- United States

- /

- Insurance

- /

- NYSE:AIG

American International Group (NYSE:AIG) To Redeem US$236 Million Debt In June 2025

Reviewed by Simply Wall St

Following American International Group's (NYSE:AIG) announcement of the full redemption of its 3.900% Notes Due 2026, the company's stock price moved 12% over the past quarter. This during a period where market indexes, such as the S&P 500 and Dow Jones, saw gains amid broader economic confidence and reductions in U.S.-China trade tariffs. AIG's increase in dividend and large-scale share buybacks may have added weight to this uptrend by enhancing investor appeal. Despite its reduced earnings, the combination of these shareholder-friendly strategies and positive market sentiment sustained AIG's performance in line with broader market trends.

The recent redemption of AIG's Notes Due 2026 and its boost in dividends and share buybacks underscore a focus on shareholder returns, aligning with its efforts to enhance underwriting efficiency through Gen AI and digitalization. Over the past five years, AIG's total return, including stock price and dividends, was 228.03%. This demonstrates a significant increase in shareholder value over a longer period, despite recent underperformance compared to the broader market and insurance industry over the past year.

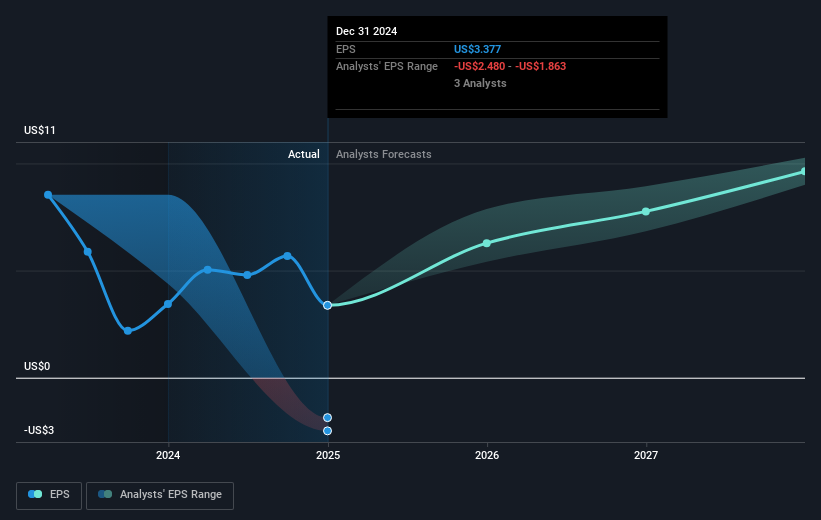

The broader application of Gen AI could potentially support revenue and earnings growth by optimizing underwriting processes and capitalizing on the partnership with India's Tata Group. However, concerns remain around higher catastrophe losses and geopolitical uncertainties, which could impact future profitability. Current stock prices, now at US$82.53, remain close to the consensus price target of US$88.31, suggesting limited upside potential based on analyst forecasts. This proximity indicates that the market may already be baking in expectations of stabilized earnings and revenue growth driven by AIG's recent initiatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade American International Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIG

American International Group

Offers insurance products for commercial, institutional, and individual customers in North America and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives