- United States

- /

- Consumer Services

- /

- NasdaqGS:DUOL

Three Stocks That May Be Undervalued According To Analysts In October 2025

Reviewed by Simply Wall St

As of October 2025, the U.S. stock market has experienced a mixture of highs and lows, with the S&P 500 and Nasdaq reaching record levels despite ongoing challenges such as a government shutdown. In this environment, identifying undervalued stocks can be particularly appealing to investors looking for potential opportunities in an otherwise volatile market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Midland States Bancorp (MSBI) | $16.31 | $31.48 | 48.2% |

| Investar Holding (ISTR) | $22.84 | $45.53 | 49.8% |

| Horizon Bancorp (HBNC) | $15.56 | $30.06 | 48.2% |

| First Commonwealth Financial (FCF) | $16.60 | $32.97 | 49.7% |

| First Busey (BUSE) | $23.29 | $45.18 | 48.5% |

| Equity Bancshares (EQBK) | $40.89 | $78.05 | 47.6% |

| Corpay (CPAY) | $290.85 | $553.44 | 47.4% |

| Atlassian (TEAM) | $147.74 | $280.16 | 47.3% |

| Alnylam Pharmaceuticals (ALNY) | $456.95 | $882.39 | 48.2% |

| AGNC Investment (AGNC) | $10.00 | $19.71 | 49.3% |

Let's review some notable picks from our screened stocks.

Duolingo (DUOL)

Overview: Duolingo, Inc. operates as a mobile learning platform in the United States, the United Kingdom, and internationally with a market cap of $15.91 billion.

Operations: The company's revenue is primarily generated from its educational software segment, which amounts to $885.15 million.

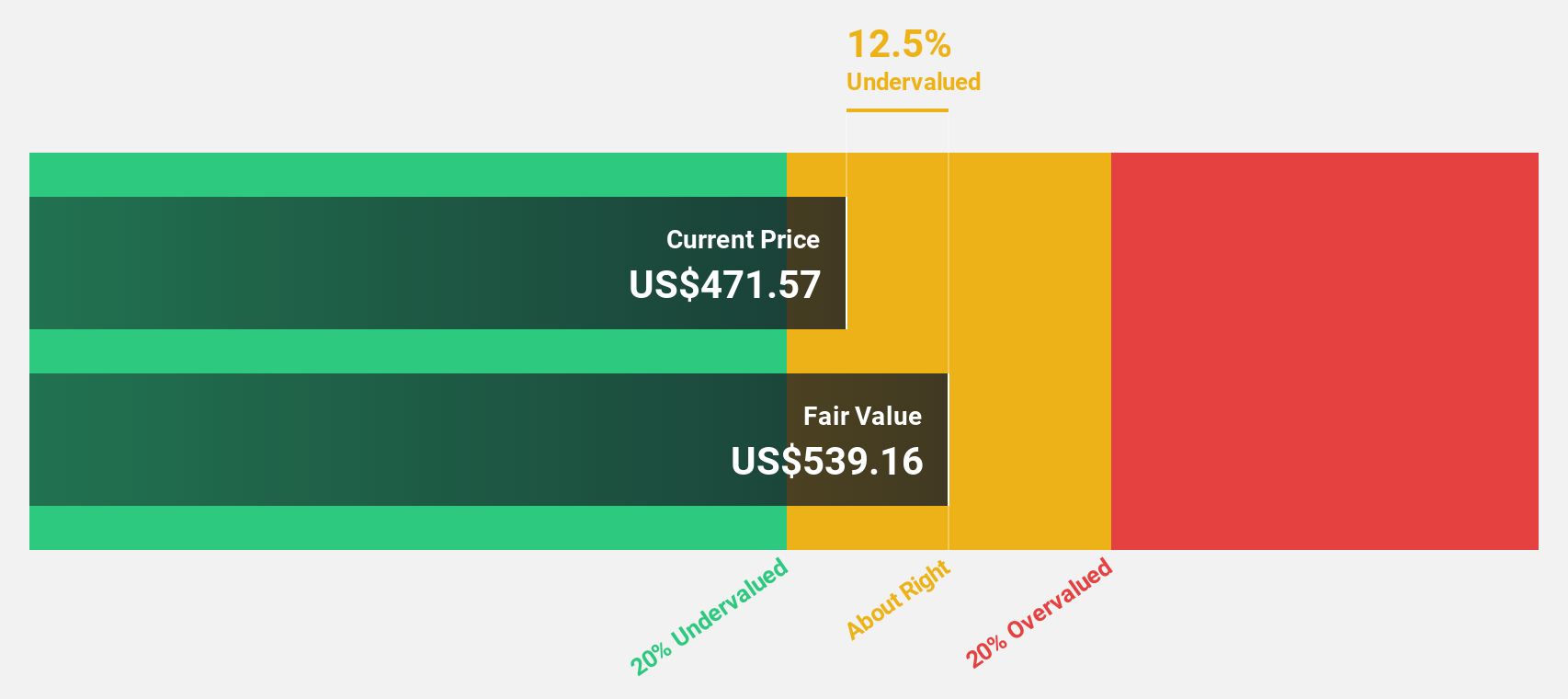

Estimated Discount To Fair Value: 29.3%

Duolingo's recent earnings report shows robust growth, with a net income of US$44.78 million, up from US$24.35 million the previous year. The company is trading at 29.3% below its estimated fair value and is highly undervalued based on discounted cash flow analysis. Despite significant insider selling, Duolingo's revenue and earnings are forecast to grow significantly faster than the market, driven by innovative product updates like AI-driven features and expanded course offerings.

- According our earnings growth report, there's an indication that Duolingo might be ready to expand.

- Get an in-depth perspective on Duolingo's balance sheet by reading our health report here.

ON Semiconductor (ON)

Overview: ON Semiconductor Corporation offers intelligent sensing and power solutions across various regions including Hong Kong, Singapore, the United Kingdom, and the United States, with a market cap of approximately $20.81 billion.

Operations: The company's revenue is derived from three main segments: Power Solutions Group ($2.98 billion), Intelligent Sensing Group ($1.03 billion), and Analog & Mixed-Signal Group ($2.39 billion).

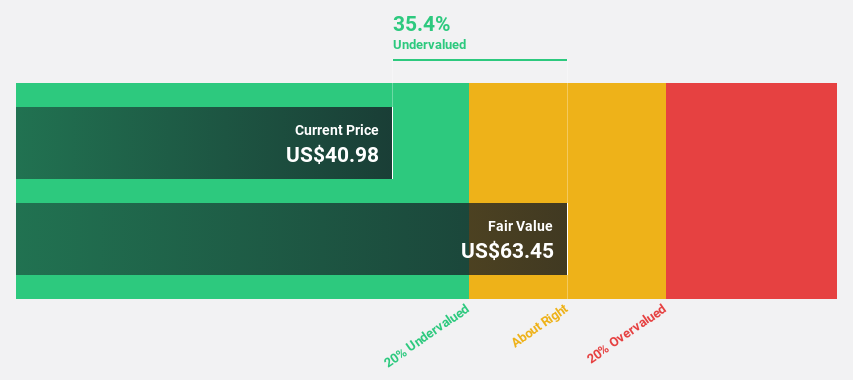

Estimated Discount To Fair Value: 16.8%

ON Semiconductor is trading at US$49.97, below its estimated fair value of US$60.06, indicating potential undervaluation based on cash flows. Despite a recent decline in net income and sales, earnings are projected to grow significantly over the next three years, outpacing the broader market's growth rate. Recent collaborations with NVIDIA and advancements in ReRAM technology highlight ON's strategic innovation efforts to enhance efficiency and performance across automotive and AI data center markets.

- In light of our recent growth report, it seems possible that ON Semiconductor's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of ON Semiconductor.

Reddit (RDDT)

Overview: Reddit, Inc. operates a digital community platform both in the United States and internationally, with a market cap of $37.86 billion.

Operations: The company's revenue is primarily derived from its Internet Information Providers segment, totaling $1.67 billion.

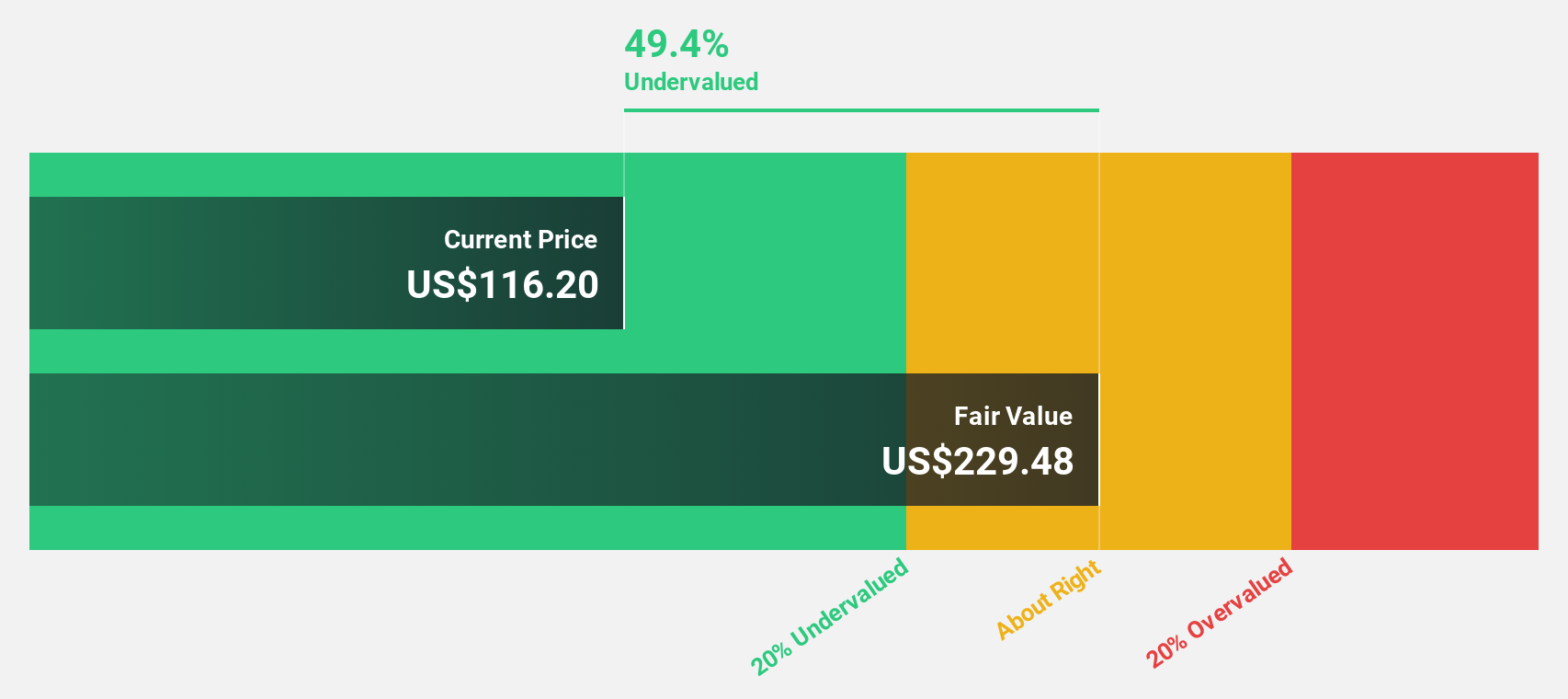

Estimated Discount To Fair Value: 28.6%

Reddit is trading at US$211.7, below its estimated fair value of US$296.41, suggesting it may be undervalued based on cash flows. Despite legal challenges and concerns over reduced traffic due to Google's AI changes, Reddit's earnings are expected to grow significantly at 37.8% annually, outpacing the broader market. Recent revenue growth and profitability improvements indicate strong operational performance, though potential disruptions in user traffic remain a concern for future advertising revenues.

- The analysis detailed in our Reddit growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Reddit's balance sheet health report.

Seize The Opportunity

- Get an in-depth perspective on all 187 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DUOL

Duolingo

Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)