- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

3 US Growth Companies With 17% Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market continues its upward momentum, with the S&P 500 reaching a record closing high, investor optimism is buoyed by strong corporate earnings and enthusiasm for AI-related business developments. In this thriving environment, companies with substantial insider ownership often capture attention due to their potential alignment of interests between shareholders and management, making them appealing prospects for growth-focused investors.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| Capital Bancorp (NasdaqGS:CBNK) | 31.1% | 30.1% |

| Ryan Specialty Holdings (NYSE:RYAN) | 16.6% | 36.4% |

| ARS Pharmaceuticals (NasdaqGM:SPRY) | 19.1% | 58.7% |

Let's dive into some prime choices out of the screener.

monday.com (NasdaqGS:MNDY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: monday.com Ltd. develops software applications across various regions including the United States, Europe, the Middle East, Africa, and the United Kingdom, with a market cap of approximately $12.65 billion.

Operations: Revenue Segments (in millions of $): monday.com generates revenue primarily from its Internet Software & Services segment, totaling $906.59 million.

Insider Ownership: 15.4%

monday.com demonstrates potential as a growth company with high insider ownership, marked by its forecasted earnings growth of 36% annually, outpacing the US market. The company's recent expansion in Denver supports its North American presence and aligns with strategic growth initiatives. Despite reporting a net loss for Q3 2024, monday.com achieved profitability over nine months and anticipates significant revenue increases. Leadership changes include appointing Adi Dar as COO to drive sustainable growth.

- Dive into the specifics of monday.com here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of monday.com shares in the market.

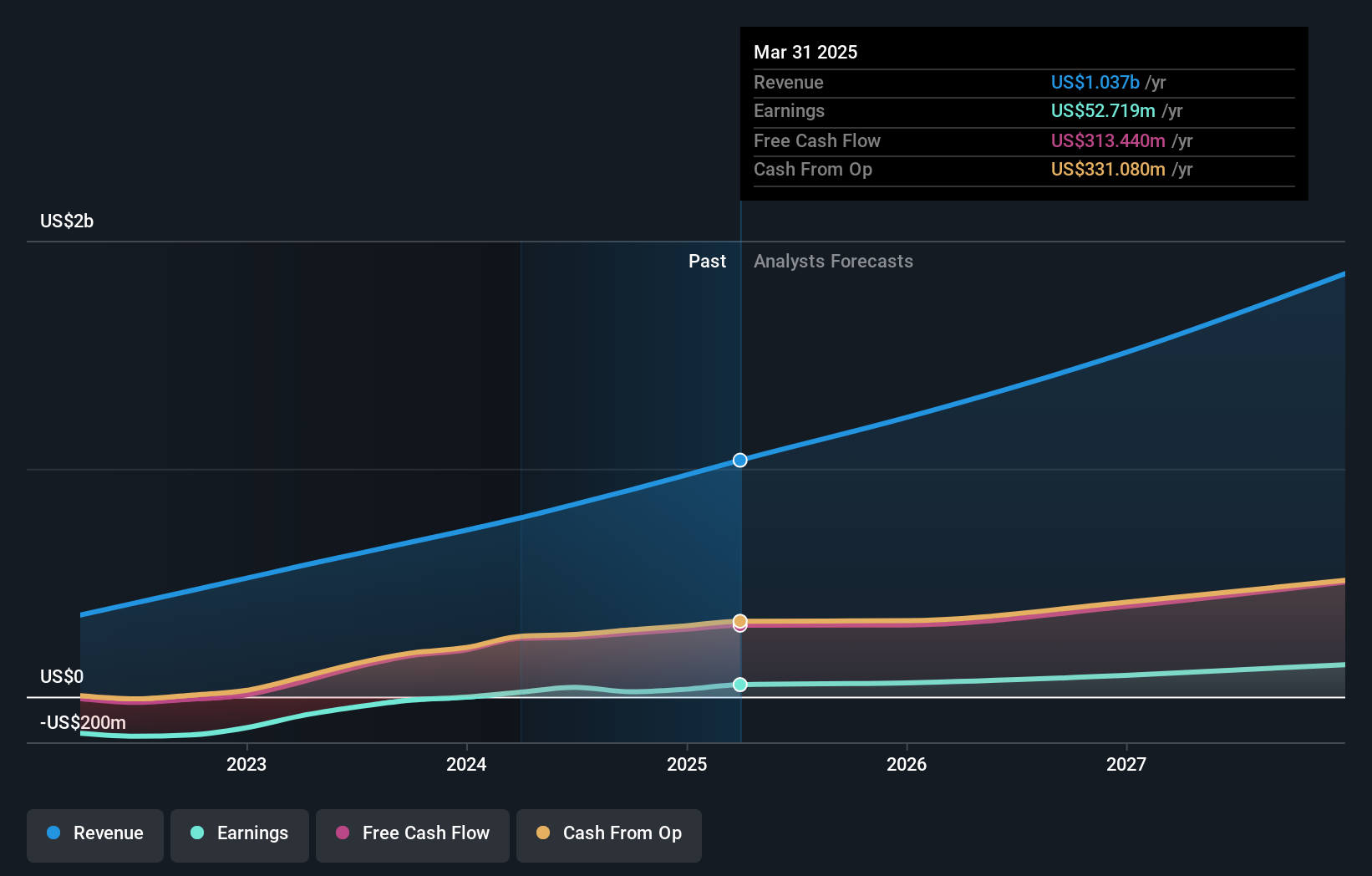

Hims & Hers Health (NYSE:HIMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hims & Hers Health, Inc. operates a telehealth platform connecting consumers to licensed healthcare professionals across the United States, the United Kingdom, and internationally, with a market cap of approximately $6.49 billion.

Operations: The company generates revenue through its online retail segment, amounting to $1.24 billion.

Insider Ownership: 13.4%

Hims & Hers Health shows growth potential with earnings forecasted to rise faster than the US market. Despite recent insider selling, the company trades significantly below its estimated fair value. Recent strategic moves include expanding product offerings with meal replacements and seeking acquisitions to enhance its platform. Notably, Hims & Hers reported strong Q3 2024 results, transitioning from a net loss to profitability and raising full-year revenue guidance to up to US$1.465 billion.

- Click to explore a detailed breakdown of our findings in Hims & Hers Health's earnings growth report.

- Upon reviewing our latest valuation report, Hims & Hers Health's share price might be too optimistic.

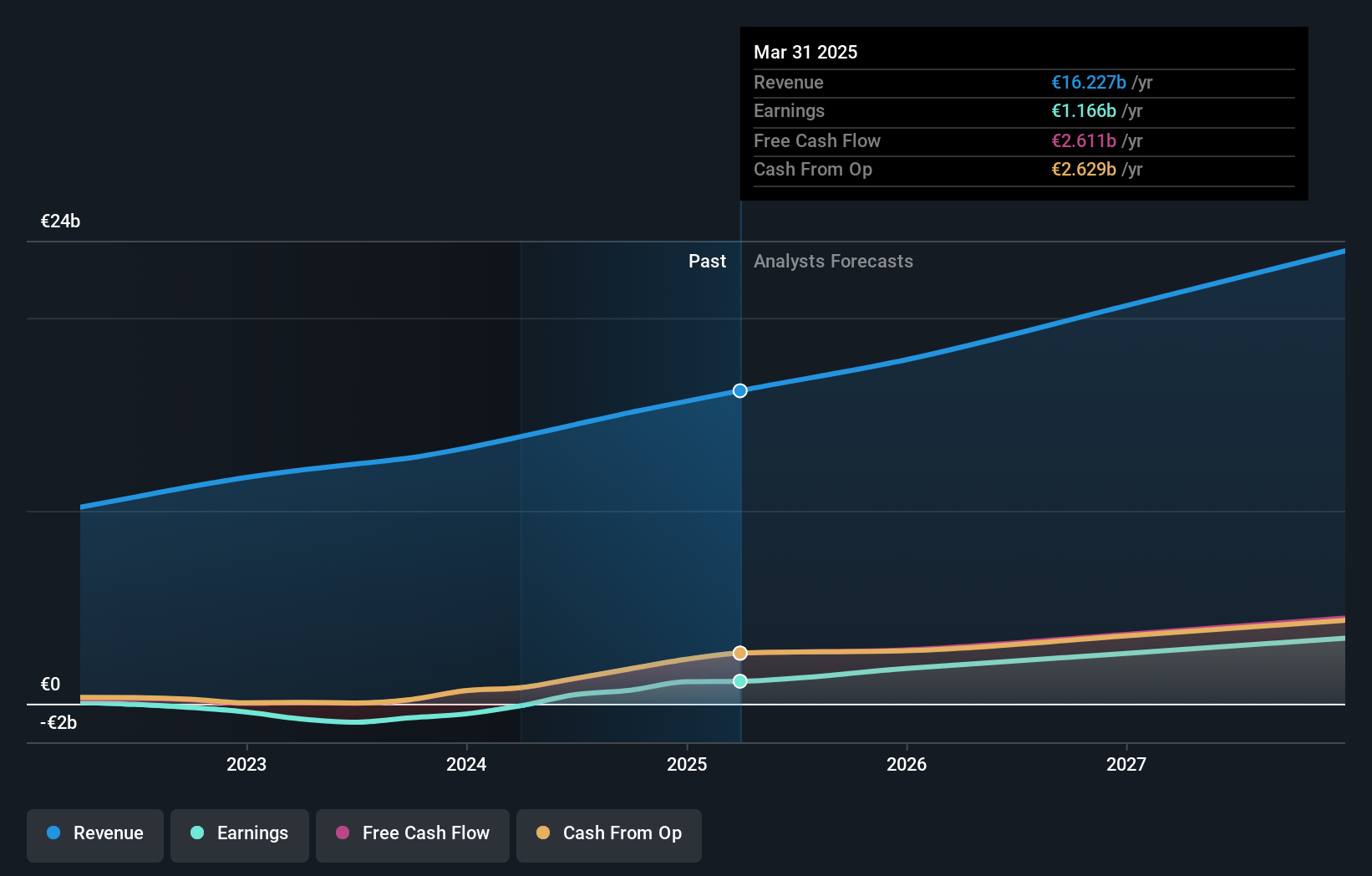

Spotify Technology (NYSE:SPOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A. operates as a global provider of audio streaming subscription services and has a market capitalization of approximately $99.74 billion.

Operations: The company's revenue is primarily derived from its Premium segment, which generated €13.28 billion, and its Ad-Supported segment, contributing €1.82 billion.

Insider Ownership: 17.6%

Spotify Technology is demonstrating robust growth potential, with earnings projected to increase significantly faster than the US market. Recent strategic partnerships, such as with Opera, enhance user engagement and accessibility. Spotify's Q3 2024 results showed substantial revenue and net income growth compared to the previous year. Despite no recent insider trading activity, its financial outlook remains strong with expected revenue of EUR 4.1 billion for Q4 2024 and operating income of EUR 481 million.

- Take a closer look at Spotify Technology's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Spotify Technology is priced higher than what may be justified by its financials.

Where To Now?

- Gain an insight into the universe of 203 Fast Growing US Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.