- United States

- /

- Insurance

- /

- NYSE:PGR

Progressive (NYSE:PGR) Declares US$0.10 Dividend Per Share

Reviewed by Simply Wall St

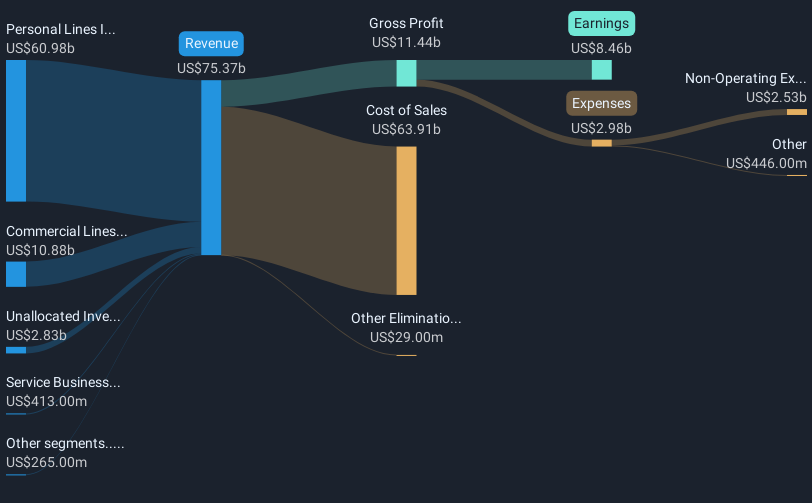

The Progressive Corporation (NYSE:PGR), having recently declared a dividend of $0.10 per share, has seen a stock price rise of 13% over the last quarter. This move reflects its robust financial performance for 2024, marked by substantial growth in both revenue and net income, which likely influenced investor confidence. The company’s earnings showed a revenue increase to USD 75,372 million, along with net income jumping to USD 8,480 million, reinforcing its positive market perception. Despite broader market volatility driven by political and economic uncertainties, such as the Trump administration's tariff policies affecting investor sentiment on a broad scale, Progressive's stock managed to outperform, benefitting from its strong earnings report. The general market decline of 5% contrasts sharply with PGR's upward trend, underscoring the overall strength of Progressive’s stock against a backdrop of broader index losses during the period.

Navigate through the intricacies of Progressive with our comprehensive report here.

Over the last five years, Progressive Corporation (NYSE:PGR) has delivered impressive total returns of 322.34%, showcasing its substantial growth and shareholder value enhancement. A pivotal factor was the strong earnings growth, with 2024 seeing revenue reach US$75.37 billion and net income soaring to US$8.48 billion. Over the past year, Progressive's earnings grew significantly by 119%, outpacing both the broader insurance industry and market rates.

Moreover, the company undertook active share repurchases, including buying back 389,103 shares for US$85.83 million in late 2024, which likely bolstered investor confidence. Consistent dividend payments, such as the $0.10 per share payouts, reinforced this positive sentiment. Despite its higher Price-To-Earnings ratio of 19.3x compared to the industry average of 12.8x, investor enthusiasm remained undeterred. This combination of strong financial performance and shareholder-friendly actions played a key role in Progressive's long-term success.

- Get the full picture of Progressive's valuation metrics and investment prospects—click to explore.

- Uncover the uncertainties that could impact Progressive's future growth—read our risk evaluation here.

- Already own Progressive? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Progressive, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGR

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives