- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

3 Stocks That May Be Priced Below Their Estimated Value In December 2025

Reviewed by Simply Wall St

As of December 2025, the U.S. stock market has been experiencing a surge, driven by the Federal Reserve's decision to cut interest rates, with major indices like the S&P 500 and Dow Jones Industrial Average nearing record highs. In this environment of fluctuating monetary policy and economic indicators, identifying stocks that may be priced below their estimated value becomes crucial for investors seeking potential opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (UMBF) | $118.43 | $232.81 | 49.1% |

| Sotera Health (SHC) | $16.89 | $33.63 | 49.8% |

| Schrödinger (SDGR) | $17.94 | $35.34 | 49.2% |

| QXO (QXO) | $21.71 | $43.12 | 49.6% |

| Pattern Group (PTRN) | $12.73 | $25.43 | 49.9% |

| Krystal Biotech (KRYS) | $239.72 | $470.09 | 49% |

| Investar Holding (ISTR) | $26.84 | $51.50 | 47.9% |

| FirstSun Capital Bancorp (FSUN) | $37.71 | $73.32 | 48.6% |

| Columbia Banking System (COLB) | $29.04 | $57.69 | 49.7% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $18.92 | $37.29 | 49.3% |

Underneath we present a selection of stocks filtered out by our screen.

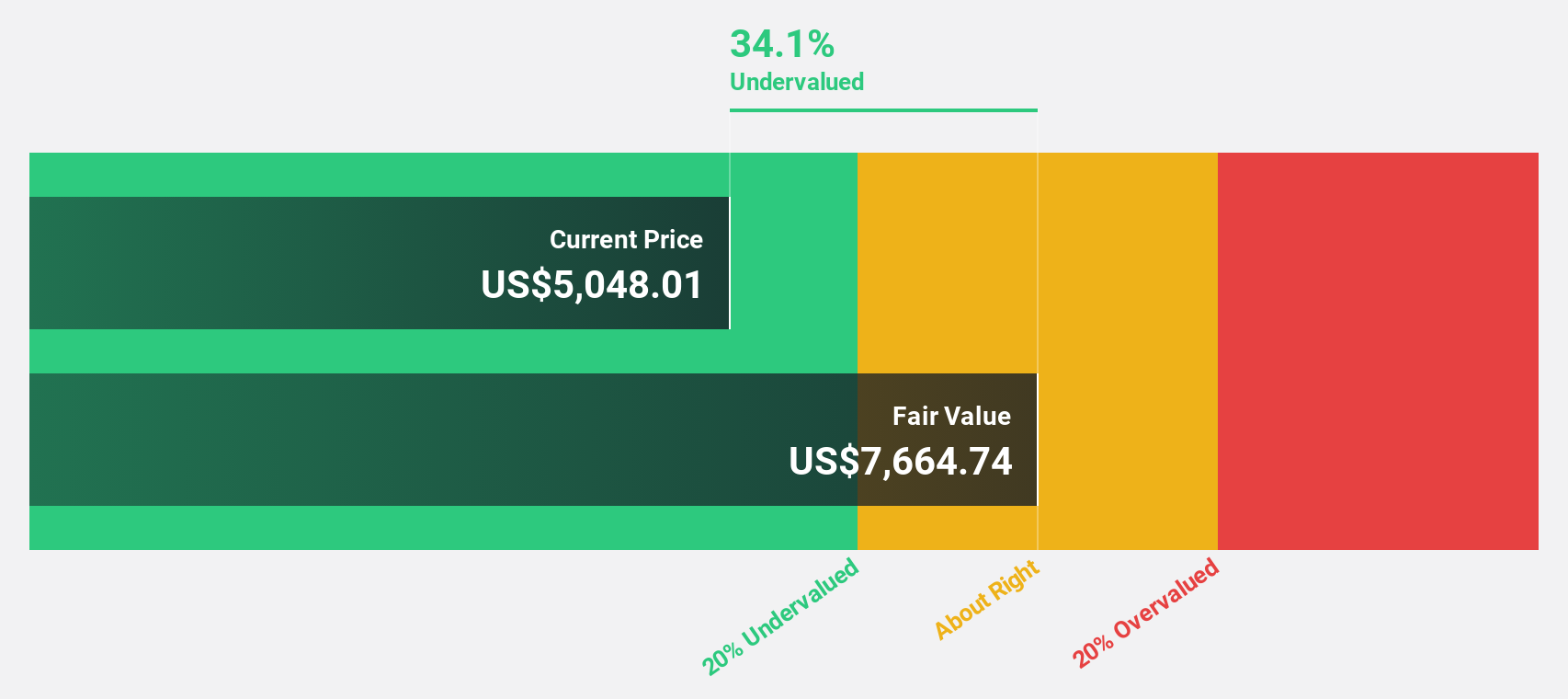

Booking Holdings (BKNG)

Overview: Booking Holdings Inc. operates as a provider of online and traditional travel and restaurant reservations, along with related services, across the United States, the Netherlands, and internationally, with a market cap of approximately $167.48 billion.

Operations: The company's revenue is primarily derived from its travel services segment, which generated $26.04 billion.

Estimated Discount To Fair Value: 30.7%

Booking Holdings is trading at US$5,277.20, significantly below its estimated fair value of US$7,609.86, suggesting it may be undervalued based on discounted cash flow analysis. Despite a high level of debt, the company's earnings are forecast to grow significantly at 20% annually over the next three years, outpacing the broader U.S. market's growth rate. A recent partnership with viagogo enhances its travel offerings and could drive further revenue opportunities in event-related travel services.

- Our growth report here indicates Booking Holdings may be poised for an improving outlook.

- Get an in-depth perspective on Booking Holdings' balance sheet by reading our health report here.

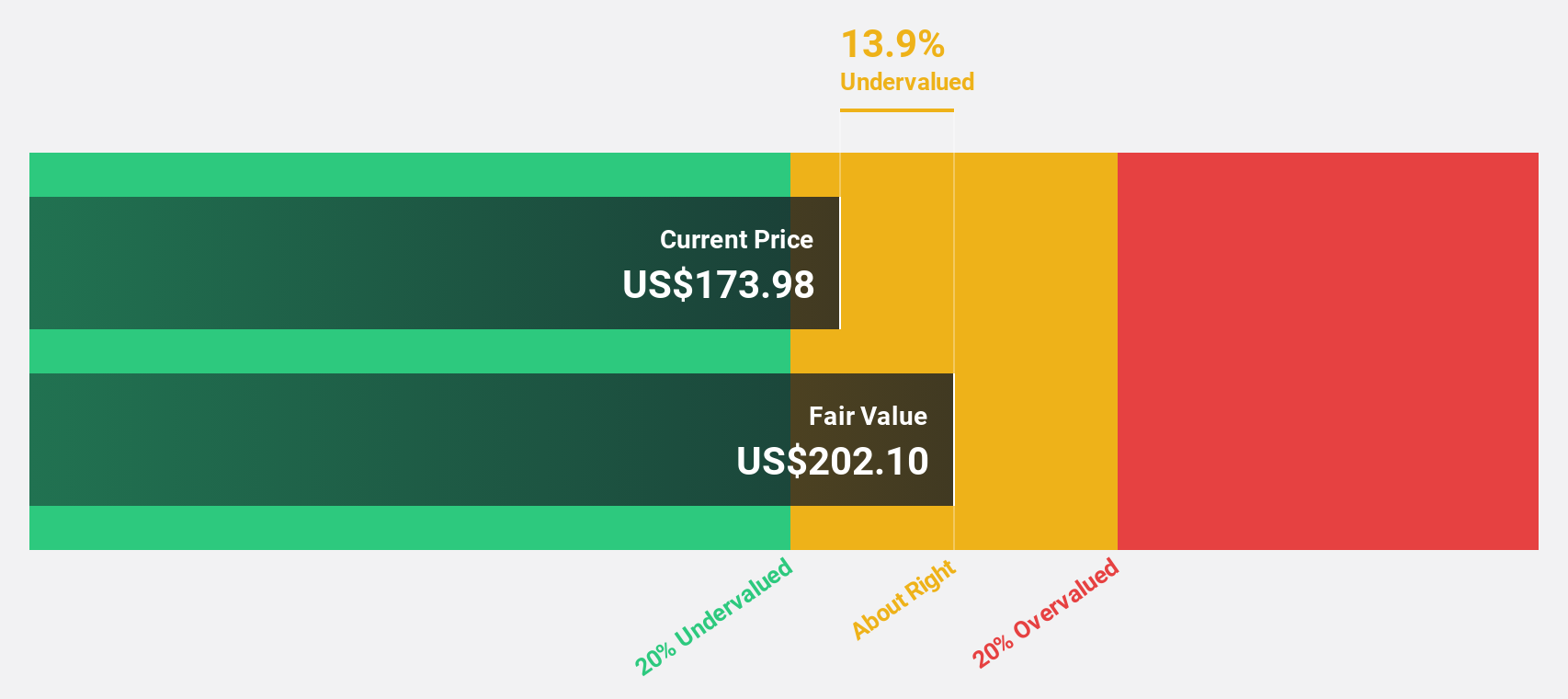

QUALCOMM (QCOM)

Overview: QUALCOMM Incorporated develops and commercializes foundational technologies for the wireless industry globally, with a market cap of approximately $194.11 billion.

Operations: The company's revenue primarily comes from Qualcomm CDMA Technologies (QCT) at $38.37 billion and Qualcomm Technology Licensing (QTL) at $5.58 billion.

Estimated Discount To Fair Value: 12%

QUALCOMM is trading at US$182.21, below its estimated fair value of US$206.97, indicating potential undervaluation based on cash flows. Despite a recent net loss, earnings are expected to grow significantly at 21.2% annually over the next three years, surpassing the U.S. market's growth rate. The company recently amended bylaws to enhance shareholder engagement and announced a strategic AI collaboration in Saudi Arabia, potentially bolstering future revenue streams and innovation capacity.

- Our comprehensive growth report raises the possibility that QUALCOMM is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in QUALCOMM's balance sheet health report.

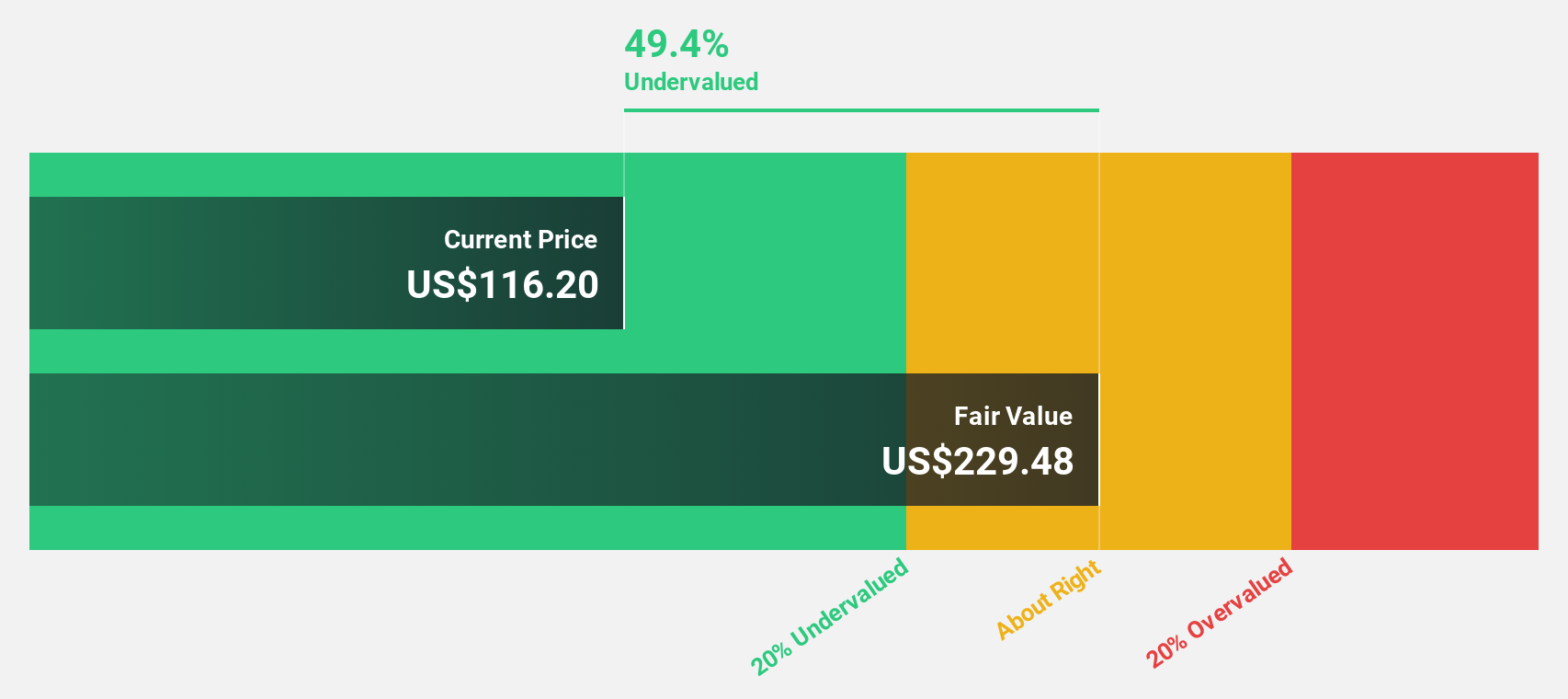

Reddit (RDDT)

Overview: Reddit, Inc. operates a digital community platform both in the United States and internationally, with a market capitalization of $45.12 billion.

Operations: The company's revenue is primarily generated from its Internet Information Providers segment, amounting to $1.90 billion.

Estimated Discount To Fair Value: 29.6%

Reddit is trading at US$238.11, significantly below its estimated fair value of US$338.35, highlighting potential undervaluation based on cash flows. The company's earnings are forecast to grow substantially at 36.1% annually, outpacing the U.S. market's growth rate. Recent strategic partnerships, such as with Bombora for enhanced B2B audience targeting, could drive further revenue growth beyond the already impressive annual forecast of 25.5%, reinforcing Reddit's strong financial trajectory post-profitability this year.

- Upon reviewing our latest growth report, Reddit's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Reddit.

Summing It All Up

- Unlock our comprehensive list of 210 Undervalued US Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026