- United States

- /

- Chemicals

- /

- NYSE:IPI

Analysts Are Betting On Intrepid Potash, Inc. (NYSE:IPI) With A Big Upgrade This Week

Intrepid Potash, Inc. (NYSE:IPI) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The revenue forecast for this year has experienced a facelift, with the analysts now much more optimistic on its sales pipeline.

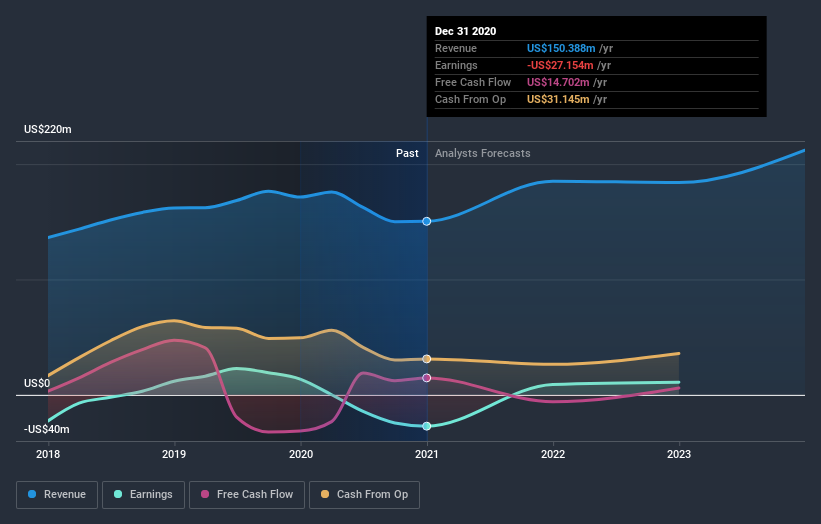

Following the upgrade, the most recent consensus for Intrepid Potash from its four analysts is for revenues of US$207m in 2021 which, if met, would be a huge 38% increase on its sales over the past 12 months. Before the latest update, the analysts were foreseeing US$185m of revenue in 2021. It looks like there's been a clear increase in optimism around Intrepid Potash, given the decent improvement in revenue forecasts.

View our latest analysis for Intrepid Potash

The consensus price target rose 27% to US$19.00, with the analysts clearly more optimistic about Intrepid Potash's prospects following this update. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Intrepid Potash at US$21.00 per share, while the most bearish prices it at US$11.00. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. For example, we noticed that Intrepid Potash's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 38% growth to the end of 2021 on an annualised basis. That is well above its historical decline of 3.1% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 6.1% per year. Not only are Intrepid Potash's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The highlight for us was that analysts increased their revenue forecasts for Intrepid Potash this year. They're also forecasting more rapid revenue growth than the wider market. There was also an increase in the price target, suggesting that there is more optimism baked into the forecasts than there was previously. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Intrepid Potash.

That's a pretty serious upgrade, but shareholders might be even more pleased to know that forecasts expect Intrepid Potash to be able to reach break-even within the next few years. You can learn more about these forecasts, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you decide to trade Intrepid Potash, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:IPI

Intrepid Potash

Intrepid Potash, Inc. delivers potassium, magnesium, sulfur, salt, and water products.

Flawless balance sheet with minimal risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)