- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Undervalued Stock Estimates For Consideration In July 2025

Reviewed by Simply Wall St

The United States market has shown a positive trajectory, rising 2.1% in the past week and climbing 14% over the last year, with earnings projected to grow by 15% annually. In this environment, identifying undervalued stocks can be a strategic move for investors seeking opportunities that may offer potential value relative to their current price levels.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $25.65 | $50.98 | 49.7% |

| UMH Properties (UMH) | $17.34 | $34.40 | 49.6% |

| SharkNinja (SN) | $107.24 | $210.61 | 49.1% |

| Roku (ROKU) | $88.27 | $173.98 | 49.3% |

| Privia Health Group (PRVA) | $22.11 | $43.37 | 49% |

| MAC Copper (MTAL) | $12.03 | $23.79 | 49.4% |

| Insteel Industries (IIIN) | $39.23 | $76.74 | 48.9% |

| Carter Bankshares (CARE) | $18.25 | $35.50 | 48.6% |

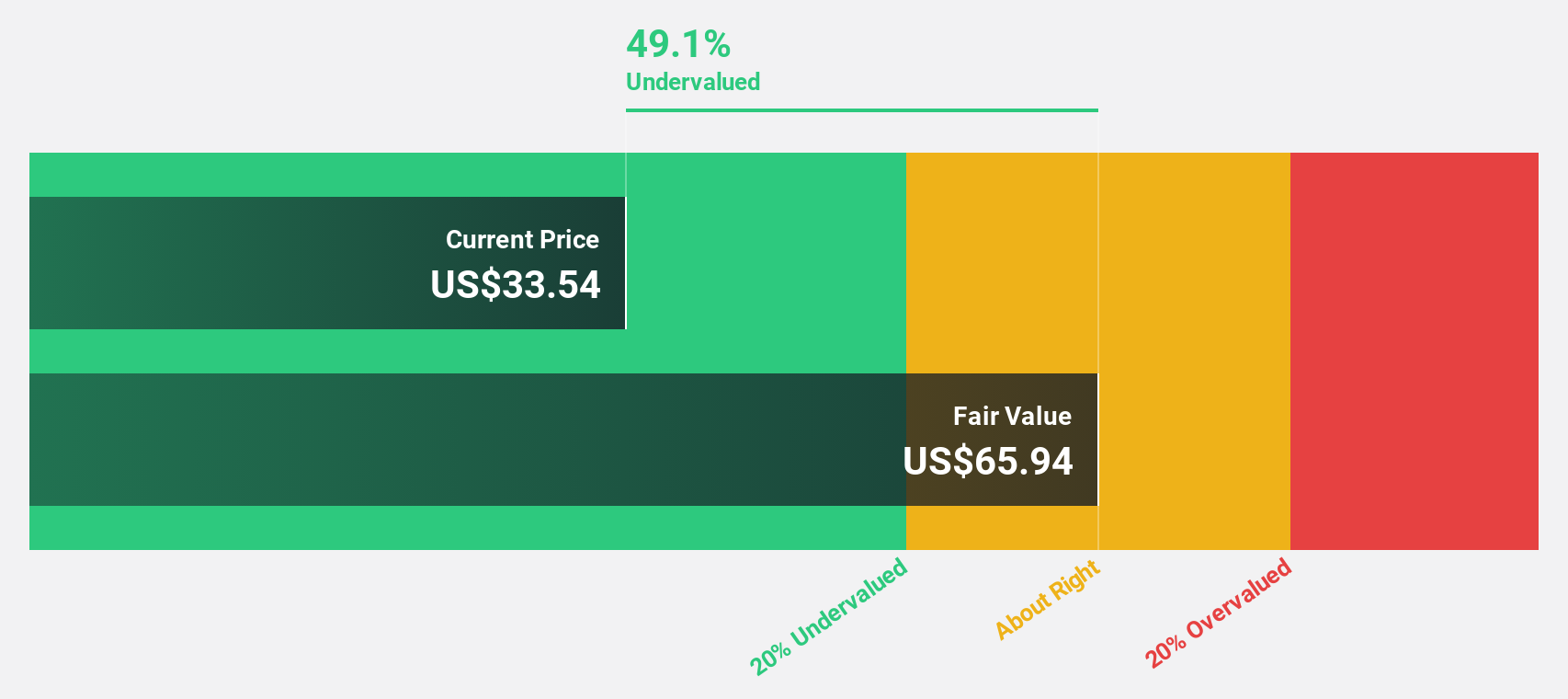

| Atlantic Union Bankshares (AUB) | $33.54 | $65.94 | 49.1% |

| Acadia Realty Trust (AKR) | $18.64 | $36.44 | 48.8% |

Let's explore several standout options from the results in the screener.

Atlantic Union Bankshares (AUB)

Overview: Atlantic Union Bankshares Corporation, with a market cap of $4.78 billion, operates as the bank holding company for Atlantic Union Bank, offering a range of banking and financial services to consumers and businesses in the United States.

Operations: The company generates revenue through its Consumer Banking segment, which accounts for $359.18 million, and its Wholesale Banking segment, contributing $394.66 million.

Estimated Discount To Fair Value: 49.1%

Atlantic Union Bankshares is trading at US$33.54, significantly below its estimated fair value of US$65.94, indicating potential undervaluation based on cash flows. Despite recent shareholder dilution, the company's revenue and earnings are forecast to grow substantially faster than the market over the next three years. Recent executive changes include a planned CFO retirement and a new chief risk officer appointment, with continued dividend affirmations supporting investor confidence in stable cash flow management.

- Our expertly prepared growth report on Atlantic Union Bankshares implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Atlantic Union Bankshares stock in this financial health report.

Dayforce (DAY)

Overview: Dayforce Inc. is a human capital management (HCM) software company operating in the United States, Canada, Australia, and internationally with a market cap of $9.16 billion.

Operations: The company's revenue segment is Human Capital Management (HCM), generating $1.81 billion.

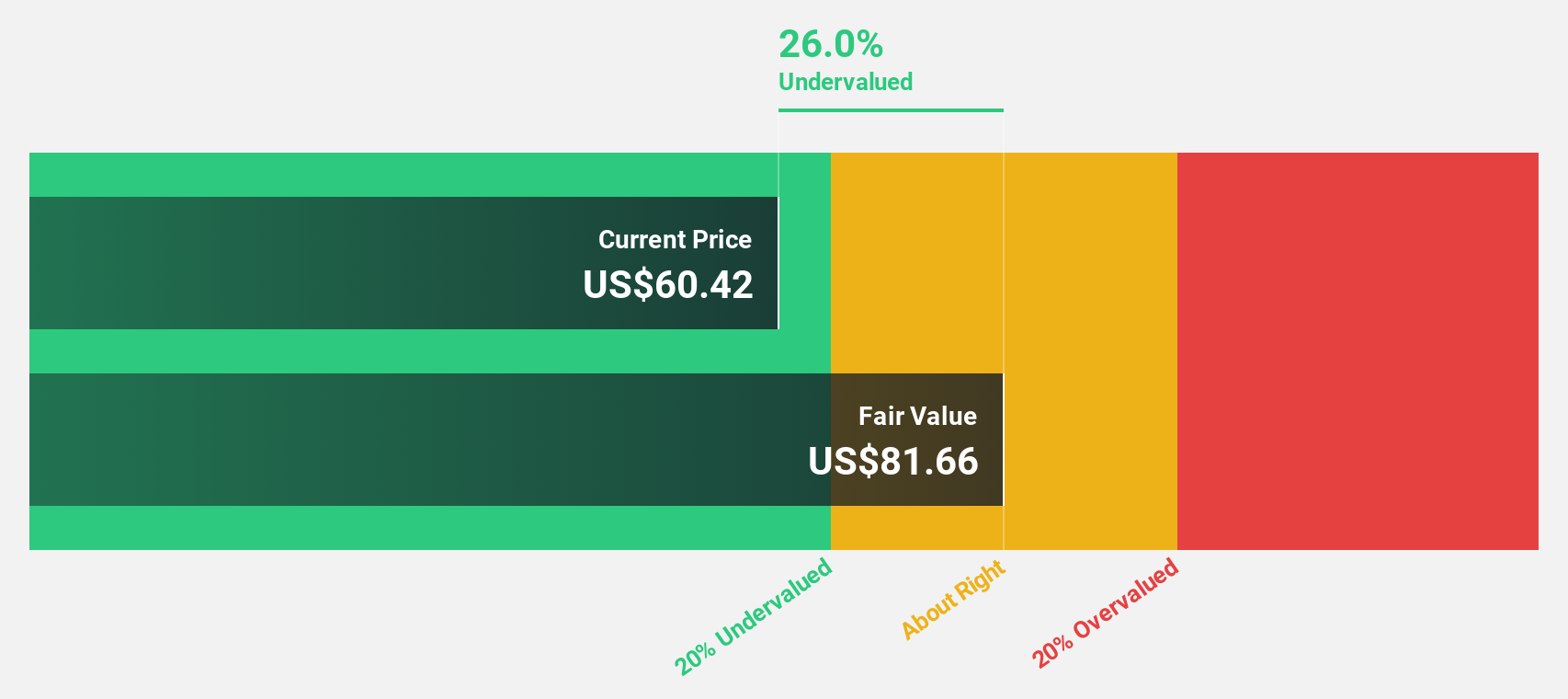

Estimated Discount To Fair Value: 36.9%

Dayforce, trading at US$57.27, is significantly below its fair value estimate of US$90.73, highlighting potential undervaluation based on cash flows. Despite a dip in profit margins from 3.3% to 1.4%, earnings are projected to grow substantially faster than the market at 37.1% annually over the next three years. Recent contracts with major clients like the Government of Canada and Hubexo underscore strong demand for its comprehensive HR solutions, supporting long-term revenue growth prospects.

- Our comprehensive growth report raises the possibility that Dayforce is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Dayforce's balance sheet health report.

Reddit (RDDT)

Overview: Reddit, Inc. operates a digital community platform both in the United States and internationally, with a market cap of approximately $28.98 billion.

Operations: The company's revenue is primarily generated from its Internet Information Providers segment, totaling $1.45 billion.

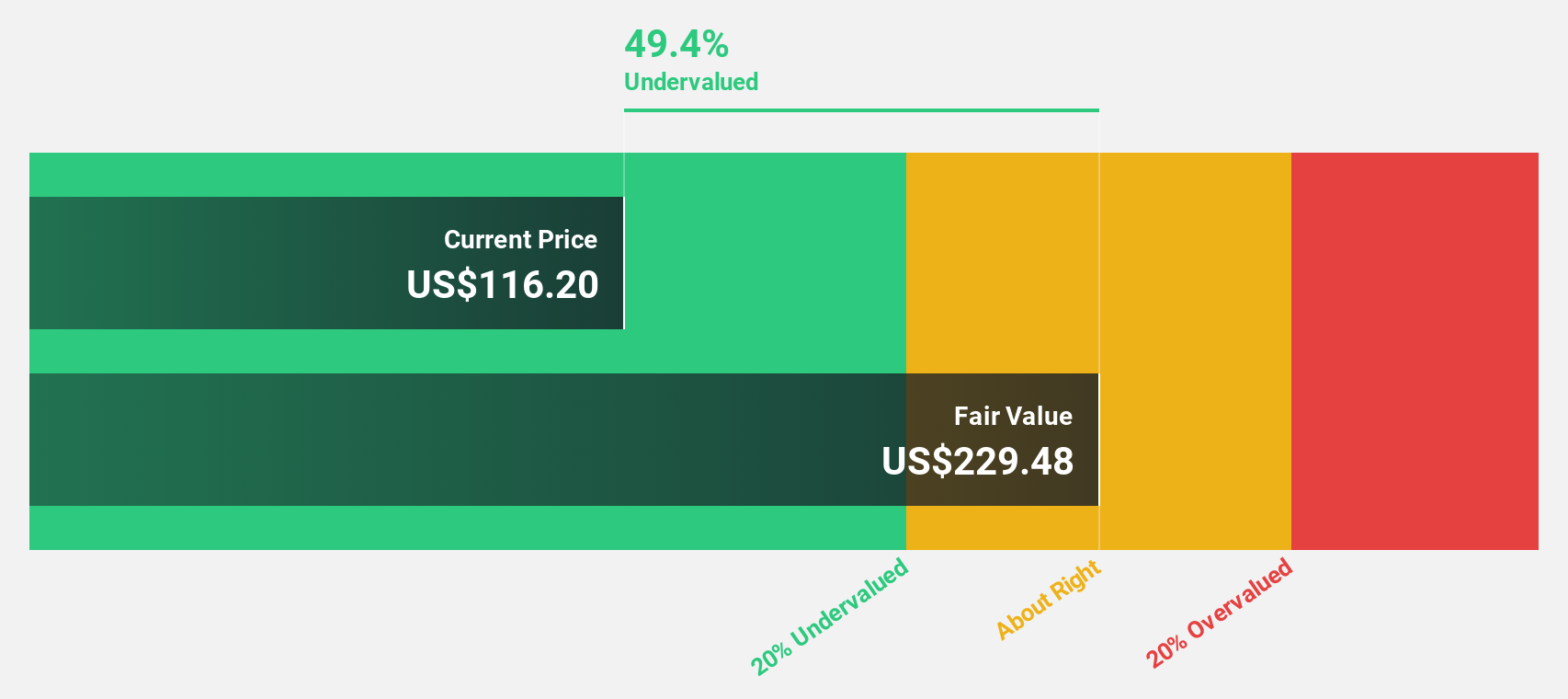

Estimated Discount To Fair Value: 36.8%

Reddit, Inc. is trading at US$157.03, significantly below its fair value estimate of US$248.32, suggesting undervaluation based on cash flows. The company recently reported a shift to profitability with a net income of US$26.16 million in Q1 2025 and anticipates revenue growth between US$410 million and US$430 million for the next quarter. Its inclusion in multiple Russell indices reflects growing market recognition, while extended credit facilities support financial stability amidst high earnings growth projections exceeding market averages.

- Our growth report here indicates Reddit may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Reddit.

Where To Now?

- Click here to access our complete index of 175 Undervalued US Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)