- United States

- /

- Professional Services

- /

- NYSE:TRU

February 2025's US Stocks That Could Be Trading Below Estimated Value

Reviewed by Simply Wall St

As U.S. stock markets approach record highs, driven by a deceleration in wholesale inflation and a tempered approach to tariffs, investors are keenly observing opportunities for potential value investments. In this environment, identifying stocks that may be trading below their estimated value can offer strategic entry points for those looking to capitalize on market inefficiencies and long-term growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $18.93 | $37.03 | 48.9% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | $29.57 | $58.94 | 49.8% |

| Old National Bancorp (NasdaqGS:ONB) | $23.86 | $45.68 | 47.8% |

| Incyte (NasdaqGS:INCY) | $70.01 | $135.22 | 48.2% |

| DiDi Global (OTCPK:DIDI.Y) | $4.97 | $9.60 | 48.2% |

| Advanced Micro Devices (NasdaqGS:AMD) | $111.81 | $214.70 | 47.9% |

| Constellium (NYSE:CSTM) | $9.53 | $18.34 | 48% |

| First Advantage (NasdaqGS:FA) | $20.01 | $38.21 | 47.6% |

| Marcus & Millichap (NYSE:MMI) | $37.27 | $73.76 | 49.5% |

| Kyndryl Holdings (NYSE:KD) | $41.54 | $82.14 | 49.4% |

Let's uncover some gems from our specialized screener.

Advanced Micro Devices (NasdaqGS:AMD)

Overview: Advanced Micro Devices, Inc. is a global semiconductor company with a market capitalization of approximately $181.04 billion.

Operations: The company's revenue is derived from four main segments: Client ($7.05 billion), Gaming ($2.60 billion), Embedded ($3.56 billion), and Data Center ($12.58 billion).

Estimated Discount To Fair Value: 47.9%

Advanced Micro Devices (AMD) is trading significantly below its estimated fair value, suggesting potential undervaluation based on cash flows. The company has demonstrated robust earnings growth, with a 95.4% increase over the past year and forecasts of 32% annual growth. Recent strategic alliances, such as collaborations with CEA and Ocient, enhance AMD's technological capabilities in AI computing and data analytics. These factors contribute to AMD's strong position for future revenue expansion amidst ongoing buybacks totaling US$3.31 billion.

- Our earnings growth report unveils the potential for significant increases in Advanced Micro Devices' future results.

- Dive into the specifics of Advanced Micro Devices here with our thorough financial health report.

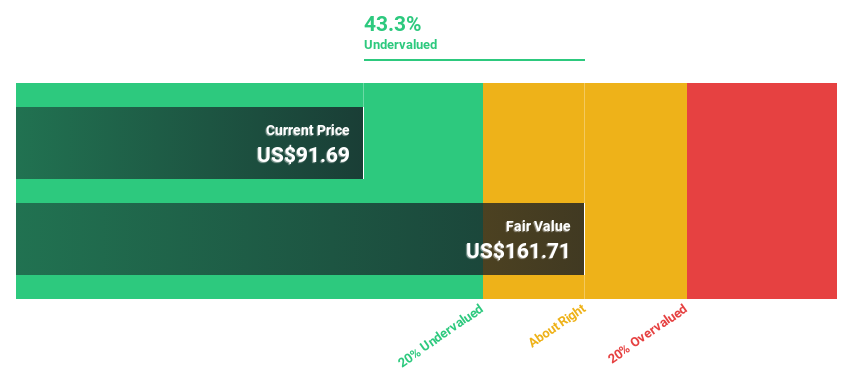

Sociedad Química y Minera de Chile (NYSE:SQM)

Overview: Sociedad Química y Minera de Chile S.A. operates as a global mining company with a market cap of $10.71 billion.

Operations: The company's revenue segments include Potassium ($255.71 million), Industrial Chemicals ($79.76 million), Iodine and Derivatives ($960.89 million), Lithium and Derivatives ($2.50 billion), and Specialty Plant Nutrition ($941.07 million).

Estimated Discount To Fair Value: 41%

Sociedad Química y Minera de Chile (SQM) is trading at US$40.17, significantly below its estimated fair value of US$68.1, indicating potential undervaluation based on cash flows. Despite a challenging period with declining sales and earnings, the company is forecast to achieve above-average market growth and become profitable in three years. However, current dividends are not well covered by earnings or free cash flows, and debt coverage by operating cash flow remains a concern.

- Our expertly prepared growth report on Sociedad Química y Minera de Chile implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Sociedad Química y Minera de Chile's balance sheet health report.

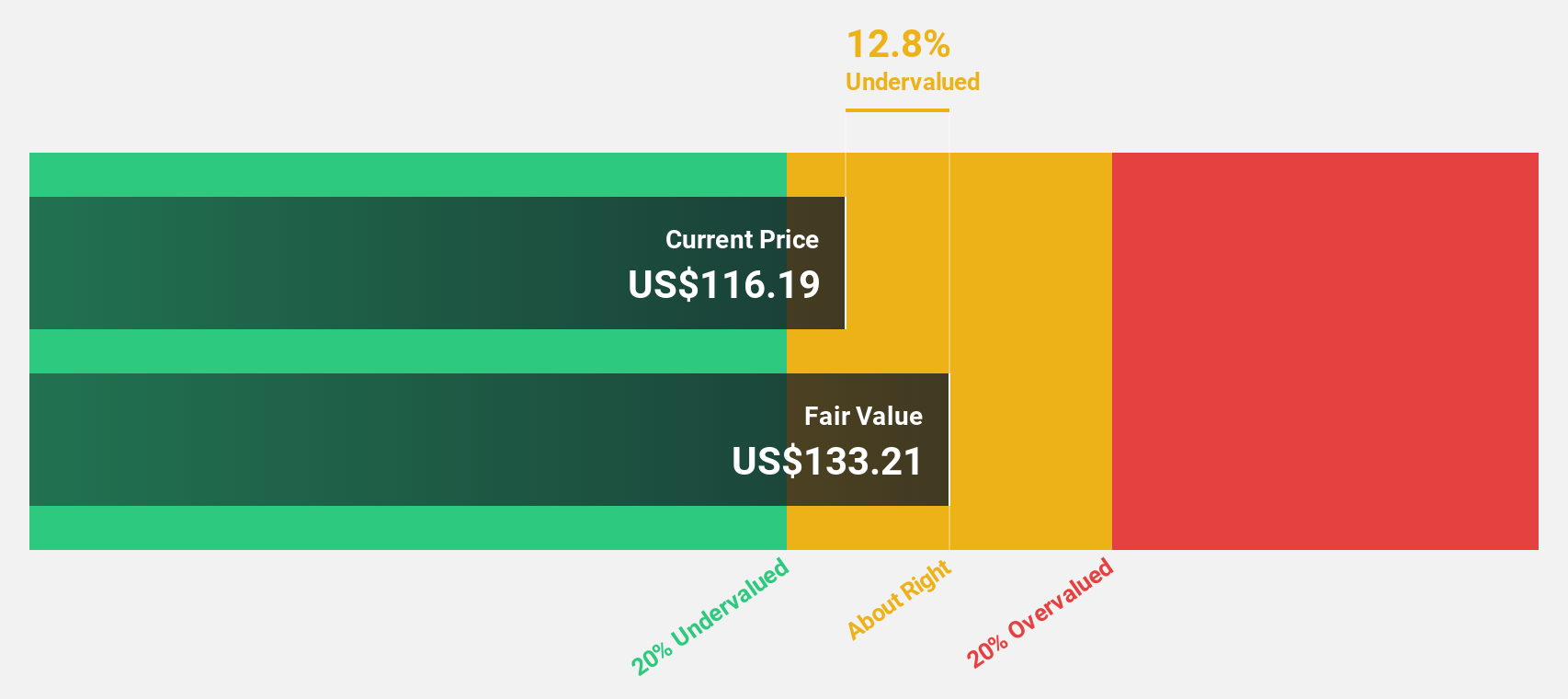

TransUnion (NYSE:TRU)

Overview: TransUnion is a global consumer credit reporting agency offering risk and information solutions, with a market cap of $18.22 billion.

Operations: The company's revenue segments include U.S. Markets at $2.48 billion, International at $1.14 billion, and Consumer Interactive at $1.59 billion.

Estimated Discount To Fair Value: 34.6%

TransUnion, trading at US$100.25, is significantly undervalued with a fair value estimate of US$153.25. Despite its debt not being well covered by operating cash flow, the company's earnings are expected to grow substantially at 29% per year, outpacing the broader market. Recent initiatives include a new consumer platform with Credit Sesame and a share repurchase program worth up to US$500 million, potentially enhancing shareholder value and operational reach in the U.S.

- Insights from our recent growth report point to a promising forecast for TransUnion's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of TransUnion.

Key Takeaways

- Click through to start exploring the rest of the 161 Undervalued US Stocks Based On Cash Flows now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransUnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRU

TransUnion

Operates as a global consumer credit reporting agency that provides risk and information solutions.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives