- United States

- /

- Entertainment

- /

- NYSE:SE

High Growth Stocks Insiders Are Eager To Own

Reviewed by Simply Wall St

As the U.S. stock market rebounds from recent tariff-related volatility, investors are keenly observing companies with solid fundamentals and strong insider confidence. In this landscape, growth stocks with high insider ownership stand out as they often signal a belief in the company's potential amidst economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.1% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.7% | 36.7% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.9% |

| Kingstone Companies (NasdaqCM:KINS) | 17.7% | 24.2% |

| Astera Labs (NasdaqGS:ALAB) | 15.9% | 61.1% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Clene (NasdaqCM:CLNN) | 20.7% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

Let's uncover some gems from our specialized screener.

Organogenesis Holdings (NasdaqCM:ORGO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Organogenesis Holdings Inc. is a regenerative medicine company that develops, manufactures, and commercializes solutions for advanced wound care as well as surgical and sports medicine markets in the United States, with a market cap of $639.21 million.

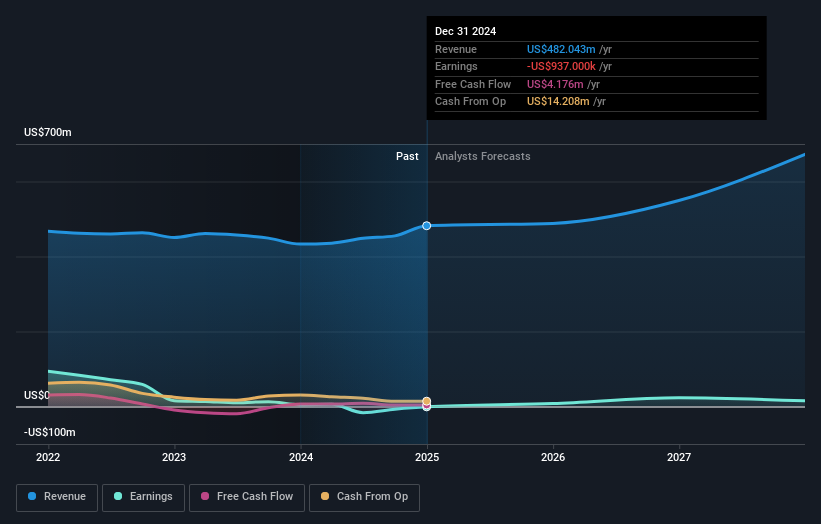

Operations: The company's revenue is primarily derived from its regenerative medicine segment, which generated $482.04 million.

Insider Ownership: 37.6%

Organogenesis Holdings demonstrates characteristics of a growth company with notable insider ownership, despite recent significant insider selling. The company reported improved Q4 2024 earnings with sales reaching US$126.66 million, up from US$99.65 million the previous year, and net income of US$7.67 million compared to a prior loss. However, its revenue growth forecast is moderate at 9.2% annually and profitability is expected within three years amidst share price volatility and low return on equity projections.

- Unlock comprehensive insights into our analysis of Organogenesis Holdings stock in this growth report.

- In light of our recent valuation report, it seems possible that Organogenesis Holdings is trading behind its estimated value.

Sportradar Group (NasdaqGS:SRAD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sportradar Group AG, along with its subsidiaries, offers sports data services for the sports betting and media industries across the United Kingdom, the United States, Malta, Switzerland, and globally; it has a market cap of approximately $6.51 billion.

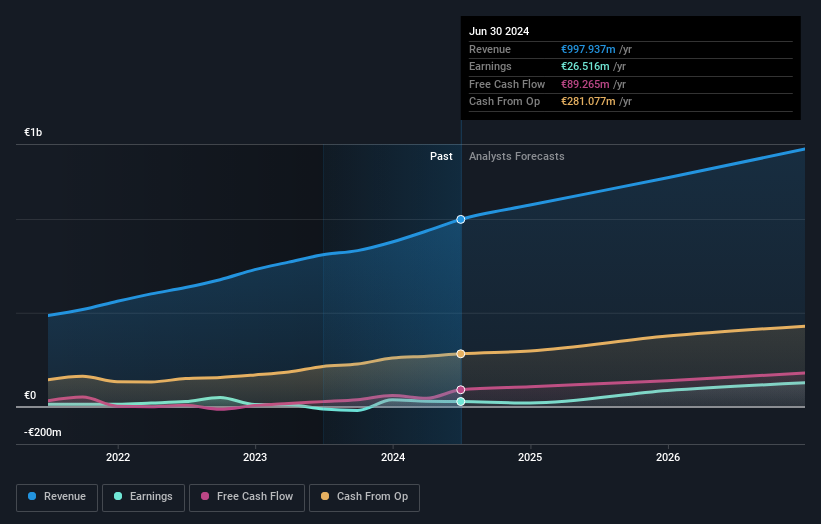

Operations: Sportradar Group generates revenue by providing sports data services tailored for the sports betting and media sectors across various international markets, including the UK, US, Malta, and Switzerland.

Insider Ownership: 31.9%

Sportradar Group is trading 10.1% below its estimated fair value, with earnings forecast to grow significantly at 28% annually, outpacing the US market's growth. Despite a slower revenue growth rate of 10.9% per year compared to some benchmarks, it surpasses the overall US market average of 8.5%. Recent developments include Major League Baseball acquiring a minority stake and changes in board membership, highlighting ongoing strategic partnerships and governance adjustments.

- Take a closer look at Sportradar Group's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Sportradar Group's share price might be too optimistic.

Sea (NYSE:SE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sea Limited operates in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, and other international markets with a market cap of $75.99 billion.

Operations: Sea Limited's revenue consists of $12.42 billion from e-commerce, $1.91 billion from digital entertainment, and $2.37 billion from digital financial services.

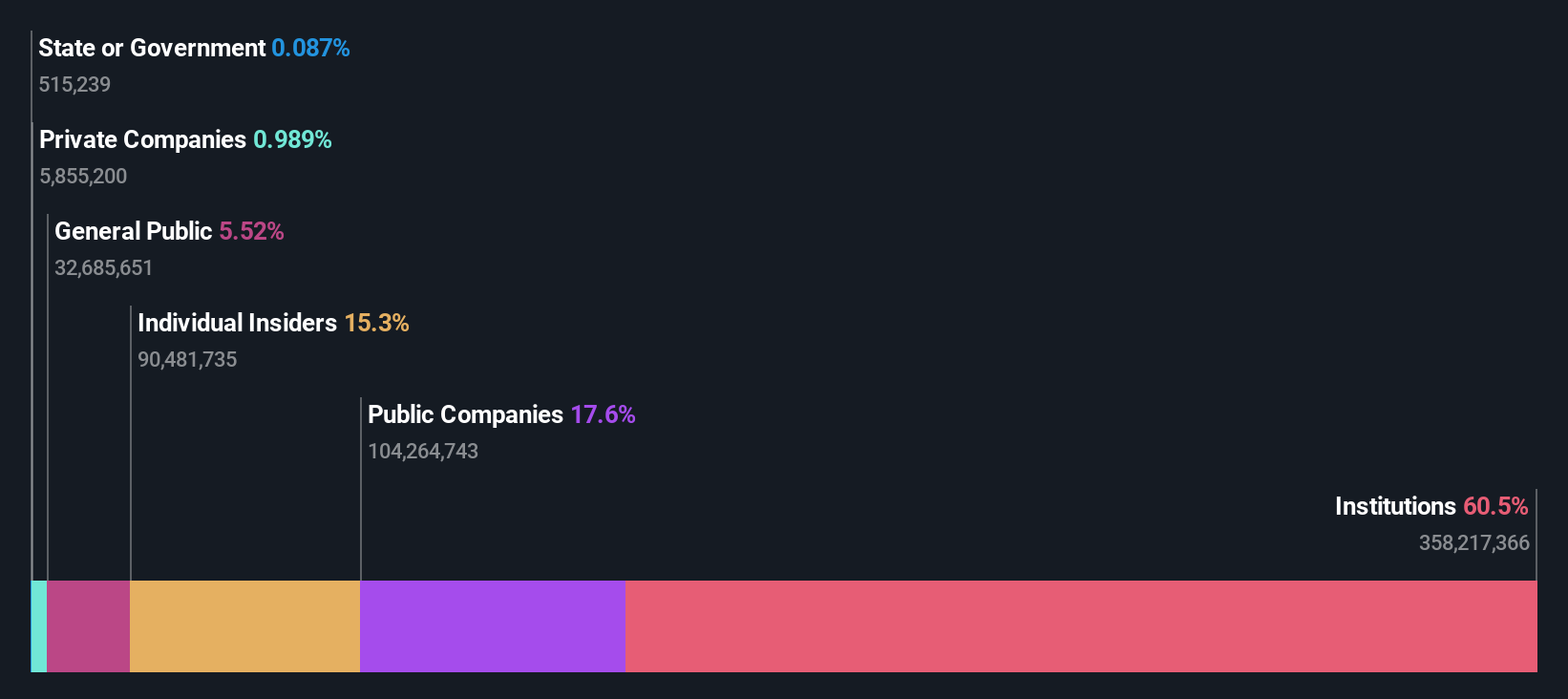

Insider Ownership: 15.1%

Sea Limited is trading 22.1% below its estimated fair value, with earnings expected to grow significantly at 33.2% annually, surpassing the US market's growth rate of 14%. Revenue is forecast to increase by 14.4% per year, outpacing the US market average of 8.5%. Recent full-year results show revenue rising to US$16.82 billion and net income improving to US$444.32 million, reflecting strong financial performance despite large one-off items impacting results.

- Delve into the full analysis future growth report here for a deeper understanding of Sea.

- Upon reviewing our latest valuation report, Sea's share price might be too pessimistic.

Next Steps

- Embark on your investment journey to our 202 Fast Growing US Companies With High Insider Ownership selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Engages in the digital entertainment, e-commerce, and digital financial service businesses in Southeast Asia, Latin America, rest of Asia, and internationally.

Flawless balance sheet with high growth potential.