- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BILI

Shareholders in Bilibili (NASDAQ:BILI) have lost 58%, as stock drops 7.0% this past week

Investing in stocks inevitably means buying into some companies that perform poorly. But long term Bilibili Inc. (NASDAQ:BILI) shareholders have had a particularly rough ride in the last three year. Regrettably, they have had to cope with a 58% drop in the share price over that period. The falls have accelerated recently, with the share price down 26% in the last three months.

If the past week is anything to go by, investor sentiment for Bilibili isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Bilibili

Because Bilibili made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Bilibili saw its revenue grow by 8.9% per year, compound. That's a fairly respectable growth rate. That contrasts with the weak share price, which has fallen 17% compounded, over three years. The market must have had really high expectations to be disappointed with this progress. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

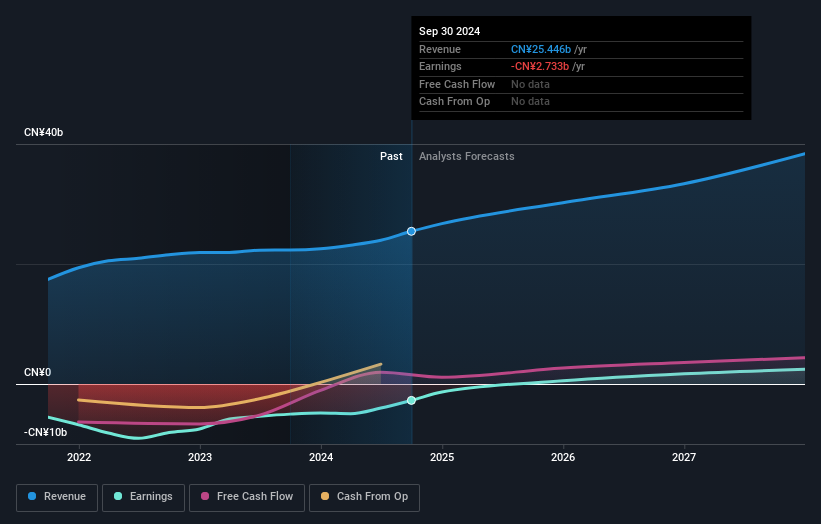

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Bilibili is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Bilibili will earn in the future (free analyst consensus estimates)

A Different Perspective

We're pleased to report that Bilibili shareholders have received a total shareholder return of 54% over one year. Notably the five-year annualised TSR loss of 4% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Bilibili you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives