- United States

- /

- Entertainment

- /

- NYSE:LION

Exploring October 2025's Undervalued Small Caps With Insider Actions

Reviewed by Simply Wall St

As the U.S. market navigates a volatile landscape marked by fluctuating indices and ongoing economic uncertainties, small-cap stocks present unique opportunities for investors seeking growth potential. In this environment, identifying stocks with strong fundamentals and insider actions can be crucial, as these elements may indicate confidence in a company's future prospects amidst broader market challenges.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Citizens & Northern | 11.3x | 2.8x | 41.11% | ★★★★★☆ |

| PCB Bancorp | 9.5x | 2.9x | 35.51% | ★★★★★☆ |

| Peoples Bancorp | 9.9x | 1.8x | 44.94% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | 26.88% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 35.16% | ★★★★☆☆ |

| Shore Bancshares | 10.0x | 2.6x | -80.76% | ★★★☆☆☆ |

| Arrow Financial | 14.6x | 3.2x | 20.98% | ★★★☆☆☆ |

| Farmland Partners | 6.7x | 8.2x | -39.95% | ★★★☆☆☆ |

| LifeStance Health Group | NA | 1.5x | 13.51% | ★★★☆☆☆ |

| Tilray Brands | NA | 2.3x | -46.84% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Northwest Bancshares (NWBI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Northwest Bancshares is a financial institution primarily engaged in banking operations, with a market capitalization of approximately $1.25 billion.

Operations: The company generates its revenue primarily from banking activities, with recent figures indicating $561.86 million in revenue. Operating expenses are a significant part of the cost structure, with general and administrative expenses consistently forming a substantial portion of these costs. The net income margin has shown variability, reaching 25.52% in recent periods, reflecting fluctuations in profitability over time.

PE: 12.8x

Northwest Bancshares, a small U.S. financial institution, recently reported strong earnings growth with net income reaching US$33.68 million for Q2 2025, up from US$4.75 million the previous year. Their strategic leadership changes include appointing Erin Siegfried as chief legal counsel and Richard Grafmyre joining the board post-merger. Despite no recent share repurchases, insider confidence is evident in these appointments. The company declared a quarterly dividend of US$0.20 per share in July 2025, reflecting its commitment to shareholder returns amidst forecasted earnings growth of 23% annually.

- Click here to discover the nuances of Northwest Bancshares with our detailed analytical valuation report.

Understand Northwest Bancshares' track record by examining our Past report.

Lionsgate Studios (LION)

