- United States

- /

- Metals and Mining

- /

- NYSE:NEM

Unveiling Three US Exchange Stocks Estimated To Be Trading Below Their Value

Reviewed by Simply Wall St

As the U.S. market experiences fluctuations with recent declines in major indices like the Nasdaq and S&P 500, investors might find opportunities in stocks that are potentially undervalued. In times of such market behavior, identifying stocks trading below their intrinsic value could offer attractive entry points for those looking to diversify or strengthen their portfolios.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Noble (NYSE:NE) | $44.47 | $88.34 | 49.7% |

| Selective Insurance Group (NasdaqGS:SIGI) | $92.52 | $181.60 | 49.1% |

| Atlantic Union Bankshares (NYSE:AUB) | $31.13 | $60.80 | 48.8% |

| Hanover Bancorp (NasdaqGS:HNVR) | $16.90 | $32.77 | 48.4% |

| Associated Banc-Corp (NYSE:ASB) | $20.29 | $39.49 | 48.6% |

| USCB Financial Holdings (NasdaqGM:USCB) | $11.88 | $23.66 | 49.8% |

| DiDi Global (OTCPK:DIDI.Y) | $4.44 | $8.83 | 49.7% |

| Open Lending (NasdaqGM:LPRO) | $5.79 | $11.30 | 48.7% |

| Hesai Group (NasdaqGS:HSAI) | $4.22 | $8.33 | 49.3% |

| Carter Bankshares (NasdaqGS:CARE) | $12.57 | $24.27 | 48.2% |

Below we spotlight a couple of our favorites from our exclusive screener

DoorDash (NasdaqGS:DASH)

Overview: DoorDash, Inc. operates a global commerce platform that links merchants, consumers, and independent contractors primarily in the United States, with a market capitalization of approximately $46.57 billion.

Operations: The company generates its revenue primarily from the Internet Information Providers segment, totaling approximately $9.11 billion.

Estimated Discount To Fair Value: 34.1%

DoorDash, currently trading at US$113.88, is perceived as undervalued based on discounted cash flow analysis, with an estimated fair value of US$172.86. Despite significant insider selling over the past three months, the company's revenue growth is projected to outpace the U.S. market average at 12.7% annually compared to 8.6%. Recent strategic partnerships across diverse sectors including sports retail and beauty enhance its market presence and could support future profitability, which is expected to see substantial growth over the next three years.

- The analysis detailed in our DoorDash growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of DoorDash stock in this financial health report.

Coupang (NYSE:CPNG)

Overview: Coupang, Inc. operates a comprehensive e-commerce platform through mobile apps and websites in South Korea, with a market capitalization of approximately $38.16 billion.

Operations: The company generates revenue primarily from Product Commerce, which amounted to $24.43 billion, and Developing Offerings, totaling $1.27 billion.

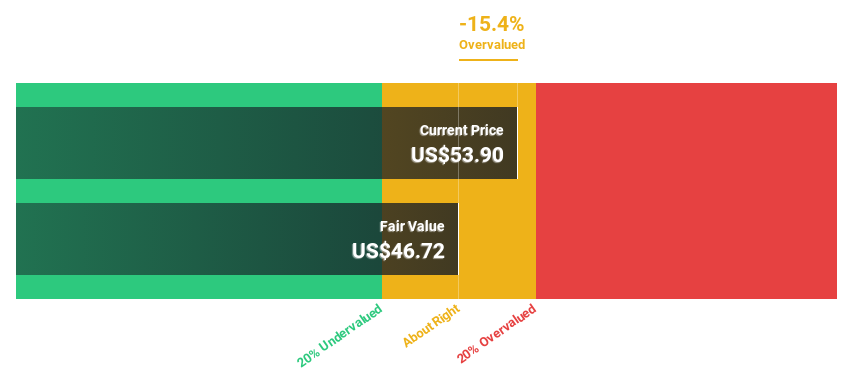

Estimated Discount To Fair Value: 40.1%

Coupang, trading at US$21.34, significantly below its estimated fair value of US$35.65, appears undervalued based on discounted cash flow metrics. Despite recent challenges, including a regulatory fine in Korea and a substantial decline in net income to US$5 million from US$91 million year-over-year, the company's revenue growth remains robust at 15.5% annually. Moreover, earnings are expected to outperform the U.S market with an annual growth rate of 17.8%.

- Insights from our recent growth report point to a promising forecast for Coupang's business outlook.

- Get an in-depth perspective on Coupang's balance sheet by reading our health report here.

Newmont (NYSE:NEM)

Overview: Newmont Corporation is a company focused on the production and exploration of gold, with a market capitalization of approximately $48.73 billion.

Operations: The revenue segments for the company are primarily derived from gold production and exploration, with significant contributions from NGM at $2.34 billion, Bodding at $1.70 billion, and Peñasquito at $1.00 billion, alongside other operations including CC&V, Ahafo, Akyem, Merian, Tanami, Porcupine, Yanacocha, Éléonore, Cerro Negro and Musselwhite generating additional revenues.

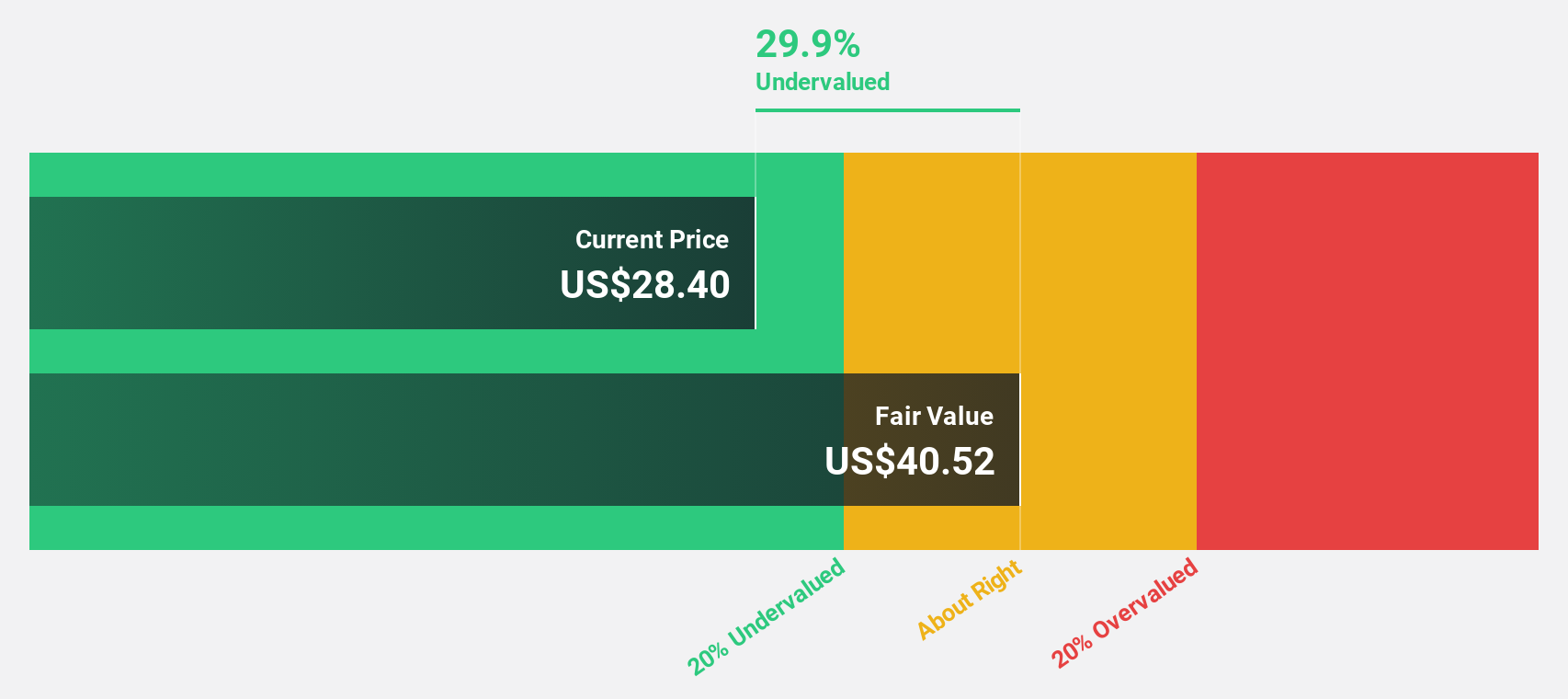

Estimated Discount To Fair Value: 12.4%

Newmont, priced at US$42.26, is trading below its fair value of US$48.22, reflecting a modest undervaluation based on discounted cash flow analysis. Despite a recent dip in net income from US$351 million to US$170 million and a 4% drop in gold production, the company's revenue growth is still strong at 9% annually and expected to surpass the U.S market average. However, its dividend coverage remains weak due to insufficient earnings and cash flows.

- Upon reviewing our latest growth report, Newmont's projected financial performance appears quite optimistic.

- Dive into the specifics of Newmont here with our thorough financial health report.

Key Takeaways

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 176 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Newmont, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Newmont might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEM

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives