- United States

- /

- Metals and Mining

- /

- NasdaqGS:METC

A Look at Ramaco Resources’s Valuation Following Hatch Partnership for Brook Mine Rare Earth Project

Reviewed by Simply Wall St

If you have been watching Ramaco Resources (METC) lately, the news that the company has tapped Hatch Ltd. to lead the next phase of its Brook Mine project is hard to ignore. This is more than just another incremental step, as the Brook Mine is positioned to become the first new rare earth mine in the U.S. since 1952. Ramaco’s decision to bring in Hatch, known for its work in developing complex mining projects, signals real momentum in advancing one of the country’s most strategically important mineral assets.

This announcement comes against a backdrop of remarkable gains for Ramaco’s stock. Over the past year, shares have more than doubled, building on accelerating momentum seen in the past quarter and month. While news of project milestones such as today’s Hatch partnership has driven excitement, previous updates about leadership changes and community investments have also kept Ramaco in investors’ conversations. However, it is moves such as a major mine development that get Wall Street’s attention.

After such a strong run, is Ramaco Resources trading at a discount to its future growth, or has the market already priced in the success of the Brook Mine project?

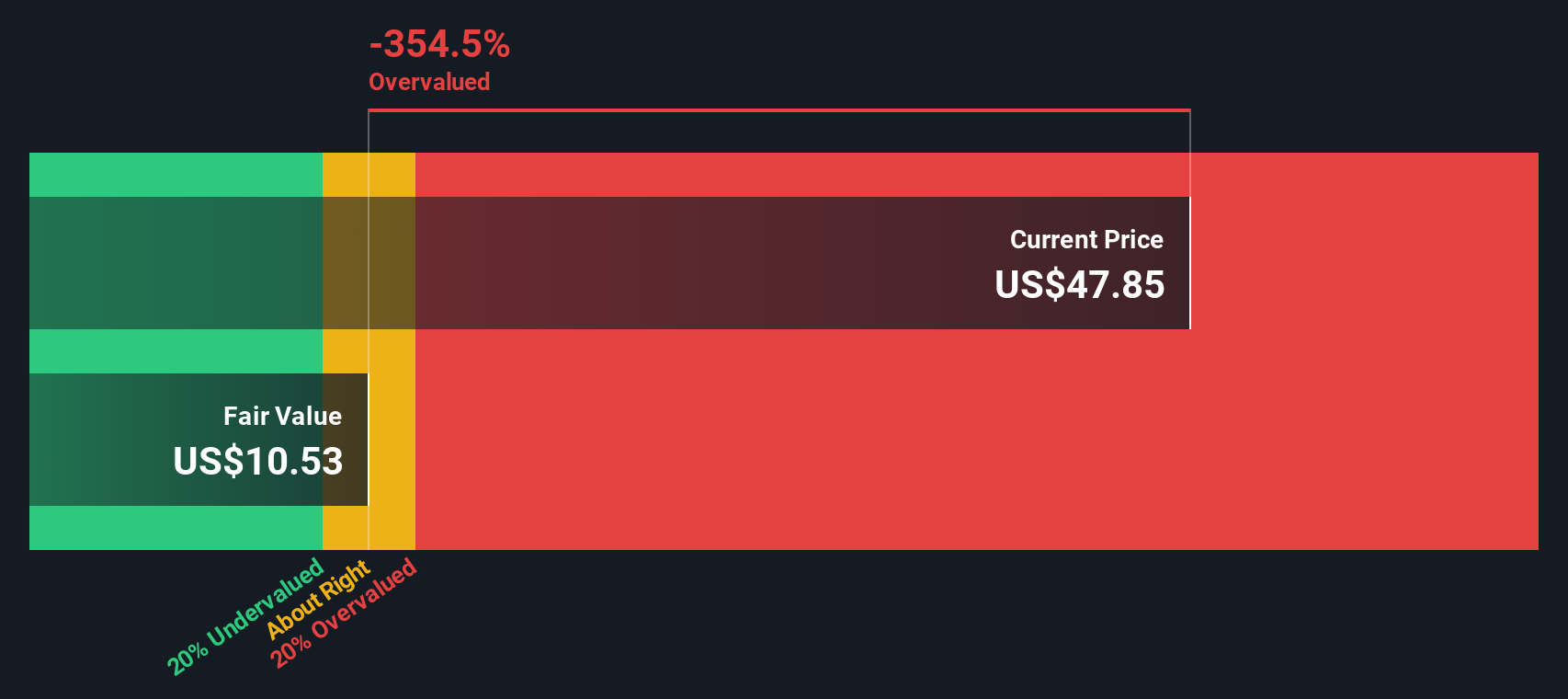

Most Popular Narrative: 30.1% Overvalued

The consensus among market-followed analysts is that Ramaco Resources stock is overvalued by a significant margin relative to its estimated future earnings.

"Ramaco's advancement of the Brook Mine into America's first new rare earth mine in over 70 years, bolstered by extensive federal government collaboration and potential policy support amid rising U.S. demand for domestic critical minerals, positions the company to unlock new, high-margin revenue streams beyond metallurgical coal, with initial commercial oxide production targeted as soon as 2027."

What secret formula did these analysts use to arrive at their bold valuation? There is one key lever that takes Ramaco from losses today to profit growth that rivals the hottest sectors. Want to see which metric they believe will skyrocket, and which optimistic assumptions they hinge the whole value on? The narrative reveals the financial forecast behind the surging price, just waiting to be uncovered.

Result: Fair Value of $21.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, any delay in government support or a downturn in rare earth prices could present challenges to Ramaco’s ambitious growth story and financial projections.

Find out about the key risks to this Ramaco Resources narrative.Another View: Discounted Cash Flow Perspective

Yet, our DCF model tells a very different story and suggests Ramaco Resources could actually be trading below what it is truly worth. Can this classic fundamentals-based approach uncover value that others might miss?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ramaco Resources Narrative

If you see things differently or want to dig into the data on your own terms, you can build a custom narrative in just a few minutes. Do it your way.

A great starting point for your Ramaco Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next great opportunity slip by. Use these powerful tools to seek out companies primed for growth, future tech, and strong income streams.

- Accelerate your portfolio with fresh companies showing robust cash flow and compelling valuation metrics using our undervalued stocks based on cash flows.

- Unlock the potential of tomorrow’s technology leaders by tapping into a selection of AI penny stocks that are reshaping industries through artificial intelligence innovation.

- Boost your passive income strategy and uncover stocks offering attractive yields by checking out dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:METC

Ramaco Resources

Engages in the development, operation, and sale of metallurgical coal.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)