experiencing moderate growth, with revenue forecasted to increase at 8.9% annually, slightly above the US market rate. Recent Q2 2024 earnings showed a significant drop in net income to $3.63 million from $50.01 million a year ago, impacting profit margins and EPS. Insider ownership remains high, bolstered by strategic executive changes and innovative AI product launches like the generative 3D API platform, positioning the company for future growth despite current financial challenges.

- Dive into the specifics of Shutterstock here with our thorough growth forecast report.

- Our valuation report here indicates Shutterstock may be undervalued.

Taking Advantage

- Click this link to deep-dive into the 175 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group, owns and operates a portfolio of businesses.

Outstanding track record with flawless balance sheet.