Simply Wall St Value Rating: ★★★★☆☆

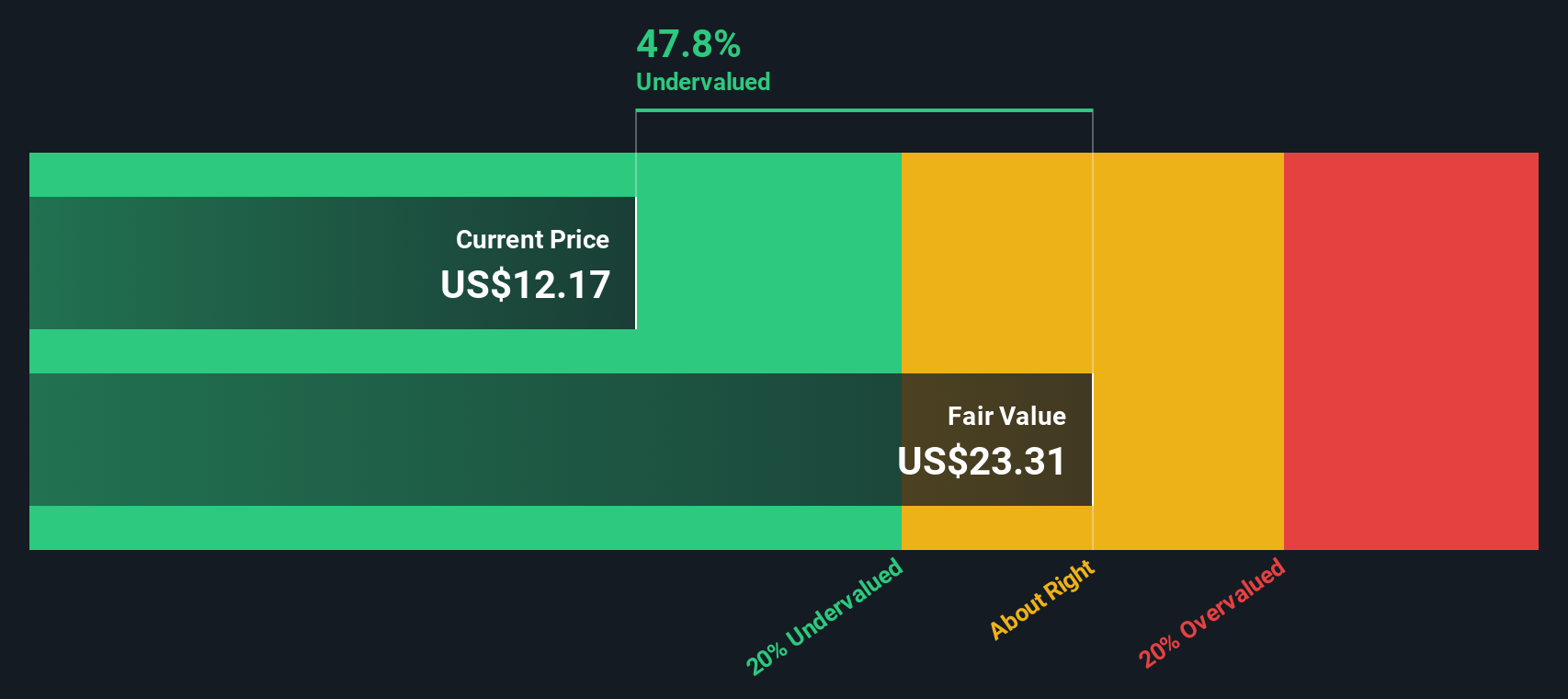

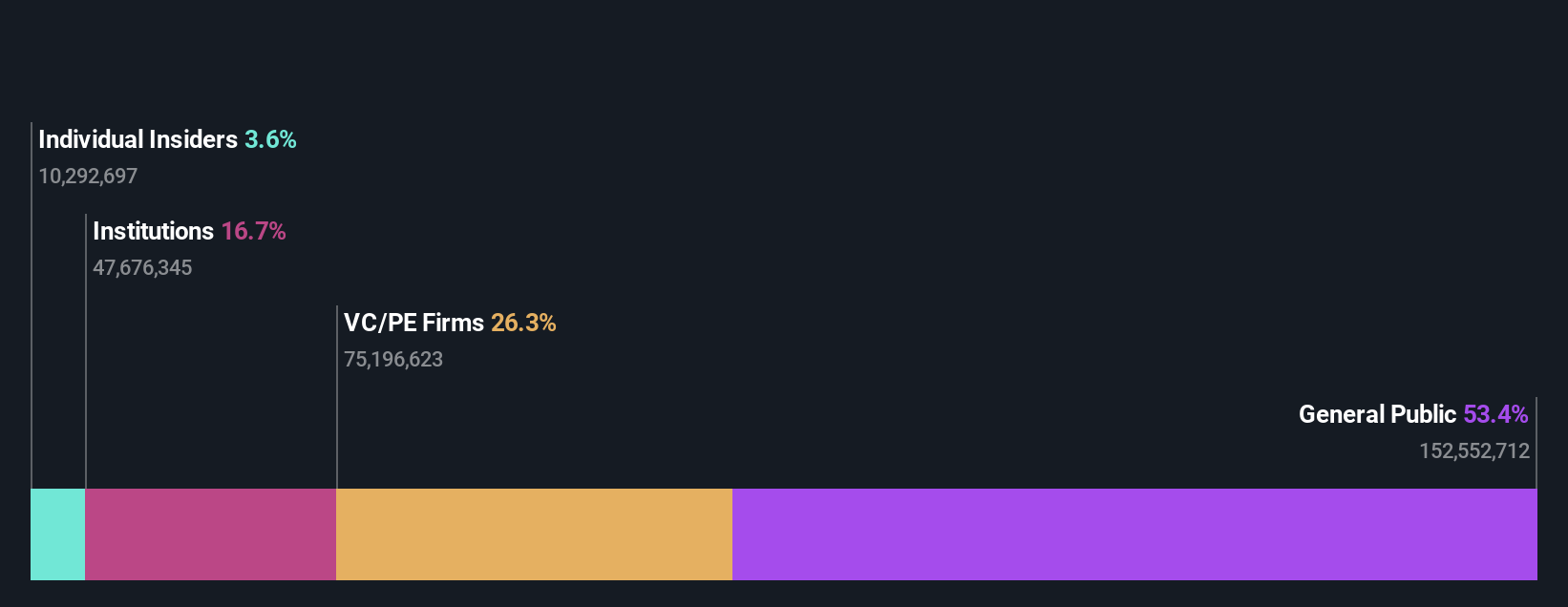

Overview: Lionsgate Studios is a diversified global entertainment company engaged in motion picture production and distribution, television programming, and syndication, with a market cap of $1.78 billion.

Operations: Lionsgate Studios generates revenue primarily from its Motion Picture and Television Production segments, amounting to $1.51 billion and $1.65 billion respectively. The company's gross profit margin has shown variability, with a recent figure of 46.31%. Operating expenses are significantly impacted by sales and marketing costs, which recently stood at $801.7 million.

PE: -4.9x

Lionsgate Studios, a smaller U.S. company, exhibits potential for growth with earnings projected to rise 92.27% annually. Despite this, they face challenges like a net loss of US$108.9 million in Q1 2025 and reliance on external borrowing for funding, which carries higher risk compared to customer deposits. The company completed a share buyback program repurchasing 16.6 million shares worth US$287.5 million since its inception in 2007, reflecting insider confidence in the company's future prospects amidst financial hurdles.

Oxford Industries (OXM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Oxford Industries is a lifestyle apparel company operating prominent brands such as Tommy Bahama, Lilly Pulitzer, and Johnny Was, with a market capitalization of approximately $1.72 billion.

Operations: Tommy Bahama is the largest revenue contributor, followed by Lilly Pulitzer and Johnny Was. The company has experienced fluctuations in its gross profit margin, reaching 63.35% most recently. Operating expenses are a significant part of the cost structure, with general and administrative expenses being a major component.

PE: 9.8x

Oxford Industries, a smaller company in the U.S., is catching attention due to its recent activities and financial outlook. The company's earnings guidance for fiscal 2025 suggests a challenging period with expected net sales between US$1.475 billion and US$1.515 billion, slightly down from last year’s US$1.52 billion, and projected GAAP EPS dropping to between US$2.35 and US$2.75 from last year's US$5.87. Despite this, they continue rewarding shareholders with consistent quarterly dividends of $0.69 per share since 1960, demonstrating commitment amidst fluctuating performance metrics like second-quarter sales of $403 million compared to $420 million the previous year and a significant drop in net income from $40 million to $17 million over the same period—highlighting potential investment opportunities given their consistent shareholder returns despite current challenges.

- Click to explore a detailed breakdown of our findings in Oxford Industries' valuation report.

Evaluate Oxford Industries' historical performance by accessing our past performance report.

Where To Now?

- Get an in-depth perspective on all 70 Undervalued US Small Caps With Insider Buying by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LION

Lionsgate Studios

Engages in diversified motion picture and television production and distribution businesses in the United States, Canada, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)