- United States

- /

- Hospitality

- /

- NasdaqGS:MAR

3 US Stocks Trading At An Estimated Discount For Value Seekers

Reviewed by Simply Wall St

As the United States stock market experiences a surge, with major indices like the S&P 500 and Dow Jones Industrial Average posting their best weekly gains in months, investors are keenly eyeing opportunities amidst this optimistic climate. In such a vibrant market environment, identifying stocks that are trading at an estimated discount can be particularly appealing for value seekers looking to capitalize on potential underappreciated opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Flushing Financial (NasdaqGS:FFIC) | $14.76 | $28.25 | 47.8% |

| Atlantic Union Bankshares (NYSE:AUB) | $37.87 | $75.61 | 49.9% |

| German American Bancorp (NasdaqGS:GABC) | $39.75 | $78.06 | 49.1% |

| Old National Bancorp (NasdaqGS:ONB) | $22.93 | $43.87 | 47.7% |

| Heartland Financial USA (NasdaqGS:HTLF) | $65.78 | $130.22 | 49.5% |

| Eli Lilly (NYSE:LLY) | $725.72 | $1419.49 | 48.9% |

| CI&T (NYSE:CINT) | $6.38 | $12.32 | 48.2% |

| Equity Bancshares (NYSE:EQBK) | $43.13 | $86.02 | 49.9% |

| Constellium (NYSE:CSTM) | $10.74 | $20.99 | 48.8% |

| LifeMD (NasdaqGM:LFMD) | $4.90 | $9.77 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

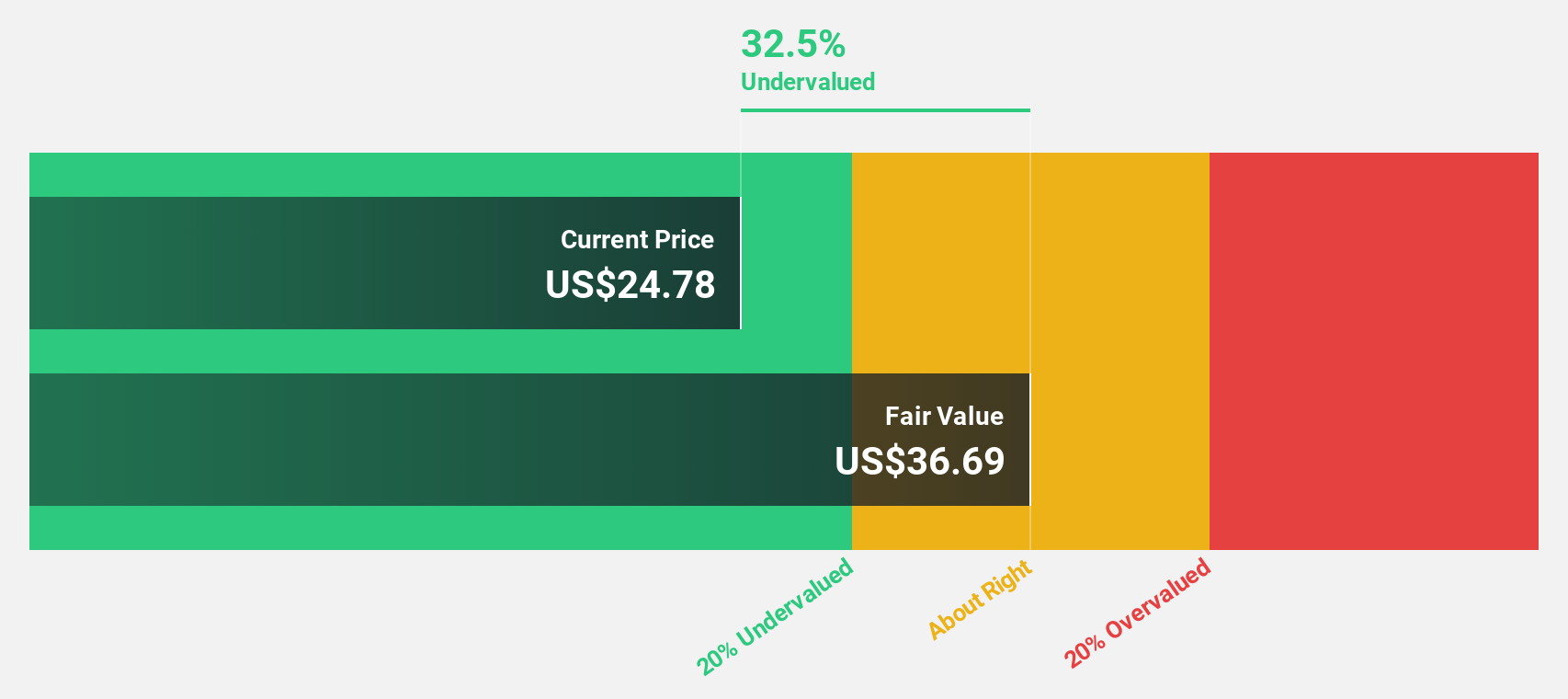

Bilibili (NasdaqGS:BILI)

Overview: Bilibili Inc. offers online entertainment services targeting young generations in China, with a market cap of $7.26 billion.

Operations: The company's revenue is primarily derived from its Internet Information Providers segment, which generated CN¥25.45 billion.

Estimated Discount To Fair Value: 46.8%

Bilibili is trading at US$17.47, significantly below its estimated fair value of US$32.83, indicating it may be undervalued based on cash flows. Despite a forecasted low return on equity of 12.3% in three years, Bilibili's revenue growth is expected to outpace the broader U.S. market with annual earnings projected to grow by 65%. Recent earnings showed improved financials with reduced net losses and a share repurchase program worth US$200 million was announced, funded by existing cash reserves.

- Our expertly prepared growth report on Bilibili implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Bilibili here with our thorough financial health report.

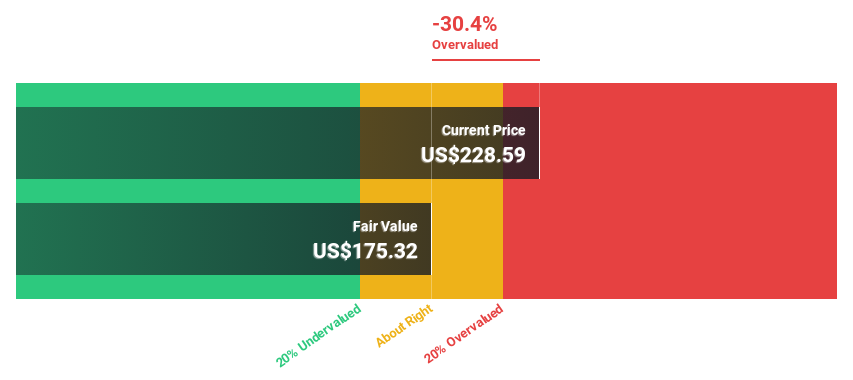

Marriott International (NasdaqGS:MAR)

Overview: Marriott International, Inc. operates, franchises, and licenses hotel, residential, timeshare, and other lodging properties globally with a market cap of approximately $77.03 billion.

Operations: The company's revenue segments include U.S. & Canada, which generated $3.33 billion, and a segment adjustment of $2.31 billion.

Estimated Discount To Fair Value: 10.4%

Marriott International, priced at US$277.18, appears undervalued relative to its fair value estimate of US$309.41 despite carrying high debt levels. Revenue growth is projected to exceed the U.S. market rate, yet earnings growth remains modest compared to broader market expectations. Recent expansions include new luxury properties in China and Thailand, enhancing Marriott's global footprint and potentially boosting cash flows through diversified offerings in high-demand regions like Las Vegas and Japan.

- Our earnings growth report unveils the potential for significant increases in Marriott International's future results.

- Get an in-depth perspective on Marriott International's balance sheet by reading our health report here.

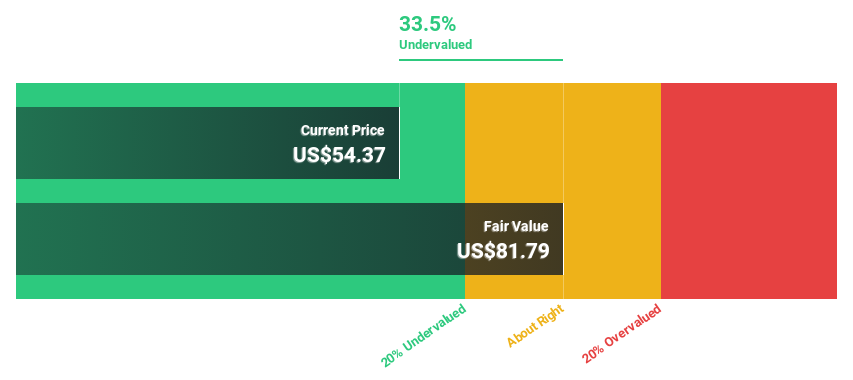

Lazard (NYSE:LAZ)

Overview: Lazard, Inc. is a financial advisory and asset management firm with operations across North and South America, Europe, the Middle East, Asia, and Australia, and has a market cap of approximately $4.63 billion.

Operations: The company's revenue is derived from three main segments: Corporate ($146.87 million), Asset Management ($1.17 billion), and Financial Advisory ($1.72 billion).

Estimated Discount To Fair Value: 22.9%

Lazard, priced at US$51.15, is trading 22.9% below its estimated fair value of US$66.33, suggesting it may be undervalued based on cash flows despite high debt levels. Earnings are forecast to grow significantly faster than the U.S. market at 30.1% annually over the next three years, though revenue growth lags behind market expectations. Recent leadership changes and strategic hires in advisory roles underscore Lazard's commitment to long-term growth and global expansion efforts.

- Insights from our recent growth report point to a promising forecast for Lazard's business outlook.

- Navigate through the intricacies of Lazard with our comprehensive financial health report here.

Next Steps

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 165 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAR

Marriott International

Engages in operation, franchising, and licensing of hotel, residential, timeshare, and other lodging properties worldwide.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives