- United States

- /

- Personal Products

- /

- NasdaqCM:NATR

Nature's Sunshine Products, Inc.'s (NASDAQ:NATR) CEO Might Not Expect Shareholders To Be So Generous This Year

Key Insights

- Nature's Sunshine Products will host its Annual General Meeting on 30th of April

- CEO Terrence Moorehead's total compensation includes salary of US$832.0k

- The total compensation is similar to the average for the industry

- Over the past three years, Nature's Sunshine Products' EPS fell by 34% and over the past three years, the total loss to shareholders 30%

The results at Nature's Sunshine Products, Inc. (NASDAQ:NATR) have been quite disappointing recently and CEO Terrence Moorehead bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 30th of April. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. The data we present below explains why we think CEO compensation is not consistent with recent performance.

View our latest analysis for Nature's Sunshine Products

How Does Total Compensation For Terrence Moorehead Compare With Other Companies In The Industry?

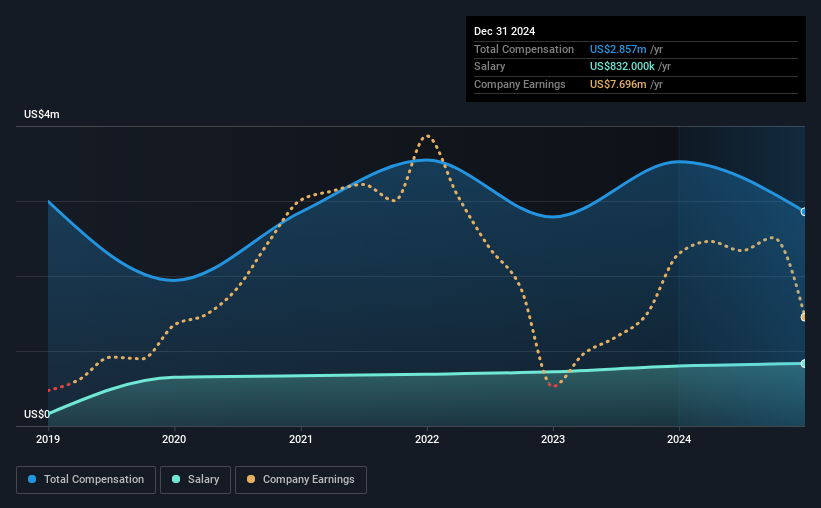

Our data indicates that Nature's Sunshine Products, Inc. has a market capitalization of US$210m, and total annual CEO compensation was reported as US$2.9m for the year to December 2024. That's a notable decrease of 19% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$832k.

In comparison with other companies in the American Personal Products industry with market capitalizations ranging from US$100m to US$400m, the reported median CEO total compensation was US$2.5m. This suggests that Nature's Sunshine Products remunerates its CEO largely in line with the industry average. What's more, Terrence Moorehead holds US$4.8m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$832k | US$800k | 29% |

| Other | US$2.0m | US$2.7m | 71% |

| Total Compensation | US$2.9m | US$3.5m | 100% |

On an industry level, roughly 36% of total compensation represents salary and 64% is other remuneration. Nature's Sunshine Products sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Nature's Sunshine Products, Inc.'s Growth Numbers

Over the last three years, Nature's Sunshine Products, Inc. has shrunk its earnings per share by 34% per year. Its revenue is up 2.0% over the last year.

Few shareholders would be pleased to read that EPS have declined. The fairly low revenue growth fails to impress given that the EPS is down. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Nature's Sunshine Products, Inc. Been A Good Investment?

With a three year total loss of 30% for the shareholders, Nature's Sunshine Products, Inc. would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Nature's Sunshine Products that investors should think about before committing capital to this stock.

Important note: Nature's Sunshine Products is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Nature's Sunshine Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NATR

Nature's Sunshine Products

A natural health and wellness company, manufactures and sells nutritional and personal care products in Asia, Europe, North America, Latin America, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives